Alkaline Battery Market Size, Share & Growth Forecast | CAGR 4.0%

Global Alkaline Battery Market Size, Share & Technology Analysis By Product (Primary Battery, Secondary Battery), By Size (AA, AAA, 9 Volts), By Application (Consumer Electronics, Remote Control, Toys and Radios), By Distribution Channel, Sustainability & Recycling Trends, Regional Demand, Key Manufacturers & Forecast 2025–2034

Report Overview

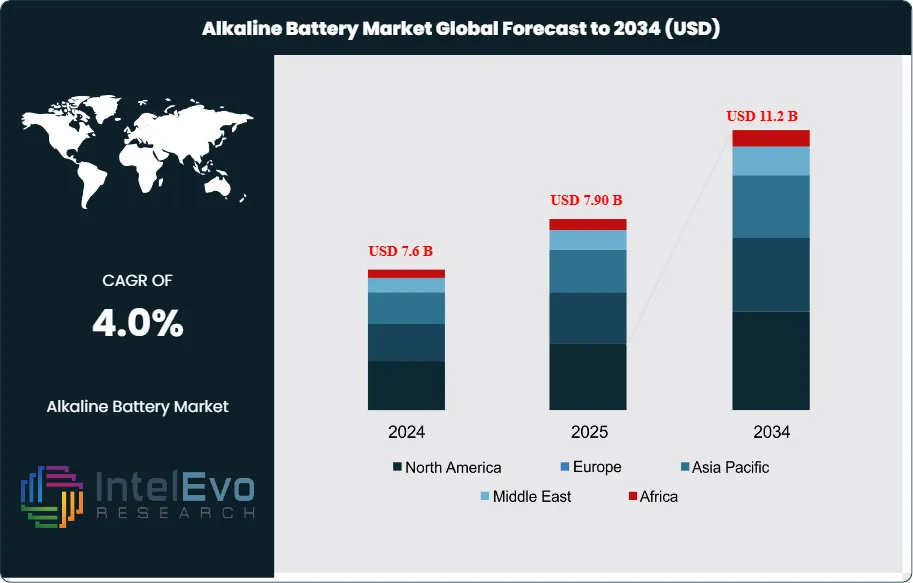

The Alkaline Battery Market is estimated at USD 7.6 billion in 2024 and is projected to reach approximately USD 11.2 billion by 2034, registering a compound annual growth rate (CAGR) of about 4.0% during 2025–2034. This steady expansion is driven by sustained demand from consumer electronics, remote controls, toys, flashlights, and emergency backup devices, particularly in regions with limited access to rechargeable alternatives. Growing preference for low-cost, long-shelf-life power sources, along with continued use in healthcare devices and industrial instrumentation, is reinforcing baseline demand. In addition, retail penetration in emerging markets and incremental improvements in battery chemistry are helping alkaline batteries remain relevant despite rising adoption of rechargeable technologies.

Get More Information about this report -

Request Free Sample ReportThis steady expansion reflects the continued relevance of alkaline batteries in consumer electronics, household devices, and industrial applications despite the rapid growth of rechargeable chemistries. Historically, alkaline batteries have maintained a dominant share of the primary battery segment due to their higher energy density, longer shelf life, and consistent 1.5-volt output compared with zinc-carbon alternatives. Over the past decade, demand has remained resilient, supported by rising consumption of portable devices and the need for reliable, low-maintenance power sources in both developed and emerging markets.

Growth is being driven by several demand-side factors. Rising household penetration of electronic toys, remote controls, flashlights, and medical devices continues to sustain baseline consumption. On the supply side, improvements in electrode materials, particularly the use of high-purity manganese dioxide, have enhanced performance and extended product life. Regulatory pressures on battery disposal and recycling, however, present challenges, particularly in Europe where compliance costs are rising. Price volatility in raw materials such as zinc and manganese also remains a risk for manufacturers, potentially impacting margins in a competitive market.

Technological progress is shaping adoption patterns. While alkaline batteries are a mature product, advances in manufacturing efficiency and packaging have improved energy density, now averaging 6.5 watt hours per cubic inch. At the same time, the broader energy storage sector is attracting significant investment. For example, Form Energy secured a USD 12 million grant in 2023 to develop a 10 MW/1000 MWh iron-air system, highlighting how capital flows into adjacent technologies can influence long-term competitive dynamics. Although such large-scale storage systems do not directly compete with alkaline batteries, they signal a shift in investor attention toward diversified chemistries.

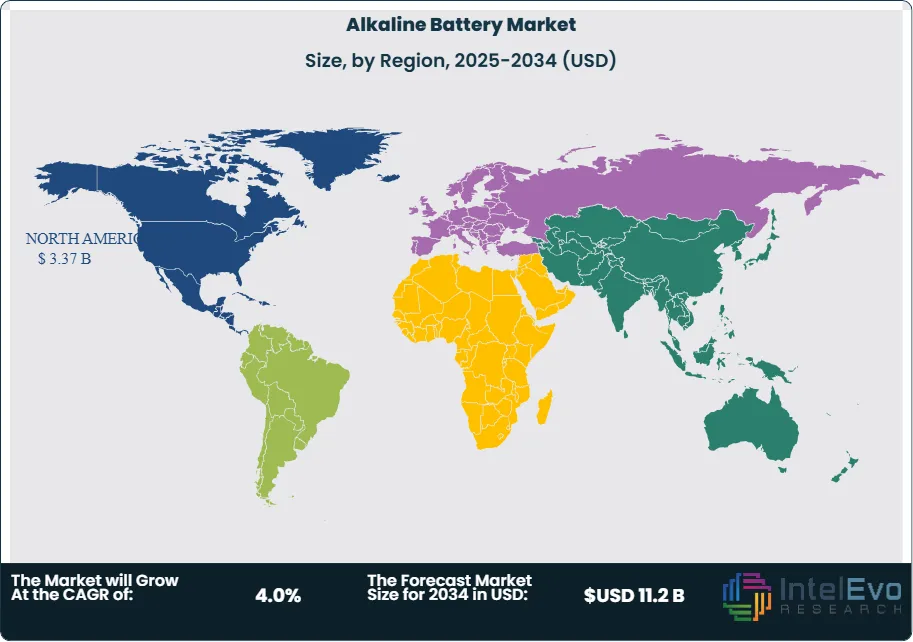

Regionally, North America and Europe remain the largest markets, supported by high per-capita consumption and established retail distribution networks. Asia-Pacific is emerging as the fastest-growing region, driven by population growth, urbanization, and rising disposable incomes in countries such as India and China. Investors should monitor Asia-Pacific closely, as expanding consumer markets and local manufacturing capacity are expected to create new opportunities for both global and regional players. The market outlook points to stable growth, with alkaline batteries retaining their role as a cost-effective and widely accessible power source through 2034.

Key Takeaways

- Market Growth: The global alkaline battery market is projected to expand from USD 7.6 billion in 2024 to USD 11.2 billion by 2034, reflecting a CAGR of 4.0% over 2025–2034. Growth is supported by sustained demand in consumer electronics and household devices requiring reliable, disposable power sources.

- Battery Type: Primary alkaline batteries accounted for 76.3% of total revenues in 2024, underscoring their continued preference over rechargeable formats due to low upfront cost, long shelf life, and widespread retail availability.

- Product Size: AA batteries held a commanding 58.3% share of the market in 2024. Their dominance is linked to high usage in toys, remote controls, and portable medical devices, making them the most commercially significant format.

- Driver: Rising global consumption of consumer electronics is a key growth driver. In 2024, the consumer electronics segment represented 48.3% of alkaline battery demand, reflecting the sector’s reliance on disposable power for small devices.

- Restraint: Regulatory pressures on battery disposal and recycling are tightening, particularly in Europe. Compliance costs and environmental restrictions are expected to weigh on margins, limiting profitability for manufacturers.

- Opportunity: Asia-Pacific presents the strongest growth potential, with rising disposable incomes and expanding retail distribution networks. The region is projected to outpace the global CAGR, creating new opportunities for both multinational and regional suppliers.

- Trend: Advances in electrode materials, including high-purity manganese dioxide, have improved energy density to an average of 6.5 watt hours per cubic inch. At the same time, investments in alternative chemistries, such as Form Energy’s USD 12 million iron-air project in 2023, highlight how capital flows are reshaping the broader energy storage landscape.

- Regional Analysis: North America led the market in 2024 with a 44.3% share, equivalent to USD 2.8 billion in revenues, supported by high per-capita consumption and established retail channels. Asia-Pacific is emerging as the fastest-growing region, while Europe remains constrained by stringent recycling mandates.

Type Analysis

The alkaline battery market in 2025 continues to be dominated by primary batteries, which accounted for more than 76% of total revenues in 2024. Their widespread use in consumer electronics, toys, and household devices reflects their affordability, convenience, and broad retail availability. Unlike rechargeable alternatives, primary batteries remain the preferred choice for applications requiring short-term but reliable power, particularly in low- to medium-drain devices.

Demand for primary batteries is expected to remain steady through the forecast period, supported by the rising penetration of portable electronics and the continued reliance on disposable power solutions in emerging markets. While secondary alkaline batteries are gaining traction in niche applications, their adoption remains limited due to higher upfront costs and competition from lithium-ion technologies. As a result, the primary battery category is projected to retain its leadership position, with incremental growth driven by both consumer demand and distribution expansion in Asia-Pacific and Latin America.

Size Analysis

AA batteries held a commanding 58.3% share of the alkaline battery market in 2024, underscoring their role as the most widely used format across household and consumer devices. Their balance of compact size and consistent 1.5-volt output makes them the default choice for remote controls, wireless peripherals, toys, and small medical devices. This segment benefits from high replacement cycles, ensuring recurring demand across both developed and emerging economies.

Looking ahead, AA batteries are expected to maintain their dominance as sales of portable consumer electronics continue to expand. The segment also benefits from improvements in energy density, with modern AA alkaline batteries offering longer lifespans and reduced leakage risks. AAA and 9-volt batteries will continue to serve specific applications, but their combined share remains significantly smaller compared with AA, which will remain the volume driver of the industry through 2034.

Application Analysis

Consumer electronics accounted for 48.3% of alkaline battery demand in 2024, making it the largest application segment. Devices such as remote controls, digital cameras, wireless keyboards, and portable audio systems continue to rely heavily on disposable alkaline batteries due to their cost-effectiveness and wide availability. The segment’s growth is closely tied to the rising adoption of wireless and portable technologies, particularly in Asia-Pacific and North America.

Other applications, including toys, radios, and small household appliances, also contribute significantly to demand. The toy industry, in particular, represents a recurring source of consumption, with seasonal sales peaks driving battery replacement cycles. As the global installed base of portable devices expands, alkaline batteries will remain a critical power source, even as rechargeable chemistries gain ground in higher-drain applications.

By Region

North America led the global alkaline battery market in 2024 with a 44.3% share, equivalent to USD 2.8 billion in revenues. The region’s dominance is supported by high per-capita consumption of consumer electronics, advanced retail infrastructure, and strong brand presence. The U.S. remains the largest contributor, driven by widespread adoption of portable devices and consumer preference for high-performance, long-lasting batteries.

Europe follows as a mature market, where regulatory frameworks around recycling and environmental compliance are shaping product development and distribution strategies. Asia-Pacific, however, is emerging as the fastest-growing region, supported by rising disposable incomes, urbanization, and expanding retail networks in countries such as China and India. Latin America and the Middle East & Africa represent smaller but growing markets, where increasing consumer electronics penetration is expected to drive incremental demand. Collectively, these regional dynamics point to stable global growth, with Asia-Pacific offering the strongest expansion opportunities through 2034.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product

- Primary Battery

- Secondary Battery

By Size

- AA

- AAA

- 9 Volts

By Application

- Consumer Electronics

- Remote Control

- Toys and Radios

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 7.6 B |

| Forecast Revenue (2034) | USD 11.2 B |

| CAGR (2024-2034) | 4.0% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Primary Battery, Secondary Battery), By Size (AA, AAA, 9 Volts), By Application (Consumer Electronics, Remote Control, Toys and Radios, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sunwoda Electronic Co., Ltd., Toshiba Corporation, Camelion Battery Co., Ltd., Energizer Holdings Inc., PKCELL Battery Co., Ltd., Sony Corporation, Fujitsu Limited, Varta Consumer Batteries, Ningbo Baowang Battery Co., Ltd., Duracell Inc, GP Batteries International Ltd., Hitachi Maxell Ltd., Eveready Industries India Ltd., Spectrum Brands Holdings, Inc., Gao Huan Photoelectric Technology Co., Ltd., Samsung SDI Co., Ltd., Panasonic Corporation, Zhongyin (Ningbo) Battery Co., Ltd., Rayovac, LEOCH Battery Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date