AI in Sports Market 2034 Size, Innovation & Forecast | 33.8% CAGR

Global AI in Sports Market Size, Share & Analysis By Component (Software, Service), By Deployment Mode (Cloud, On-premise), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Others), By Application(Player Analysis, Fan Engagement, Data Interpretation & Analysis, Other Applications), Industry Adoption Trends, Investment Hotspots & Forecast 2025–2034

Report Overview

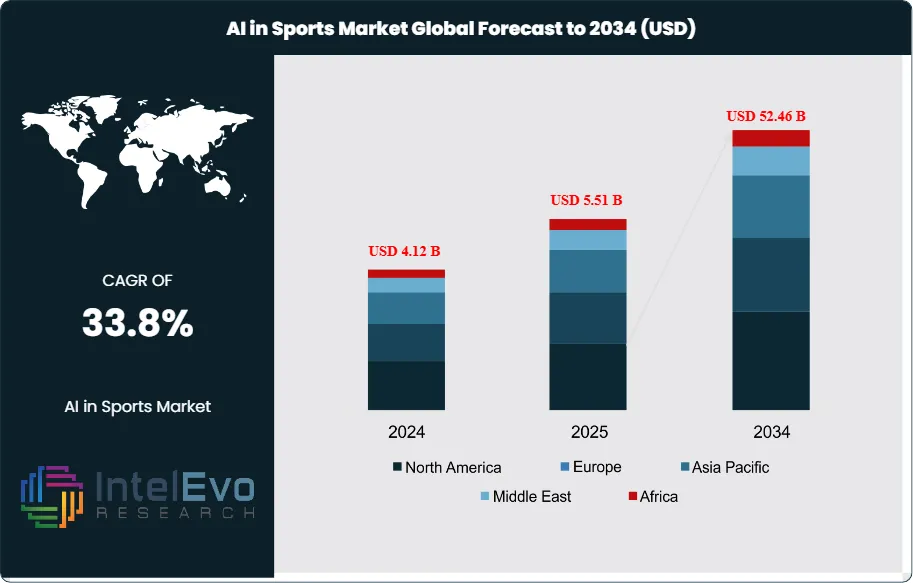

The AI in Sports Market was valued at approximately USD 4.12 Billion in 2024 and is projected to reach nearly USD 52.46 Billion by 2034, growing at an estimated CAGR of around 33.8% from 2025 to 2034. AI-powered performance analytics, injury-risk detection, and real-time game insights are transforming how clubs, leagues, and broadcasters operate. From computer-vision scouting to predictive coaching systems, AI is redefining competitive strategy and fan engagement. The next decade marks a technology-driven revolution in global sports, unlocking massive commercial, athletic, and media-innovation opportunities.

Get More Information about this report -

Request Free Sample ReportMarket development has accelerated from early analytics pilots to enterprise-scale deployments across teams, leagues, broadcasters, sportsbooks, and venue operators. Between 2019 and 2023, adoption shifted from isolated performance-analysis tools to integrated data stacks combining computer vision, wearables, tracking systems, and cloud-based model ops; software now accounts for an estimated 60–65% of spend, with services and integration comprising the balance.

Solutions for performance and tactics analytics represent roughly 45–50% of current revenue, followed by fan-engagement and media automation (25–30%) and operations and integrity applications (15–20%). As rights holders monetize data more effectively, average spend per top-tier club has risen at double-digit rates, while broadcasters report uplifts of 8–12% in engagement on AI-personalized OTT feeds.

Demand-side growth is underpinned by the pursuit of competitive advantage, measurable ROI from injury-risk reduction and conditioning (often 10–20% reductions in soft-tissue incidents where programs are mature), and the premium on differentiated fan experiences. On the supply side, lower inference costs, edge AI in wearables, and the availability of pretrained vision and language models have reduced time-to-value. Key risks include athlete-data governance and consent (biometric data increasingly treated as personally identifiable), model bias and explainability in selection decisions, IP ownership of derived data, and cybersecurity across interconnected venue systems. Regulatory scrutiny is tightening around betting-linked use cases and GDPR/CCPA compliance, raising integration and compliance costs for multi-jurisdiction operators.

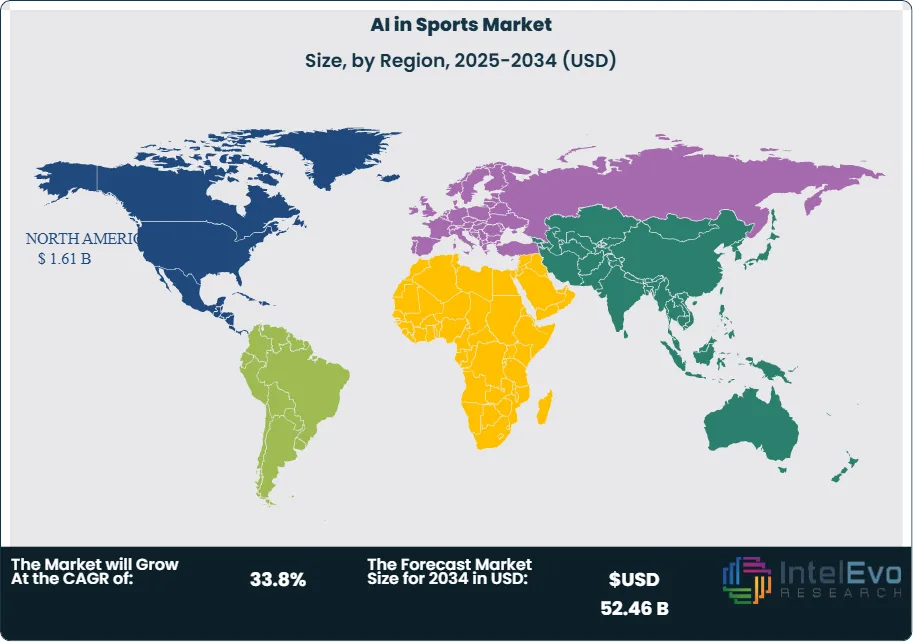

Technology innovation is reshaping adoption: multimodal tracking that fuses optical, LPS/UWB, and inertial signals; reinforcement learning for strategy optimization; digital twins of players and training loads; automated highlights and synthetic commentary; and AI-driven ad insertion for virtualized signage. North America currently leads with ~40% revenue share, supported by deep investments in the NFL, NBA, MLB, and collegiate programs; Europe follows at ~30% on the back of data-rich football leagues. Asia–Pacific is the fastest-growing region (estimated >35% CAGR) as cricket, football, and basketball franchises scale analytics, while the Middle East accelerates smart-venue builds tied to mega-events. Investment hotspots include computer-vision platforms, athlete-wellness analytics, and fan-personalization layers embedded into OTT and betting ecosystems.

Key Takeaways

- Market Growth: The global AI in Sports market was USD 4.12 Billion in 2024 and is projected to reach USD 52.46 Billion by 2034 (33.8% CAGR), propelled by measurable performance gains, personalized fan engagement, and falling edge-inference costs.

- Segment Dominance – Component: Software led with ~72% revenue share in 2024 as value concentrates in analytics platforms, computer-vision pipelines, and MLOps; leading vendors include Stats Perform, Genius Sports (Second Spectrum), Catapult, Hudl, WSC Sports, and Pixellot.

- Segment Dominance – Deployment: On-premise accounted for ~57% of spend in 2024 due to data control, latency, and compliance needs in elite competitions; hybrid models are expanding as cloud and federated learning narrow security and jurisdictional gaps.

- Segment Dominance – Technology: Machine Learning was the top technology with >26% share in 2024, underpinned by player-tracking models, injury-risk classifiers, and recommendation engines; rapid gains are expected in computer vision and NLP as multimodal models scale.

- Segment Dominance – Application: Data Interpretation & Analysis dominated at ~34% share in 2024, reflecting demand for tactical insights and workload optimization; adjacent use cases in broadcasting and fan personalization expanded ~40% in 2024, while athlete health monitoring/injury prevention adoption is projected to grow ~25% in 2024.

- Driver: Accelerating enterprise adoption—over 30% of sports governing bodies had implemented AI by 2024—combines with macro AI momentum (global AI market expected to reach ~USD 2,745 billion by 2034) to sustain investment in performance analytics, media automation, and betting integrity solutions.

- Restraint: Athlete-data privacy, IP ownership, and explainability requirements elevate integration and legal costs and keep workloads on-prem (57% share), slowing cloud-native scaling and cross-league data sharing.

- Opportunity: Smart-venue operations (crowd flow, security, energy) and digital twins for training are poised for outsized growth, with AI-optimized venue initiatives estimated to rise ~30% in 2024 and VR-based training expected to become mainstream from 2024; talent-scouting adoption is projected to exceed 60% by 2024.

- Trend: Generative and multimodal AI are reshaping media—automated highlights, synthetic commentary, and virtualized signage—driving double-digit engagement uplifts; broadcasters and leagues increasingly deploy solutions from WSC Sports, Pixellot, Hawk-Eye, and AWS to differentiate OTT experiences.

- Regional Analysis: North America led with ~39% share in 2024 on deep tech stacks across the NFL, NBA, MLB, and college sports; Europe follows on data-rich football ecosystems, while Asia-Pacific is the fastest-growing region (expected >35% CAGR) and the Middle East is an investment hotspot via smart-venue builds tied to mega-events.

Component Analysis

Software remains the revenue anchor of AI in Sports in 2025, accounting for an estimated 70–73% of spend as clubs, leagues, broadcasters, and sportsbooks prioritize analytics platforms, computer-vision pipelines, and MLOps. Value concentrates in feature-rich stacks that fuse tracking data, video, and contextual metadata to drive player optimization and media automation; leading providers include Stats Perform, Genius Sports (Second Spectrum), Catapult, Hudl, WSC Sports, Pixellot, and Sportlogiq. As of 2025, platform contracts increasingly bundle SDKs and APIs for personalization, raising software ARPU and stickiness.

Services—consulting, systems integration, model tuning, and managed operations—represent the remaining 27–30% but are expanding faster (high-20s CAGR through 2030) as buyers move from pilots to multi-property rollouts and seek hybrid data governance. Demand is strongest for edge deployment design, data rights/compliance advisory, and reliability engineering for live workflows, particularly around injury-risk models and automated content production at scale.

Deployment Mode Analysis

On-premise retains a slight majority in 2025 (≈55–58% share) due to latency-sensitive use cases, sovereign data mandates, and the competitive sensitivity of biometric and tactical datasets. Elite teams value deterministic performance for in-stadium decisioning and prefer keeping model weights and player data within club-controlled environments, often leveraging HCI appliances and GPU clusters.

Cloud and hybrid models are the fastest-rising, projected to surpass on-prem around 2028–2029 as confidential computing, federated learning, and fine-grained access controls reduce risk. Cloud economics favor bursty workloads (e.g., generative highlight creation, large-scale simulation), while CDNs and edge inference mitigate round-trip delays for broadcast overlays and OTT personalization.

By Technology

Machine Learning remains the largest technology bucket in 2025 with ~26–28% share, underpinning workload management, injury-risk scoring, scouting, and pricing/integrity analytics. Clubs report double-digit reductions in soft-tissue injuries where ML-led load management is mature, supporting continued budget allocation.

Computer Vision is close behind (~24–26% share) and outgrowing the overall market, driven by multi-camera optical tracking, pose estimation, and automated officiating. Vendors such as Second Spectrum, Hawk-Eye Innovations, Veo, and Pixellot scale lower-cost capture that broadens adoption from tier-one leagues to academies. NLP/GenAI (≈18–22%) accelerates synthetic commentary, automated metadata, and conversational analytics for coaches and fans, while “Others” (reinforcement learning, knowledge graphs, anomaly detection) power strategy simulation and betting integrity.

Application Analysis

Data Interpretation & Analysis remains the core application in 2025 (~33–35% share), transforming heterogeneous data—tracking, biosignals, video, and context—into actionable insights for selection, tactics, and recovery. Mature programs report 5–10% improvements in player availability and 3–5% uplift in points gained per season tied to decision-support adoption.

Fan Engagement and media automation is the fastest-growing cluster (often >35% CAGR), with AI-generated highlights, personalized feeds, and virtualized signage delivering 8–12% increases in watch time and ad yield for rights holders. Player Analysis continues to scale via wearables and edge inference; in top-tier environments, sensor penetration exceeds two-thirds of rosters, enabling real-time feedback loops and individualized training. “Other” uses—venue operations, safety, and officiating—gain momentum as smart-venue programs mature.

Regional Analysis

North America remains the largest market in 2025 with ~38–40% share (≈USD 1.6–1.8 billion), supported by data-rich ecosystems across the NFL, NBA, MLB, NHL, and NCAA, and deep partnerships between leagues, broadcasters, and AI vendors. Europe follows (~28–30%) on sustained adoption in football (EPL, Bundesliga, La Liga) and tennis/cricket, with GDPR-aligned data architectures shaping deployment choices and vendor selection.

Asia Pacific is the fastest-growing region (projected ~30–35% CAGR through 2030) as cricket, football, and basketball franchises scale tracking and content automation; APAC’s share is poised to rise from the low-20s in 2025 toward ~28–30% by 2030. Latin America expands on football analytics and cost-efficient CV capture, while the Middle East & Africa accelerates via government-backed sports investments and smart-venue builds linked to mega-events, making the Gulf a near-term innovation hotspot despite a smaller installed base.

Get More Information about this report -

Request Free Sample ReportMarket Key segments

By Component

- Software

- Service

By Deployment Mode

- Cloud

- On-premise

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Others

By Application

- Player Analysis

- Fan Engagement

- Data Interpretation & Analysis

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 4.12 B |

| Forecast Revenue (2034) | USD 52.46 B |

| CAGR (2024-2034) | 33.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Software, Service), By Deployment Mode (Cloud, On-premise), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Others), By Application(Player Analysis, Fan Engagement, Data Interpretation & Analysis, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SAP SE, SAS Institute Inc, Opta Sports (Perform Group), Catapult Group International Ltd, TruMedia Networks, Salesforce.com Inc., IBM Corporation, Sportradar AG, Microsoft Corporation, Genius Sports Group, WSC Sports, Hawk-Eye Innovations, Pixellot Ltd., Zebra Technologies, Oracle Corporation, Stats Perform, ShotTracker Inc., Zebra-Motorola Solutions, Kognitiv Spark |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date