AI in Predictive Toxicology Market Size, Growth | CAGR 32.6%

Global AI in Predictive Toxicology Market Size, Share & Growth Analysis By Technology (Machine Learning, Deep Learning, NLP), By Application (Drug Safety, Chemical Risk Assessment, Environmental Toxicology, Cosmetics Testing), By End User (Pharma & Biotech, CROs, Regulatory Agencies, Chemical Manufacturers), Regional Outlook, Competitive Landscape, Key Players, Emerging Trends & Forecast 2025–2034

Report Overview

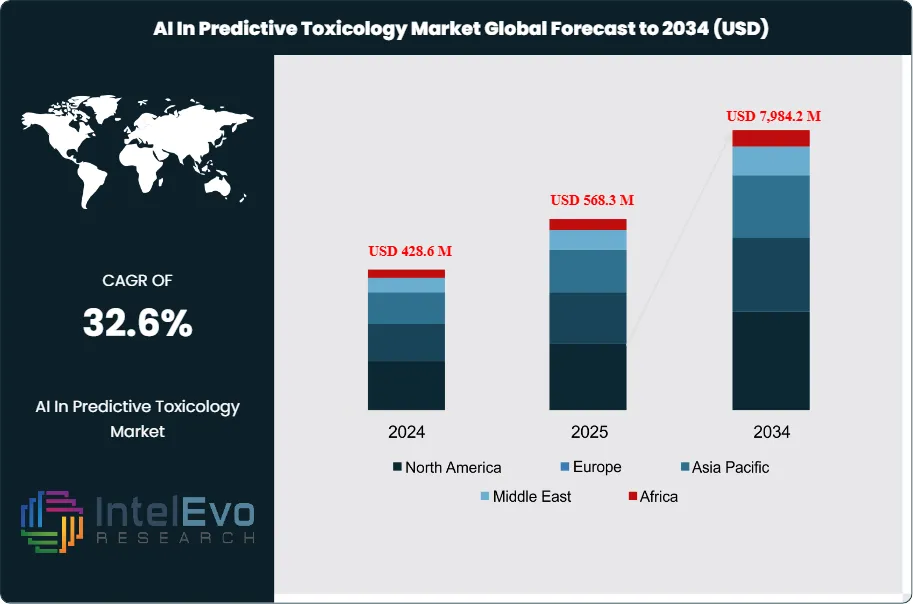

The AI in Predictive Toxicology Market is estimated at USD 428.6 million in 2024 and is projected to reach USD 7,984.2 million by 2034, reflecting a powerful CAGR of approximately 32.6% from 2025–2034. This trajectory highlights the rapid institutionalization of AI-driven safety assessment tools across drug discovery, chemical innovation, and consumer product testing. By 2025, the market has transitioned from small-scale pilot experiments to fully scaled programs across pharmaceuticals, chemicals, and cosmetics. Sponsors increasingly deploy AI platforms to triage expansive compound libraries, prioritize candidates ahead of wet-lab testing, and meet rising safety expectations. Adoption surged as regulators intensified pressure to reduce animal testing and accelerate early-stage toxicology workflows. AI-enabled models are now embedded earlier in discovery pipelines, helping identify risks related to genotoxicity, cardiotoxicity, hepatotoxicity, and endocrine disruption—ultimately reducing late-stage attrition and shortening timelines for IND-enabling studies.

Get More Information about this report -

Request Free Sample ReportVendors report a significant uptick in software subscription bookings and validation-services revenue, driven by enterprise-level standardization of model governance and auditability. Efficiency remains the primary catalyst for adoption: in silico toxicology assessments reduce dependence on animal studies, cut per-compound evaluation costs, and decrease wet-lab assay volume. Many organizations cite double-digit reductions in cycle times and testing expenses, underscoring the ROI of AI-enhanced screening frameworks.

On the supply side, maturing AI toolchains have strengthened model fidelity, throughput, and workflow compatibility. Modern architectures—such as graph neural networks, transformers, and multi-task learning—now integrate chemistry, omics, and imaging data within unified pipelines. These advancements, combined with uncertainty quantification and conformal prediction techniques, improve trust in predictions, particularly in edge-case scenarios. Seamless integration with LIMS, ELN, and enterprise data lakes enables continuous model retraining and real-world performance monitoring, further reinforcing adoption.

Despite strong momentum, significant challenges remain. Data heterogeneity, sparse labels, and inconsistent metadata still constrain model generalization, requiring ongoing investment in data cleaning, ontology mapping, and bias oversight. Validation requirements differ across regulatory jurisdictions, adding operational complexity for global R&D workflows. Intellectual property considerations and transparency expectations influence vendor selection, with enterprises prioritizing explainable AI, provenance tracking, and defensible model documentation.

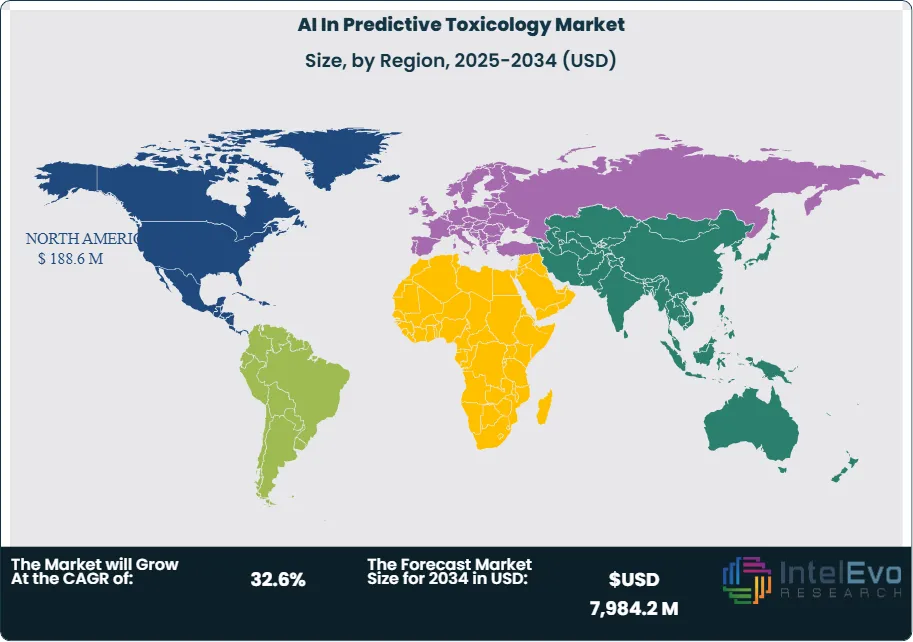

Regionally, North America maintains its leadership position in 2025 spending due to a dense biotech ecosystem and strong CRO capacity. Europe follows closely, supported by proactive regulatory bodies and public–private innovation initiatives, while Asia Pacific demonstrates the fastest expansion as domestic pharma pipelines grow and governments support AI-enabled safety testing. Investment hotspots include model-as-a-service platforms, multimodal data partnerships, and solutions linking toxicology predictions with ADME and exposure modeling. Over the next decade, market winners will be those who combine validated algorithms, high-quality datasets, and seamless workflow integration to transform predictive accuracy into fewer animal studies, lower per-asset development costs, and faster go/no-go decisions.

Key Takeaways

- Market Growth: The Global AI in Predictive Toxicology market was USD 428.6 million in 2024 and is projected to reach USD 7,984.2 million by 2034, a 32.6% CAGR. Growth is driven by animal-reduction mandates, earlier safety triage in discovery, and faster IND decision cycles.

- Technology: Machine learning led in 2023 with 41% share, or about USD 147.6 million of revenue. Adoption reflects broad availability of QSAR, graph networks, and transformer-based classifiers that scale across endpoints.

- Component: Solutions accounted for 61% of 2023 spend, or roughly USD 219.7 million. Buyers prefer licensed platforms with audit trails, model governance, and LIMS/ELN integrations over standalone services.

- Driver: Regulatory pressure to reduce animal testing and compress timelines is shifting budgets to in silico screening. Sponsors report double-digit cuts in wet-lab assays and earlier attrition of unsafe candidates, which lowers per-compound evaluation cost.

- Restraint: Data heterogeneity and sparse labels limit external validity. Enterprises incur material costs for curation, ontology mapping, and validation, which can delay deployment by multiple quarters and cap near-term ROI.

- Opportunity: Asia Pacific is set to outgrow the global average on the back of expanding domestic pipelines and government-backed AI programs. A sustained high-20s to low-30s CAGR in the region would add several hundred million dollars to 2033 demand.

- Trend: Multimodal pipelines that combine chemistry, omics, and high-content imaging are moving into production. Vendors now bundle uncertainty quantification and conformal prediction, improving decision confidence and model acceptance in QA workflows.

- Regional Analysis: North America led with ~44% share in 2023, or about USD 158.4 million, supported by a dense biotech base and CRO capacity. Europe follows with strong regulatory engagement, while Asia Pacific shows the fastest adoption as local pharma scales discovery and preclinical testing.

Type Analysis

Machine learning remains the core technology in 2025, accounting for 41% of 2023 spend and expanding with wider use of graph neural networks, transformers, and multi-task QSAR. These models fuse chemical structures, bioassay outputs, and omics signals to predict class-specific liabilities with higher recall, which improves early triage and reduces late-stage failures. Natural language processing scales evidence synthesis by extracting signals from millions of abstracts, reports, and adverse event records; you gain faster literature surveillance and better priors for model training. Computer vision supports automated readouts from histopathology and cell imaging, cutting manual review time and standardizing scoring; adoption rises as labs embed imaging pipelines into LIMS and ELN systems.

Application Analysis

Genotoxicity remains the largest endpoint, representing 35% of 2023 demand as sponsors screen early for mutation and carcinogenicity risk. AI models flag structural alerts and dose–response patterns before animal studies, which trims repeat assays and rework. Hepatotoxicity, cardiotoxicity, and neurotoxicity form the next tier of spend. Computer vision and time-series analytics improve liver and cardiac signal detection from high-content imaging and MEA data, while NLP surfaces mechanistic evidence that supports regulatory submissions. You should expect multi-endpoint models that link exposure, ADME, and toxicity to gain share because they reduce handoffs between discovery and safety teams.

End-Use Analysis

Pharmaceutical and biotech companies account for the largest buyer group at roughly 53% of 2023 revenue, driven by the need to compress preclinical timelines and cut wet-lab costs per compound. Typical programs report double-digit reductions in screening assays when in silico triage is embedded before GLP studies. Chemicals and cosmetics firms expand usage to meet animal-reduction mandates and to accelerate ingredient safety reviews; portfolio-level screening helps you prioritize reformulation decisions. Research institutes and CROs act as capability multipliers, offering validation datasets, assay standardization, and fee-for-service model tuning for sponsors that lack in-house teams. Agriculture and food safety add incremental demand as residue and exposure modeling integrates with toxicity prediction.

Regional Analysis

North America led with about 44% of global revenue in 2023, supported by a dense biotech base, active CRO ecosystem, and high software spend per program. Europe follows with strong regulatory engagement and public–private consortia that fund method validation and data sharing. Asia Pacific posts the fastest growth as domestic pharma increases discovery pipelines and governments back AI adoption in preclinical safety; you should watch China, India, and Singapore for new data partnerships and local cloud deployments. Latin America and the Middle East & Africa remain smaller but expand through reference deployments at national labs and universities; targeted grants and cloud-first tools lower entry barriers and support gradual scale-up through 2030 and beyond.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

By Toxicity Endpoints

- Genotoxicity

- Hepatotoxicity

- Neurotoxicity

- Cardiotoxicity

By Component

- Solution

- Services

By End User

- Pharma and Biotechnology Companies

- Chemical and Cosmetics

- Research Organization

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 428.6 M |

| Forecast Revenue (2034) | USD 7,984.2 M |

| CAGR (2024-2034) | 32.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Technology, Machine Learning, Natural Language Processing, Computer Vision, By Toxicity Endpoints, Genotoxicity, Hepatotoxicity, Neurotoxicity, Cardiotoxicity, By Component, Solution, Services, By End User, Pharma and Biotechnology Companies, Chemical and Cosmetics, Research Organization, Others |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Recursion Pharmaceuticals, Lhasa Limited, Exscientia PLC, Biovista, Benevolent AI, Instem plc, Insilico Medicine, Cyclica, Berg Health |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

AI In Predictive Toxicology Market

Published Date : 19 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date