AI in Remote Patient Monitoring Market Size | 24.8% CAGR

Global AI in Remote Patient Monitoring Market Size, Share & Analysis By Monitoring Device Type (Wearable, Implantable, Stationary), By Component (Hardware, Software, Services), By Technology (Machine Learning, Natural Language Processing, Computer Vision), By Application (Chronic Disease Management, Geriatric Care Management, Sleep Apnea Monitoring, Fitness Monitoring) Industry Dynamics & Forecast 2025–2034

Report Overview

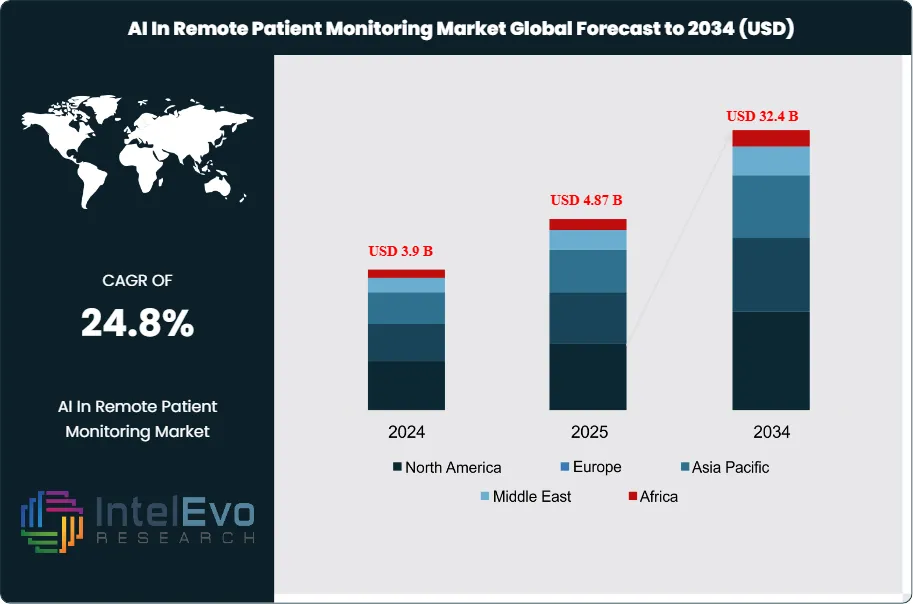

The Artificial Intelligence (AI) in Remote Patient Monitoring (RPM) Market is valued at USD 3.9 billion in 2024 and is projected to reach approximately USD 32.4 billion by 2034, growing at a powerful CAGR of around 24.8% from 2025–2034. The surge reflects rising adoption of AI-enabled wearables, predictive health alerts, and chronic-care monitoring platforms across global healthcare systems. With hospitals prioritizing virtual-first models and payers expanding reimbursement for continuous monitoring, AI-driven RPM is becoming a cornerstone of preventive and personalized care. Increasing integration of digital biomarkers, real-time analytics, and edge-AI devices is further driving visibility and engagement on professional and social platforms.

Get More Information about this report -

Request Free Sample ReportFrom a niche adjunct to telehealth pilots, AI-enabled RPM has evolved into a core capability for hospital-at-home and chronic disease management programs. The market’s expansion reflects a clear shift from episodic, facility-based care toward continuous, data-driven models: connected wearables, home diagnostics, and ambient sensors now generate high-frequency vitals and behavioral data that machine-learning models translate into risk scores, early-warning alerts, and personalized interventions. As a result, health systems report lower avoidable admissions and improved adherence, while payers see pathway-level cost containment—key in a period when healthcare expenditure growth is outpacing GDP in many economies.

Demand is anchored in the rising chronic disease burden and aging populations. Diabetes alone affects roughly 465 million adults worldwide, and cardiometabolic conditions account for a growing share of hospital utilization—both strong use cases for AI-triaged monitoring, medication optimization, and complications prevention. On the supply side, falling sensor costs, maturing cloud/edge architectures, and interoperability frameworks (e.g., FHIR-based data exchange) are removing integration friction, while the expansion of CPT/DRG-linked reimbursement in developed markets is normalizing RPM as a billable service line. Nevertheless, adoption faces constraints: uneven broadband coverage, clinician workflow fatigue, privacy and cybersecurity risks, and regulatory complexity spanning software-as-a-medical-device approvals, model transparency, and data residency. Algorithmic bias and explainability remain board-level concerns, especially as models scale across diverse populations.

Technological innovation is accelerating. Multimodal AI combines photoplethysmography, ECG, and activity streams to improve predictive accuracy; edge inference cuts latency for fall detection and cardiac events; and generative AI supports patient messaging, triage summarization, and care-plan personalization. Digital biomarkers for heart failure, COPD, and post-operative recovery are moving from validation to deployment, while anomaly-detection pipelines reduce alarm fatigue by double-digit percentages.

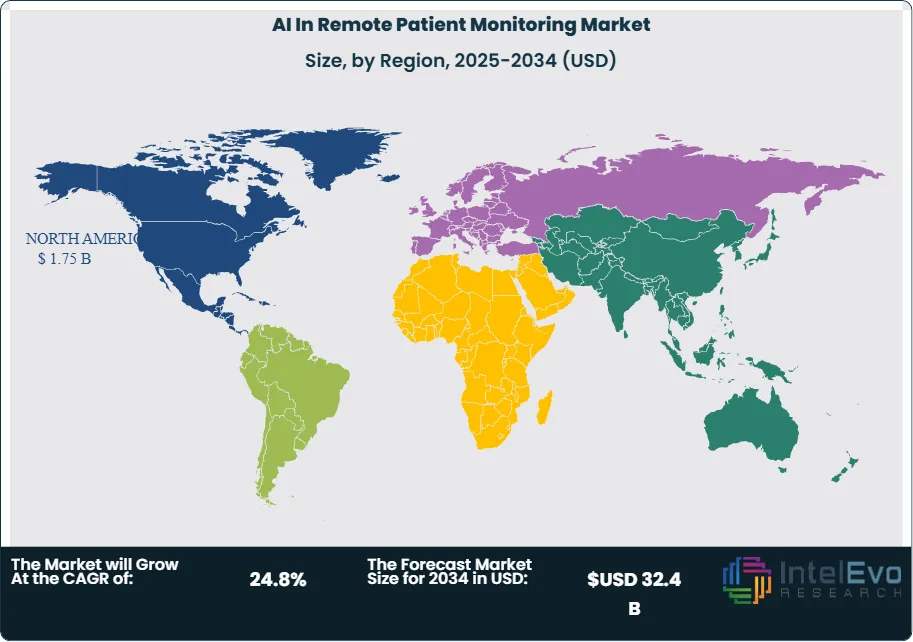

Regionally, North America leads on revenue—supported by payer incentives and mature telehealth infrastructure—while Western Europe advances under value-based care and stringent data-protection frameworks. Asia–Pacific is the fastest-growing investment hotspot, buoyed by large chronic disease cohorts, government digital-health strategies, and local device ecosystems; India and China are notable for scale economics and rapid mobile adoption. Emerging opportunities include remote oncology support, maternal health, and perioperative pathways, where investors should watch for platforms that pair clinically validated algorithms with interoperable data layers and outcomes-based contracting.

Key Takeaways

- Market Growth: The Global AI in Remote Patient Monitoring (RPM) market was USD 3.9 billion in 2024 and is projected to reach ~ USD 32.4 billion by 2034, reflecting a 24.8% CAGR as providers shift from episodic to continuous, data-driven care and as payers scale reimbursement-linked RPM programs.

- Offering: Managed Monitoring Services lead revenue with an estimated ~50%+ share, propelled by per-patient, per-month fees that bundle devices, dashboards, and clinical oversight; software subscriptions and analytics platforms are the fastest-growing layer as AI pipelines move from pilot to enterprise rollout.

- Application: Cardiometabolic management (cardiac conditions + diabetes) accounts for the largest application share (≈40%), underpinned by high readmission costs and a global diabetes burden of ~465 million adults; COPD and post-acute recovery pathways are gaining traction with double-digit annual adoption.

- End User: Providers (health systems and home-health networks) capture the majority of deployments due to integration with EHR workflows and hospital-at-home models, while payers accelerate funding for risk-based members, catalyzing multiyear RPM contracts and outcomes-based payments.

- Driver: Rising chronic disease prevalence and aging populations expand the monitored cohort, while AI models that triage risk and personalize interventions deliver measurable impact—commonly reporting double-digit reductions in avoidable admissions and improved medication adherence in year one.

- Restraint: Data governance and workflow burden remain binding constraints; compliance for SaMD, HIPAA/GDPR, and model validation often adds 6–12 months to procurement cycles, and alarm fatigue from legacy rules engines can depress clinician adoption without AI-based anomaly filtering.

- Opportunity: Asia–Pacific represents the standout growth opportunity (often >30% CAGR potential) as large patient pools, national digital-health programs, and cost-optimized device ecosystems support scale; high-value niches include heart failure, COPD, perioperative monitoring, and oncology supportive care.

- Trend: Multimodal and edge AI are moving mainstream—combining PPG/ECG, activity, and contextual signals for earlier decompensation detection—while generative AI increasingly automates patient messaging, triage summarization, and care-plan personalization, cutting manual touchpoints per patient.

- Technology: Interoperability via FHIR, secure cloud/edge architectures, and continuous model monitoring are becoming table stakes; vendors showcasing explainability, bias testing, and real-world evidence are winning enterprise RFPs and commanding premium pricing.

- Regional Analysis: North America leads on revenue (≈40–45%) with mature reimbursement and telehealth infrastructure; Western Europe follows under value-based care and stringent data-protection regimes; Asia–Pacific is the fastest-growing investment hotspot, with India and China driving volume through mobile-first adoption and local manufacturing.

Type Analysis

In 2025, AI-enabled remote patient monitoring (RPM) is anchored by three device classes—wearable, implantable, and stationary—each serving distinct acuity tiers. Wearables remain the revenue leader after capturing 61.2% share in 2023, supported by continuous collection of heart rate, blood pressure, SpO₂, rhythm, and glucose signals that feed real-time risk scoring and adaptive care plans. Tier-1 OEMs continue to expand medical-grade features—e.g., Fitbit’s Sense/Versa/Inspire lines adding on-wrist SpO₂ and advanced heart-rate analytics—improving adherence and enabling earlier intervention at scale.

Implantables (e.g., insertable cardiac monitors, long-wear biosensors) are a smaller installed base but post the fastest unit-value growth as payers back monitoring in high-risk cohorts where early decompensation detection materially lowers readmissions. Stationary devices (home hubs, BP cuffs, scales, spirometers) sustain adoption in geriatric and post-acute settings, increasingly paired with edge inference to filter noise and curb false alerts. The mix shift through 2030 favors multi-sensor kits that blend wearable convenience with stationary reliability for longitudinal signal fidelity.

Component Analysis

Software is the core value layer, accounting for 75.3% of market revenue in 2023 and retaining primacy in 2025 as providers standardize on SaaS platforms for data orchestration, predictive analytics, clinician dashboards, and alert routing. Platforms such as Philips IntelliSpace Corsium exemplify how real-time streaming, cohort stratification, and decision support convert raw device data into measurable outcomes and billable pathways.

Hardware growth remains steady but increasingly commoditized as sensor costs fall and connectivity (BLE/5G) becomes ubiquitous. Services—spanning managed monitoring, patient onboarding/logistics, and clinician oversight—represent a rising share of new contracts, particularly in hospital-at-home programs; many providers prefer per-member-per-month bundles that combine devices, software licenses, and 24/7 clinical escalation into outcomes-linked SLAs.

Technology Analysis

Machine learning (ML) is the backbone technology with a 53.9% share in 2023, and it continues to dominate 2025 deployments for anomaly detection, risk scoring, and personalized titration. Multivariate ML models fuse vitals, activity, and context to flag early decompensation and typically drive double-digit reductions in non-actionable alerts once tuned on local data.

Natural language processing (NLP) converts patient-reported messages and clinician notes into structured insights, accelerating triage and closing care gaps, while computer vision (CV) supports respiratory effort assessment and wound/edema tracking via camera feeds. “Others” include reinforcement learning for dosage optimization and privacy-preserving techniques (federated learning, differential privacy) that maintain accuracy while meeting data-residency and security requirements.

Application Analysis

Chronic disease management is the anchor use case, holding 55.2% share in 2023 and extending leadership through 2025 as diabetes, cardiovascular disease, COPD, and hypertension programs adopt AI-triaged monitoring to reduce avoidable admissions and improve adherence. With roughly ~465 million adults living with diabetes globally, continuous glucose monitors, cardiac rhythm analytics, and BP trend models are integral to proactive, home-based care.

Adjacent growth pockets include geriatric care management (fall detection, frailty indexing, medication reminders) and sleep apnea monitoring, where home diagnostics and AI-aided PAP adherence raise long-term efficacy. Fitness monitoring remains a feeder segment: while less reimbursed, it broadens the funnel for clinical-grade enrollment as algorithms graduate from wellness to regulated decision support.

Regional Analysis

North America leads on revenue (≈40–45% share) in 2025, underpinned by established RPM reimbursement frameworks, high EHR interoperability, and scale programs across integrated delivery networks. Europe (≈20–25%) advances under value-based care and stringent data-protection regimes that favor vendors with explainability and post-market surveillance baked into SaMD lifecycles.

Asia Pacific is the fastest-growing region (often >30% CAGR outlook), propelled by large chronic-disease cohorts, government-backed digital-health roadmaps, and cost-optimized device ecosystems; China and India drive volume via mobile-first participation and local manufacturing. Latin America and Middle East & Africa remain emerging but increasingly active, with national telehealth initiatives and public-private pilots focusing on cardiometabolic and maternal-child health; scaling hinges on broadband availability, clinician capacity, and procurement models that bundle devices with managed services.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Monitoring Device Type

- Wearable

- Implantable

- Stationary

By Component

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Others

By Application

- Chronic Disease Management

- Geriatric Care Management

- Sleep Apnea Monitoring

- Fitness Monitoring

- Other

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.9 B |

| Forecast Revenue (2034) | USD 32.4 B |

| CAGR (2024-2034) | 24.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Monitoring Device Type (Wearable, Implantable, Stationary), By Component (Hardware, Software, Services), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Others), By Application (Chronic Disease Management, Geriatric Care Management, Sleep Apnea Monitoring, Fitness Monitoring, Other) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Medasense Biometrics Ltd, Sensely Inc., AICure LLC, International Business Machines Corp. (IBM), Modernizing Machine, Inc., BPG Bio, Inc., Atomwise Inc., Caption Health Inc., Nuance Communications, Ferrum Health |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

AI In Remote Patient Monitoring Market

Published Date : 03 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date