1,6-Hexanediol Diacrylate Market Size, Growth & Forecast | CAGR of 7.9%

Global 1,6-Hexanediol Diacrylate (HDDA) Market Size, Share & Analysis By Purity (98%, 99%, 99.5%, 99.9%), By Viscosity (Low Viscosity, Medium Viscosity, High Viscosity, Very High Viscosity), By Grade (Monomer, Acrylates, Di functional), By Application (Coatings and Adhesives, Electronics, Medical Devices, Packaging), By End-Use (Automotive, Construction, Consumer Goods, Electronics, Healthcare) Industry Regions & Key Players – Supply Chain Analysis, Pricing Trends & Forecast 2025–2034

Report Overview

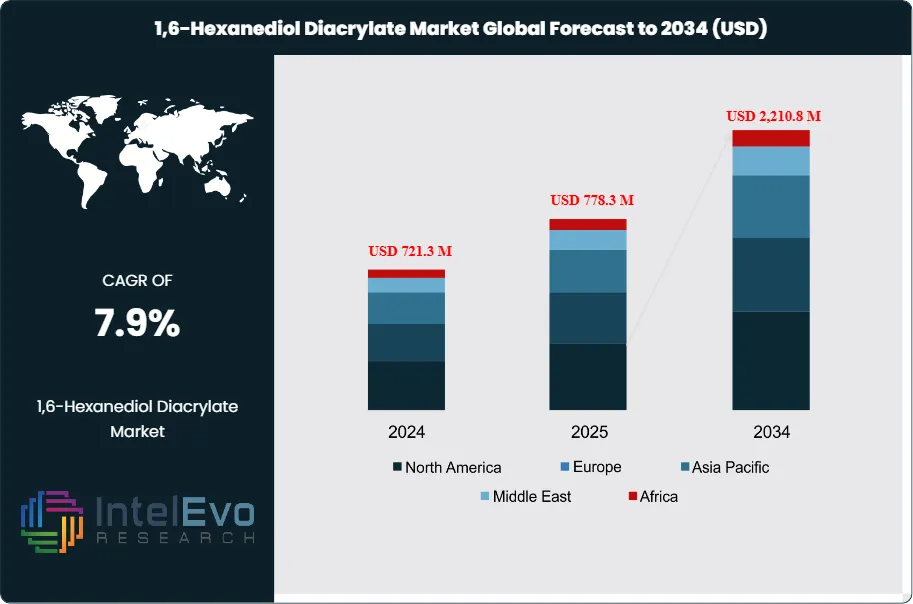

The 1,6-Hexanediol Diacrylate market is estimated at USD 721.3 million in 2024 and is on track to reach approximately USD 2,210.8 million by 2034, reflecting a CAGR of 7.9% from 2025–2034. Growing demand for high-performance UV-curable coatings, adhesives, and advanced polymer materials is accelerating global uptake. The shift toward lightweight manufacturing, 3D printing, and specialty resins is further boosting market momentum. With industries rapidly transitioning to sustainable and high-efficiency materials, 1,6-Hexanediol Diacrylate is emerging as a key enabler of next-generation production technologies.

Get More Information about this report -

Request Free Sample ReportThis growth reflects steady demand from high-performance material applications, particularly in automotive, electronics, and industrial coatings. 1,6-Hexanediol diacrylate (HDDA), a difunctional acrylate monomer, plays a key role as a cross-linking agent in polymer and resin production. Its strong chemical resistance, thermal stability, and adhesive performance make it integral to products such as UV-cured coatings, sealants, and specialty inks. As manufacturers shift toward faster-curing, low-emission solutions, HDDA is gaining preference for its performance in UV-curing systems, which support more efficient and environmentally compliant manufacturing processes.

The expansion of UV-cured resins is a primary driver, supported by industry trends favoring solvent-free formulations. In particular, the coatings and printing sectors are adopting HDDA-based resins to enhance product durability and chemical resistance. Simultaneously, growth in the automotive and construction industries is driving increased use of HDDA in adhesives and sealants designed to perform under harsh environmental conditions. This demand is reinforced by ongoing R&D investments in acrylic resin technologies, which are widening the scope of HDDA applications.

Challenges remain around raw material volatility and environmental regulations, especially in markets transitioning toward bio-based chemicals. However, these risks are prompting investment into sustainable alternatives. HDDA’s role in emerging bio-acrylate development offers a path to regulatory compliance and long-term competitiveness.

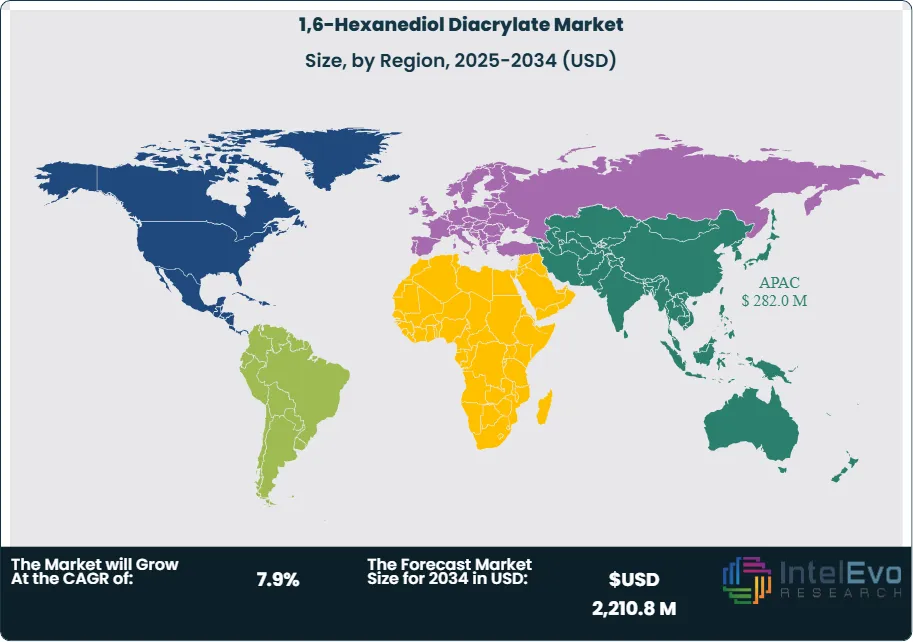

Regionally, Asia Pacific leads the market, accounting for 42.3% of global revenue in 2024, or approximately USD 282.0 million. Strong manufacturing bases in China, Japan, and South Korea, combined with rising demand from electronics and automotive sectors, continue to make the region the primary growth engine. Europe and North America are expected to maintain stable demand, supported by regulatory pressures and ongoing technology upgrades in coating and adhesives production.

As industries move toward low-VOC, high-performance solutions, HDDA's role in advanced polymer systems positions it for continued long-term relevance and strategic investment across key industrial value chains.

Key Takeaways

- Market Growth: The global 1,6-Hexanediol Diacrylate market is projected to grow from USD 721.3 million in 2024 to USD 2,210.8 million by 2034, registering a CAGR of 7.9%. Growth is primarily driven by rising demand for UV-curable coatings, high-performance adhesives, and advanced composite materials across industrial and automotive sectors.

- Purity: The 99.5% purity segment holds 37.4% of the market, supported by its extensive use in high-performance applications requiring enhanced chemical resistance and durability.

- Viscosity: Medium viscosity products (10–100 cPs) account for 38.4% of total demand due to their versatility in formulating UV-curable resins, inks, and adhesives.

- Grade: Monomer grade 1,6-Hexanediol Diacrylate leads with a 46.4% share, favored for its superior reactivity and suitability in polymer and resin production.

- Application: Coatings and adhesives represent the largest application segment at 52.1%, driven by the compound’s role in enhancing hardness, adhesion, and chemical resistance in end-use products.

- End-Use: The automotive industry consumes 40.3% of total volume, reflecting strong demand for advanced adhesives and protective coatings in OEM and aftermarket applications.

- Driver: Rising adoption of UV-curing technologies in coatings and printing processes is a key growth factor, offering faster processing, lower emissions, and improved material performance.

- Restraint: Raw material price volatility and environmental regulations related to acrylate production continue to pressure margins and restrict adoption in cost-sensitive markets.

- Opportunity: Asia-Pacific presents significant expansion potential, led by China, India, and Southeast Asia. The region is expected to maintain a leading position with a 42.3% share, equivalent to USD 282.0 million in 2024.

- Trend: Increasing investment in bio-based acrylates and low-VOC resin formulations is shaping long-term growth strategies, aligning with regulatory and customer preferences for sustainable alternatives.

Purity Analysis

The 99.5% purity grade leads the 1,6-Hexanediol Diacrylate market with a 37.4% share as of 2024, reflecting its widespread use in high-performance formulations. This grade is preferred for applications where consistency and stability are essential, such as in UV-curable coatings and adhesives for automotive and electronics manufacturing. Its precise chemical profile supports performance in demanding industrial environments, reinforcing its dominance in the segment.

The 99.9% purity segment is also gaining traction, particularly in advanced manufacturing sectors such as medical devices and high-end electronics. Its ultra-low impurity levels make it suitable for applications that demand stringent quality control and minimal reactivity deviation. While still a smaller segment, it is growing steadily, especially in high-precision and biocompatible product lines.

Lower purity grades such as 99% and 98% continue to serve cost-sensitive applications where premium performance is not a requirement. These grades are commonly used in standard adhesives and coatings for general industrial use, offering sufficient functionality at lower cost. Manufacturers seeking bulk quantities for high-volume processes typically rely on these variants.

Viscosity Analysis

Medium viscosity formulations (10–100 cPs) account for the largest share of the market at 38.4%, favored for their balanced flow characteristics. These grades are widely used in UV-curable resins, coatings, and adhesives, particularly where ease of application and uniform coverage are required. Their ability to combine strong wetting with reliable film formation makes them a top choice for formulators across multiple sectors.

Low viscosity products (0–10 cPs) follow closely, especially in applications requiring deep substrate penetration and rapid curing. They are widely adopted in precision coatings, advanced adhesives, and inkjet printing technologies where fluidity and quick drying are essential.

Higher viscosity grades (100–1000 cPs and above) cater to niche segments such as structural adhesives and high-build protective coatings. These formulations are valued for their mechanical strength and thicker application capabilities, making them ideal for structural bonding and wear-resistant surfaces. While they account for a smaller share, their demand is consistent in applications prioritizing durability and impact resistance.

Grade Analysis

Monomer grade dominates the market with a 46.4% share due to its versatility in UV-curable systems. Its reactive properties and compatibility with crosslinking processes make it an essential ingredient in coatings, adhesives, and 3D printing resins. The growing preference for fast-curing, high-strength materials in industrial applications supports continued demand for this grade.

Acrylate-grade products also hold a notable position, particularly in specialty coatings where flexibility and chemical resistance are required. These grades are increasingly used in protective coatings across industrial and commercial applications, including electronics and packaging, where performance under stress is critical.

Difunctional grades cater to engineered applications that require high elasticity and impact tolerance. Though a smaller share of the market, this segment serves specialized demand in engineered polymers, elastomers, and performance resins, particularly in automotive and construction end uses.

Application Analysis

Coatings and adhesives remain the primary application segment, accounting for 52.1% of total market demand. This dominance is linked to the shift toward UV-curable and solvent-free formulations in industrial coatings, automotive refinishing, and assembly adhesives. The material’s crosslinking capabilities enhance product life, reduce environmental impact, and support faster production cycles.

Electronics is the second-largest application, benefiting from the compound’s electrical insulation, thermal resistance, and adhesion properties. It is used in printed circuit boards, conformal coatings, and electronic encapsulants, especially in sectors such as consumer electronics and automotive electronics.

In the medical devices segment, demand is rising due to the compound’s biocompatibility and suitability for UV-curable adhesives and coatings. These are critical in device assembly, coatings for implantables, and diagnostic tools. Packaging applications are also expanding, with UV-curable coatings and inks offering improved durability, scratch resistance, and substrate adhesion on a wide range of packaging materials.

End-Use Analysis

The automotive sector leads the end-use segment, accounting for 40.3% of market demand. This reflects growing use of UV-curable coatings and adhesives in lightweight vehicle components, structural bonding, and protective exterior finishes. High durability and resistance to environmental wear support the use of 1,6-Hexanediol Diacrylate in OEM and aftermarket applications.

Construction follows, driven by increased use of weather-resistant coatings, high-strength adhesives, and protective sealants. These applications benefit from the material’s mechanical performance and chemical resistance, making it suitable for infrastructure and commercial projects.

Consumer goods also represent a growing segment, with applications in furniture coatings, appliance finishes, and durable adhesives. Meanwhile, the electronics and healthcare sectors continue to expand, supported by ongoing miniaturization trends and demand for precision adhesives in medical device production.

Regional Analysis

Asia Pacific holds the leading regional share at 42.3%, equivalent to USD 282.0 million in 2024. Rapid industrial growth, particularly in China, India, and Southeast Asia, continues to drive demand for UV-curable technologies in automotive, electronics, and packaging industries. Manufacturing scale, low production costs, and regulatory support for industrial development underpin the region’s growth.

North America follows with a significant share, supported by rising adoption of advanced materials in 3D printing, medical devices, and specialty coatings. Stringent environmental regulations are accelerating the shift toward low-VOC and solvent-free formulations, where 1,6-Hexanediol Diacrylate plays a central role.

Europe remains a mature but active market, with demand supported by sustainable product development and regulatory mandates for bio-based and low-emission materials. Germany, France, and the UK are leading adopters of high-performance acrylates in construction, automotive, and industrial coatings.

Latin America and the Middle East & Africa are showing steady growth, driven by infrastructure investment, automotive assembly, and industrial manufacturing. Although their market shares are comparatively smaller, rising demand for advanced coatings and adhesives creates long-term opportunities for manufacturers looking to expand regional presence.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Purity

- 98%

- 99%

- 99.5%

- 99.9%

By Viscosity

- Low Viscosity (0-10 cps)

- Medium Viscosity (10-100 cPs)

- High Viscosity (100-1000 cPs)

- Very High Viscosity (1000 cps and above)

By Grade

- Monomer

- Acrylates

- Di functional

- Others

By Application

- Coatings and Adhesives

- Electronics

- Medical Devices

- Packaging

- Others

By End-Use

- Automotive

- Construction

- Consumer Goods

- Electronics

- Healthcare

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 721.3 M |

| Forecast Revenue (2034) | USD 2,210.8 M |

| CAGR (2024-2034) | 7.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Purity (98%, 99%, 99.5%, 99.9%), By Viscosity (Low Viscosity (0-10 cps), Medium Viscosity (10-100 cPs), High Viscosity (100-1000 cPs), Very High Viscosity (1000 cps and above)), By Grade (Monomer, Acrylates, Di functional, Others), By Application (Coatings and Adhesives, Electronics, Medical Devices, Packaging, Others), By End-Use (Automotive, Construction, Consumer Goods, Electronics, Healthcare, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DIC Corporation, Wuxi Zhongheng Chemical, Shenyang Zhongyi Chemical, Mitsubishi Chemical, Jiangsu Rihua Fine Chemical, Kuraray Co., Ltd., Sumitomo Chemical, Haihang Chemistry, Showa Denko, Zhejiang Satellite Petrochemical, Yinyong Chemicals, Shanghai, Nisshin Chemical, Nagase Specialty Materials, Shandong Huangtai Jinyue Chemical |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

1,6-Hexanediol Diacrylate Market

Published Date : 22 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date