AI Dubbing Tools Market Size, Growth Outlook & Forecast | CAGR of 20.4%

Global AI Dubbing Tools Market Size, Share & Media Localization Analysis By Type (HPC, SCC, Specialty Concretes), By Deployment (On-Premise, Cloud), By Application (Pavers (Roads & Walkways), Retaining Walls (Soil Stabilization & Landscaping), Precast Elements, Structural Components), By End-Use (Residential, Commercial, Industrial), Multilingual Content Demand, Creator Economy Impact, Key Platforms & Forecast 2025–2034

Report Overview

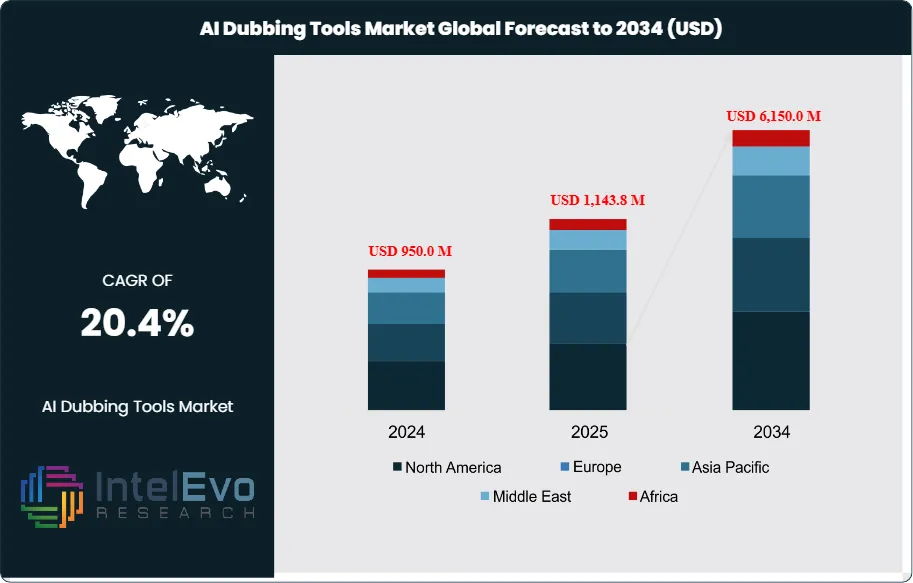

The AI dubbing tools market is estimated at USD 950.0 million in 2024 and is projected to reach approximately USD 6,150.0 million by 2034, registering a compound annual growth rate (CAGR) of about 20.4% during 2025–2034. This accelerated expansion reflects the rapid globalization of digital content across streaming platforms, gaming, advertising, and e-learning, where demand for fast, scalable multilingual localization is intensifying. Advances in generative AI voice synthesis, real-time translation, and emotion-aware speech models are significantly improving output quality, widening acceptance beyond cost-driven use cases. As content owners prioritize simultaneous global releases and creators seek to monetize international audiences, AI dubbing tools are becoming a core component of modern content production workflows.

Get More Information about this report -

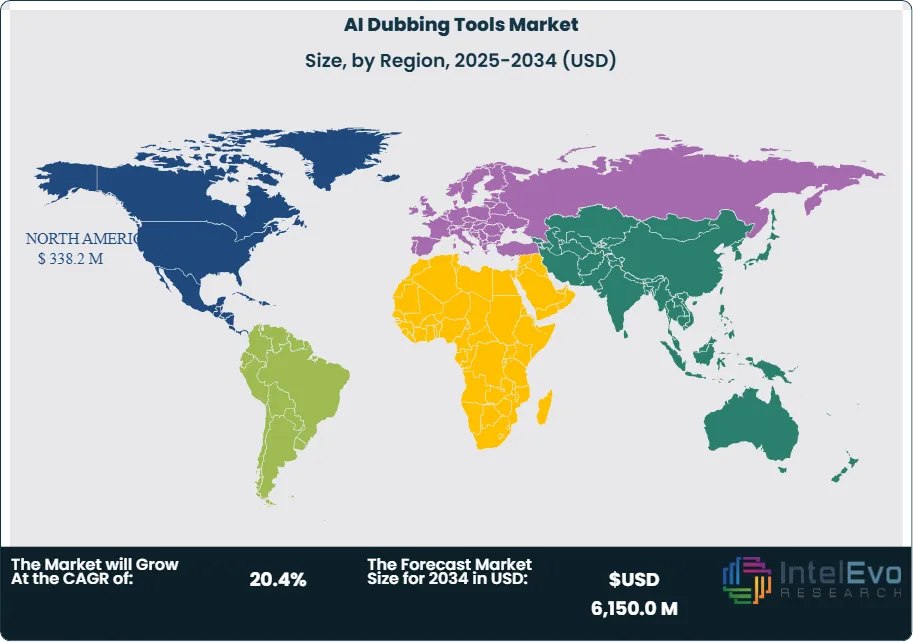

Request Free Sample ReportThe market has expanded rapidly in recent years, supported by the surge in global streaming platforms, rising digital content consumption, and the growing need for multilingual accessibility. North America accounted for 35.6% of global revenue in 2023, valued at USD 282.8 million, while Asia-Pacific is emerging as a high-growth region due to its large, linguistically diverse audience base and increasing investments in digital media infrastructure.

AI dubbing tools automate the traditionally labor-intensive process of voice replacement in audiovisual content. By applying machine learning and natural language processing, these solutions generate synthetic voices that replicate human tone, inflection, and emotion. This capability is critical for film studios, streaming platforms, and e-learning providers seeking to localize content at scale. The demand is reinforced by consumer preferences: surveys show that 72% of Indian viewers prefer foreign-language content, with nearly one-quarter choosing dubbed versions over subtitles. On platforms like Netflix, consumption of dubbed content has grown by more than 120% annually, while the company’s dubbing investments have risen between 25% and 35% per year.

Technology advancements are accelerating adoption. Automated lip-sync alignment, hyper-realistic voice synthesis, and AI voice cloning across more than 130 languages are improving quality and reducing turnaround times. YouTube’s introduction of multi-language audio tracks, with early pilots showing 3,500 videos in 40 languages and 15% of watch time from non-primary languages, highlights the scale of opportunity for content creators. These developments position AI dubbing as a cost-effective alternative to traditional dubbing, particularly for mid-tier content producers with limited budgets.

Key growth drivers include the globalization of media, rising demand for accessible content, and the cost and time efficiencies of AI-based workflows. Challenges remain around regulatory oversight, particularly in intellectual property rights and ethical use of cloned voices. Governments are beginning to support AI-driven localization through digital transformation initiatives, but compliance with copyright frameworks will be essential to sustain trust.

For investors, North America and Europe remain established revenue centers, while Asia-Pacific and Latin America represent the fastest-growing opportunities. With streaming, gaming, and education sectors expanding globally, AI dubbing tools are positioned as a critical enabler of multilingual engagement and long-term market growth.

Key Takeaways

- Market Growth: The global asparaginase market, estimated at USD 950.0 million in 2024, is forecast to surge to USD 6,150.0 million by 2034, reflecting a strong compound annual growth rate (CAGR) of 20.4%. This expansion is primarily fueled by the increasing prevalence of cancer worldwide and heightened regulatory initiatives aimed at lowering acrylamide concentrations in food products.

- Deployment Model: Cloud-based solutions accounted for 68% of total revenue in 2023, supported by lower upfront costs, faster integration, and the ability to scale dubbing projects across multiple languages.

- Application: Content creators represented 45% of the market in 2023, reflecting their need for rapid, cost-efficient dubbing to expand audience reach on platforms such as YouTube and Netflix.

- Driver: Streaming platforms are accelerating adoption. Netflix increased its dubbing investments by 25–35% annually, while consumption of dubbed content on the platform has grown by more than 120% per year.

- Restraint: Intellectual property and ethical concerns around AI voice cloning remain a barrier. Compliance with copyright frameworks and protection of voice actors’ rights could slow adoption in regulated markets.

- Opportunity: Asia-Pacific presents the strongest growth potential, with its large multilingual population and expanding digital infrastructure. The region is expected to post a CAGR above the global average through 2033.

- Trend: Automated lip-sync technology and AI voice cloning across more than 130 languages are improving viewer experience and reducing production timelines. Early adoption by platforms like YouTube, which tested 3,500 multi-language videos in 40 languages, signals strong momentum.

- Regional Analysis: North America led with a 35.6% share in 2023, valued at USD 282.8 million, supported by advanced AI ecosystems and high streaming penetration. Asia-Pacific and Latin America are emerging as investment hotspots, with double-digit growth rates driven by rising demand for localized entertainment and education content.

Type Analysis

High-performance concrete and self-consolidating concrete continue to define the structural landscape of the global market in 2025. High-performance concrete is increasingly adopted in large-scale infrastructure projects due to its superior durability and strength, particularly in regions investing heavily in transport and urban development. Self-consolidating concrete, valued for its ease of placement and reduced labor requirements, is gaining traction in both residential and commercial construction. Together, these two categories account for the majority of demand, while other specialty concretes, including lightweight and fiber-reinforced variants, are carving out niche applications in industrial and high-rise projects.

The growth trajectory is supported by rising urbanization and government-backed infrastructure spending. For example, global infrastructure investment is projected to exceed USD 3.5 trillion annually by 2030, with concrete-intensive projects forming a significant share. The demand for advanced concrete types is also linked to sustainability requirements, as manufacturers integrate supplementary cementitious materials to reduce carbon emissions. This shift is expected to accelerate adoption across both developed and emerging economies.

Application Analysis

Pavers represent a significant share of the application segment, driven by rapid urban expansion and the need for durable road and walkway solutions. Municipal projects and smart city initiatives are fueling demand, with Asia Pacific alone expected to account for over 40% of new paving applications by 2030. Retaining walls, another key application, are witnessing strong uptake in both residential landscaping and large-scale infrastructure, particularly in flood-prone regions where soil stabilization is critical.

Other applications, including precast elements and structural components, are expanding steadily as construction firms seek cost-efficient and time-saving solutions. The adoption of advanced concretes in these areas is supported by automation in precast manufacturing and the rising use of modular construction techniques. These applications are expected to grow at a CAGR above the overall market average through 2035, reflecting their role in modern construction practices.

End-Use Analysis

Residential construction remains the largest end-use segment, supported by rising housing demand in emerging economies and government-backed affordable housing programs. In India alone, urban housing demand is projected to exceed 25 million units by 2030, creating sustained demand for high-performance and self-consolidating concretes. Commercial buildings, including offices, retail complexes, and mixed-use developments, are also a major growth driver, particularly in North America and Europe where renovation and green building initiatives are expanding.

Industrial construction, while smaller in share, is gaining momentum as global manufacturing hubs expand. Warehouses, logistics centers, and production facilities increasingly require durable concrete solutions that can withstand heavy loads and operational stress. This segment is expected to post steady growth, supported by the expansion of e-commerce and global supply chain realignment.

Regional Analysis

North America accounted for 35.6% of the global market in 2023 and continues to lead in 2025, supported by advanced construction practices, high adoption of sustainable building materials, and strong investment in infrastructure renewal. The United States remains the largest contributor, with federal infrastructure programs driving demand for high-performance concrete in highways, bridges, and public facilities.

Europe follows closely, with stringent environmental regulations accelerating the adoption of low-carbon concrete solutions. Countries such as Germany, France, and the UK are investing heavily in sustainable construction, creating opportunities for advanced concrete types. Asia Pacific, however, is the fastest-growing region, with China, India, and Southeast Asia driving demand through rapid urbanization and large-scale infrastructure projects. Latin America and the Middle East & Africa are emerging markets, where rising urban populations and government-backed infrastructure spending are expected to generate double-digit growth rates through 2035.

This regional distribution highlights a dual trend: mature markets focusing on sustainability and efficiency, while emerging economies prioritize capacity expansion and urban development. Both dynamics ensure long-term growth opportunities across the global concrete market.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- High-Performance Concrete (HPC)

- Self-Consolidating Concrete (SCC)

- Specialty Concretes

By Deployment

- On-Premise

- Cloud

By Application

- Pavers (Roads & Walkways)

- Retaining Walls (Soil Stabilization & Landscaping)

- Precast Elements

- Structural Components

By End-Use

- Residential

- Commercial

- Industrial

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 950.0 M |

| Forecast Revenue (2034) | USD 6,150.0 M |

| CAGR (2024-2034) | 20.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (High-Performance Concrete (HPC), Self-Consolidating Concrete (SCC), Specialty Concretes), By Deployment (On-Premise, Cloud), By Application (Pavers (Roads & Walkways), Retaining Walls (Soil Stabilization & Landscaping), Precast Elements, Structural Components), By End-Use (Residential, Commercial, Industrial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Papercup, Amazon Web Services (AWS), Respeecher, Veritone, Inc., Deepdub, Google, iSpeech, Microsoft Azure Cognitive Services, WellSaid Labs, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date