AI in Regtech Market Size, Growth Outlook & Trends | CAGR of 34.8%

Global AI in Regtech Market Size, Share & Compliance Automation Analysis By Type (Solutions, Services), By Application (Regulatory Compliance, Risk Management, Financial Crime, Identity Management, Compliance Support, Analytics, Automated Trading), By Operation Model (Unsupervised Learning, Supervised Learning, Reinforced Learning, Semi-Supervised Learning), Regulatory Complexity Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

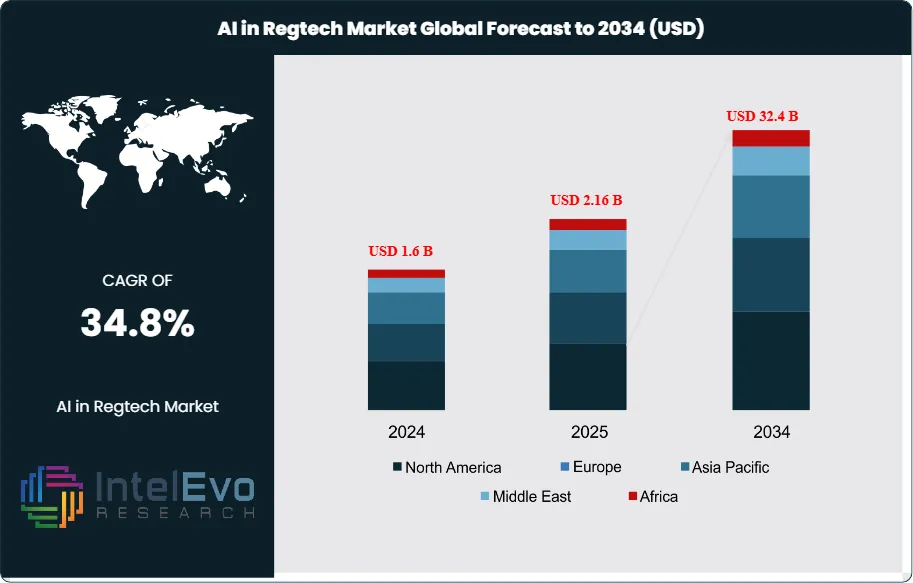

The AI in Regtech market is estimated at USD 1.6 billion in 2024 and is projected to reach approximately USD 32.4 billion by 2034, registering a robust CAGR of about 34.8% during 2025–2034. This strong growth trajectory reflects escalating regulatory complexity, rising compliance costs, and increased enforcement actions across banking, fintech, and capital markets. Financial institutions are rapidly adopting AI-driven solutions for real-time AML monitoring, fraud detection, and automated reporting to reduce false positives and operational risk. As regulators push for faster, more transparent compliance frameworks, AI-powered Regtech platforms are becoming a core component of digital governance and risk management strategies worldwide.

Get More Information about this report -

Request Free Sample ReportThis rapid expansion reflects the growing reliance on artificial intelligence to manage increasingly complex regulatory environments. Over the past decade, compliance costs for financial institutions alone have risen by more than 60%, and firms now spend up to 10% of their operating budgets on regulatory functions. AI-driven Regtech solutions are emerging as a critical response, enabling organizations to automate monitoring, streamline reporting, and reduce the risk of non-compliance penalties that can exceed USD 1 billion annually for large banks.

The market’s trajectory is shaped by both demand-side and supply-side forces. On the demand side, regulators across the United States, Europe, and Asia-Pacific have tightened rules on anti-money laundering, data privacy, and financial transparency. This has created a surge in demand for automated compliance tools that can process vast datasets in real time. On the supply side, advances in natural language processing, predictive analytics, and machine learning have made AI applications more accurate and cost-effective, driving adoption across banking, insurance, and fintech. However, challenges remain. High implementation costs, data security concerns, and the lack of standardized regulatory frameworks across jurisdictions continue to slow adoption in smaller firms.

Technology is reshaping the market at speed. AI-enabled transaction monitoring systems now reduce false positives by up to 50%, while robotic process automation cuts manual compliance workloads by as much as 40%. Cloud-based Regtech platforms are gaining traction, offering scalability and integration with existing enterprise systems. The integration of AI with blockchain for audit trails and with biometric authentication for identity verification is also expanding the scope of applications.

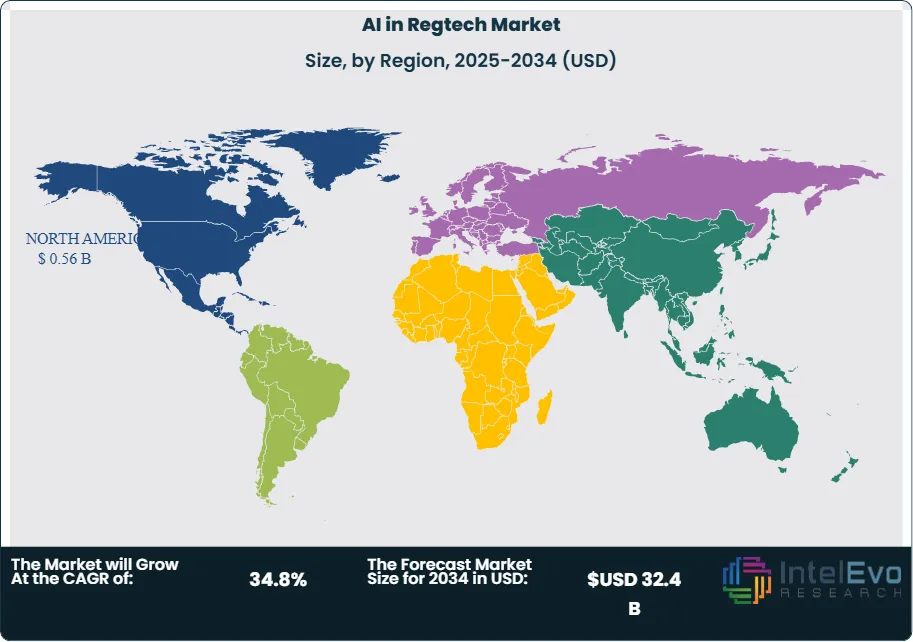

Regionally, North America leads with more than 40% of current market share, driven by stringent regulatory oversight and early adoption of AI tools by major financial institutions. Europe follows closely, supported by GDPR compliance requirements and strong investment in fintech hubs such as London and Frankfurt. Asia-Pacific is the fastest-growing region, with markets like Singapore and Hong Kong positioning themselves as regulatory sandboxes that attract global investment. For investors, the strongest opportunities lie in AI-powered compliance automation, fraud detection, and cross-border regulatory reporting, where demand is accelerating fastest.

Key Takeaways

- Market Growth: The global AI in Regtech market was valued at USD 1.6 billion in 2024 and is projected to reach USD 32.4 billion by 2034, expanding at a CAGR of 34.8%. Growth is driven by rising compliance costs, stricter global regulations, and the demand for automated risk management solutions.

- Type: The solutions segment accounted for 65.9% of total revenue in 2023, reflecting strong adoption of AI-powered compliance platforms that automate monitoring, reporting, and fraud detection. Services are expected to grow faster as firms seek integration and managed compliance support.

- Application: Regulatory compliance led with 30.6% share in 2023, supported by increasing adoption of AI tools for anti-money laundering, Know Your Customer (KYC), and transaction monitoring. Fraud detection and risk analytics are emerging as high-growth applications with double-digit adoption rates.

- Technology: Unsupervised learning held 41.4% share in 2023, as financial institutions deploy anomaly detection models to identify suspicious transactions without predefined rules. Supervised learning and reinforcement learning are gaining traction in predictive compliance and adaptive risk scoring.

- Driver: Rising regulatory scrutiny is a key growth driver. Global banks spent over USD 270 billion on compliance in 2022, and AI-enabled Regtech solutions are reducing false positives in transaction monitoring by up to 50%, creating measurable cost savings.

- Restraint: High implementation costs and integration challenges limit adoption among small and mid-sized firms. Initial deployment of AI-based compliance systems can exceed USD 5 million for large institutions, slowing penetration in resource-constrained markets.

- Opportunity: Asia-Pacific presents the strongest growth potential, with projected CAGR above 40% through 2033. Regulatory sandboxes in Singapore, Hong Kong, and Australia are accelerating adoption, making the region a priority for investors.

- Trend: AI integration with blockchain and biometric authentication is expanding Regtech capabilities. Companies such as IBM and NICE Actimize are investing in AI-driven identity verification and audit trail solutions, signaling a shift toward multi-technology compliance ecosystems.

- Regional Analysis: North America led with 36.7% share in 2023, supported by stringent U.S. and Canadian regulatory frameworks. Europe follows with strong adoption driven by GDPR and AML directives. Asia-Pacific is the fastest-growing region, while Latin America and the Middle East are emerging markets with rising fintech adoption and regulatory modernization.

By Type

As of 2025, the solutions segment continues to dominate the AI in Regtech market, accounting for more than two-thirds of total revenue. This leadership reflects the strong demand for AI-powered compliance platforms, risk management systems, and automated audit tools that reduce manual workloads and improve accuracy. Enterprises across banking, insurance, and healthcare are prioritizing these solutions to manage rising compliance costs, which for large financial institutions can exceed 10% of operating budgets.

The strength of this segment is reinforced by advances in natural language processing and machine learning, which allow systems to interpret complex regulatory updates and adapt compliance frameworks in real time. Vendors such as IBM, NICE Actimize, and Fenergo are expanding their AI-driven offerings, enabling firms to detect anomalies, predict risks, and maintain audit-ready records. Services, while smaller in share, are gaining traction as organizations seek integration support and managed compliance operations, particularly in mid-sized enterprises.

Looking ahead, the solutions segment is expected to maintain its lead, supported by continuous investment in AI research and the growing need for proactive compliance management. With global regulatory changes accelerating, adoption of AI-based solutions is projected to grow at a CAGR above 35% through 2033, ensuring this category remains the backbone of the Regtech market.

By Application

Regulatory compliance remains the largest application area, representing more than 30% of global revenue in 2025. The segment’s dominance is driven by the need to manage increasingly complex frameworks such as GDPR in Europe, AMLD6, and evolving U.S. financial regulations. AI systems are now widely used to automate monitoring, reporting, and audit processes, reducing compliance-related errors and lowering the risk of penalties that can exceed USD 1 billion for major banks.

Risk management and financial crime prevention are emerging as high-growth applications. AI-powered transaction monitoring platforms are reducing false positives by up to 50%, while predictive analytics tools are helping institutions identify fraud patterns before they escalate. Identity management and KYC verification are also expanding rapidly, supported by biometric authentication and AI-enabled document validation.

As multinational corporations expand into new markets, the complexity of cross-border compliance is intensifying. AI applications that can adapt to multiple jurisdictions are becoming essential, particularly for global banks and fintech firms. This trend ensures that regulatory compliance will remain the anchor segment, while risk management and financial crime detection drive incremental growth.

By End-Use

The financial services sector remains the largest end-user of AI in Regtech, accounting for more than 60% of total demand in 2025. Banks, insurers, and asset managers are investing heavily in AI-driven compliance systems to manage rising regulatory scrutiny and operational risks. The cost of compliance for global banks has more than doubled over the past decade, making automation a strategic priority.

Commercial enterprises, particularly in healthcare, telecommunications, and energy, are also increasing adoption. These industries face strict data privacy and reporting requirements, and AI tools are helping them manage compliance more efficiently. Industrial firms are beginning to adopt Regtech solutions as environmental, social, and governance (ESG) reporting becomes mandatory in several regions.

Residential and smaller-scale enterprises represent a limited share but are expected to grow as cloud-based Regtech platforms become more affordable. The shift toward subscription-based compliance services is lowering barriers to entry, enabling mid-sized firms to adopt AI-driven compliance tools without large upfront investments.

By Region

North America continues to lead the global market in 2025, holding more than 35% share. The region’s dominance is supported by a concentration of financial institutions, strong regulatory oversight, and early adoption of AI technologies. The U.S. Securities and Exchange Commission and Federal Reserve are continuously updating compliance requirements, driving demand for agile AI-powered solutions.

Europe follows closely, supported by GDPR enforcement, anti-money laundering directives, and the presence of fintech hubs in London, Frankfurt, and Paris. The region is also seeing strong adoption of AI in ESG compliance reporting, which is becoming a regulatory priority.

Asia Pacific is the fastest-growing region, with projected CAGR above 40% through 2033. Markets such as Singapore, Hong Kong, and Australia are establishing regulatory sandboxes that encourage AI adoption, while China and India are expanding investments in Regtech to strengthen financial oversight. Latin America and the Middle East & Africa remain smaller markets but are gaining momentum as digital banking expands and regulators introduce stricter compliance frameworks. For investors, Asia Pacific represents the strongest growth opportunity, while North America and Europe remain the most mature markets.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Solutions

- Services

By Application

- Regulatory Compliance

- Risk Management

- Financial Crime

- Identity Management

- Compliance Support

- Analytics

- Automated Trading

- Other Applications

By Operation Model

- Unsupervised Learning

- Supervised Learning

- Reinforced Learning

- Semi-Supervised Learning

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 1.6 B |

| Forecast Revenue (2034) | USD 32.4 B |

| CAGR (2024-2034) | 34.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Solutions, Services), By Application (Regulatory Compliance, Risk Management, Financial Crime, Identity Management, Compliance Support, Analytics, Automated Trading, Other Applications), By Operation Model (Unsupervised Learning, Supervised Learning, Reinforced Learning, Semi-Supervised Learning) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Trulioo, Fund Recs, IBM Watson Financial Services, Onfido, Sysxnet Limited, ComplyAdvantage, Elliptic, White and Case LLP, WorkFusion, IdentityMind Global, AlgoDynamix, Sift Science, Behavox Ltd., Corlytics Ltd., FundApps Ltd., Trunomi, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date