1-Octanol Market Size & Growth Analysis | APAC, US, Europe, LATAM

Global 1-Octanol Market Size, Share & Analysis By Purity (Upto 98%, Above 98%), By Grade (Food Grade, Industrial Grade), By Application (Plasticizer, Flavores & Fragrances, Pharmaceuticals, Chemicals, Paints & Coatings, Others) Industry Regions & Key Players – Price Trends, Capacity Expansion, Supply-Demand Outlook & Forecast 2025–2034

Report Overview

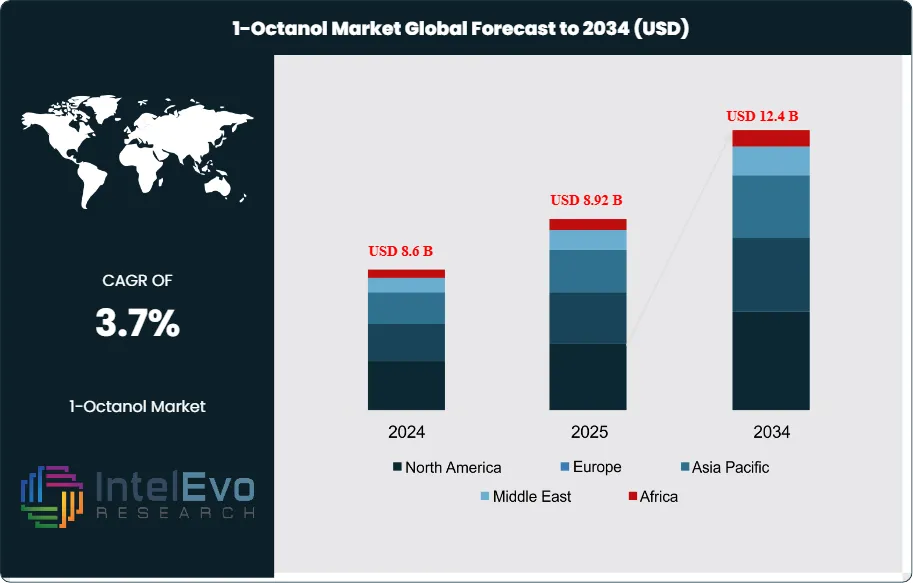

The 1-Octanol market is valued at approximately USD 8.6 billion in 2024 and is projected to reach nearly USD 12.4 billion by 2034, registering a steady CAGR of about 3.7% during 2025–2034. Growing demand for plasticizers, surfactants, and specialty chemicals across pharmaceuticals and personal care is driving long-term consumption. With rapid expansion in biodegradable formulations and green-chemistry–based alcohol production, 1-Octanol is emerging as a critical building block for next-generation industrial and cosmetic applications.

Get More Information about this report -

Request Free Sample ReportDemand has expanded steadily over the past decade, with a brief pandemic-era dip in 2020 followed by normalization across plastics, fragrances, and industrial processing. From 2018–2022, volumes grew at roughly 2%–3% annually, and the medium-term outlook remains resilient as downstream end uses diversify beyond traditional plasticizers into higher-value cosmetic and specialty chemical applications. By application, plasticizers remain the single largest outlet, accounting for an estimated 38%–40% of 2023 consumption, supported by flexible PVC in construction, cables, and consumer goods. Fragrances and flavor esters represent about 22%–25%, solvents and defoamers around 18%–20%, and cosmetics/personal care roughly 12%–14%, with the balance in textiles, paper, and niche intermediates.

Growth is underpinned by multiple demand-side and supply-side drivers. Rising spend on beauty and personal care, particularly in Asia, is lifting consumption of emollient fatty alcohols and octyl esters. On the supply side, incremental capacity additions and improved catalyst selectivity in oxo and Ziegler routes are trimming unit costs and reducing off-spec formation. Key challenges persist: volatility in olefin feedstocks and hydrogen costs, tightening environmental rules (e.g., restrictions on certain phthalates in plasticizers), and decarbonization pressures that raise the bar for solvent emissions and process energy intensity. Procurement risks tied to logistics and energy markets continue to influence contract pricing and inventory strategies.

Technology is reshaping the landscape. Producers are piloting bio-based octanol via fermentation and catalytic upgrading of bio-intermediates, while digital twins, advanced process control, and AI-assisted predictive maintenance are lifting plant utilization and shrinkage yields by low-single-digit percentage points. Downstream, formulators are adopting higher-purity grades for fine fragrances and skincare, with automation improving batch consistency in esterification units.

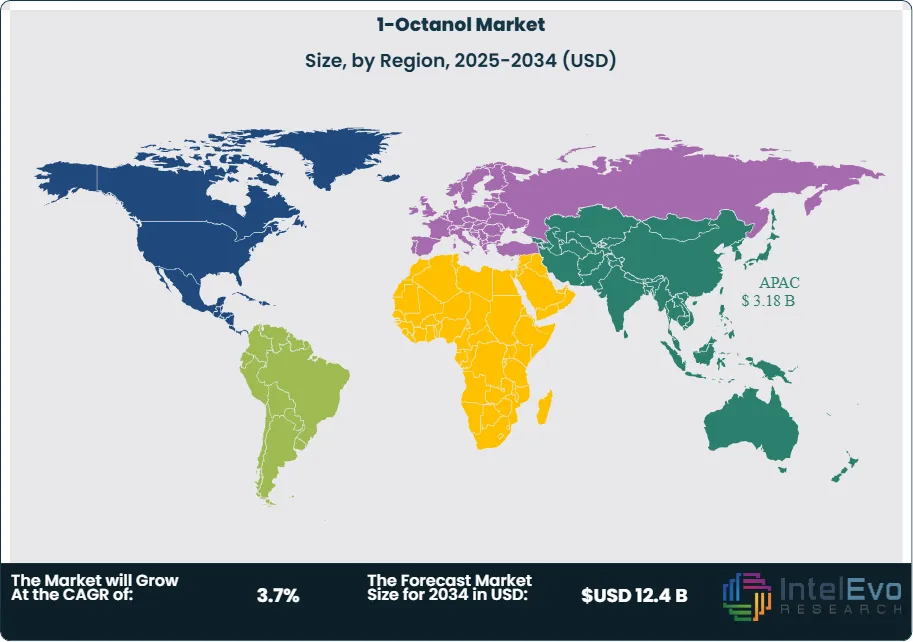

Regionally, Asia Pacific leads with an estimated 47%–50% revenue share in 2023, anchored by China, India, and Southeast Asia; Europe follows at roughly 22%–24% on the strength of specialty fragrances and stringent quality standards; North America accounts for about 18%–20% with stable industrial and consumer demand. Investment hotspots to watch include integrated petrochemical hubs in China’s coastal provinces, Indian specialty chemical clusters, and EU sites advancing low-carbon, bio-content octanol—areas positioned to capture premium growth as sustainability and performance requirements rise.

Key Takeaways

- Market Growth: The 1-Octanol market totals USD 8.6 billion in 2024 and is projected to reach USD 12.4 billion by 2034 (3.7% CAGR), adding ~USD 3.8 billion in incremental value as demand advances in flavors & fragrances, plasticizers, industrial solvents, and personal care.

- Application: Flavors & Fragrances leads with 36.5% share in 2023 (≈USD 2.26 billion), underpinned by robust consumption of octyl esters in fine fragrances and flavorings and steady premiumization in consumer products.

- Purity: >98% purity grades command 61.2% share (≈USD 3.79 billion) due to stringent quality needs in pharmaceuticals, cosmetics, and high-end fragrance bases; this segment is poised to outpace overall market growth as compliance thresholds tighten.

- Driver: Industrial grade 1-Octanol accounts for 54.6% of 2023 revenue (≈USD 3.39 billion), supported by plasticizer and lubricant formulations and capacity reliability in integrated petrochemical hubs—particularly across Asia’s construction and manufacturing value chains.

- Restraint: Regulatory scrutiny on phthalate plasticizers and VOC emissions, coupled with petrochemical feedstock volatility, caps upside—reflected in a modest 2.5% CAGR, which trails many specialty chemical adjacencies by roughly ~100 bps.

- Opportunity: Mix-upgrade toward >98% purity in high-growth end uses (pharma, premium cosmetics) is a margin and revenue lever; a 5-pp increase in high-purity share (from 61.2% to ~66.2%) implies ~USD 0.31 billion additional high-purity sales on the 2023 base.

- Trend: Producers are prioritizing specialty and high-purity cuts and debottlenecking for tighter specifications, while formulators expand octyl ester portfolios; leading suppliers (e.g., BASF, OQ Chemicals, Sasol, KH Neochem) are emphasizing premium grades and reliability in supply to win share.

- Regional Analysis: APAC dominates with 36.4% share (≈USD 3.25 billion) on the strength of its industrial base and policy support; the rest of world contributes 63.5% (≈USD 3.94 billion), with Europe and North America together comprising roughly half of this remainder and emerging hotspots in India and ASEAN expected to gain mix in high-purity demand.

Type Analysis

In 2025, the 1-Octanol market remains skewed toward high specifications: Above 98% purity accounts for roughly ~62% of global demand (≈ USD 4.0–4.1 billion out of an estimated USD 6.5 billion market), sustained by its critical role in premium fragrances, flavor esters, and high-end personal care where trace impurities affect odor, taste, and regulatory conformance. This tranche is set to expand faster than the overall market (≈ ~3.0% CAGR through 2033 vs. market 2.5%), aided by tighter quality standards and mix-upgrade in export-oriented specialty chemicals.

The Up to 98% purity segment continues to serve cost-sensitive industrial uses—plasticizer intermediates, solvent systems, and defoamers in pulp & paper and textiles—maintaining a sizable ~38% share. While volume growth is steady, pricing power is modest given competition from alternate solvents and cyclical downstreams. By Grade, Industrial Grade still holds a slim majority (just over ~53% in 2025) due to entrenched consumption in plasticizers and lubricants, but Food Grade is the faster riser (≈ 3.2–3.5% CAGR) as flavor houses and beverage formulators prioritize traceability, allergen control, and clean-label inputs. Leading suppliers (e.g., BASF, OQ Chemicals, Sasol, KH Neochem) are tilting capacity toward high-purity and food-grade cuts to capture premium margins and reduce off-spec losses via advanced process control and catalyst improvements.

Application Analysis

Flavors & Fragrances remains the largest application at ~36–37% of 2025 demand (≈ USD 2.3–2.4 billion), supported by premiumization in beauty and fine fragrance and steady launches of octyl-ester portfolios. Plasticizers follow at roughly ~31% (≈ USD 2.0 billion), anchored by flexible PVC in construction wiring, flooring, and consumer goods; performance and regulatory scrutiny are pushing formulators toward tighter-spec octanol-derived esters. Pharmaceuticals contribute ~11% (≈ USD 0.7 billion) as octanol serves both as solvent and intermediate for select APIs, while Chemicals (surfactants, coatings intermediates) comprise ~13% (≈ USD 0.85 billion) on the back of diversified industrial demand.

Paints & Coatings accounts for ~7% (≈ USD 0.46 billion), where octanol improves film formation and adhesion, particularly in water-borne systems. The Others bucket (~1–2%) includes agricultural adjuvants and niche extraction processes. Across applications, mix is shifting to higher-purity inputs; a +3–4 pp swing toward >98% grades by 2030 would unlock incremental premium revenue even under a moderate volume trajectory.

End-Use Analysis

Demand is diversified across Personal Care & Cosmetics, Plastics & Polymers, Food & Beverage, Pharmaceuticals, and Industrial Processing (pulp & paper, textiles). In 2025, Personal Care & Cosmetics represents roughly ~20–22% of consumption, benefiting from sustained growth in skincare and fine fragrance, especially in Asia’s masstige and premium tiers. Plastics & Polymers (plasticizer value chains) capture ~28–32%, closely tracking construction, white goods, and cable demand, with upgrades to consistent-spec inputs reducing rework and scrap.

Food & Beverage absorbs ~10–12% via flavoring systems, with food-grade compliance (FCC, EU additives) driving supplier differentiation. Pharmaceuticals sits near ~10–12%, supported by solvent and intermediate roles under stricter GMP expectations. Industrial Processing and Textiles/Paper collectively contribute ~20–22%, leveraging octanol’s defoaming and solvency benefits; adoption is stable, though efficiency programs and alternative process aids cap upside.

Regional Analysis

Asia Pacific remains the demand and supply anchor, controlling approximately 36.4% of 2025 revenue (≈ USD 3.25 billion) on the strength of integrated petrochemical hubs in China and Southeast Asia, India’s specialty chemicals build-out, and vibrant end-markets in beauty, food, and PVC. Europe holds ~22–24%, concentrated in high-spec fragrances (France, Switzerland) and stringent quality regimes that favor >98% grades; decarbonization policies are also accelerating process optimization and potential bio-routes. North America represents ~18–20%, underpinned by stable industrial uses and a resilient consumer base in personal care and home care.

Latin America (≈ 7–9%) is a rising outlet led by Mexico and Brazil, where flexible packaging and consumer goods support plasticizer and fragrance demand. Middle East & Africa (≈ 9–11%) benefits from petrochemical adjacency and infrastructure projects, gradually improving self-sufficiency. Looking to 2030–2033, Asia Pacific is poised to outgrow the global average by ~50–100 bps, while Europe and North America focus on value over volume through higher-purity, food-grade, and low-carbon offerings; selective investments in bio-based or low-emission octanol could lift regional premiums and secure long-term contracts.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Purity

- Upto 98%

- Above 98%

By Grade

- Food Grade

- Industrial Grade

By Application

- Plasticizer

- Flavores & Fragrances

- Pharmaceuticals

- Chemicals

- Paints & Coatings

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 8.6 B |

| Forecast Revenue (2034) | USD 12.4 B |

| CAGR (2024-2034) | 3.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Purity (Upto 98%, Above 98%), By Grade (Food Grade, Industrial Grade), By Application (Plasticizer, Flavores & Fragrances, Pharmaceuticals, Chemicals, Paints & Coatings, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Axxence Aromatic GmbH, Hebei Guanlang Biotechnology Co., Ltd., BASF SE, Kao Chemical Corporation, Sasol Limited, Liaoning Huaxing Group Chemical, Bharat Petroleum Corporation Limited, Shandong Zhishang Chemical Co., Ltd., Sisco Research Laboratories Pvt. Ltd., SABC, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date