AI in Event Management Market Size, Share & Growth | CAGR 19.8%

Global AI in Event Management Market Size, Share, and Industry Analysis by Component (Software, Services), by Deployment Mode (Cloud-Based, On-Premise), by Application (Event Planning & Scheduling, Attendee Engagement, Marketing & Promotion, Ticketing & Registration, Analytics & Reporting), by Event Type (Corporate Events, Entertainment & Sports, Conferences & Exhibitions, Virtual & Hybrid Events), by End User (Enterprises, Event Organizers, Venues), Regional Insights, Competitive Landscape, Technology Trends, Market Dynamics, and Forecast 2025–2034

Report Overview

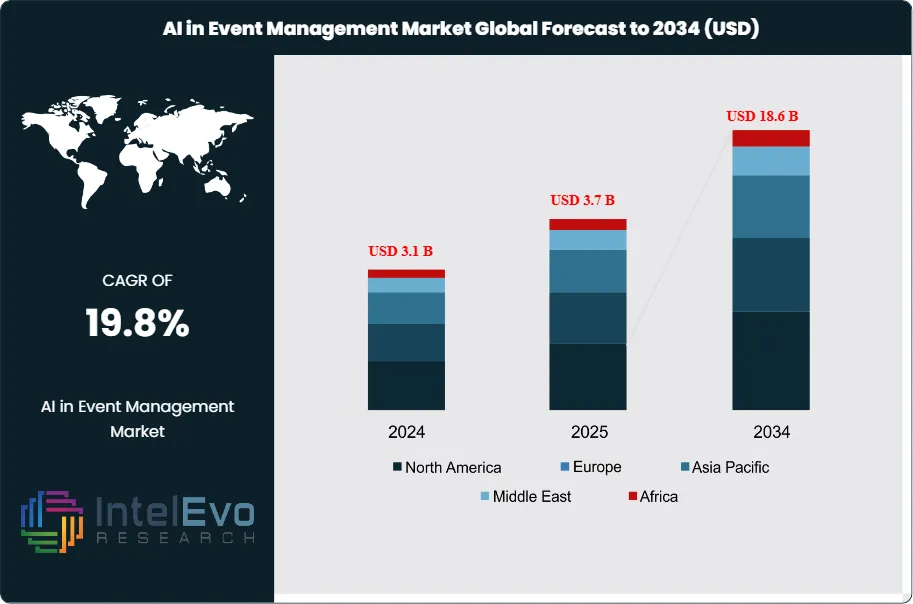

The AI in Event Management Market is estimated at USD 3.1 billion in 2024 and is projected to reach approximately USD 18.6 billion by 2034, registering a compound annual growth rate (CAGR) of 19.8% during 2025–2034. This strong expansion is driven by the rapid adoption of AI-powered tools for event planning, audience engagement, and real-time analytics across corporate, entertainment, and large-scale public events. Event organizers are increasingly leveraging AI for personalized attendee experiences, predictive demand forecasting, automated scheduling, and dynamic pricing. In parallel, the rise of hybrid and virtual events, coupled with growing demand for data-driven decision-making and cost optimization, is accelerating AI integration and positioning the market for sustained long-term growth across global event ecosystems.

Get More Information about this report -

Request Free Sample ReportThis expansion reflects a structural shift in how organizations plan, execute, and evaluate events, with artificial intelligence moving from experimental use cases to core operational infrastructure. Over the past five years, the market has transitioned from pilot deployments to scaled adoption, supported by rising corporate event volumes and the need to manage increasingly complex attendee data.

Demand-side momentum is strong. Approximately 70% of event planners now deploy AI tools to streamline registration, ticketing, and attendee engagement. These solutions reduce planning costs by up to 30% through automated scheduling, budgeting, and resource allocation. On the attendee side, AI-driven personalization strategies are improving satisfaction by 20%, as platforms tailor agendas, networking opportunities, and content recommendations to individual preferences. Supply-side factors are equally important. Cloud providers and AI vendors are expanding infrastructure to support real-time analytics and predictive modeling. Amazon Web Services, for example, has committed USD 15.24 billion in Japan by 2027 to expand cloud capacity, underscoring the scale of investment flowing into AI-enabled services.

The funding environment reinforces this trajectory. In 2023, average funding for AI startups rose by 66%, signaling investor confidence in the commercial viability of AI-driven event solutions. These capital inflows are accelerating product development in areas such as conversational AI, predictive analytics, and automated customer support. The ability of AI to process large data volumes in real time is also enhancing adaptability, with event managers reporting a 25% improvement in their capacity to adjust agendas, logistics, and resource allocation on short notice.

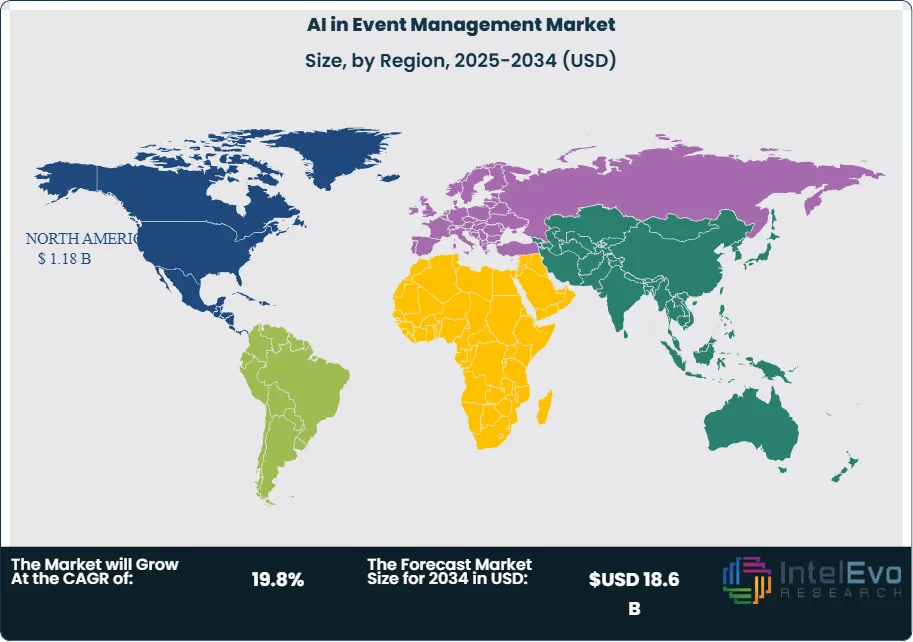

Regional adoption patterns highlight both maturity and opportunity. North America and Western Europe remain the largest markets, driven by high corporate event density and advanced digital infrastructure. Asia-Pacific is emerging as the fastest-growing region, supported by large-scale investments in cloud and AI ecosystems, particularly in Japan, China, and India. For investors, these markets represent near-term growth hotspots, while Latin America and the Middle East are expected to gain traction as digital infrastructure strengthens.

The market outlook is clear. AI in event management is no longer a peripheral tool but a strategic enabler of efficiency, personalization, and scalability. For stakeholders, the next decade will be defined by the ability to integrate AI into core event operations, capture cost savings, and deliver measurable improvements in attendee engagement.

Key Takeaways

- Market Growth: The global AI in event management market was valued at USD 3.1 billion in 2024 and is projected to reach USD 18.6 billion by 2034, expanding at a CAGR of 19.8%. Growth is driven by rising demand for automation, real-time analytics, and personalized attendee engagement.

- Component: Software accounted for 68.5% of total revenue in 2023, reflecting strong adoption of AI-powered platforms for registration, ticketing, and predictive analytics. Hardware and services remain secondary contributors but are expected to gain traction as integration complexity increases.

- Deployment Mode: Cloud-based solutions captured 69.1% of the market in 2023, supported by scalability, lower upfront costs, and rapid deployment. On-premise deployments continue to serve regulated industries but are losing share as enterprises migrate to cloud ecosystems.

- Application: Event planning represented 34.8% of market share in 2023, making it the largest application area. AI tools are increasingly used for scheduling, budgeting, and resource allocation, reducing operational costs by up to 30%.

- End User: Event organizers and planners held 42.3% of the market in 2023, reflecting their reliance on AI to manage large-scale conferences and exhibitions. Corporate enterprises and hospitality providers are emerging as secondary adopters.

- Driver: Rising corporate event volumes and the need for real-time decision-making are accelerating adoption. AI-driven personalization has improved attendee satisfaction by 20%, while automation has cut planning time by up to 25%.

- Restraint: High implementation costs and integration challenges limit adoption among small and mid-sized event firms. These barriers slow penetration in emerging markets where budgets remain constrained.

- Opportunity: Asia-Pacific is expected to record the fastest CAGR through 2033, supported by large-scale investments in AI infrastructure in Japan, China, and India. This region offers significant upside for vendors targeting high-growth corporate and entertainment event segments.

- Trend: AI-powered chatbots, recommendation engines, and predictive analytics are becoming standard features. In 2023, funding for AI startups rose 66%, signaling strong investor confidence in expanding AI applications for event management.

- Regional Analysis: North America led with 38.8% share and USD 0.69 billion in revenue in 2023, driven by advanced digital infrastructure and high corporate event density. Asia-Pacific is the fastest-growing region, while Europe remains a stable market with strong adoption in corporate and trade events.

Component Analysis

By 2025, software continues to dominate the AI in event management market, accounting for more than two-thirds of total revenue. Its strength lies in automating critical functions such as registration, scheduling, and resource allocation, which collectively reduce planning costs by up to 30%. AI-enabled platforms now integrate predictive analytics and personalization engines, allowing organizers to tailor agendas and networking opportunities to individual participants. This capability has driven adoption among large-scale conferences and exhibitions, where attendee satisfaction is a key performance metric.

Services, while smaller in share, are becoming increasingly important as enterprises seek customized deployments. Consulting, integration, and ongoing support services are essential for organizations with complex event portfolios or compliance requirements. As AI applications expand into multilingual support, accessibility, and security, service providers are expected to capture a growing share of incremental spending. The combined strength of software and services ensures that AI adoption is not only about automation but also about adaptability to diverse event formats and organizational needs.

Deployment Mode Analysis

Cloud-based platforms represent the clear preference in 2025, holding more than 70% of the market. Their appeal lies in scalability, cost efficiency, and real-time data integration, which are critical for managing hybrid and global events. Cloud solutions enable instant updates across devices, support large attendee volumes, and provide advanced analytics dashboards that improve decision-making during live events. The rise of subscription-based models has further reduced barriers to entry, making cloud adoption accessible to mid-sized event firms.

On-premise deployments remain relevant for organizations handling sensitive data or high-profile events where security and compliance are paramount. Governments, defense-related conferences, and financial institutions continue to rely on locally managed systems. However, the overall market trajectory favors cloud adoption, with hybrid models emerging as a middle ground. Vendors offering flexible deployment options are best positioned to capture demand across both segments.

Application Analysis

Event planning remains the largest application area, contributing over one-third of total market revenue in 2025. AI tools are now widely used for venue selection, budgeting, and logistics optimization, reducing manual errors and improving efficiency. Predictive scheduling algorithms have become standard, enabling organizers to anticipate attendance peaks and allocate resources accordingly.

Event marketing and attendee management are expanding rapidly. AI-driven marketing platforms analyze behavioral data to deliver targeted campaigns, while attendee management systems automate registration, feedback collection, and engagement tracking. These applications have demonstrated measurable impact, with AI-driven personalization improving attendee satisfaction by 20% and retention rates by 15%.

Other applications, including security monitoring, accessibility services, and post-event analytics, are gaining traction. For example, AI-powered surveillance tools are being deployed at large venues to enhance safety, while real-time translation services are improving inclusivity at international events. Though smaller in current share, these applications represent high-growth niches with strong long-term potential.

End-User Analysis

Professional event organizers and planners remain the largest end-user group, accounting for more than 40% of the market in 2025. Their reliance on AI stems from the need to manage complex, multi-day events with thousands of participants. Automation of logistics, scheduling, and attendee engagement has become essential to maintaining efficiency and profitability.

Corporate users are expanding their adoption of AI for product launches, investor meetings, and internal conferences. The ability to deliver personalized experiences at scale is driving adoption among Fortune 500 companies, particularly in technology and financial services. Governments are also increasing their use of AI for high-security events, policy summits, and public gatherings, where compliance and precision are critical.

Other end-users, including universities, non-profits, and hospitality providers, are beginning to integrate AI into workshops, fundraising events, and guest experiences. While smaller in share, this segment is expected to grow steadily as AI solutions become more affordable and accessible.

Regional Analysis

North America remains the largest regional market in 2025, holding nearly 38% of global revenue. The region benefits from advanced digital infrastructure, high corporate event density, and the presence of leading AI vendors. The United States continues to lead adoption, with strong demand from technology, healthcare, and financial services sectors.

Europe follows closely, supported by strong adoption in Germany, the UK, and France. The region’s emphasis on compliance and data privacy has driven demand for secure AI solutions, particularly in government and corporate events. Asia Pacific, however, is the fastest-growing region, projected to expand at a CAGR above 25% through 2033. Investments in AI infrastructure in China, Japan, and India are fueling adoption, with large-scale exhibitions and entertainment events driving demand.

Latin America and the Middle East & Africa remain smaller markets but are showing steady growth. Brazil, the UAE, and Saudi Arabia are emerging as regional hubs, supported by investments in tourism and large-scale international events. As digital infrastructure improves, these regions are expected to play a more prominent role in the global market over the next decade.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Component

- Software

- Services

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Event Planning

- Event Marketing

- Attendee Management

- Other Applications

End-User

- Event Organizers and Planners

- Corporate

- Government

- Other End-Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.1 B |

| Forecast Revenue (2034) | USD 18.6 B |

| CAGR (2024-2034) | 19.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component, (Software, Services), Deployment Mode, (Cloud-Based, On-Premise), Application, (Event Planning, Event Marketing, Attendee Management, Other Applications), End-User, (Event Organizers and Planners, Corporate, Government, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | RainFocus, Grip, Zoho Corporation, Hubilo, Cvent Inc., Taskade, Eventbrite, OpenAI, Community Brands Intermediate, LLC, ClickUp, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

AI in Event Management Market

Published Date : 06 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date