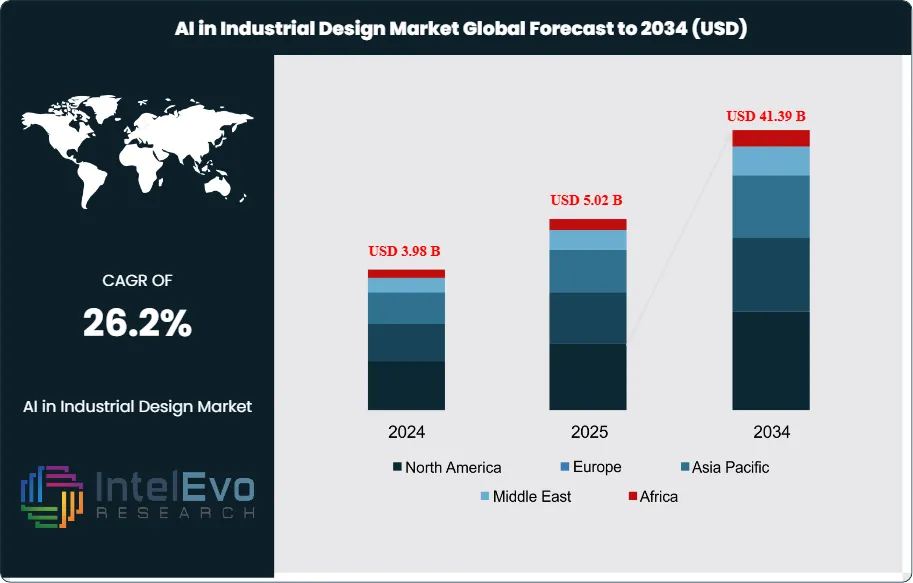

$41.39 Billion AI in Industrial Design Market by 2034 | CAGR 26.2%

Global AI in Industrial Design Market Size, Share, Analysis Report By Component (Services, Software), Deployment Type (On-premise, Cloud-based), Industry Vertical (Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Other Industry Verticals) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

The AI in Industrial Design Market size is expected to be worth around USD 41.39 Billion by 2034, from USD 3.98 Billion in 2024, growing at a CAGR of 26.2% during the forecast period from 2024 to 2034. The AI in Industrial Design Market represents a transformative technological sector that leverages artificial intelligence, machine learning algorithms, and advanced computational tools to enhance and optimize the industrial design process. This market encompasses software applications, services, and platforms that enable automated design generation, performance prediction, simulation optimization, and intelligent decision-making throughout product development cycles. The integration of AI technologies allows designers to explore vast design spaces, generate multiple iterations rapidly, and optimize products for performance, cost-effectiveness, and manufacturing efficiency while reducing traditional design constraints and time-to-market pressures.

Get More Information about this report -

Request Free Sample ReportKey factors driving market expansion include the widespread adoption of Industry 4.0 initiatives and smart manufacturing technologies, which increased by 35% in 2022 compared to the previous year. The automation of design processes, enhanced computational capacity, integration with Computer-Aided Design (CAD) tools, and the growing demand for customized solutions are primary growth catalysts. Additionally, the convergence with emerging technologies such as Internet of Things (IoT), 5G connectivity, and advanced robotics creates synergistic effects that enhance real-time data collection and enable complex virtual simulations. However, the market faces significant challenges including high implementation costs for cutting-edge hardware and software infrastructure, substantial personnel training requirements, and concerns regarding data privacy and security. These financial barriers particularly impact smaller enterprises and startups, potentially limiting widespread adoption and creating technological divides within industries.

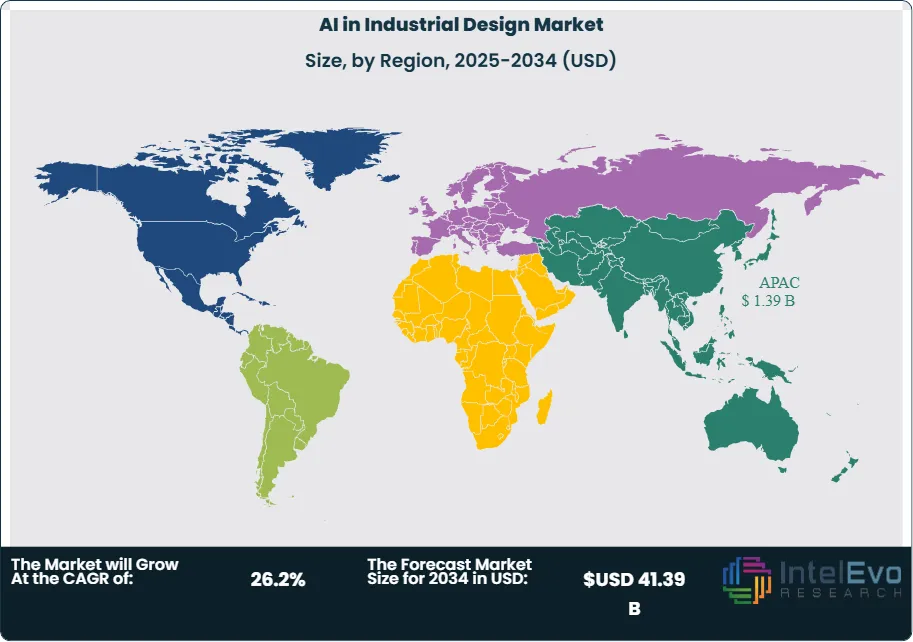

Asia Pacific dominates the AI in Industrial Design market, capturing 34.7% market share in 2023 with revenues of approximately USD 1.2 billion. This regional leadership is driven by robust manufacturing sectors in China, Japan, and South Korea, substantial government investments in digital transformation initiatives like China's "Made in China 2025" and India's "Make in India" campaigns, and the rapid adoption of cloud-based AI solutions by numerous small and medium-sized enterprises. North America maintains significant market presence due to advanced technological infrastructure and major software vendors, while Europe shows steady growth supported by strong automotive and aerospace industries.

The COVID-19 pandemic significantly accelerated AI adoption in industrial design as organizations faced unprecedented challenges requiring rapid adaptation and innovation. The market experienced supply chain disruptions and limited technology adoption in 2020 due to lockdowns and shifting industry priorities, leading to a temporary slowdown in year-over-year growth. However, the pandemic ultimately catalyzed digital transformation initiatives as companies recognized the critical need for automation, remote collaboration capabilities, and resilient design processes that could operate independently of physical constraints. This shift established AI-powered design tools as essential components for maintaining business continuity and competitive advantage in the post-pandemic landscape.

Regional conflicts and geopolitical tensions have significantly disrupted the AI in Industrial Design market through increased tariffs and supply chain fragmentation. The 2024 U.S. tariffs imposed duties up to 27% on critical AI hardware components including data processing machines, servers, and specialized computing equipment imported from China, Taiwan, Vietnam, and Mexico, affecting $200 billion worth of imports. These tariffs have substantially increased AI infrastructure costs, making deployment more expensive and forcing companies to relocate data center construction abroad. The disruption extends beyond direct costs, as studies indicate that a standard deviation increase in tariffs could reduce output growth by 0.4% over five years. Supply chain regionalization has emerged as a defensive strategy, with manufacturers establishing dual supply chain models across Vietnam, India, and Mexico to reduce dependency on single markets. The ongoing trade friction has prompted companies to adopt "manufacture locally, sell locally" approaches and strengthen regional supply networks to mitigate geopolitical risks.

International trade agreements are creating new opportunities for AI in Industrial Design market expansion through enhanced technology transfer, research collaboration, and standardization initiatives. The U.S.-Mexico-Canada Agreement (USMCA) facilitates cross-border AI technology development and deployment, while the European Union's digital single market policies promote harmonized AI standards across member states. China has established a National AI Industry Investment Fund with USD 8.2 billion in initial funding and a National Venture Capital Guidance Fund targeting USD 138 billion over 20 years to support AI, semiconductor, and quantum technology development through public-private partnerships. The United Kingdom has committed £100 million to enhance the Alan Turing Institute's AI research capabilities and established the AI Safety Institute to ensure advanced AI system security. These strategic investments and bilateral agreements are fostering international cooperation in AI research, enabling companies to access global talent pools, and creating frameworks for mutual recognition of AI-powered design standards across borders, ultimately driving market growth through reduced barriers to entry and enhanced technological collaboration.

Key Takeaways

- Market Growth: The AI in Industrial Design Market is expected to reach USD 41.39 Billion by 2033, driven by advancing generative design technologies, increasing demand for design optimization, accelerated digital transformation in manufacturing, and growing emphasis on sustainability and material efficiency.

- Component Dominance: Software solutions lead the market segment due to comprehensive functionality, immediate implementation benefits, and the ability to integrate with existing CAD/CAM systems while delivering measurable improvements in design efficiency and innovation.

- Deployment Mode Dominance: Cloud-based deployment leads the AI in Industrial Design market due to its superior scalability, cost-effectiveness, and ability to provide on-demand access to powerful AI computing resources without requiring significant upfront infrastructure investments.

- Industry Vertical Dominance: The automotive industry leads AI adoption in industrial design due to intense competitive pressure for innovation, complex design requirements, and the critical need for rapid prototyping and optimization in developing electric vehicles and autonomous driving technologies.

- Drivers: Key growth drivers include the need for design optimization, sustainability requirements, rapid prototyping demands, competitive pressure for innovation, and the availability of cloud-based AI design platforms that democratize access to advanced tools.

- Restraints: Growth is challenged by high implementation costs, integration complexity with legacy systems, skills gap in AI design methodologies, and concerns about data security and intellectual property protection in cloud environments.

- Opportunities: Significant opportunities exist in generative design expansion, sustainable design optimization, SME market penetration, integration with IoT and digital twins, and emerging applications in biotechnology and renewable energy sectors.

- Trends: Key trends include cloud-based design platforms, real-time collaboration tools, AI-driven sustainability optimization, integration with manufacturing execution systems, and the emergence of no-code AI design environments.

- Regional Leader: Asia Pacific leads the global AI in Industrial Design market due to its massive manufacturing infrastructure, rapid Industry 4.0 adoption, and strong government support for digital transformation initiatives across major economies like China, Japan, and South Korea.

Component Analysis

Software Leads With more than 70% Market Share In AI in Industrial Design Market, The component segment divides into software solutions and services, with software solutions commanding the dominant position due to their comprehensive functionality and ability to deliver immediate, measurable improvements in design productivity and innovation capabilities. Software solutions include AI-powered CAD tools, generative design platforms, simulation software, and optimization engines that enable designers to explore vast design spaces, automatically generate solutions, and optimize products for multiple objectives simultaneously. The software segment's leadership stems from its ability to provide scalable, integrated platforms that can transform existing design workflows while delivering quantifiable benefits including reduced design time, improved product performance, and enhanced innovation capabilities.

Deployment Mode Analysis

Cloud-based solutions dominate this segment because they offer several critical advantages for AI-intensive industrial design applications. The computational demands of AI algorithms, particularly for complex simulations and generative design processes, require substantial processing power that cloud platforms can provide elastically based on project needs. This deployment mode enables real-time collaboration among distributed design teams, automatic software updates, and access to the latest AI models without manual installations. Cloud platforms also offer better data management capabilities and integration with other cloud-based engineering tools. On-premise deployment, while still relevant for organizations with strict data security requirements or regulatory compliance needs, represents a smaller market share due to higher initial costs, maintenance complexity, and limited scalability. On-premise solutions are typically preferred by large enterprises in sensitive industries like aerospace and defense, where data sovereignty and security concerns outweigh the convenience and cost benefits of cloud deployment.

Industry Vertical Analysis

Automotive dominates this market because the industry faces unprecedented design challenges requiring AI-powered solutions for vehicle optimization, lightweight material selection, aerodynamic efficiency, and integration of complex electronic systems. The shift toward electric vehicles demands innovative battery packaging, thermal management, and weight reduction that AI design tools can address through generative design and simulation optimization. Additionally, autonomous vehicle development requires sophisticated sensor integration and safety-critical design validation that benefits significantly from AI assistance. Consumer electronics follows as a strong secondary segment, leveraging AI for miniaturization, aesthetic optimization, and rapid product iteration cycles. Aerospace & defense represents a specialized but valuable market segment, using AI for complex structural optimization and performance-critical applications, though adoption is slower due to stringent regulatory requirements. Healthcare applications focus on medical device design and prosthetics optimization, while other industry verticals including manufacturing equipment, architecture, and industrial machinery contribute to steady market growth through diverse AI-powered design applications.

Regional Analysis

Asia Pacific Leads With nearly 35% Market Share In AI in Industrial Design Market, Asia Pacific leads the global AI in Industrial Design market, capitalizing on its large-scale manufacturing base, swift adoption of Industry 4.0 technologies, and proactive government initiatives supporting digital transformation. The region is a focal point for advanced manufacturing, where countries like China, Japan, and South Korea are deploying AI-powered design solutions to drive productivity, improve product quality, and accelerate innovation cycles. Significant investments in smart manufacturing, coupled with rising demand for innovative and complex industrial products across automotive, electronics, and aerospace sectors, are fueling regional dominance. Major digital transformation programs, particularly in China and Japan, are fostering robust ecosystems for AI-driven design, while India's rapidly growing IT and engineering service industry strengthens the development and implementation of these technologies. The synergetic effect of government incentives, expanding manufacturing activity, and increasing talent availability has firmly positioned Asia Pacific at the forefront of AI adoption in industrial design.

North America maintains a significant market share driven by advanced technology infrastructure, established software vendors like Autodesk and ANSYS, and substantial R&D investments. Europe demonstrates steady growth supported by robust automotive and aerospace industries, with emphasis on sustainable manufacturing practices. Latin America and Middle East & Africa regions show emerging potential through expanding manufacturing sectors and increasing recognition of AI design technologies as competitive advantages.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

- Services

- Software

Deployment Mode

- On-Premise

- Cloud-Based

Industry Vertical

- Consumer Electronics

- Automotive

- Healthcare

- Aerospace & Defense

- Other Industry Verticals

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 5.02 B |

| Forecast Revenue (2034) | USD 41.39 B |

| CAGR (2025-2034) | 26.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Services, Software), Deployment Type (On-premise, Cloud-based), Industry Vertical (Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Other Industry Verticals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Autodesk Inc., Dassault Systèmes, Siemens PLM Software, PTC Inc., ANSYS Inc., SolidWorks Corporation (Dassault Systèmes), Bentley Systems, Altair Engineering Inc., NVIDIA Corporation, Adobe Inc., Onshape (PTC), Keyshot (Luxion), Rhino (Robert McNeel & Associates), Fusion 360 (Autodesk), Computational Engineering International (CEI) |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the AI in Industrial Design Market?

AI in Industrial Design Market expected to skyrocket to USD 41.39 Bn by 2034, growing at 26.2% CAGR. Explore detailed analysis, trends, and key opportunities.

Who are the major players in the AI in Industrial Design Market?

Autodesk Inc., Dassault Systèmes, Siemens PLM Software, PTC Inc., ANSYS Inc., SolidWorks Corporation (Dassault Systèmes), Bentley Systems, Altair Engineering Inc., NVIDIA Corporation, Adobe Inc., Onshape (PTC), Keyshot (Luxion), Rhino (Robert McNeel & Associates), Fusion 360 (Autodesk), Computational Engineering International (CEI)

Which segments covered the AI in Industrial Design Market?

Component (Services, Software), Deployment Type (On-premise, Cloud-based), Industry Vertical (Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Other Industry Verticals)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

AI in Industrial Design Market

Published Date : 26 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date