AI in Home Automation Market Size & Smart Home Trends | 28.4% CAGR

Global AI in Home Automation Market Size, Share & Analysis By Component (Hardware, Software, Services), Technology (Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Other Technologies), Application (Voice Assistants, Security and Surveillance, Energy Management, Predictive Maintenance, Other Applications) Market Dynamics, Innovation Trends & Forecast 2025–2034

Report Overview

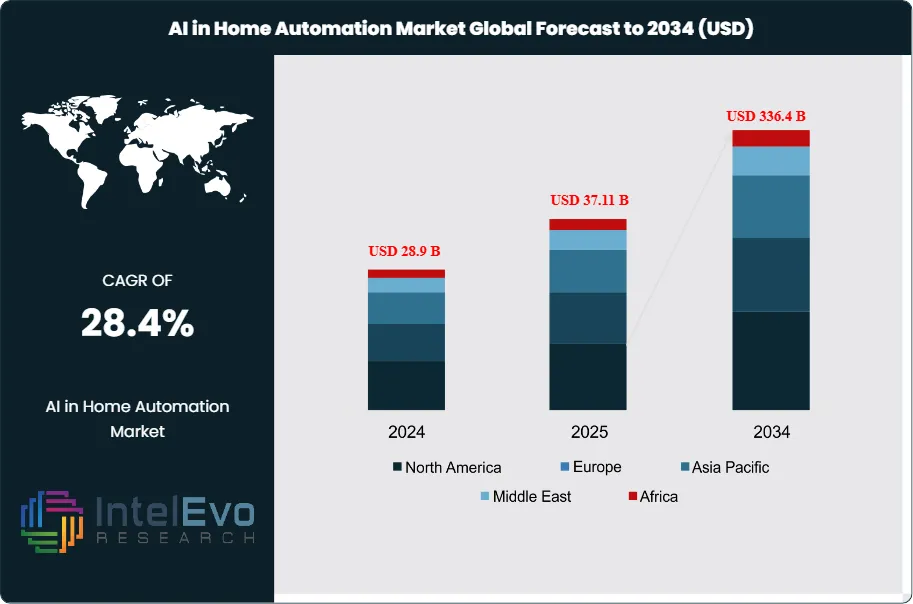

The AI in Home Automation Market is projected to grow from USD 28.9 Billion in 2024 to approximately USD 336.4 Billion by 2034, expanding at a CAGR of around 28.4% during 2025–2034. The growing adoption of AI-powered smart assistants, energy management systems, and home security solutions is revolutionizing modern living experiences. Integration with IoT and voice-controlled devices like Alexa and Google Home continues to enhance comfort, connectivity, and energy efficiency. As consumers prioritize convenience and sustainability, AI-driven automation is rapidly becoming the foundation of the next-generation smart home ecosystem.

Get More Information about this report -

Request Free Sample ReportThe market for AI-driven home automation has entered a high-growth trajectory, reflecting the convergence of artificial intelligence, Internet of Things (IoT) connectivity, and rising consumer appetite for intelligent living solutions. Smart thermostats, automated lighting, and AI-powered security systems have transitioned from luxury to mainstream adoption, driven by their ability to enhance comfort, efficiency, and safety within residential environments. These solutions leverage advanced machine learning algorithms to analyze user behaviors and optimize household operations, making homes increasingly adaptive and personalized.

Several structural factors are fueling this growth. First, the rapid proliferation of IoT devices has expanded the foundation for AI integration, enabling seamless device interconnectivity. Second, improvements in broadband and wireless connectivity are allowing real-time data exchange and control, thereby enhancing responsiveness and efficiency. At the same time, heightened consumer awareness of energy management and sustainability is pushing adoption of AI-powered home energy management systems, which are forecast to generate approximately USD 3.1 billion by 2025. Security also remains a primary driver, with surveys indicating that over 60% of consumers prioritize AI-enabled smart security systems in their purchasing decisions.

Nevertheless, market expansion is not without challenges. Data privacy and cybersecurity concerns pose significant adoption barriers, particularly in regions with stringent regulatory frameworks. Additionally, high upfront costs for advanced AI-based solutions limit penetration in price-sensitive markets. Overcoming these challenges will require industry players to focus on cost optimization, robust data governance practices, and consumer trust-building initiatives.

Regionally, North America and Europe lead in adoption, underpinned by high disposable incomes, early technology uptake, and mature digital infrastructures. Meanwhile, Asia Pacific is emerging as a high-potential investment hub, driven by rapid urbanization, smart city initiatives, and a growing middle class with increasing demand for connected lifestyles. The market’s trajectory is further reinforced by projections that global smart homes will surpass 375 million by 2024, with around 20% of households worldwide expected to adopt smart technologies by 2025.

As AI capabilities advance and integration with emerging technologies deepens, the home automation ecosystem will continue to attract significant investments. This presents both opportunities for established players to scale and for new entrants to differentiate through niche solutions such as enhanced data security, energy optimization, and affordable smart home packages tailored to diverse consumer segments.

Key Takeaways

- Market Growth: The AI in Home Automation Market is projected to reach USD 336.4 Billion by 2034, growing at a robust CAGR of 28.4% between 2025 and 2034, underscoring strong global demand for intelligent residential solutions.

- Component (Hardware): Hardware led the market in 2023 with a 47.1% share, driven by rising adoption of smart devices such as sensors, cameras, and connected appliances forming the backbone of AI-enabled ecosystems.

- Technology (Machine Learning): Machine Learning (ML) accounted for 42.4% of market share in 2023, reflecting its critical role in enabling predictive analytics, behavioral learning, and real-time decision-making across home automation systems.

- Application (Voice Assistants): Voice Assistants captured 28.5% of the market in 2023, propelled by increasing consumer reliance on AI-powered platforms like Alexa, Google Assistant, and Siri to control home environments seamlessly.

- Driver: Rising consumer demand for convenience, energy efficiency, and smart security solutions continues to fuel adoption of AI-integrated home automation technologies, further supported by expanding IoT device penetration.

- Restraint: Data privacy concerns, cybersecurity risks, and high upfront costs of advanced AI-enabled systems remain key barriers to widespread adoption, particularly in cost-sensitive and regulation-heavy markets.

- Opportunity: Expanding smart city initiatives, coupled with the integration of AI into energy management and predictive maintenance applications, offer significant opportunities for vendors to introduce differentiated solutions.

- Trend: The convergence of AI with voice recognition, natural language processing, and computer vision is transforming user interactions, enabling homes to evolve into adaptive, intelligent environments tailored to resident behaviors.

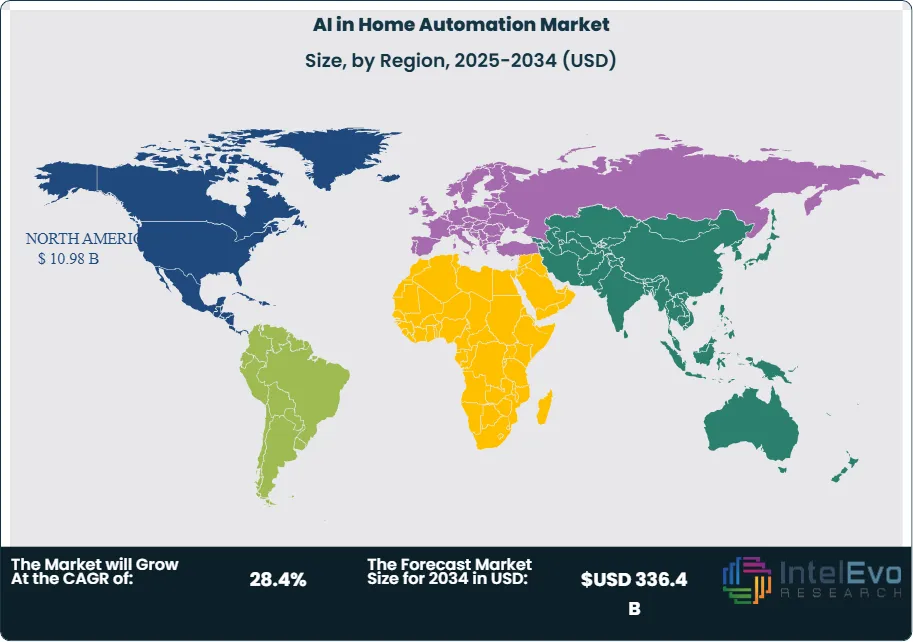

- Regional Analysis: North America and Europe remain the largest markets due to early adoption, mature infrastructure, and high purchasing power, while Asia Pacific is emerging as the fastest-growing region, fueled by urbanization, rising middle-class incomes, and government-backed digitalization initiatives.

Component Analysis

The hardware segment continues to anchor the AI in home automation market, holding more than 47% share in 2025. Hardware encompasses sensors, controllers, smart appliances, and integrated hubs that form the backbone of intelligent ecosystems. With the rise of AI-enabled devices such as Nest thermostats, Ring cameras, and Amazon’s Echo smart displays, consumers increasingly prioritize devices that ensure seamless connectivity, energy efficiency, and enhanced security. Falling component costs and advancements in wireless standards like Wi-Fi 6E and 5G are accelerating adoption by making devices more accessible and reliable.

Software, meanwhile, is gaining traction as AI algorithms and cloud-based platforms drive personalization and predictive functionalities. Software solutions—ranging from smart home apps to AI-driven operating systems—are vital in orchestrating device interoperability and ensuring real-time analytics. Leading players such as Google, Apple, and Samsung continue to expand ecosystems with proprietary platforms that lock in consumer loyalty. Services, though currently smaller in market share, are poised for rapid expansion. Managed services, installation, and after-sales support are becoming differentiators, with companies like ADT and Vivint increasingly offering subscription-based AI-driven monitoring and energy management packages.

Technology Analysis

Machine Learning (ML) dominates with over 42% market share in 2025, enabling predictive analytics, adaptive learning, and automated energy optimization. From thermostats that adjust dynamically to AI-driven surveillance detecting anomalies, ML remains the cornerstone of innovation. Its integration into predictive maintenance for appliances and smart energy systems is reducing household costs and enhancing efficiency.

Natural Language Processing (NLP) underpins the rapid growth of voice-driven automation, powering assistants like Alexa, Google Assistant, and Siri. As NLP models improve in multilingual capabilities and contextual understanding, adoption across non-English-speaking markets is accelerating. Computer Vision is emerging as a transformative technology for home security, enabling advanced facial recognition, package detection, and even elderly care monitoring. Other technologies, such as edge AI and reinforcement learning, are further enhancing data privacy and enabling on-device processing, addressing growing regulatory and consumer concerns around cybersecurity.

Application Analysis

Voice assistants remain the largest application segment, accounting for 28% of the market in 2025. Integration into everyday devices—smart speakers, TVs, and even refrigerators—has cemented their role as the central interface for home automation. Continuous improvements in conversational AI and ecosystem integration ensure this segment maintains leadership.

Security and surveillance are rapidly scaling, driven by demand for AI-enabled smart cameras, doorbells, and access control systems. With nearly 63% of consumers preferring security-focused solutions, this segment is projected to grow significantly as cybersecure AI solutions enter mainstream adoption. Energy management is another critical growth area, particularly as sustainability priorities intensify. AI-enabled energy systems, such as Schneider Electric’s EcoStruxure and Tesla’s Powerwall integrations, are optimizing consumption and reducing costs for eco-conscious households. Predictive maintenance, while nascent, is gaining traction through AI-powered diagnostics in appliances and HVAC systems, minimizing downtime and extending asset lifespans.

Regional Analysis

North America retains leadership in 2025 with over 38% market share, supported by strong infrastructure, high purchasing power, and presence of leading players like Amazon, Google, and Apple. Consumer preference for advanced home automation, coupled with government-backed incentives for energy-efficient solutions, reinforces adoption across the U.S. and Canada.

Europe follows closely, driven by sustainability mandates, stringent data protection regulations, and increasing household adoption of energy-efficient smart solutions. The region benefits from mature digital infrastructure and high regulatory trust, making it attractive for premium AI solutions.

Asia Pacific is the fastest-growing region, propelled by urbanization, smart city projects, and a rapidly expanding middle-class consumer base. Countries such as China, Japan, and South Korea are leading adoption, supported by domestic champions like Xiaomi and Samsung. India is emerging as a significant growth hotspot, fueled by affordable IoT devices and rising digital penetration. Latin America and the Middle East & Africa are also expanding steadily, with growth concentrated in urban centers where infrastructure upgrades support smart home deployments.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Component

- Hardware

- Software

- Services

Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Computer Vision

- Other Technologies

Application

- Voice Assistants

- Security and Surveillance

- Energy Management

- Predictive Maintenance

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 28.9 B |

| Forecast Revenue (2034) | USD 336.4 B |

| CAGR (2024-2034) | 28.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Hardware, Software, Services), Technology (Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Other Technologies), Application (Voice Assistants, Security and Surveillance, Energy Management, Predictive Maintenance, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Amazon (Alexa, Ring), Google (Nest, Assistant), Apple (HomeKit, Siri), Samsung (SmartThings, Bixby), Microsoft, Honeywell, Siemens, LG Electronics (ThinQ), Schneider Electric, Ecobee |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

AI in Home Automation Market

Published Date : 20 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date