AI in Waste Management Market Size 2024–2034 | Growth & 30.8% CAGR

Global AI in Waste Management Market Size, Share & Analysis By Technology (Machine Learning, Computer Vision, Robotics), By Application (Waste Sorting, Recycling Optimization, Smart Collection, Landfill Monitoring), By End-User (Municipalities, Industrial, Commercial) Industry Regions & Key Players – Sustainability Drivers, Digital Transformation & Forecast 2025–2034

Report Overview

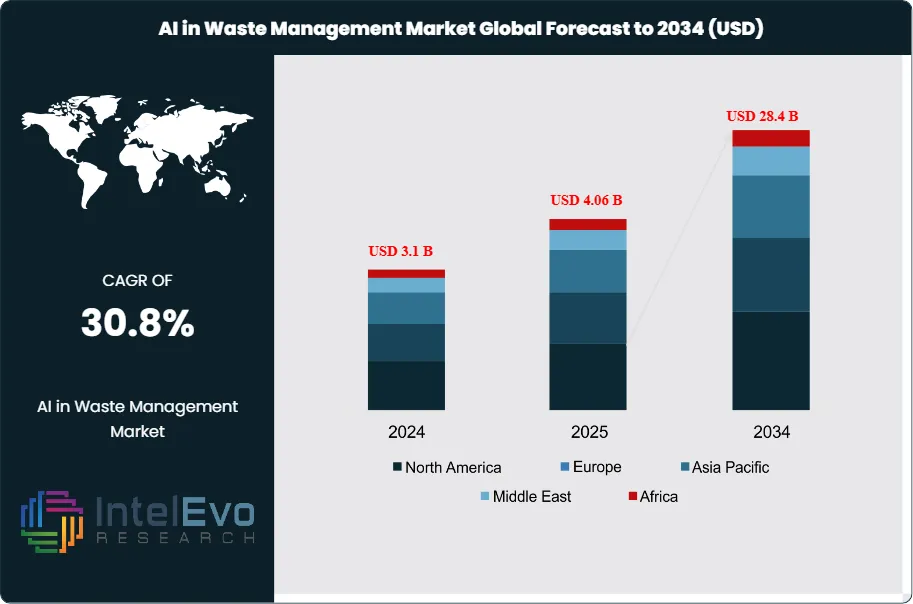

The AI in Waste Management Market is valued at approximately USD 3.1 billion in 2024 and is projected to reach nearly USD 28.4 billion by 2034, reflecting a robust CAGR of about 30.8% over 2025–2034. Rapid urbanization, tightening sustainability mandates, and the global shift toward smart waste ecosystems are accelerating adoption across municipalities and enterprises. As AI-driven sorting, prediction, and automation tools become central to circular economy initiatives, the sector is emerging as one of the fastest-growing segments in the environmental technology landscape.

Get More Information about this report -

Request Free Sample ReportThis acceleration reflects a broader shift as governments and enterprises seek smarter, more sustainable ways to handle the 2 billion tonnes of municipal solid waste produced annually. Over the past decade, rising landfill volumes, tightening environmental regulations, and mounting public pressure have pushed waste management systems toward digitization.

AI tools—particularly machine learning, which accounted for 44.1% of market share in 2023—are increasingly used to automate sorting, reduce contamination in recyclables, and optimize collection routes. The software segment led the market in 2023, commanding over 42.5% of revenues, supported by demand for intelligent platforms that analyze waste streams and improve recovery yields. Container management applications are also gaining momentum, with projected growth above 30%, driven by AI’s ability to adjust pickup schedules in real time and minimize fleet downtime.

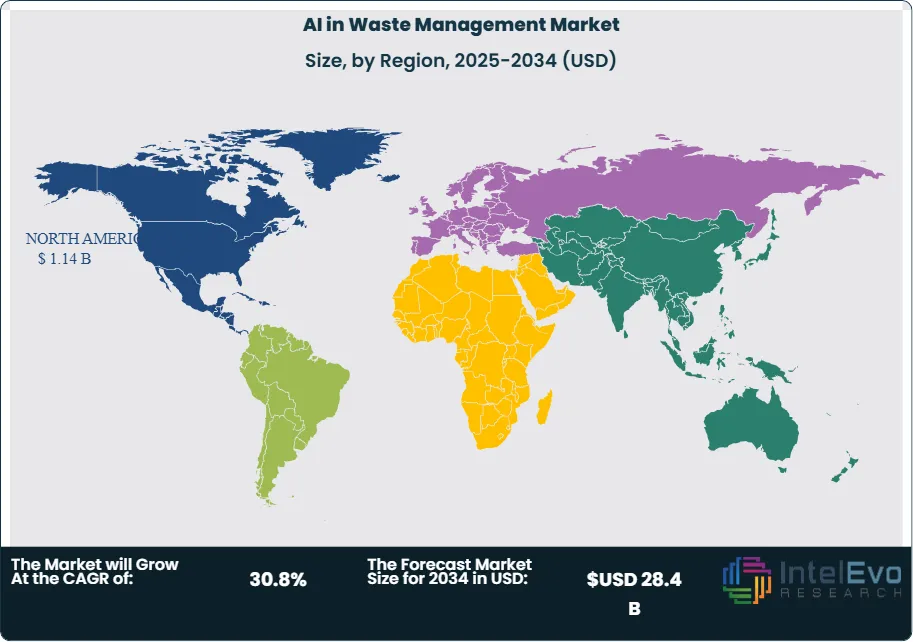

However, growth remains uneven across regions. North America led in 2023 with a 36.9% share, benefiting from early infrastructure investment and strong municipal partnerships. Europe, by contrast, has made AI integral to recycling networks; more than 88% of its waste is either composted or recycled, underscoring robust policy alignment and circular economy commitments. Asia Pacific is emerging as the fastest-growing region, propelled by rapid urbanization and escalating waste volumes. India and Southeast Asia are increasingly deploying AI pilots to enhance waste traceability and reduce landfill dependency.

Despite the strong momentum, significant barriers persist. Implementation costs remain prohibitive for low-income municipalities, and classification accuracy continues to pose technical challenges—particularly when dealing with mixed or contaminated waste streams. These hurdles delay adoption and limit scalability, especially in regions lacking digital infrastructure or standardized waste segregation practices.

Still, the opportunity for transformation is substantial. Nearly 80% of global urban waste remains untreated and is often dumped in landfills, creating environmental and economic burdens. AI-enabled systems capable of identifying material composition, predicting generation patterns, and improving diversion rates have the potential to unlock significant value. Early adopters are already integrating AI with IoT and robotics to streamline operations. As regulatory pressure intensifies and digital capabilities expand, the sector is expected to shift from isolated pilot programs to widespread deployments, fundamentally reshaping global waste management dynamics.

Key Takeaways

- Market Growth: The global AI in waste management market is projected to reach USD 28.4 billion by 2034, up from USD 3.1 billion in 2024, registering a CAGR of 30.8% (2025-2034). This growth is driven by rising urban waste volumes, stricter environmental policies, and increased investment in smart infrastructure.

- Technology: Machine Learning led the technology segment in 2023 with a 44.1% market share. Its dominance reflects its core role in enabling automated waste recognition, predictive analytics, and adaptive learning in sorting systems.

- Component: Software solutions accounted for over 42.5% of market revenue in 2023. High demand for AI-based analytics platforms and real-time waste monitoring tools continues to drive adoption among municipalities and private operators.

- Application: Waste Sorting and Segregation was the top application in 2023, representing more than 38% of the market. AI’s precision in material identification significantly improves recycling rates and contamination control.

- Driver: Urban centers globally dispose of nearly 80% of their waste untreated. The need to improve landfill diversion rates and operational efficiency is accelerating the deployment of AI in municipal waste systems.

- Restraint: High upfront investment and limited digital infrastructure in developing regions restrict broader AI adoption. These factors raise operational risks and slow down deployment, especially outside major urban hubs.

- Opportunity: Container Management is the fastest-growing application, expected to grow at over 30%. AI is increasingly being used to optimize collection routes and container fill-level tracking, reducing fleet costs and service inefficiencies.

- Trend: Integration of AI with IoT is gaining traction. Smart bins, robotic sorters, and real-time tracking are now central to pilot projects in Europe and North America, where governments are pushing for AI-enabled zero-waste initiatives.

- Regional Analysis: North America led in 2023 with a 36.9% revenue share due to strong municipal digitization. Asia Pacific is the fastest-growing region, driven by rapid urbanization and public sector investment in sustainable waste infrastructure.

Component Analysis

As of 2025, software continues to dominate the AI in waste management market, holding more than 42% of total industry revenue. This leadership stems from its foundational role in enabling system intelligence. AI platforms rely on software to interpret sensor data, execute sorting algorithms, and manage decision logic essential for real-time waste processing and operational planning.

Software applications are increasingly cloud-based and modular, enabling quick updates and seamless integration across varied waste management environments. These platforms process inputs from smart bins, robotic arms, and IoT networks, allowing users to automate route planning, monitor container fill levels, and predict maintenance needs. The increasing complexity of waste streams globally has made adaptable software solutions critical. As of 2025, demand is rising for machine learning-integrated platforms that improve sorting precision and recovery rates, while also reducing manual handling costs. Software’s flexibility in scaling across small municipalities and large urban centers alike ensures its ongoing centrality to the market.

Technology Analysis

Machine learning maintains its position as the leading technology in AI-powered waste management, accounting for over 44% of market share in 2025. The technology’s strength lies in its ability to recognize patterns and learn from historical data, which directly supports predictive maintenance, route optimization, and improved material recovery.

In waste operations, machine learning models identify trends in waste generation, enabling real-time adjustments to collection schedules and reducing excess mileage. This has a direct impact on reducing fuel usage and emissions. Additionally, the technology enhances optical and robotic sorting systems by enabling high-accuracy classification of mixed waste—essential for maintaining the quality of recyclables. As investment in AI tools grows, machine learning applications are expected to expand into anomaly detection, contamination identification, and adaptive logistics management. Its role in optimizing both upstream and downstream waste processing ensures the segment remains integral to the sector's evolution.

Application Analysis

Waste sorting and segregation remains the core application within AI in waste management, capturing more than 38% of total market value in 2025. This dominance reflects the critical role accurate sorting plays in recycling and landfill reduction strategies. With landfill capacity tightening in urban centers, automated systems capable of high-throughput sorting have become essential.

AI-driven systems now use computer vision alongside machine learning to sort materials like plastics, paper, glass, and organics with high accuracy and consistency. This automation has significantly improved material purity and reduced contamination, increasing both the economic value of recyclables and compliance with regulatory requirements. Municipalities under pressure to meet zero-waste goals are adopting AI sorting infrastructure at scale. Looking ahead, real-time learning capabilities and integration with robotic arms are expected to drive further improvements in efficiency and throughput, reinforcing sorting and segregation as the market's most critical application area.

End-Use Analysis

In 2025, commercial buildings represent a leading end-use segment for AI in waste management, with adoption driven by strict environmental regulations and cost-saving imperatives. Businesses face increasing pressure to report on sustainability metrics and reduce waste-related expenses. AI technologies help automate compliance and improve waste diversion performance.

Residential buildings also see growing adoption, particularly in densely populated urban areas. Municipalities are introducing smart bins and AI-enabled monitoring systems to track household waste patterns and promote recycling compliance. Industrial facilities, while slower to adopt due to infrastructure limitations, are showing interest in AI to reduce operational waste and manage hazardous materials more safely. Across all segments, the push for higher recycling rates and reduced landfill usage is driving investment in intelligent systems that can deliver measurable waste reduction outcomes.

Regional Analysis

North America continues to lead the global AI in waste management market in 2025, holding a 36.9% share, supported by its mature digital infrastructure and regulatory mandates focused on sustainability. The U.S. and Canada have invested heavily in smart city projects, many of which prioritize AI-powered waste solutions. North America’s AI in waste management market was valued at approximately USD 0.6 billion in 2023 and is projected to grow steadily through 2030.

Asia Pacific, however, is emerging as the fastest-growing region. Rapid urbanization, increasing waste generation, and stronger environmental policies in countries like China, India, and South Korea are driving AI adoption in municipal waste systems. Government-led pilot projects and public-private partnerships are accelerating the rollout of smart waste platforms. Meanwhile, Europe maintains high waste recovery rates—over 88% in some countries—through integrated AI systems that support circular economy objectives. Latin America and the Middle East & Africa, while currently in earlier adoption stages, are gaining attention for targeted investments in urban waste automation and infrastructure development.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Other Technologies

By Application

- Waste Sorting and Segregation

- Predictive Maintenance

- Route Optimization

- Other Applications

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.1 B |

| Forecast Revenue (2034) | USD 28.4 B |

| CAGR (2024-2034) | 30.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, Hardware, Software, Services, By Technology, Machine Learning, Natural Language Processing, Computer Vision, Other Technologies, By Application, Waste Sorting and Segregation, Predictive Maintenance, Route Optimization, Other Applications |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Microsoft Corporation, TOMRA Systems ASA, Greyparrot AI Ltd., AMP Robotics Corporation, Intuitive AI, Rubicon, ABB Group, Terex Corporation, IBM Corporation, CleanRobotics, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

AI in Waste Management Market

Published Date : 17 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date