AI in Trading Market Size, Trends & Forecast | 12.4% CAGR

Global AI in Trading Market Size, Share & Analysis By Deployment Mode (Cloud-Based, On-Premise), By Application Mode (Algorithmic Trading, Risk Management, Portfolio Optimization, Sentiment Analysis) Industry Regions & Key Players – Market Volatility Insights & Forecast 2025–2034

Report Overview

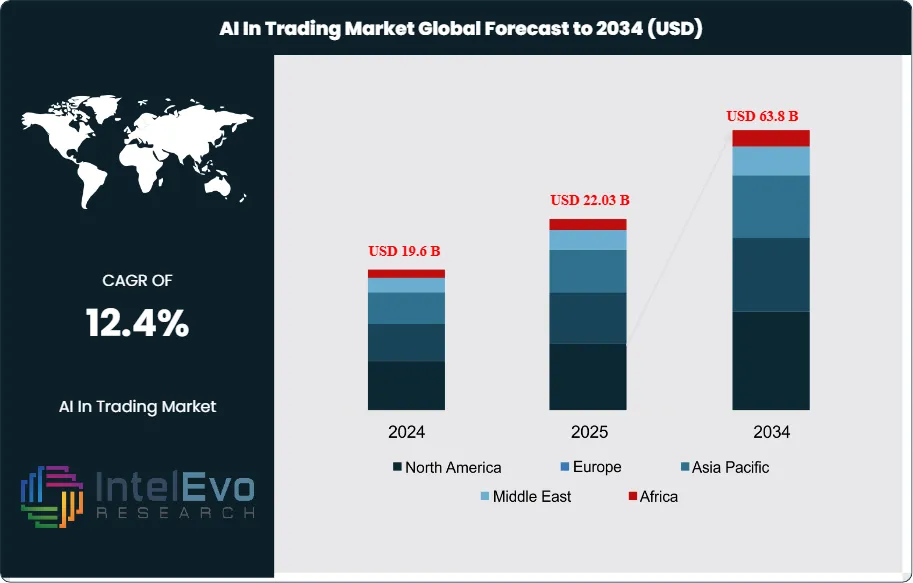

The AI in Trading Market is projected to grow from USD 19.6 Billion in 2024 to approximately USD 63.8 Billion by 2034, expanding at a CAGR of around 12.4% during 2025–2034. The adoption of AI-powered trading algorithms, predictive analytics, and automated decision-making is accelerating across financial institutions and fintech platforms. Real-time data processing and machine learning models are reshaping trading strategies, reducing errors, and enhancing portfolio performance. As digital transformation advances in the global financial ecosystem, AI-driven trading systems are becoming essential tools for competitive and high-frequency market operations. This driven by the rapid adoption of algorithmic trading and the proliferation of big data analytics, offering strategic opportunities for hedge funds, investment banks, and asset managers.

Get More Information about this report -

Request Free Sample ReportThe market is undergoing a transformative evolution as artificial intelligence reshapes trading strategies, risk management, and portfolio optimization. AI-powered trading platforms leverage advanced technologies such as machine learning, natural language processing, and predictive analytics to process vast volumes of financial data in real time. This capability enables institutions to identify trading opportunities with higher precision, improve decision-making speed, and mitigate market risks in increasingly complex financial environments.

Key drivers underpinning market growth include the rising demand for automated and high-frequency trading, the exponential expansion of financial datasets, and the industry’s shift toward more sophisticated trading strategies. However, the market also faces challenges, particularly around regulatory scrutiny and the need for robust compliance frameworks. As global regulators intensify oversight of algorithmic trading practices, financial institutions are turning to AI-enabled compliance and surveillance tools to address risks of market manipulation and operational inefficiencies.

Technological advancements are at the core of this market’s momentum. AI-driven sentiment analysis platforms, predictive risk management systems, and intelligent order execution solutions are redefining competitive differentiation across the trading landscape. Furthermore, strategic investments in AI startups and trading technologies highlight a strong capital inflow, with AI-related ventures capturing more than a quarter of U.S. startup investment dollars in recent years. This surge demonstrates growing confidence in AI’s transformative role in financial markets.

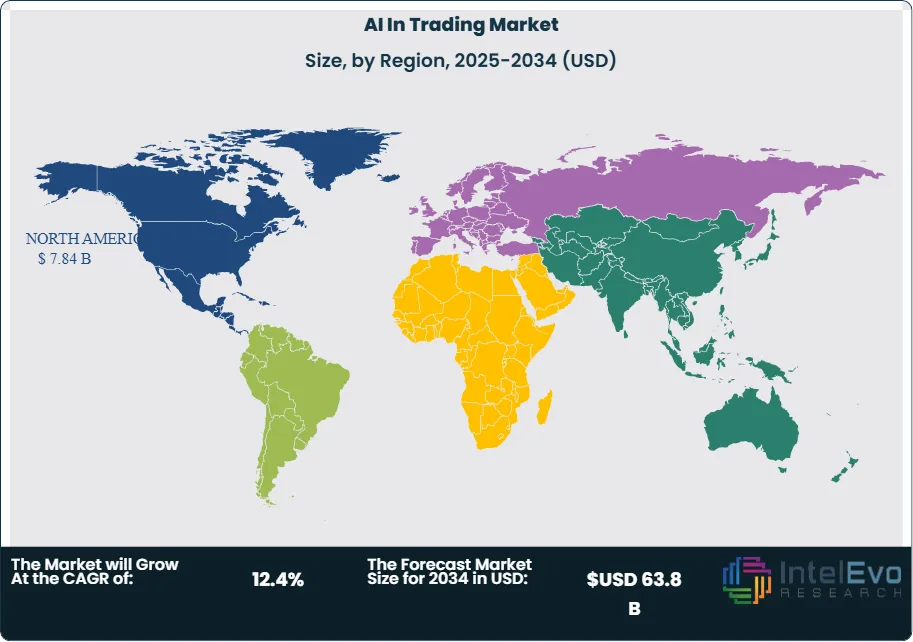

Regionally, North America and Europe continue to dominate AI in trading adoption, driven by mature financial ecosystems and favorable regulatory frameworks. Meanwhile, Asia-Pacific is emerging as a fast-growing investment hotspot, fueled by expanding capital markets, increased digitalization, and supportive government initiatives.

Looking ahead, the market is set to benefit from accelerating global AI investments, which are projected to approach USD 200 billion by 2025. This trajectory underscores the strategic importance of AI in shaping next-generation trading systems, positioning the sector as a critical driver of efficiency, transparency, and innovation within global financial services.

Key Takeaways

- Market Growth: The global AI in Trading Market was valued at USD 19.6 Billion in 2024 and is projected to reach USD 63.8 Billion by 2034, advancing at a CAGR of 12.4% from 2025 to 2034. Growth is primarily fueled by the rising adoption of algorithmic trading and the increasing availability of big data analytics.

- Deployment Model: In 2023, the Cloud-Based segment accounted for over 72.5% of market share, supported by its scalability, flexibility, and cost-efficiency compared to on-premise systems. This dominance is expected to continue as financial institutions increasingly shift toward digital infrastructure.

- Trading Type: Algorithmic Trading led the market in 2023 with more than 37.1% share, driven by its ability to execute high-frequency trades, manage complex datasets, and minimize latency in decision-making. Hedge funds and investment banks are the primary adopters of these systems.

- Driver: Rapid advancements in AI technologies, including machine learning, natural language processing, and predictive analytics, are enabling more accurate trade forecasting, real-time risk assessment, and automated order execution.

- Restraint: Regulatory scrutiny and compliance requirements surrounding algorithmic and high-frequency trading pose operational challenges, with institutions required to adopt costly monitoring systems to prevent manipulation and ensure transparency.

- Opportunity: The Asia-Pacific region presents significant growth potential, as emerging markets witness accelerated digitalization of financial services, rising capital inflows, and government initiatives supporting AI adoption in capital markets.

- Trend: Increasing integration of AI-driven sentiment analysis tools and predictive analytics platforms is transforming decision-making processes, enabling traders to capture market signals from news, social media, and economic indicators more effectively.

- Regional Analysis: North America held over 40.9% of the market in 2023, supported by strong technological infrastructure, concentration of AI firms, and favorable regulations. Meanwhile, Asia-Pacific is projected to be the fastest-growing region, driven by expanding capital markets in China, India, and Singapore.

Deployment Mode Analysis

By 2025, cloud-based deployment continues to dominate the AI in trading landscape, accounting for more than 70% of global market share. Financial institutions are increasingly drawn to cloud solutions for their ability to deliver scalable, cost-efficient, and flexible infrastructure without the burden of maintaining extensive on-premises systems. This model enables rapid deployment of AI-powered trading tools, significantly lowering upfront investment and operational complexity.

Cloud platforms also allow seamless integration of advanced AI models, ensuring traders can update and recalibrate algorithms in near real-time to respond to market volatility. The ability to process massive datasets with high computational efficiency remains a critical differentiator, especially as firms adopt machine learning and deep learning models to extract predictive insights from both historical and live data streams. Major providers such as Amazon Web Services, Microsoft Azure, and Google Cloud have strengthened their positions by offering tailored financial services solutions with embedded compliance and security features.

As regulators impose stricter oversight on algorithmic trading and data protection, enhanced cloud security protocols are reinforcing adoption. Providers now emphasize end-to-end encryption, real-time compliance monitoring, and adherence to global financial regulations. These capabilities, coupled with the growing need for speed and accuracy in trading, suggest that cloud-based deployment will remain the cornerstone of AI adoption in financial markets over the coming decade.

Application Analysis

Algorithmic trading remains the leading application area for AI in financial markets in 2025, representing more than one-third of total market revenue. This dominance stems from the increasing reliance on automated systems to execute large-scale trades with speed, precision, and minimal latency. By automating execution strategies, firms can capture micro-opportunities in volatile markets while reducing the risk of human error.

The sophistication of algorithmic systems has advanced rapidly with the integration of machine learning, predictive analytics, and real-time sentiment analysis. These tools enable continuous strategy refinement, allowing trading firms to adapt models dynamically as new market data emerges. Institutions such as JPMorgan Chase and Goldman Sachs have expanded their use of AI-driven algorithms to support both high-frequency trading and long-term portfolio strategies.

In parallel, regulatory frameworks promoting transparency and fair market practices have increased adoption, as algorithmic platforms offer detailed transaction records and robust monitoring capabilities. Looking forward, the convergence of AI with blockchain and quantum computing is expected to further elevate algorithmic trading, creating opportunities for more secure, efficient, and data-rich trading environments. This positions the segment as a long-term growth driver in the global AI in trading market.

Regional Analysis

North America continues to hold the largest share of the global AI in trading market in 2025, accounting for over 40% of industry revenues. The region benefits from advanced financial ecosystems, a strong presence of AI technology providers, and leading exchanges such as NASDAQ and the New York Stock Exchange that are deeply invested in AI integration. In 2025, the market value in North America is estimated to surpass USD 15 billion, reflecting sustained growth momentum.

The United States and Canada play central roles in shaping adoption trends, supported by extensive R&D investments from both the private sector and government initiatives. Technology leaders including IBM, NVIDIA, and emerging fintech startups continue to develop specialized AI solutions tailored for risk management, portfolio optimization, and predictive analytics. The availability of high-performance computing infrastructure further enhances the region’s competitive edge.

Moreover, North America’s regulatory climate has been increasingly supportive of responsible AI adoption in financial services. Efforts to balance innovation with oversight have encouraged broader implementation across institutional investors, hedge funds, and asset managers. Coupled with the region’s strong culture of data-driven investment strategies, North America is expected to maintain its leadership position while also setting global benchmarks for AI deployment in trading.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Deployment Mode

- Cloud-Based

- On-Premise

By Application Mode

- Algorithmic Trading

- Risk Management

- Portfolio Optimization

- Sentiment Analysis

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 19.6 B |

| Forecast Revenue (2034) | USD 63.8 B |

| CAGR (2024-2034) | 12.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment Mode (Cloud-Based, On-Premise), By Application Mode (Algorithmic Trading, Risk Management, Portfolio Optimization, Sentiment Analysis, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | QuantConnect, NVIDIA Corporation, Sentieo, OpenAI, Hudson Labs, Numerai, Amazon Web Services Inc., Alphasense Inc., Kavout Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date