4D Printing Market Size, Share & Forecast 2024–2034 | 40.3% CAGR

Global 4D Printing Market Size, Share & Analysis By Material (Programmable Carbon Fiber, Programmable Textiles, Programmable Bio material, Others), By End User (Aerospace and Defense, Healthcare, Automotive, Others), Innovation Pipeline, Industry Challenges & Forecast 2025–2034

Report Overview

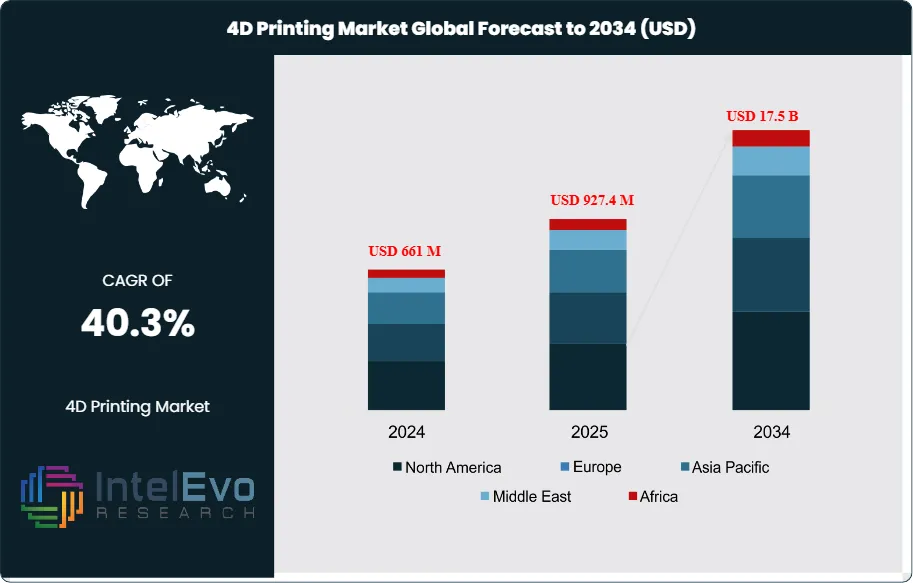

The 4D Printing Market size is expected to reach approximately USD 661 million in 2024 and around USD 17.5 billion by 2034, up from USD 472 million in 2023, growing at a CAGR of 40.3% during the forecast period from 2024 to 2034. As the next frontier of additive manufacturing, 4D printing expands the capabilities of 3D printing by integrating time as a functional dimension. This breakthrough enables printed objects to self-assemble or transform their shape and properties in response to external stimuli such as heat, light, or moisture. At the core of this technology are programmable smart materials designed to adapt to changing environments, unlocking entirely new opportunities across industries.

Get More Information about this report -

Request Free Sample ReportThe adoption of 4D printing is being driven by its versatility and transformative applications. In healthcare, researchers are exploring self-adjusting implants and prosthetics that can grow or adapt with patients, offering more personalized and durable treatment options. In construction and architecture, 4D-printed structures that reconfigure based on environmental factors are being positioned as solutions to enhance energy efficiency, resilience, and sustainability. Automotive and aerospace sectors are also investing in the technology to design lightweight, adaptive components that optimize performance and durability.

Parallel markets underscore the momentum behind this innovation. The global 3D printing industry is forecast to surpass USD 135 billion by 2033, reflecting a broader shift toward digital and automated manufacturing. Similarly, the integration of artificial intelligence in 3D printing—expected to reach USD 34.8 billion by 2033—is accelerating the development of smarter, more responsive design and production processes. Together, these trends highlight the fertile ecosystem supporting the rapid growth of 4D printing.

Despite its potential, the market faces notable challenges. The development of materials with predictable, reliable transformation properties remains a key hurdle, as does refining printing processes to ensure consistency, scalability, and cost-effectiveness. Overcoming these limitations will be essential to moving beyond research and pilot projects toward widespread commercial adoption.

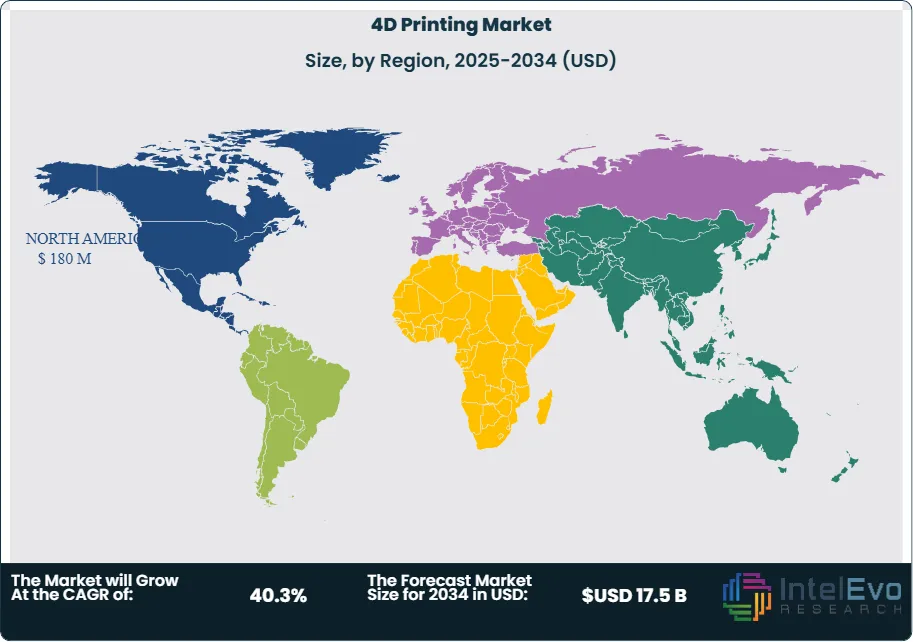

Regionally, North America and Europe are emerging as early leaders due to strong R&D activity and funding in advanced manufacturing and materials science. Meanwhile, Asia Pacific is expected to experience the fastest growth, driven by investments in industrial automation, healthcare innovation, and infrastructure development. As the technology matures, 4D printing is set to reshape global manufacturing by enabling adaptive, sustainable, and highly functional products across diverse applications.

Key Takeaways

- Market Growth: By 2034, the 4D printing market is expected to approach USD 17.5 billion, rising sharply from about USD 661 million in 2024. This represents a robust CAGR of nearly 40.3%, fueled by expanding use of programmable materials in aerospace, healthcare, and construction, alongside stronger R&D funding globally.

- Material: Programmable carbon fiber accounted for over one-third of global revenue in 2023 (34.6%), reflecting its strength-to-weight efficiency and adaptability. Its performance advantages make it the preferred material for aerospace and automotive manufacturers aiming to reduce weight without compromising durability

- End Use: The aerospace and defense sector represented 35.6% of total revenues in 2023, underpinned by demand for adaptive, lightweight structures. Defense organizations are particularly advancing investment in 4D-printed parts for next-generation aircraft and mission-critical systems.

- Driver: Breakthroughs in smart materials and additive manufacturing processes are enabling components that self-adjust to temperature, pressure, or physiological changes. This capability is accelerating adoption in medical implants, infrastructure, and other sectors requiring adaptive functionality.

- Restraint: High development costs, supply chain limits for programmable materials, and challenges in large-scale production remain obstacles. These issues are slowing commercialization beyond pilot projects, especially in cost-sensitive industries.

- Opportunity: Healthcare offers the most significant upside, with applications ranging from patient-specific prosthetics to implants that evolve with the body. Construction also presents growth potential through self-assembling building elements and climate-responsive structures.

- Trend: Integration of 4D printing with AI-powered simulation platforms is becoming a competitive differentiator, allowing firms to predict material behavior, reduce design iterations, and deliver higher-precision adaptive products.

- Regional Analysis: North America contributed over 37% of total revenues in 2023 (USD 176.5 million), supported by strong defense budgets, advanced R&D, and manufacturing expertise. Meanwhile, Asia Pacific is forecast to expand at the fastest CAGR, driven by government innovation programs in China, Japan, and South Korea, alongside growing investments in industrial automation and infrastructure.

Material Analysis

As of 2025, programmable carbon fiber remains the leading material in the 4D printing market, accounting for over one-third of global revenues. Its dominance is attributed to its exceptional strength-to-weight ratio, structural durability, and versatility in design—all of which make it indispensable in performance-driven industries such as aerospace, defense, and automotive. Beyond mechanical resilience, programmable carbon fiber offers unique adaptive properties, allowing components to alter shape or stiffness in response to external conditions such as temperature or pressure.

The commercial adoption of this material is gaining momentum in aerospace, where weight reduction and performance optimization are top priorities. For example, adaptive carbon fiber structures are being explored to reduce reliance on additional mechanical systems by self-adjusting under varying flight conditions, leading to improved fuel efficiency. Similarly, in sports and high-performance automotive applications, carbon fiber composites are being engineered to enhance responsiveness and endurance.

Future growth of this segment is expected to accelerate as advancements in smart material engineering make production more cost-efficient and scalable. Researchers are also exploring new applications in energy management and healthcare, including carbon fiber-based implants that can adapt to the human body’s dynamic environment. With continued progress in programmable composites, this material is set to reinforce its leadership position, shaping the future of responsive and sustainable design across industries.

End User Analysis

In 2025, the aerospace and defense sector continues to represent the largest end-use segment in the 4D printing market, accounting for more than one-third of total demand. This leadership is driven by the sector’s requirement for materials that can withstand extreme conditions while enhancing performance, resilience, and sustainability. Programmable structures capable of self-healing, shape-shifting, or optimizing aerodynamic properties are becoming critical in advancing both military and commercial aviation.

A key value proposition for aerospace and defense lies in the ability of 4D-printed components to reduce weight without compromising strength, directly improving fuel efficiency and operational effectiveness. In military applications, self-adjusting or self-repairing parts provide strategic advantages by minimizing downtime and enabling equipment to perform in unpredictable environments. As sustainability pressures intensify, defense contractors and aerospace manufacturers are also leveraging 4D printing to cut material waste and design components for reuse or recycling.

Looking ahead, the sector’s reliance on high-performance adaptive solutions is expected to deepen. With defense budgets increasingly prioritizing advanced manufacturing technologies and the aviation industry seeking to decarbonize operations, 4D printing is poised to play an even greater role in shaping the future of aerospace and defense innovation.

Regional Analysis

As of 2025, North America remains the largest regional market for 4D printing, commanding over 37% of global revenues and valued at approximately USD 180 million. This leadership reflects the region’s advanced research ecosystem, substantial investments in additive manufacturing, and strong government support for innovation in next-generation technologies. Key industries—including aerospace, defense, healthcare, and automotive—are driving adoption as they seek to integrate programmable materials into mission-critical applications.

The presence of leading technology developers, research universities, and industrial innovators in the United States and Canada has created a fertile environment for scaling 4D printing beyond prototypes into commercialized applications. For instance, collaborations between aerospace firms and research institutions are pushing forward the development of adaptive aircraft components, while healthcare organizations are testing patient-specific implants made from programmable biomaterials.

North America’s regulatory environment, particularly in healthcare and automotive sectors, is also contributing to market growth by demanding higher levels of safety, precision, and sustainability in manufacturing practices. With continued funding, strong intellectual property generation, and a robust pipeline of partnerships, North America is positioned to maintain its leadership role while setting global benchmarks for the deployment of 4D printing technologies.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Material

- Programmable Carbon Fiber

- Programmable Textiles

- Programmable Bio material

- Others

By End User

- Aerospace and Defense

- Healthcare

- Automotive

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 661 M |

| Forecast Revenue (2034) | USD 17.5 B |

| CAGR (2024-2034) | 40.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Material (Programmable Carbon Fiber, Programmable Textiles, Programmable Bio material, Others), By End User (Aerospace and Defense, Healthcare, Automotive, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Autodesk Inc., Stratasys Ltd., Materialise NV, Dassault Systèmes SA, Organovo Holdings Inc., Hewlett Packard Enterprise Company, CT CoreTechnologie Group, EnvisionTEC, Inc., The ExOne Company, Heineken NV |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date