AI in Accounting Market Size | Growth Outlook & 34.8% CAGR

Global AI in Accounting Market Size, Share & Analysis By Component (Solution, Services), By Technology (Natural Language Processing, Robotic Process Automation (RPA), Machine Learning and Deep Learning), By Application (Invoice and Billing Processing, Automated Bookkeeping, Fraud Detection and Risk Management, Payroll Processing, Financial Forecasting and Auditing, Tax Compliance) Industry Transformation Trends & Forecast 2025–2034

Report Overview

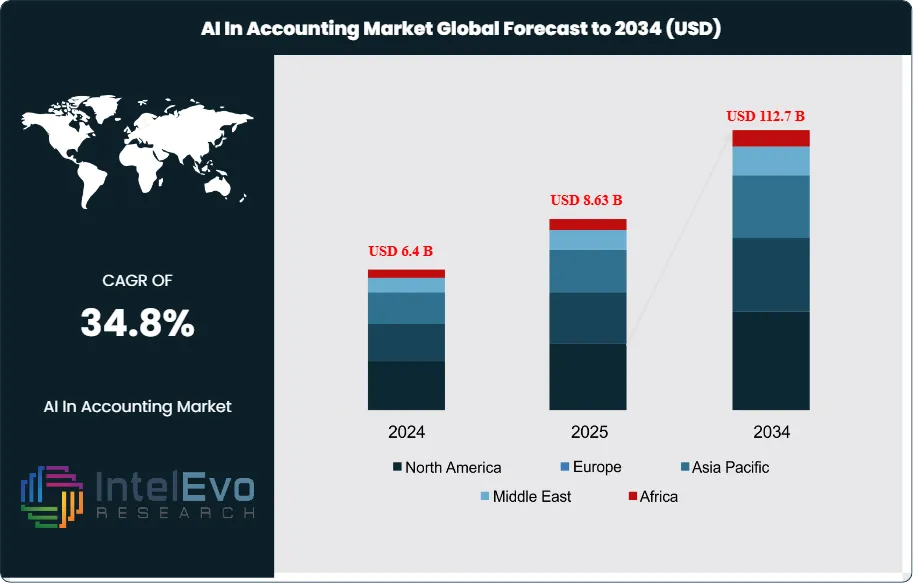

The AI in Accounting Market is valued at approximately USD 6.4 billion in 2024 and is projected to reach nearly USD 112.7 billion by 2034, expanding at a powerful CAGR of about 34.8% from 2025–2034. The surge is driven by accelerated adoption of AI copilots, autonomous bookkeeping engines, and real-time financial analytics across enterprises of all sizes. As CFOs prioritize digital transformation and regulators encourage automated compliance, AI-driven finance tools are reshaping audit quality, forecasting accuracy, and decision-making speed. With generative AI redefining reporting workflows and eliminating manual bottlenecks, the category continues to trend strongly across fintech, corporate finance, and SaaS innovation platforms.

Get More Information about this report -

Request Free Sample ReportThis exponential trajectory reflects the transformative impact of artificial intelligence on the accounting sector, as enterprises accelerate their digital transformation strategies to streamline financial operations, improve compliance, and gain real-time insights.

Historically, accounting functions were dominated by manual data entry, rule-based processes, and legacy systems with limited interoperability. However, the last five years have marked a decisive shift, with organizations adopting AI-driven solutions to reduce human error, enhance efficiency, and ensure audit-readiness. As of 2024, AI adoption in accounting is increasingly being integrated across accounts payable/receivable, fraud detection, financial forecasting, tax management, and regulatory reporting. This shift is not only driven by the need for operational optimization but also by mounting regulatory scrutiny and the rising volume of financial data generated by global enterprises.

Key growth drivers include the need for real-time data analysis, growing cybersecurity concerns, and rising pressure to improve transparency in financial reporting. On the supply side, advancements in natural language processing (NLP), machine learning (ML), and robotic process automation (RPA) have enabled intelligent workflows that reduce reliance on manual intervention. However, challenges such as high implementation costs, data privacy risks, and resistance to change among traditional accounting teams may moderate the pace of adoption in certain markets.

Technological innovation remains a critical enabler, with cloud-based AI accounting platforms gaining traction for their scalability and ease of integration with enterprise resource planning (ERP) systems. Emerging use cases such as predictive analytics for cash flow management, AI-powered audits, and autonomous transaction categorization are reshaping how finance teams operate and make decisions.

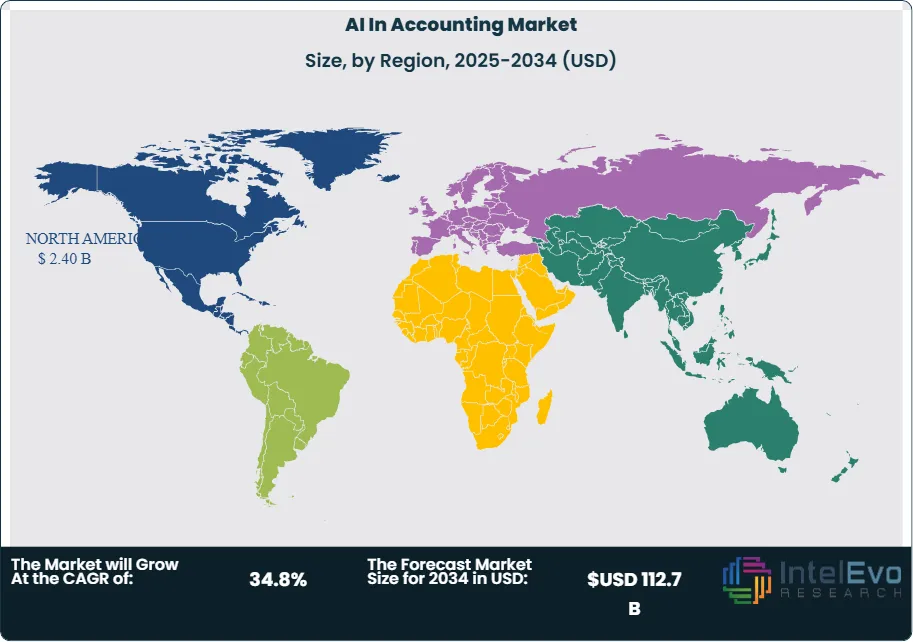

Regionally, North America holds a dominant market share, driven by early adoption, mature digital infrastructure, and a high concentration of financial institutions. Meanwhile, Asia-Pacific is emerging as a lucrative investment hotspot, particularly in economies like India, China, and Singapore, where rapid digitization and favorable regulatory environments are fostering demand for AI-driven financial tools. As enterprises prioritize agility, compliance, and data-driven decision-making, AI is poised to become an indispensable asset in the future of accounting.

Key Takeaways

- Market Growth: The global AI in accounting market was valued at USD 6.4 billion in 2024 and is projected to reach USD 112.7 billion by 2034, expanding at a robust CAGR of 34.8% from 2025–2034. Growth is primarily driven by rising demand for automation, regulatory compliance, and real-time financial reporting.

- Component: Solutions led the market with a commanding 67.2% revenue share in 2024, as organizations increasingly invest in AI-powered accounting software to automate core functions such as transaction processing, forecasting, and audit support.

- Technology: Machine learning and deep learning technologies dominated the market in 2024, underpinning advanced applications such as anomaly detection, predictive analytics, and intelligent document processing in financial operations.

- Application: Automated bookkeeping emerged as the leading application segment in 2024, driven by demand for faster reconciliation, reduced manual errors, and enhanced data accuracy across accounts payable and receivable functions.

- Driver: Escalating enterprise focus on efficiency and compliance is fueling adoption, particularly in heavily regulated industries. AI tools reduce financial close time by up to 40% and improve audit readiness, making them vital for corporate finance teams.

- Restraint: High implementation costs and data privacy concerns remain significant barriers, especially for small and medium-sized enterprises. Initial setup and integration can cost upwards of USD 500,000 for enterprise-grade systems, limiting adoption in cost-sensitive markets.

- Opportunity: The Asia-Pacific region presents substantial growth potential, expected to be the fastest-growing market through 2033. Countries like India, China, and Singapore are investing in digital financial infrastructure, offering opportunities for vendors targeting mid-market and enterprise segments.

- Trend: The integration of AI accounting tools with enterprise resource planning (ERP) systems is accelerating, with platforms like Oracle, SAP, and QuickBooks introducing native AI functionalities. This convergence is enabling end-to-end automation and strategic decision-making across finance departments.

- Regional Analysis: North America dominated with a 37.5% revenue share in 2024, led by strong U.S. market performance. In contrast, Asia-Pacific is witnessing the highest CAGR due to rapid digitalization, government support for AI, and increasing adoption among emerging economies.

Component Analysis

As of 2025, AI-driven solutions continue to lead the global AI in accounting market, accounting for over 67% of total revenue. This dominance is underpinned by the widespread deployment of intelligent software platforms designed to automate core accounting tasks such as ledger management, invoicing, compliance tracking, and predictive financial analysis. These platforms are increasingly powered by advanced technologies like machine learning (ML) and natural language processing (NLP), delivering higher speed, precision, and scalability across accounting departments. Large and mid-sized enterprises are especially inclined toward off-the-shelf AI solutions that can integrate seamlessly with existing ERP systems like SAP, Oracle, and QuickBooks, thereby accelerating digital transformation initiatives and maximizing return on investment.

The services segment, while smaller in comparison, is witnessing accelerated growth driven by the rising complexity of AI implementation. Organizations—particularly small and medium enterprises (SMEs)—are turning to service providers for AI consulting, data migration, model training, and solution customization. The shift toward cloud-based, subscription-driven AI platforms has also increased demand for ongoing support and managed services. With accounting functions becoming more data-intensive and regulatory environments evolving rapidly, the role of AI advisory services is becoming essential in helping firms navigate compliance requirements, system integration challenges, and long-term optimization strategies.

Technology Analysis

In 2025, machine learning and deep learning technologies maintain a clear lead in the AI in accounting market, thanks to their exceptional ability to process and analyze large volumes of structured financial data. These technologies power applications such as automated reconciliations, fraud detection, cash flow forecasting, and dynamic financial modeling. Enterprises are adopting these tools to enhance audit trail accuracy and accelerate month-end close cycles, often reducing manual workload by 30–40%. As organizations place greater emphasis on real-time data insights and predictive intelligence, ML and deep learning are emerging as foundational technologies across all tiers of financial management.

Simultaneously, natural language processing (NLP) is becoming a key enabler in automating unstructured financial tasks. From extracting data from invoices and bank statements to enabling voice-activated accounting and chatbot-based client interactions, NLP is redefining user experience within finance departments. While NLP currently represents a smaller share of the market, its influence is expanding rapidly, especially with the integration of AI into compliance reporting, audit documentation, and intelligent query resolution. The growing prevalence of conversational AI interfaces in finance platforms is expected to further accelerate NLP adoption over the next five years.

Application Analysis

In terms of application, automated bookkeeping remains the cornerstone of AI integration in accounting, commanding the largest market share in 2025. Organizations across industries are leveraging AI tools to automate data entry, categorize transactions, and maintain real-time ledgers with minimal human input. The appeal lies in cost efficiency, scalability, and reduced error rates—benefits particularly crucial for SMEs aiming to modernize operations without overhauling entire finance teams. Cloud-enabled platforms also allow remote teams to access synchronized records securely, making bookkeeping automation one of the most widely adopted AI applications globally.

Beyond bookkeeping, financial forecasting and auditing are experiencing significant momentum. AI-enabled forecasting tools provide finance leaders with actionable insights based on historical patterns, market trends, and internal performance data. This is proving essential in an era marked by economic volatility and tighter compliance scrutiny. Similarly, AI-based audit systems offer continuous monitoring and real-time flagging of anomalies, significantly improving governance and risk management. As companies pivot toward proactive financial planning and data-driven oversight, the use of AI in forecasting and auditing is expected to grow at a CAGR exceeding 40% through 2030.

Regional Analysis

Geographically, North America remains the leading region in the AI in accounting market, with a revenue share of approximately 37.5% in 2024, supported by early technology adoption, a mature enterprise ecosystem, and heavy investment in financial digitization. The U.S. in particular has been at the forefront, with large corporations and tech-driven accounting firms deploying AI solutions to reduce labor costs and improve operational accuracy. Regulatory initiatives emphasizing transparency and financial accountability are also pushing firms toward real-time AI-powered reporting tools.

In contrast, the Asia Pacific region is emerging as the fastest-growing market, driven by accelerating digital transformation across financial sectors in countries such as India, China, Japan, and Singapore. SMEs in these markets are increasingly adopting AI tools to improve financial visibility and ensure compliance with regional tax and reporting regulations. Supportive government policies, a young tech-savvy workforce, and the rapid expansion of fintech ecosystems further enhance the region’s attractiveness. As cloud infrastructure matures and local vendors offer more affordable AI solutions, Asia Pacific is poised to significantly narrow the adoption gap with developed markets over the next decade.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Solution

- Services

By Technology

- Natural Language Processing

- Robotic Process Automation (RPA)

- Machine Learning and Deep Learning

By Application

- Invoice and Billing Processing

- Automated Bookkeeping

- Fraud Detection and Risk Management

- Payroll Processing

- Financial Forecasting and Auditing

- Tax Compliance

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 6.4 B |

| Forecast Revenue (2034) | USD 112.7 B |

| CAGR (2024-2034) | 34.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Solution, Services), By Technology (Natural Language Processing, Robotic Process Automation (RPA), Machine Learning and Deep Learning), By Application (Invoice and Billing Processing, Automated Bookkeeping, Fraud Detection and Risk Management, Payroll Processing, Financial Forecasting and Auditing, Tax Compliance) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Oracle, Zoho Corporation Pvt. Ltd., Intuit Inc., Deloitte Touche Tohmatsu Limited, Sage Group plc, Xero Limited, Ernst & Young Global Limited, Microsoft, PricewaterhouseCoopers International Limited, KPMG International Limited |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date