AI-Based 3D Vision System Market Size | 27.4% CAGR Forecast 2034

Global AI-Based 3D Vision System Market Size, Share, Industry Analysis By Component (Hardware, Software, Services), By Technology (Stereo Vision, Time-of-Flight, Structured Light), By Application (Robotics, Quality Inspection, Autonomous Vehicles, Healthcare Imaging), By End Use Industry, Global Trends, Key Players & Forecast 2025–2034

Report Overview

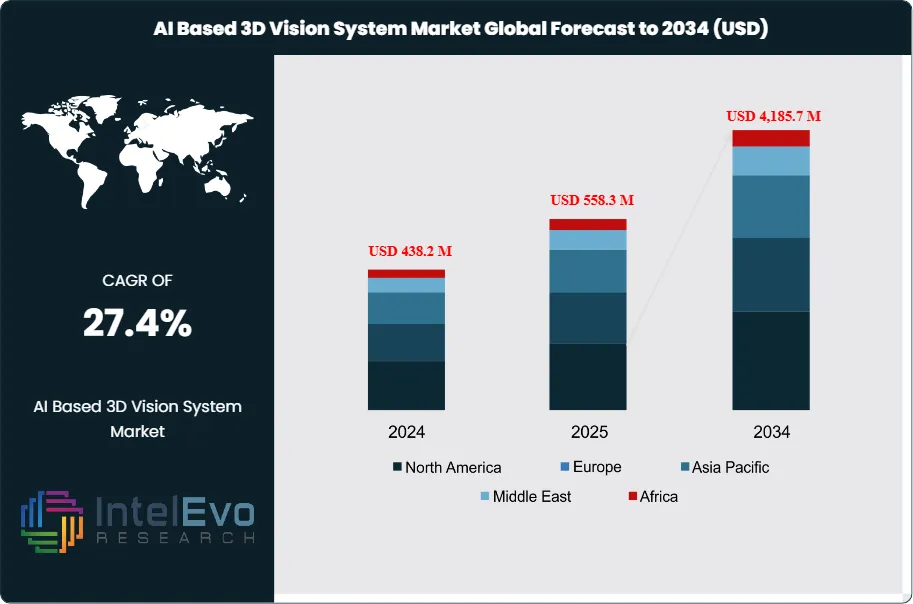

The AI-based 3D vision system market is estimated at USD 438.2 million in 2024 and is projected to reach approximately USD 4,185.7 million by 2034, reflecting a strong CAGR of about 27.4% from 2025–2034. These updated values reflect accelerating demand for intelligent automation, precision robotics, and real-time machine vision capabilities across industrial and high-tech sectors.

Get More Information about this report -

Request Free Sample ReportThe AI-based 3D vision system market has shifted from a niche technology in industrial automation to a key feature in advanced manufacturing ecosystems. Demand has increased in the past five years as industries focus on higher automation, accuracy, and efficiency. Automotive, electronics, and medical device manufacturers lead the adoption, driven by their need for precise, complex tasks at scale. In 2024, North America had the largest market share at 34.6% and generated USD 105 million in revenue, supported by strong investments in robotics, smart factories, and intelligent inspection systems.

AI-enabled 3D vision systems provide real-time spatial intelligence. This capability supports critical applications like defect detection, autonomous navigation, volumetric measurement, and robotic picking in changing conditions. Their value grows as manufacturers seek to increase output and reduce errors. For example, automated inspection using 3D vision can cut quality control cycle times by up to 40% in high-volume production settings. These improvements are especially important as industries speed up digital transformation efforts and integrate AI technologies to enhance manufacturing processes.

On the supply side, ongoing improvements in sensor calibration, neural network models, optical parts, and processing systems are significantly boosting accuracy and reliability. Modern AI-based 3D vision solutions can now identify unusual shapes, track fast-moving objects, and adjust to different lighting or environmental conditions. This increase in performance is crucial in logistics, semiconductor packaging, precision assembly, and autonomous robotics. As computational power becomes cheaper and AI training processes improve, vendors are providing more flexible and modular systems suited to various industrial needs.

Despite this progress, several challenges still slow widespread adoption. High initial costs for deployment are a significant barrier, especially for small and mid-sized companies with limited automation budgets. Integrating with older equipment and split industrial control systems also hampers implementation in conservative sectors. Concerns about compatibility, maintenance skills, and long-term return on investment create more hesitation. However, early adopters are showing measurable benefits, which encourages broader industry acceptance as digital factories become more common.

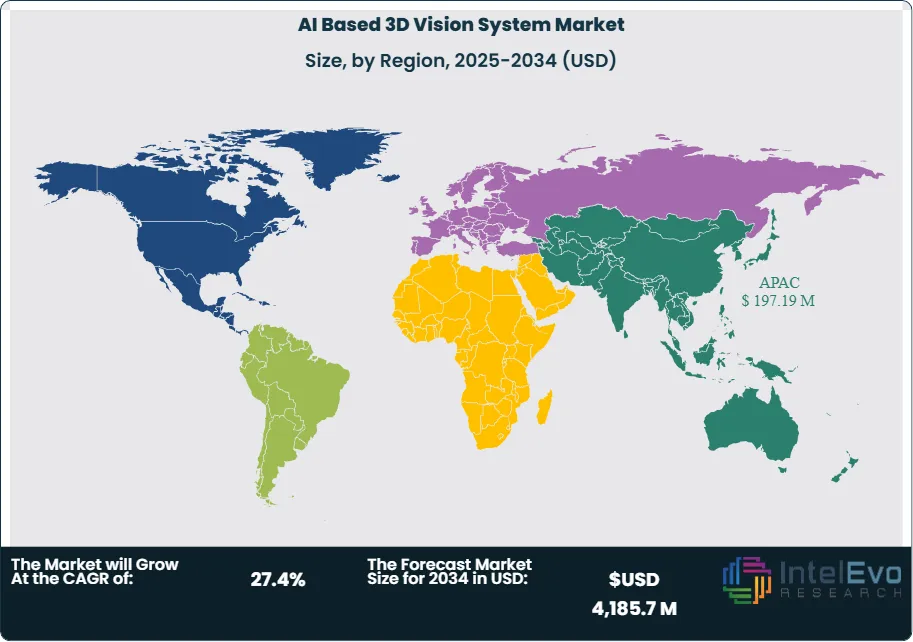

Global adoption trends indicate a positive outlook for long-term growth. The Asia Pacific region is quickly becoming a high-growth area, boosted by automotive manufacturing centers in China, Japan, and South Korea, along with government-supported AI modernization initiatives. European industries are also relying more on adaptive vision systems to comply with strict quality and safety standards in sectors like pharmaceuticals, aerospace, and advanced materials. As AI algorithms become better at learning from real-time production data and adapting automatically to changing conditions, AI-based 3D vision is becoming essential for the next generation of industrial intelligence. With growing complexity in automation, the need for precise, high-performing 3D vision technology will only increase over the next decade.

Key Takeaways

- Market Growth: The global AI-based 3D vision system market is projected to reach USD 4,185.7 million by 2034, up from USD 438.2 million in 2024, reflecting a CAGR of 27.4%. Growth is driven by increasing automation needs in manufacturing, robotics, and quality control.

- Component: Hardware accounted for over 67.8% of total market revenue in 2024. This dominance is due to high demand for advanced sensors, cameras, and processors that enable precise 3D data capture and real-time analysis.

- Platform Type: PC-based systems led the market with a 51.3% share in 2024. Their dominance stems from superior computing power and ease of integration with industrial automation infrastructure.

- Application: Quality Assurance & Inspection was the leading application, representing over 47.2% of market revenue in 2024. Manufacturers are adopting 3D vision systems to reduce defects and improve throughput in high-precision environments.

- End Use Industry: Automotive remained the top end-use sector in 2024, contributing more than 19.5% of market revenue. Key drivers include increased adoption of robotics in assembly lines and demand for high-accuracy component inspection.

- Driver: Rising automation in industrial processes is accelerating adoption. AI-based 3D vision systems reduce inspection time by up to 40% in high-volume operations, directly improving productivity and lowering labor costs.

- Restraint: High upfront costs and integration challenges remain barriers for small and mid-sized enterprises. Many manufacturers face difficulties aligning AI-based systems with legacy equipment, slowing overall implementation rates.

- Opportunity: Asia Pacific presents strong upside, supported by automotive production growth and government-backed AI investments. Markets like China, India, and Japan are expected to see double-digit adoption growth through 2030.

- Trend: Integration of deep learning models with 3D vision systems is advancing real-time object recognition and adaptive automation. Companies are prioritizing systems that can learn from live production data to improve accuracy without manual recalibration.

- Regional Analysis: North America led the global market in 2024 with a 34.6% share and USD 105 million in revenue. While the U.S. remains a hub for early adoption, Asia Pacific is gaining momentum as a manufacturing and R&D center with accelerating CAGR projections.

Component Analysis

Hardware remains the largest revenue contributor in AI-based 3D vision. Buyers continue to invest in depth sensors, industrial cameras, optics, laser profilers, and embedded compute that capture and pre-process 3D data. Hardware intensity is not easing in 2025, given the shift to higher-resolution imagers and faster interfaces that feed AI models at line speed. Broader machine vision spend is set to expand at double-digit rates through 2030, keeping capital equipment at the center of budgets.

Software is scaling with model upgrades and toolchains that cut deployment time. You now see vendors shipping domain-specific AI for defect classification, 3D point-cloud analytics, and synthetic data pipelines. AI in computer vision is one of the fastest-growing layers, with market estimates pointing to high-twenties to low-thirties CAGR into the 2030s, which will raise software’s mix as subscriptions and runtime licenses compound.

Services are moving from one-off integration to lifecycle contracts. System design, dataset curation, validation, and MLOps support are recurring needs as factories refresh lines every 18 to 36 months. As total machine vision outlays rise into the 2030 horizon, services revenue tracks deployments across brownfield plants and multi-site rollouts.

Type Analysis

PC-based systems retain the installed base in complex 3D tasks. They offer high compute headroom, broad SDK support, and flexible I/O for multi-camera cells. Manufacturers favor PC architectures for demanding point-cloud fusion, metrology, and AI inference on larger models. With global machine vision revenue projected to grow at roughly 13 percent CAGR to 2030, PC-based platforms will stay embedded in high-throughput inspection cells and robotics workstations.

Smart-camera-based systems are gaining share in 2025 as on-sensor AI improves. New devices pair CMOS imagers with NPUs, shrinking footprint and install time while meeting IP65/67 needs on the line. Industry trackers project the broader smart-camera segment to expand at low-to-mid teens CAGR this decade. Niche forecasts for smart-camera 3D solutions also point to mid-teens growth to 2033 as vendors like Cognex and Keyence push integrated 3D offerings. Expect faster uptake in packaging, food and beverage, and logistics where single-unit installs reduce integration cost.

“Others” includes modular vision sensors, FPGA/SoC edge boxes, and hybrid architectures that split inference between camera, edge, and server. These builds support retrofits where PC cabinets are impractical but full smart-camera consolidation is not feasible. Growth will mirror overall machine vision expansion as integrators mix components to meet takt-time and accuracy targets.

Application Analysis

Quality assurance and inspection remains the anchor application. It held the largest share in 2024 and continues to lead in 2025, driven by tighter defect ppm targets, serialization, and regulatory compliance. AI-enabled 3D raises detection rates for surface flaws, assembly errors, and dimensional out-of-tolerance parts, cutting scrap and recall risk in automotive, electronics, and pharma.

Positioning and guidance is scaling with robot installs and autonomous material handling. 3D vision supports bin-picking, depalletizing, and path planning in warehouses and mixed-model assembly. As logistics and e-commerce invest in automation, guidance workloads are moving from pilot to production, supported by rising global machine vision spend through 2030.

Measurement and metrology benefit from higher-resolution sensors and improved point-cloud processing. Plants use 3D vision for inline gauging, body-in-white alignment, and blade or die wear checks. Better accuracy at line speed expands use from lab QA to shop-floor SPC, raising attach rates across metalworking and precision assembly.

Industry Vertical Analysis

Automotive remains a major buyer as EV platforms and mixed-model lines demand tighter tolerances and higher first-time-through rates. 3D vision underpins battery pack assembly, seam inspection, and robot guidance. Regional analyses show automotive as a leading user in Asia, with shares near half of industrial machine vision demand in some markets, underscoring its outsized pull on global roadmaps.

Electronics and semiconductor lines use 3D vision for board-level inspection, connector alignment, and advanced packaging. As component miniaturization continues, AI-assisted 3D detection reduces false rejects and rework. Machinery and equipment OEMs embed 3D vision into turnkey cells, creating pull-through for services and software.

Pharmaceuticals and healthcare deploy 3D for blister integrity, vial and syringe checks, and device assembly verification. Postal and logistics operations add 3D volumetric measurement, label reading, and damage detection to speed sortation and billing accuracy. These verticals expand the use cases beyond discrete manufacturing and stabilize demand across cycles.

Regional Analysis

Asia Pacific is the fastest-growing region in 2025. Multiple sources point to double-digit CAGRs, supported by electronics clustering in China, South Korea, and Taiwan; automotive capacity in China and Southeast Asia; and strong supplier bases in Japan. Some estimates placed APAC machine vision revenue near 9 to 10 billion dollars in 2024, with growth above 13 percent expected into the 2030s.

North America maintains a significant revenue base due to high automation intensity and ongoing AI investment cycles. The region benefits from strong integrator ecosystems and rapid adoption in logistics and consumer goods. Europe remains a core market with entrenched automotive and machinery OEMs and steady upgrades tied to quality and sustainability mandates. Global machine vision and 3D sub-segments are projected to expand at low-to-mid teens CAGRs through 2030, supporting broad regional growth.

Latin America and the Middle East & Africa are smaller today but show rising project counts in food processing, mining, and packaging. As component prices fall and smart-camera deployments simplify installs, these regions should post above-average growth from a smaller base. Your strategy in 2025 should prioritize APAC for volume, North America and Europe for high-value cells, and targeted wins in emerging regions with standardized, rapid-deploy solutions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Hardware

- Software

- Services

By Type

- PC Based

- Smart Camera Based

- Others

By Application

- Quality Assurance & Inspection

- Positioning & Guidance

- Measurement

- Others

By Industry Vertical

- Automotive

- Electronics & Semiconductor

- Machinery & Equipment

- Pharmaceuticals & Healthcare

- Postal & Logistics

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 438.2 M |

| Forecast Revenue (2034) | USD 4,185.7 M |

| CAGR (2024-2034) | 27.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, Hardware, Software, Services |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SewerAI, Basler AG, Orbital Insight, Mashgin, Keyence Corporation, KITWARE, Skyrora, Cognex Corporation, Path Robotics, Proprio, THALES, New Frontier Aerospace, Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

AI Based 3D Vision System Market

Published Date : 22 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date