AI in Visual Effects (VFX) Market Size | 17.5% CAGR Growth

Global AI in Visual Effects Market Size, Share & Analysis By Component (Software, Services, Hardware), By Technology (Artificial Intelligence (AI), Augmented Reality (AR)), By Product (Simulation FX, Animation, Modelling, Matte Painting, Compositing, Others), By Application (Movies, Television, Gaming, Advertisements, Others) Industry Trends, Cost Optimization, Competitive Landscape & Forecast 2025–2034

Report Overview

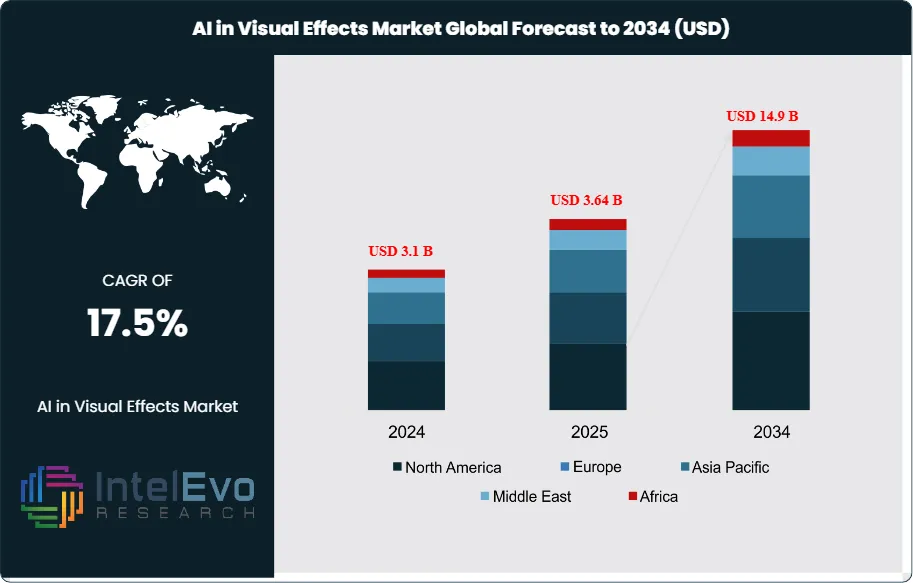

The AI in Visual Effects (VFX) Market is valued at USD 3.1 billion in 2024 and is projected to reach approximately USD 14.9 billion by 2034, expanding at a robust CAGR of about 17.5% from 2025–2034. Growth is accelerating as studios, OTT platforms, and gaming publishers adopt AI-driven pipelines for animation, compositing, motion capture, and digital doubling. With generative AI slashing rendering time by 40–60% and reducing VFX production costs by up to 25%, creators are pushing for faster content cycles and higher photorealism. The rise of virtual production, real-time engines, and AI-enhanced CGI is amplifying visibility across entertainment, advertising, and social media platforms.

Get More Information about this report -

Request Free Sample ReportThis rapid expansion reflects both cyclical content demand and structural adoption of AI across the VFX pipeline. From a small but pivotal base—about 11% of the broader VFX spend in 2023 (the global VFX market was ~USD 15 billion and is projected to reach ~USD 40 billion by 2033 at a 10.7% CAGR)—AI-enabled tools are compressing timelines, elevating photorealism, and lowering unit costs per shot, thereby expanding the addressable project set for studios of all sizes.

Market dynamics are increasingly favorable. On the demand side, streaming platforms continue to prioritize VFX-heavy originals, while game studios, including mobile, seek more immersive, cinematic experiences. On the supply side, persistent labor constraints and cost inflation are catalyzing automation in rotoscoping, matchmoving, cleanup, denoising, and upscaling, with real-time rendering letting artists iterate “in the shot” and cut days from review cycles. AI’s impact on throughput and consistency is material: studios report faster asset turnover and fewer iteration loops, supporting both higher asset reuse and improved asset libraries. Key challenges remain—GPU availability and cloud costs, data licensing and IP provenance, and evolving labor agreements around AI-assisted workflows—but risk is increasingly manageable via hybrid compute strategies, secure data pipelines, and transparent tool governance.

Technology is the primary unlock. Neural Radiance Fields (NeRFs) and related novel-view-synthesis techniques accelerate environment capture and digital doubles with fewer plates; diffusion models streamline concepting, matte painting, and look-dev; physics-informed AI improves simulation fidelity for fluids, fire, and crowds; and ML-driven quality control flags continuity issues earlier in dailies. Toolchains are converging around real-time engines integrated with AI-assisted asset creation, enabling virtual production and previs to flow directly into final pixel.

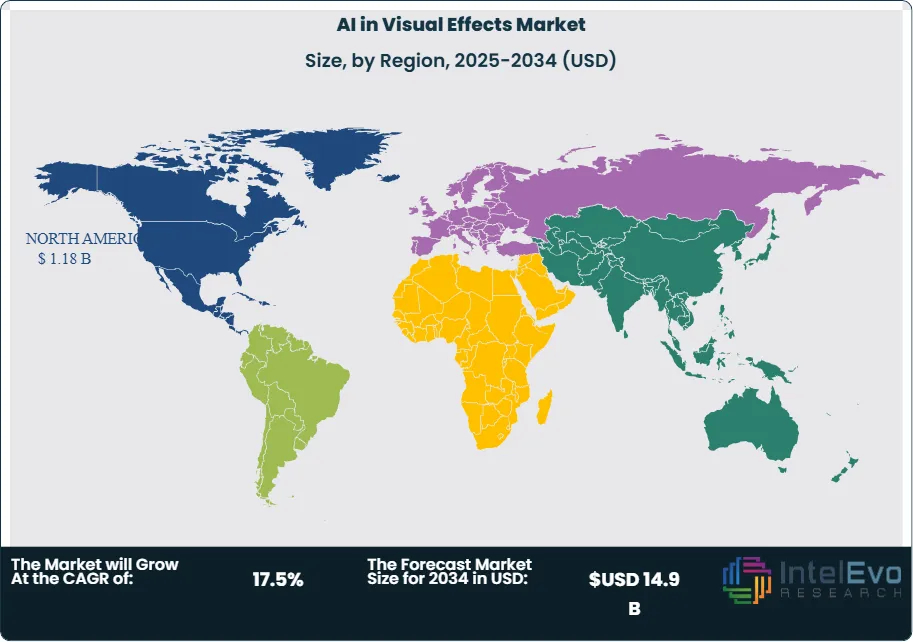

Regionally, North America led in 2023 with a 38% share (≈USD 0.6 billion), underpinned by large studio pipelines and robust post-production ecosystems. Europe remains competitive, supported by tax incentives and mature vendor networks, while Asia–Pacific is the fastest-emerging hotspot, with expanding capabilities in India, China, and Korea. Investment attention should focus on cloud-native VFX platforms, AI-enabled asset management, and real-time pipeline integrations—areas most likely to capture outsized value as adoption scales through 2034.

Key Takeaways

- Market Growth: The AI in Visual Effects (VFX) market stands at USD 3.1 billion in 2024 and is projected to reach USD 14.9 billion by 2034, a ~6x scale-up at a 17.5% CAGR, propelled by streaming-led content volume, real-time rendering, and automation across the post-production pipeline.

- Offering: Services captured 56.1% of 2023 revenue as studios outsourced AI-assisted rotoscoping, cleanup, denoising, and upscaling to specialist vendors, accelerating turnaround and shifting spend from capex to opex.

- Technology: Machine learning & deep learning techniques accounted for ~75.2% of revenue in 2023, reflecting fast adoption of diffusion models, NeRF-based environment capture, and ML-driven QC that improve photorealism while compressing iteration cycles.

- Driver: Streaming platforms and premium episodic TV are intensifying VFX requirements; with the broader VFX market at ~USD 15 billion in 2023 (projected USD 40 billion by 2033, 10.7% CAGR), AI’s role expands as studios seek lower cost per shot and faster time-to-final pixel.

- Restraint: Adoption remains early-stage—AI spend represented ~11% of total VFX outlays in 2023 (USD 1.6B of a USD 15B market)—with scale limited by GPU/cloud costs, data/IP provenance hurdles, and workflow retraining.

- Opportunity: Rising AI attach rates to the broader VFX market (from ~11% in 2023 to ~24% implied by USD 9.6B on a USD 40B VFX market by 2033) create a net new USD ~8.0B revenue pool, with outsized upside in cloud-native pipelines, AI asset management, and real-time engine integrations.

- Trend: Convergence of virtual production and AI—NeRFs for rapid scene reconstruction, diffusion-assisted look-dev/matte painting, and ML physics for fluids/fire/crowds—is moving previs assets closer to final pixel, reducing rework and enabling scalable, shot-level automation.

- Regional Analysis: North America led with ~38% share in 2023 (≈USD 0.6B), supported by large studio pipelines and mature post ecosystems; Europe sustains competitiveness via incentives and vendor density, while Asia-Pacific is the fastest-emerging hotspot (India/China/Korea) and is expected to outpace the global CAGR as capacity and talent pools expand.

Component Analysis

The services layer remains the economic center of AI-driven VFX in 2025, accounting for an estimated ~55% of category revenue (vs. 56.1% in 2023) as studios lean on managed pipelines, show-specific model tuning, and MLOps/QA services to operationalize AI at scale. Engagements span roto/cleanup automation, denoise/upscale passes, and real-time look-dev, with leading vendors integrating directly into DCC and game-engine workflows to compress review cycles by 20–30%. Software is the fastest-expanding component, propelled by diffusion/NeRF toolsets, AI asset managers, and QC/continuity analytics; recurring licenses and usage-based pricing are shifting budgets from capex to opex. Hardware spend is increasingly cloud-centric as GPU scarcity and bursty render needs push productions to AWS/Azure/GCP and specialized render farms; hybrid strategies lower up-front capex while preserving on-prem control for sensitive assets.

Looking ahead, software is set to take incremental share through 2030 as model-assisted authoring and automated compositing mature, while services scale by packaging “shots-as-a-service” for mid-tier shows and regional studios. Hardware outlays grow in line with content volume, but unit costs per shot decline as model efficiency and inference-time optimizations improve.

Technology Analysis

AI remains the core technology, representing ~77% of 2025 spend (75.2% in 2023) and underpinning the end-to-end pipeline—from concept and previs to simulation, compositing, and final pixel. Diffusion models, NeRF-based environment capture, and ML physics shorten iteration loops and raise photorealism; studios report double-digit cuts in shot turnaround and fewer QC notes per sequence. Toolchains now combine model-assisted layout/matte painting with automated matchmove and object tracking, elevating both throughput and consistency.

AR’s role is expanding in on-set visualization, virtual production, and marketing assets, where AI-enhanced overlays improve blocking, lighting decisions, and client approvals. While a smaller base, AR is projected to outpace overall market growth through 2030 as broadcasters, advertisers, and live events adopt real-time, AI-assisted graphics.

Product Analysis

Animation is the largest product bucket in 2025, contributing an estimated ~28–30% of revenue as AI accelerates character/creature workflows, lip-sync, and crowd replication for streaming series and stylized features. Compositing remains foundational at ~20–22%, with ML-assisted keying, grain management, and continuity checks reducing manual passes and rework. Modelling benefits from generative base-mesh creation and topology suggestions, moving toward ~12–14% share as asset libraries scale.

Simulation FX (fluids, fire, destruction, cloth) is the fastest grower, supported by physics-informed networks and learned solvers that cut sim times materially; adoption is strongest in action/fantasy sequences and AAA game cinematics. Matte painting modernizes via diffusion-guided environment builds and control-net workflows, while “Others” (including QC analytics and pipeline orchestration) grows as studios formalize data/telemetry layers.

Application Analysis

Television/streaming remains the top application in 2025 with ~38–40% share, reflecting high series throughput and tighter delivery cadences where AI reduces cost per episode. Feature films account for ~27–29%, emphasizing large-format spectacle with heavier Simulation FX and complex compositing. Gaming comprises ~22–24% and is the fastest-growing use case as real-time engines integrate AI for cinematic pipelines, in-engine cutscenes, and promotional assets; mobile and cross-platform launches amplify demand.

Advertisements (~8–10%) adopt AI VFX for rapid, multi-variant creative and localized assets, while “Others” (OTT promos, episodic marketing, immersive installations) captures niche but rising spend as brands pursue real-time, personalized visuals.

Regional Analysis

North America remains the largest regional market in 2025 with an estimated 36–38% share (≈USD 0.85 billion on a ~USD 2.29 billion global market), supported by studio pipelines, tax incentives, and close ties to hyperscale cloud/GPU providers. Europe holds ~25–27% on the back of strong vendor ecosystems in the UK, Germany, France, and Spain, with steady adoption of virtual production stages and incentive-driven post-work.

Asia Pacific is the fastest-advancing region at an expected growth rate above the global CAGR through 2030, reaching ~30–32% share by mid-decade as India expands service capacity, China invests in premium episodic and theatrical content, and Korea/Japan drive high-end animation and games. Latin America and the Middle East & Africa together contribute ~6% but are emerging outsourcing and virtual-production hubs as fiber connectivity and incentives improve, creating cost-competitive alternatives for select sequences.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Software

- Services

- Hardware

By Technology

- Artificial Intelligence (AI)

- Augmented Reality (AR)

By Product

- Simulation FX

- Animation

- Modelling

- Matte Painting

- Compositing

- Others

By Application

- Movies

- Television

- Gaming

- Advertisements

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.1 B |

| Forecast Revenue (2034) | USD 14.9 B |

| CAGR (2024-2034) | 17.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Software, Services, Hardware), By Technology (Artificial Intelligence (AI), Augmented Reality (AR)), By Product (Simulation FX, Animation, Modelling, Matte Painting, Compositing, Others), By Application (Movies, Television, Gaming, Advertisements, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Pixomondo, Framestore, Weta Digital, Rodeo FX, Adobe, Loom AI, Animal Logic, Industrial Light and Magic, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date