AI in Cancer Diagnostics Market Size, Forecast | 26.2% CAGR Growth

Global AI in Cancer Market Size, Share & Analysis By Product Type (Software Solutions, Services, Hardware), By Application (Breast Cancer, Brain Tumor, Colorectal Cancer, Lung Cancer, Others), By End-user (Hospital, Surgical Centers & Medical Institutes, Others), Clinical Accuracy Trends & Forecast 2025–2034

Report Overview

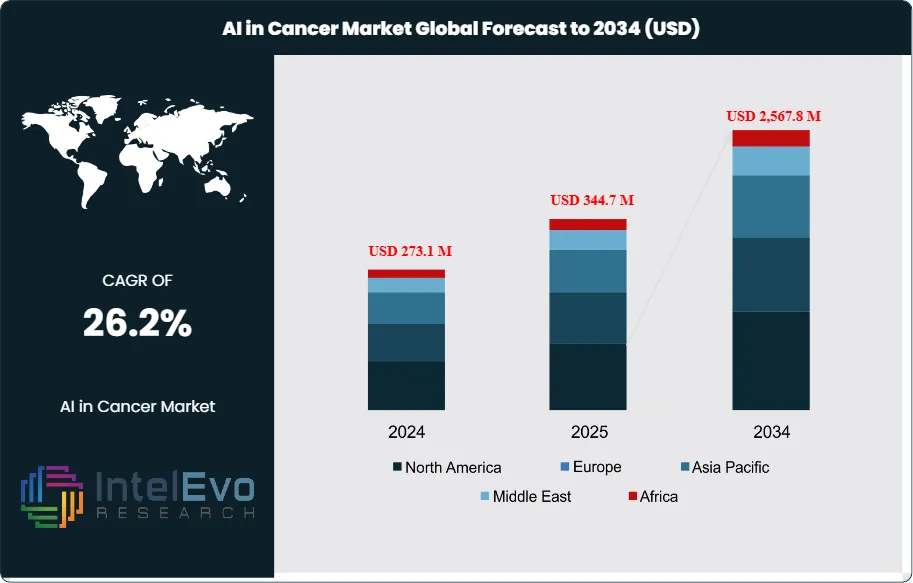

The AI in Cancer Diagnostics Market is estimated at US$ 273.1 million in 2024 and is on track to reach roughly US$ 2,567.8 million by 2034, implying a compound annual growth rate of 26.2% over 2025–2034. This remarkable expansion underscores the growing role of artificial intelligence in transforming oncology diagnostics. Historically, cancer detection relied heavily on manual interpretation of imaging and pathology reports, which often introduced delays and variability.

Get More Information about this report -

Request Free Sample ReportHowever, recent years have seen a dramatic shift toward AI-enabled solutions that enhance accuracy, reduce diagnostic turnaround times, and support oncologists in making better-informed clinical decisions. The anticipated surge in market value reflects both rising cancer prevalence—over 19 million new cases were reported globally in 2022—and the urgent need for scalable diagnostic solutions capable of addressing growing clinical complexity.

Several factors are driving this momentum. On the demand side, healthcare systems face mounting pressure to detect cancers earlier, when survival rates are significantly higher, and to deliver precision medicine tailored to individual patients. Supply-side advancements in machine learning, deep learning, and computer vision have enabled algorithms to detect subtle tumor patterns in medical imaging, analyze genomic profiles, and synthesize electronic health record data with unprecedented speed. At the same time, challenges remain, including regulatory scrutiny around AI-driven diagnostics, high implementation costs, data privacy concerns, and the need for extensive clinical validation to ensure safety and reliability.

Technological innovation is at the heart of this market’s expansion. Integrating AI with next-generation sequencing has unlocked new opportunities to identify genetic mutations linked to specific cancers, guiding personalized treatment strategies. Emerging platforms, such as Tempus AI+ launched in October 2022, illustrate how real-world data combined with AI analytics can refine precision oncology research and accelerate breakthroughs in diagnosis and therapy. Furthermore, AI-enabled automation is streamlining workflows by reducing repetitive tasks, freeing clinicians to focus on complex cases and improving overall healthcare efficiency.

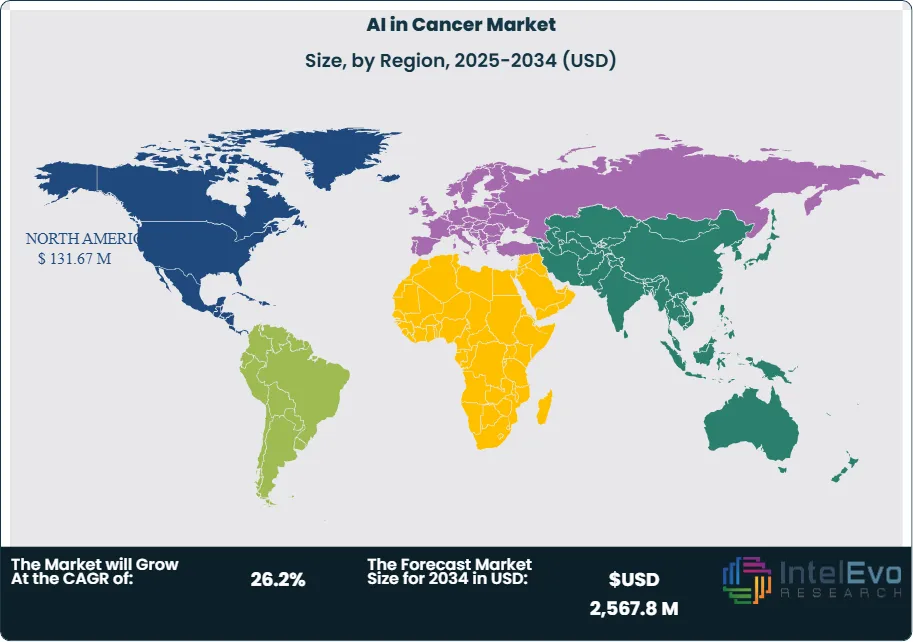

Geographically, North America leads adoption due to robust healthcare infrastructure, significant R&D investments, and favorable regulatory frameworks. Europe follows closely, supported by strong precision medicine initiatives, while Asia-Pacific is emerging as a high-growth region fueled by rising cancer incidence and expanding healthcare digitization. For investors, opportunities are particularly strong in markets embracing early detection and precision oncology, where AI adoption is accelerating rapidly. Together, these dynamics position AI-driven cancer diagnostics as one of the most transformative growth frontiers in healthcare over the next decade.

Key Takeaways

- Market Growth: The AI in Cancer Diagnostics Market generated US$ 273.1 million in 2024 and is projected to reach US$ 2,567.8 million by 2034, reflecting a robust CAGR of 26.2%. Growth is driven by rising cancer incidence worldwide, greater adoption of precision oncology, and the integration of AI into medical imaging and genomics.

- Segment Dominance – Product Type: Software solutions accounted for 60.4% of the market in 2023, positioning them as the clear leader. Their dominance is attributed to scalable deployment, rapid algorithm upgrades, and integration with imaging and sequencing platforms, while hardware and services lag in adoption.

- Segment Dominance – Application: Breast cancer diagnostics represented 35.0% of market revenue in 2023, underscoring the high global prevalence of breast cancer (over 2.3 million new cases annually) and strong demand for early detection tools. AI-powered imaging solutions are accelerating adoption in this category.

- Segment Dominance – End User: Hospitals captured 52.8% of revenue in 2023, reflecting their central role in implementing AI-driven diagnostic platforms across radiology, pathology, and oncology departments. Their strong purchasing power and access to large patient datasets further reinforce dominance.

- Driver: Advancements in machine learning, deep learning, and computer vision are improving early tumor detection accuracy rates by up to 15–20% compared with conventional methods, directly supporting better survival outcomes and reducing diagnostic errors.

- Restraint: High implementation and integration costs, particularly in low- and middle-income countries, limit adoption. Establishing AI-enabled diagnostic infrastructure can increase oncology department operating costs by 12–18% in the short term, hindering wider penetration.

- Opportunity: Integration of AI with next-generation sequencing (NGS) represents a high-growth area, enabling personalized oncology. This segment is projected to expand at an above-average CAGR, driven by precision medicine initiatives and demand for mutation-specific therapies.

- Trend: Partnerships between AI developers and healthcare providers are accelerating innovation. For instance, Tempus AI+ (launched in October 2022) leverages real-world patient data and AI analytics to enhance precision oncology research and improve diagnostic accuracy.

- Regional Analysis: North America led the market with a 48.3% revenue share in 2023, supported by strong R&D investment and advanced healthcare infrastructure. Asia-Pacific is expected to post the fastest growth over 2025–2034, driven by rising cancer prevalence, expanding healthcare access, and aggressive digital health initiatives.

Product Type Analysis

Software solutions remain the dominant segment in the AI in cancer diagnostics market, accounting for more than 60% of total revenue in 2024 and projected to maintain their lead through 2034. Their growth is supported by the rising integration of advanced AI algorithms—including deep learning, natural language processing, and computer vision—into diagnostic workflows. These solutions enable clinicians to analyze complex datasets such as genomic sequences, pathology slides, and radiology images with greater speed and precision than traditional methods, significantly reducing diagnostic errors.

The demand for software platforms is further fueled by their scalability and compatibility with existing hospital infrastructure, particularly electronic health records (EHR) and laboratory information systems (LIS). As healthcare providers manage growing patient volumes and increasingly complex cancer cases, AI-powered diagnostic software is expected to streamline workflows, reduce turnaround times by up to 30%, and enhance treatment decision-making. Services and hardware, though essential, are anticipated to grow at a slower pace as they primarily support the widespread adoption of software-led solutions.

Application Analysis

Breast cancer represents the largest application segment, capturing 35% of the AI in cancer diagnostics market in 2024, with demand driven by its status as the most prevalent cancer among women globally. AI technologies are particularly impactful in this space, where machine learning models applied to mammography, ultrasound, and MRI have demonstrated improvements in early detection accuracy rates by 10–20% compared with conventional screenings. This is expected to translate into earlier intervention and improved survival outcomes.

Beyond breast cancer, AI applications are expanding rapidly in lung and colorectal cancer diagnostics, where imaging complexity and high incidence rates create strong use cases for automation. For instance, AI-enhanced CT analysis in lung cancer can detect nodules with greater precision, reducing false negatives and enabling more targeted treatment planning. As awareness campaigns and screening programs expand globally, adoption of AI across all major cancer categories is expected to accelerate, with multi-modal diagnostic platforms playing a central role in comprehensive oncology care.

End-User Analysis

Hospitals accounted for 52.8% of global revenues in 2024 and are projected to retain dominance as the primary adopters of AI in cancer diagnostics. Large patient inflows, advanced oncology departments, and access to integrated IT infrastructure position hospitals as the central hubs for AI deployment. By leveraging AI-enabled platforms, hospitals are improving clinical workflows, accelerating diagnostic turnaround, and enhancing multidisciplinary treatment planning.

The widespread integration of AI into hospital radiology and pathology departments is also improving diagnostic yield and operational efficiency. AI solutions support oncologists in interpreting complex biopsy results, sequencing data, and imaging scans, which is vital for delivering precision medicine. Over the forecast period, hospitals are expected to expand adoption not only for clinical purposes but also for oncology research, clinical trials, and resource optimization, ensuring their position as the largest and fastest-evolving end-user segment.

Regional Analysis

North America continues to lead the AI in cancer diagnostics market, representing 48.3% of global revenue in 2024. The region benefits from strong investment in precision medicine, widespread use of digital imaging, and a favorable regulatory environment. The U.S. Food and Drug Administration (FDA) has been instrumental in advancing adoption, with more than 50 AI/ML-enabled oncology devices cleared between 2022 and 2024. Major industry players, such as Siemens Healthineers and GE HealthCare, are actively deploying AI-driven diagnostic platforms across hospitals and cancer centers, further accelerating market growth.

In contrast, Asia Pacific is expected to record the highest CAGR between 2025 and 2034, propelled by rising cancer incidence, rapid healthcare digitalization, and strong government investment in AI-based healthcare infrastructure. China’s healthcare expenditure surpassed US$1.2 trillion in 2022, with significant allocations toward advanced diagnostic technologies, while Japan and South Korea are actively promoting AI adoption in oncology as part of broader aging population strategies. Global companies such as Philips and regional players are capitalizing on this momentum, with diagnostic imaging sales in Asia Pacific already contributing significantly to global revenues in 2024.

Europe maintains a solid position, driven by established healthcare systems and widespread adoption of digital pathology and genomics. Meanwhile, Latin America and the Middle East & Africa are emerging as promising frontiers, with increasing cancer awareness, expanding healthcare access, and early-stage investments in AI-enabled diagnostic platforms. Collectively, these dynamics underscore a geographically diverse growth trajectory, with North America leading today and Asia Pacific emerging as the key growth engine for the next decade.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Software Solutions

- Services

- Hardware

By Application

- Breast Cancer

- Brain Tumor

- Colorectal Cancer

- Lung Cancer

- Others

By End-user

- Hospital

- Surgical Centers & Medical Institutes

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 273.1 M |

| Forecast Revenue (2034) | USD 2,567.8 M |

| CAGR (2024-2034) | 26.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Software Solutions, Services, Hardware), By Application (Breast Cancer, Brain Tumor, Colorectal Cancer, Lung Cancer, Others), By End-user (Hospital, Surgical Centers & Medical Institutes, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Paige AI Inc, EarlySign, Cancer Center.ai, PathAI, Inc, Tempus AI, Inc, SkinVision, Flatiron Health |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date