AI in PropTech Market Size, Growth & Forecast | 25.6% CAGR

Global AI in PropTech Market Size, Share & Analysis By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By End-Use (Residential, Commercial) Industry Digitization Trends & Forecast 2025–2034

Report Overview

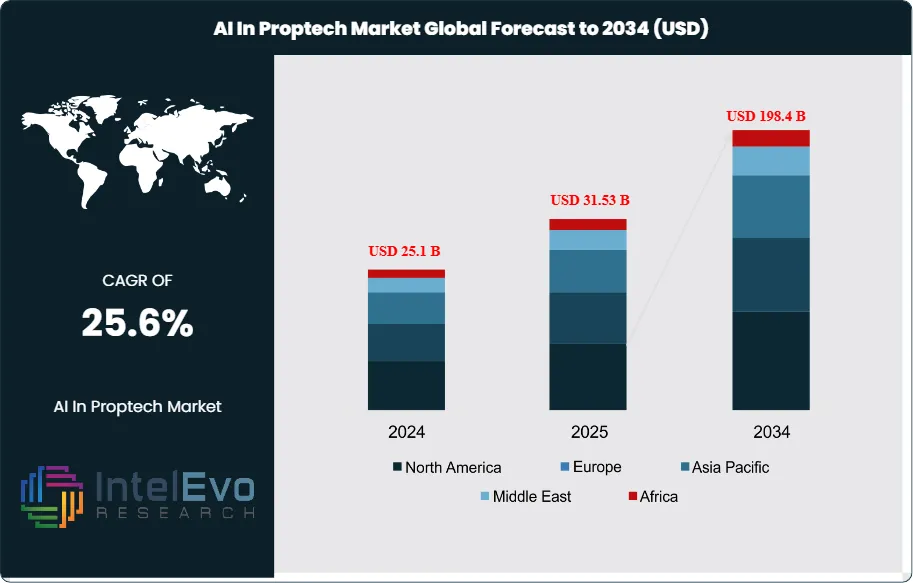

The AI in PropTech Market is valued at approximately USD 25.1 billion in 2024 and is projected to reach nearly USD 198.4 billion by 2034, expanding at an estimated CAGR of around 25.6% during 2025–2034. AI-driven automation, energy-optimization platforms, predictive maintenance, and smart-building analytics are transforming real estate operations across commercial, residential, and industrial assets. With digital twins, autonomous property management, and AI-enabled investment analytics gaining momentum, PropTech is entering a high-growth decade driven by efficiency, sustainability, and data-led decision-making. These advancements are reshaping tenant experience, reducing operating costs, and accelerating adoption across global developers, facility managers, and institutional investors—making AI one of the most disruptive forces in the real estate ecosystem.

Get More Information about this report -

Request Free Sample ReportAfter an early commercialization phase marked by pilots and point solutions, adoption has accelerated as owners, operators, and investors seek measurable gains in leasing velocity, asset valuation accuracy, operating expense reduction, and energy optimization. Funding signals remain supportive: AI-powered proptech companies attracted roughly USD 630 million in 2024, while landmark 2021 rounds—USD 700 million for Better.com and USD 500 million each for ServiceTitan and Hippo Insurance—demonstrated the category’s scale potential and strategic relevance. On the demand side, enterprises are unlocking value from previously siloed real-estate data: JLL reported 1.9 million square meters of demand for AI-enabled real estate solutions by end-2024 and used automated valuation and database tools to support analysis of USD 11 billion in transaction volumes, underscoring momentum in high-stakes, data-heavy workflows.

Growth is propelled by multiple vectors. Digitization of property management and facilities operations is expanding the addressable base for predictive maintenance, dynamic work-order routing, and computer-vision-based inspections, typically yielding 10–20% maintenance savings and 5–15% energy reductions at scale. On the supply side, cloud ubiquity, IoT sensor proliferation, and increasingly accessible ML platforms lower integration barriers, while maturing APIs enable bidirectional data flow across leasing, accounting, and building management systems. Regulatory and macro headwinds—data privacy, model explainability, fragmented data standards, and cyclical capex constraints from higher rates—remain manageable but require robust governance, cybersecurity, and clear ROI narratives.

Technology innovation is reshaping adoption patterns. Generative AI is accelerating lease abstraction, marketing content creation, and tenant communications; digital twins and physics-informed models optimize HVAC and space utilization; and AI-augmented underwriting enhances risk screening and portfolio rebalancing. Computer vision and NLP unlock unstructured data from site images and documents, while autonomous analytics deliver real-time variance alerts to asset managers. Regionally, North America leads on revenue and platform maturity, Europe advances with ESG-driven retrofits and strict data regimes, and Asia–Pacific is the fastest-growing arena as smart-city investments scale in China, India, and Southeast Asia. Emerging hotspots such as the Gulf states and Singapore combine green-building mandates with capital availability, positioning them as outsize adopters. For investors, the most attractive opportunities cluster around interoperable data layers, energy and maintenance optimization, and AI-driven transaction workflows that compress cycle times and improve yield.

Key Takeaways

- Market Growth: The global AI in PropTech market was USD 25.1 billion in 2024 and is projected to reach USD 198.4 billion by 2034 (25.6% CAGR), driven by digitization of property operations, cloud/IoT data exhaust, and maturing AI toolchains. Incremental value creation of ≈USD 198.4 billion over 2025–2034 reflects accelerating adoption across valuation, maintenance, leasing, and energy optimization.

- Component: Solutions led with 67.3% revenue share in 2024, outpacing services due to packaged analytics, digital twins, and AI-enabled valuation/CRM that deliver faster time-to-value and portfolio-scale deployment. Services remain essential for integration and data engineering but account for the remaining 32.7%.

- Deployment Mode: Cloud-based platforms captured 68.0% share in 2024 as elastic compute and API ecosystems reduced training/inference costs and sped integrations; on-premises persists in data-sovereignty and mission-critical sites. Growing multi-cloud adoption is widening the gap through faster release cycles and security certifications.

- Driver: Data-rich workflows are primed for automation—lease abstraction, predictive maintenance, and tenant engagement—supporting 10–20% maintenance savings and 5–15% energy reductions at scale. Capital formation remains supportive, with ~USD 630 million invested in AI-proptech in 2024 and prior mega-rounds (e.g., USD 700M/Better.com; USD 500M/ServiceTitan; USD 500M/Hippo) signaling sustained investor confidence.

- Restraint: Fragmented data standards, privacy/regulatory constraints, and legacy BMS/CAFM silos raise integration complexity, typically adding ≈10–15% to project costs and extending deployments by 3–6 months. Explainability and model-risk governance requirements can further slow enterprise procurement cycles.

- Opportunity: Commercial and industrial smart-building upgrades are underpenetrated relative to Residential’s 60.5% share (2024) and are poised to outgrow the market at ~24–26% CAGR. If they capture ~30–35% of incremental spend, these segments could unlock ≈USD 42–49 billion in new revenue by 2034, led by energy, maintenance, and space-optimization use cases.

- Trend: Generative AI is scaling from pilots to production—automating 60–80% of lease-clause extraction, accelerating marketing content, and streamlining tenant support—while computer vision enables remote inspections and anomaly detection. Interoperable data layers and API-first ecosystems are becoming de facto standards for cross-platform underwriting and asset-performance analytics.

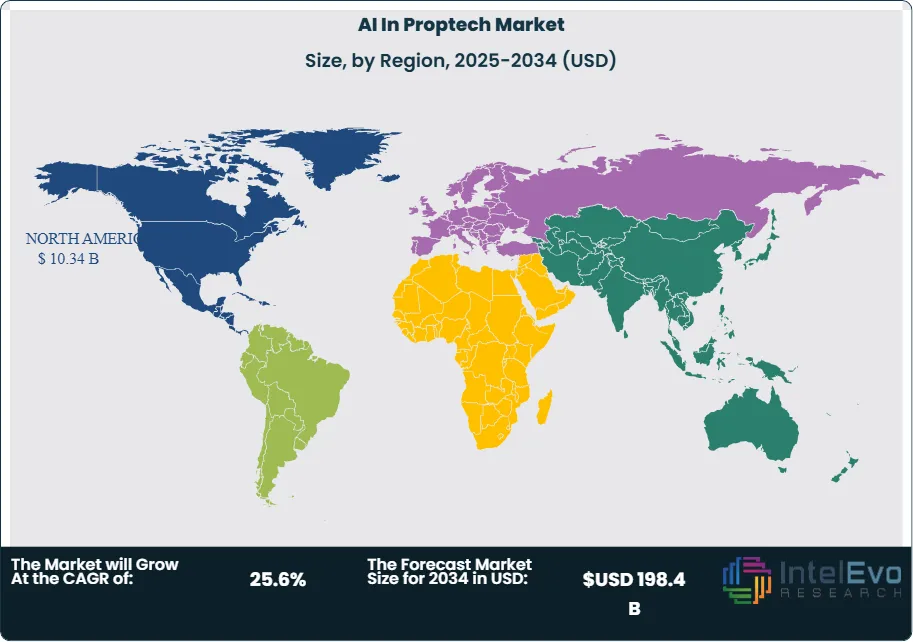

- Regional Analysis: North America led with a 41.2% share (≈USD 8.4 billion) in 2024 on platform maturity and enterprise budgets; Europe is expanding under ESG retrofits and data-governance regimes. Asia–Pacific is the fastest-growing investment hotspot, projected at ~26–28% CAGR through 2034, with smart-city and green-building programs in China, India, Southeast Asia, and the Gulf states accelerating AI deployment.

Component Analysis

Solutions remain the center of gravity for AI in PropTech, accounting for an estimated 67.3% of segment revenue in 2024 and retaining leadership into 2025 as owners and operators prioritize packaged analytics, computer-vision modules, and AI-enhanced valuation/CRM suites that deliver rapid, portfolio-scale ROI. Productized capabilities—lease abstraction, anomaly detection for building systems, and digital-twin optimization—are increasingly embedded into core platforms, compressing deployment cycles and expanding attach rates across property management and brokerage workflows.

Services, while the smaller share, are gaining strategic weight as enterprises move from pilots to scaled programs. Demand is shifting toward data engineering, MLOps, model governance, and change-management services that de-risk AI adoption in regulated environments. As the broader market advances at roughly a low-20s CAGR through the late 2020s, advisory and integration services are positioned to grow in line with—or modestly ahead of—the total market, supported by multi-cloud rollouts, legacy system remediation, and enterprise-grade security requirements.

Deployment Mode Analysis

Cloud-based delivery dominated with about 68.0% share in 2024 and continues to expand in 2025, propelled by elastic compute for training/inference, API ecosystems, and usage-based pricing that lowers total cost of ownership for portfolios spanning hundreds of assets. Cloud-first stacks enable near real-time ingestion of IoT feeds and geospatial data, supporting predictive maintenance and space-utilization analytics across distributed footprints while meeting procurement expectations for speed and interoperability.

On-premise remains essential for data-sovereign workflows, mission-critical facilities, and environments with strict latency or uptime constraints. Hybrid patterns are becoming standard: model development and orchestration in the cloud, with inference at the edge for computer vision (e.g., access control, safety monitoring) or BMS integrations. In 2025+, heightened compliance obligations and customer security audits sustain on-premise and private-cloud demand, even as net new deployments skew cloud-first.

End-Use Analysis

Residential applications led with approximately 60.5% share in 2024 and continue to anchor volume as smart-home ecosystems, multifamily platforms, and resident-experience apps scale globally. Operators report double-digit improvements in work-order cycle times and 5–15% reductions in energy consumption where AI-enabled controls, demand response, and automated fault detection are deployed—supporting rent premiums and lower operating costs in competitive markets.

Commercial adoption is accelerating from a smaller base, driven by decarbonization mandates, corporate ESG reporting, and the economics of predictive maintenance (often yielding 10–20% maintenance savings) for large office, retail, and logistics portfolios. AI-assisted underwriting, dynamic space planning, and lease analytics are moving from pilots to standard practice, narrowing the gap with residential as enterprises consolidate data lakes and deploy portfolio-wide analytics.

Regional Analysis

North America remains the revenue leader—about 41.2% share, or roughly USD 8.4 billion in 2024—underpinned by platform maturity, deep venture and corporate investment, and rapid adoption across multifamily and single-family rental platforms. Europe follows with robust momentum as energy-efficiency retrofits, data-privacy regimes, and evolving AI governance catalyze deployments in office, hospitality, and social housing; EU-aligned compliance features are becoming vendor differentiators.

Asia Pacific is the fastest-growing region through 2025+, supported by smart-city initiatives, green-building codes, and large new-build pipelines in China, India, Southeast Asia, Japan, and Australia. The Middle East & Africa and Latin America are earlier in the curve but show rising project pipelines—particularly in the Gulf’s high-spec commercial assets and Brazil/Mexico’s institutionalizing multifamily and logistics sectors—where greenfield developments and government digital-infrastructure programs favor cloud-first, AI-ready proptech stacks.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By End-Use

- Residential

- Commercial

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 25.1 B |

| Forecast Revenue (2034) | USD 198.4 B |

| CAGR (2024-2034) | 25.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By End-Use (Residential, Commercial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Reonomy, Realtor.com, Skyline AI, Jones Lang LaSalle Incorporated, HouseCanary, Inc., Zillow Group, Apartment List, Compass, Redfin Corporation, Roof AI, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date