AI in Trade Finance Market Size, Share | CAGR of 17.8%

Global AI in Trade Finance Market Size, Share & Analysis Report By Solution (Document Automation, Risk Analytics, Fraud Detection, Predictive Forecasting, Blockchain, Simulation), By Enterprise Size (SMEs, Large Enterprises), Deployment Model (Cloud-Based, On-Premises, Hybrid), Industry Vertical (BFSI, Logistics, Manufacturing, Retail & E-Commerce), Region & Key Players – Segment Overview, Market Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

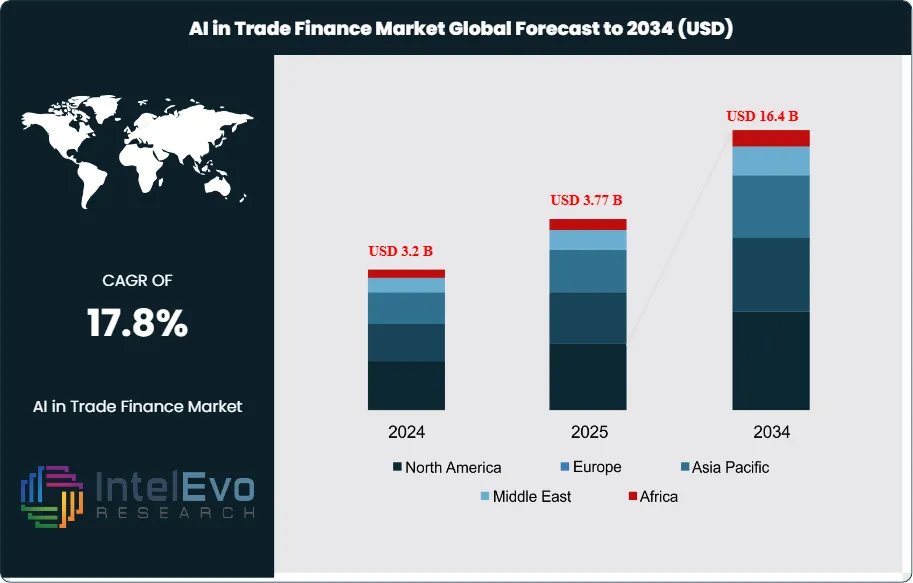

The AI in Trade Finance Market size is expected to be worth around USD 16.4 Billion by 2034, up from USD 3.2 Billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2024 to 2034. The AI in trade finance market encompasses a broad range of artificial intelligence-driven solutions and services designed to automate, optimize, and secure the complex processes involved in international trade transactions.

Get More Information about this report -

Request Free Sample ReportThis market represents a transformative shift in the global financial ecosystem, as banks, corporates, and fintechs increasingly leverage AI, machine learning, and advanced analytics to streamline document processing, enhance risk assessment, detect fraud, and improve compliance in trade finance operations. The ecosystem includes AI-powered platforms, document digitization tools, risk analytics engines, and integration services that serve financial institutions, exporters, importers, and logistics providers.

The AI in trade finance market is experiencing robust growth driven by the accelerating pace of digital transformation in banking, the rising complexity of global trade, and the growing demand for real-time, data-driven decision-making. Key growth catalysts include the integration of natural language processing (NLP) for document automation, machine learning for credit and risk scoring, and advanced analytics for anti-money laundering (AML) and know-your-customer (KYC) compliance. The market benefits from the increasing pressure on banks and corporates to reduce operational costs, mitigate fraud, and enhance customer experience in a highly regulated and competitive environment.

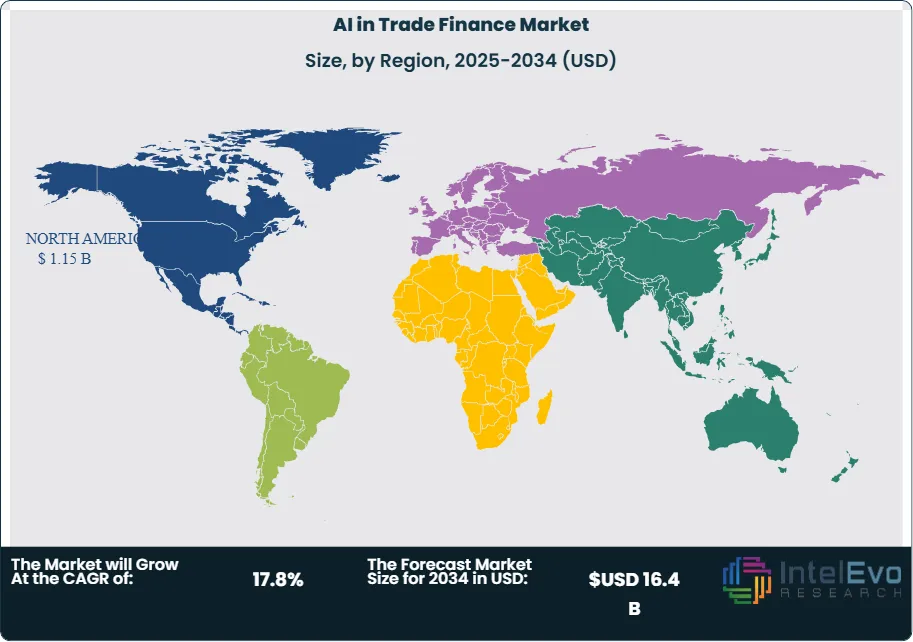

North America and Europe dominate the global AI in trade finance market, with leadership stemming from the concentration of major financial institutions, advanced regulatory frameworks, and a strong culture of innovation. Asia-Pacific represents the fastest-growing regional market, driven by rapid digitalization, expanding trade corridors, and government initiatives supporting fintech innovation.

The COVID-19 pandemic fundamentally accelerated the adoption of AI in trade finance as organizations faced unprecedented supply chain disruptions, increased fraud risk, and the need for remote, paperless operations. The crisis created urgent demand for digital trade solutions, automated document processing, and real-time risk monitoring, prompting banks and corporates to invest in AI-powered platforms that enhance resilience and support business continuity.

Rising regulatory complexity, data privacy concerns, and the need for transparent, explainable AI have significantly influenced the market, creating opportunities for vendors to differentiate through secure, compliant, and user-friendly solutions. The market is also witnessing increased demand for industry-specific AI models, low-code/no-code analytics platforms, and integration with trade finance networks and blockchain-based trade platforms.

Key Takeaways

- Market Growth: The AI in Trade Finance Market is expected to reach USD 16.4 Billion by 2034, fueled by digital transformation, the need for risk mitigation, and ongoing innovation in AI and analytics.

- Solution Type Dominance: Document automation and risk analytics platforms lead market share due to their ability to deliver real-time, data-driven insights and compliance automation.

- Enterprise Size Dominance: Large financial institutions and multinational corporates dominate, driven by complex trade operations, regulatory requirements, and substantial technology investment capabilities.

- Deployment Model Dominance: Cloud-based solutions lead the deployment segment, primarily due to scalability, cost efficiency, and ease of integration with existing systems.

- Industry Vertical Dominance: Banking and financial services hold the largest share, owing to regulatory complexity, high transaction volumes, and the need for precise risk management.

- Driver: Key drivers accelerating growth include the demand for real-time trade processing, the complexity of global trade, and the need for automation in compliance and risk management.

- Restraint: Growth is hindered by data privacy concerns, integration challenges, and the shortage of skilled AI talent in trade finance.

- Opportunity: The market is poised for expansion due to opportunities like industry-specific AI models, low-code analytics platforms, and the integration of AI with blockchain and trade networks.

- Trend: Emerging trends including explainable AI, autonomous trade finance, and the convergence of AI with blockchain and IoT are reshaping the market by enabling new business models and strategic capabilities.

- Regional Analysis: North America leads owing to advanced infrastructure and enterprise adoption. Asia-Pacific shows high promise due to rapid digitalization and government support for fintech.

Solution Type Analysis

Document Automation and Risk Analytics Platforms Lead: Document automation and risk analytics platforms maintain a commanding position in the AI in trade finance market, establishing themselves as the most rapidly expanding segment due to exceptional demand for real-time, data-driven trade processing. These platforms leverage NLP and machine learning to digitize, extract, and validate data from trade documents such as letters of credit, bills of lading, and invoices. The sector’s market leadership originates from the essential role that document automation plays in reducing manual errors, accelerating transaction cycles, and supporting compliance.

Other key solution types include AI-powered fraud detection, credit scoring engines, and compliance monitoring tools. Organizations increasingly rely on these tools to automate routine tasks, reduce operational risk, and enhance the accuracy of trade finance operations. The integration of AI with trade finance networks, blockchain platforms, and ERP systems further enhances the value proposition, enabling end-to-end automation and real-time visibility across the trade finance lifecycle.

Enterprise Size Analysis

Large Financial Institutions Dominate, But SME Adoption Is Rising: Large financial institutions and multinational corporates maintain a commanding position in the AI in trade finance market, establishing themselves as the primary consumers of advanced AI-driven solutions due to their complex trade operations, significant technology investment capabilities, and extensive regulatory compliance responsibilities. These organizations encounter multifaceted challenges encompassing global trade flows, multi-currency transactions, and comprehensive risk management requirements that necessitate specialized AI expertise.

Their market dominance is reinforced by their capacity to finance large-scale digital transformation projects, execute organization-wide AI adoption, and integrate advanced analytics across multiple business units and geographies. However, small and medium enterprises (SMEs) are increasingly adopting AI in trade finance, driven by the availability of affordable, cloud-based solutions and the need to compete on agility and efficiency.

Deployment Model Analysis

Cloud-Based Solutions Lead, On-Premises and Hybrid Models Persist: Cloud-based deployment models demonstrate exceptional growth rates, signaling a fundamental transformation toward scalable, cost-efficient, and globally accessible trade finance solutions. Cloud-based AI in trade finance platforms offer rapid implementation, seamless integration with other enterprise systems, and the ability to leverage advanced analytics without significant upfront investment in IT infrastructure.

On-premises and hybrid deployment models persist, particularly in highly regulated industries and regions with strict data residency requirements. These models offer greater control over data security and customization but may involve higher costs and longer implementation timelines. The accelerated adoption of cloud-based solutions reflects changing client preferences for flexibility, scalability, and continuous innovation.

Industry Vertical Analysis

Banking and Financial Services Lead: The banking and financial services sector holds the leading position among industry verticals, driven by the industry’s exposure to regulatory complexity, high transaction volumes, and the need for precise, real-time risk management. Financial institutions consistently require advanced AI-driven solutions for document processing, fraud detection, regulatory reporting, and scenario analysis.

Other key verticals include logistics, manufacturing, and retail, each adopting AI in trade finance to address industry-specific challenges such as supply chain risk, payment delays, and compliance with international trade regulations.

Region Analysis

North America Leads, Asia-Pacific Is Fastest-Growing: North America holds a commanding position in the global AI in trade finance market, establishing unparalleled market leadership through substantial revenue generation and technology adoption. This regional supremacy is fundamentally anchored by the United States’ overwhelming market presence, which demonstrates exceptional growth potential and market maturity. The region benefits from a concentration of leading financial institutions, advanced regulatory frameworks, and a strong culture of innovation.

Asia-Pacific emerges as the most rapidly expanding regional market, demonstrating exceptional growth momentum driven by accelerated digitalization, government support for fintech innovation, and expanding trade corridors. Major economies including China, India, Japan, and Southeast Asian nations are experiencing unprecedented demand for AI-driven trade finance solutions as organizations modernize their finance functions and pursue global expansion strategies.

Europe maintains a substantial and influential presence in the global AI in trade finance landscape through well-established financial markets, regulatory complexity, and mature economies requiring advanced analytics and compliance solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Solution Type

- Document Automation

- Risk Analytics & Credit Scoring

- Fraud Detection & Compliance

- Predictive Analytics & Forecasting

- Blockchain Integration

- Scenario Modeling & Simulation

Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Deployment Model

- Cloud-Based

- On-Premises

- Hybrid

Industry Vertical

- Banking & Financial Services

- Logistics & Transportation

- Manufacturing

- Retail & E-Commerce

- Others

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 3.77 B |

| Forecast Revenue (2034) | USD 16.4 B |

| CAGR (2025-2034) | 17.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Solution Type(Document Automation, Risk Analytics & Credit Scoring, Fraud Detection & Compliance, Predictive Analytics & Forecasting, Blockchain Integration, Scenario Modeling & Simulation), Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), Deployment Model( Cloud-Based, On-Premises, Hybrid), |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM Corporation, Traydstream, Cleareye.ai, Surecomp, Finverity, Wave BL, Contour, Infosys, Persistent Systems, Tata Consultancy Services (TCS), Oracle Corporation, Finastra, SAP SE, Kyriba, OpenText, TradeIX (Marco Polo Network), TrustBills, Incomlend, R3 (Corda), DataLog Finance |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the AI in Trade Finance Market?

The Global AI in Trade Finance Market is projected to grow from USD 3.2 Billion in 2024 to USD 16.4 Billion by 2034, at a CAGR of 17.8%. Explore key trends, growth drivers, and forecasts.

Who are the major players in the AI in Trade Finance Market?

IBM Corporation, Traydstream, Cleareye.ai, Surecomp, Finverity, Wave BL, Contour, Infosys, Persistent Systems, Tata Consultancy Services (TCS), Oracle Corporation, Finastra, SAP SE, Kyriba, OpenText, TradeIX (Marco Polo Network), TrustBills, Incomlend, R3 (Corda), DataLog Finance

Which segments covered the AI in Trade Finance Market?

Solution Type(Document Automation, Risk Analytics & Credit Scoring, Fraud Detection & Compliance, Predictive Analytics & Forecasting, Blockchain Integration, Scenario Modeling & Simulation), Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), Deployment Model( Cloud-Based, On-Premises, Hybrid),

Industry Vertical(Banking & Financial Services, Logistics & Transportation, Manufacturing, Retail & E-Commerce, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date