Allergy Diagnostics Market Size, Growth & Forecast | CAGR of 9.6%

Global Allergy Diagnostics Market Size, Share & Healthcare Analysis Product & Service (Consumables, Instruments, Services), Test Type (In Vivo, In Vitro), Allergen (Inhaled Allergens, Food Allergens, Drug Allergens, Other Allgerens), End-user (Diagnostic Laboratories, Hospital-based Laboratories, Academic Research Institutes), Rising Allergy Burden, Precision Diagnostics Trends & Forecast 2025–2034

Report Overview

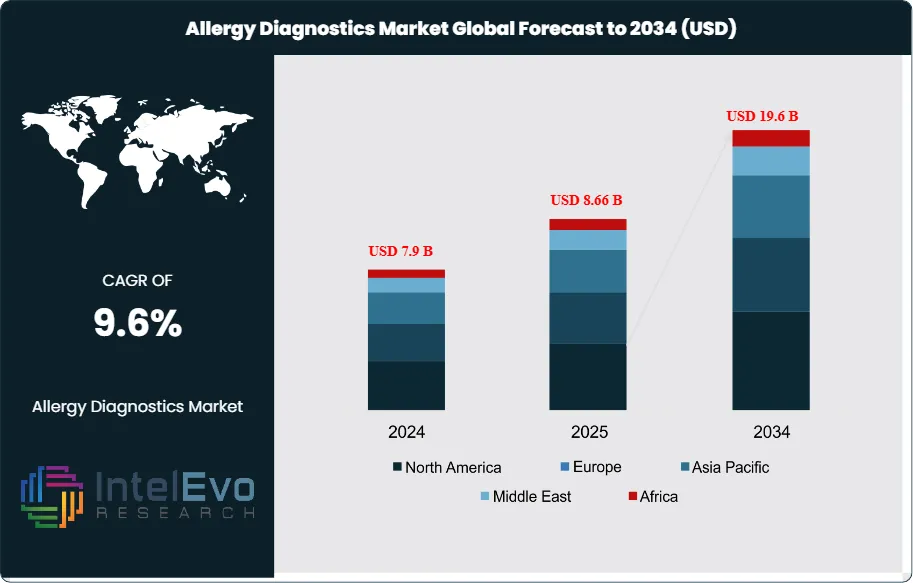

The Allergy Diagnostics Market is estimated at USD 7.9 billion in 2024 and is projected to reach approximately USD 19.6 billion by 2034, registering a compound annual growth rate (CAGR) of about 9.6% during 2025–2034. This sustained expansion is driven by the rising global prevalence of allergic disorders, increased awareness of early and accurate diagnosis, and growing adoption of in-vitro diagnostic tests over traditional methods. Technological advances in molecular diagnostics, expanding pediatric and geriatric patient pools, and improved reimbursement for allergy testing are further supporting long-term market momentum across both developed and emerging healthcare systems.

Get More Information about this report -

Request Free Sample ReportThis market has expanded rapidly over the past decade, driven by rising allergy prevalence and improved diagnostic capabilities. Urbanization now affects over 80% of the global population, according to WHO, exposing millions to poor air quality and increasing the incidence of allergic rhinitis and asthma. In low-income regions, this exposure is more acute, accelerating demand for reliable allergy testing. Between 2018 and 2023, the market grew at a steady pace, with skin prick and blood tests dominating clinical workflows. From 2024 onward, growth is expected to accelerate as healthcare systems prioritize early detection and personalized treatment.

Demand-side drivers include rising awareness, improved access to healthcare, and growing cases of food, drug, and insect allergies. On the supply side, manufacturers are expanding test menus and integrating automated platforms to meet clinical demand. Regulatory bodies continue to push for standardization and accuracy, especially in pediatric and immunocompromised populations. However, reimbursement gaps and limited infrastructure in emerging economies remain key challenges.

Technology is reshaping the landscape. AI-based diagnostic algorithms, digital phenotyping, and multiplex assays are gaining traction. Labs are adopting automated platforms that reduce turnaround time and improve test sensitivity. Blood-based assays are increasingly preferred for their scalability and reduced patient discomfort. You’ll also see a shift toward integrated allergy panels that combine multiple allergens in a single test, improving efficiency and clinical decision-making.

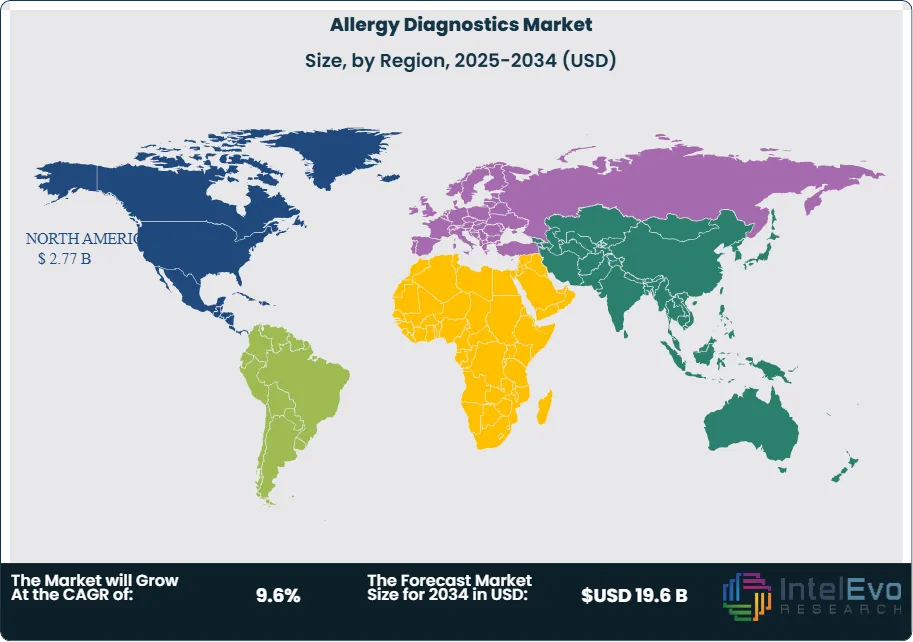

North America leads the market, accounting for over 35% of global revenue in 2023. Europe follows closely, driven by strong public health initiatives and reimbursement support. Asia-Pacific is the fastest-growing region, with China and India showing double-digit growth due to rising urbanization and healthcare investments. Investors should watch Southeast Asia and Latin America, where allergy prevalence is rising but diagnostic infrastructure remains underdeveloped.

As allergy cases continue to climb, the need for accurate, fast, and accessible diagnostics will intensify. Your opportunity lies in identifying platforms that combine clinical precision with operational efficiency across diverse healthcare settings.

Key Takeaways

- Market Growth: The global Allergy Diagnostics market was valued at USD 7.9 billion in 2024 and is projected to reach USD 19.6 billion by 2034, expanding at a CAGR of 9.6% from 2025 to 2034. Rising allergy prevalence linked to urbanization and air pollution remains the primary growth driver.

- Product & Service: Consumables accounted for 45% of total revenue in 2023, reflecting recurring demand for reagents, kits, and testing supplies that support high testing volumes in clinical settings.

- Test Type: In vivo testing led the market with a 58% share in 2023, supported by widespread adoption of skin prick and intradermal tests as first-line diagnostic tools due to their cost-effectiveness and clinical reliability.

- Allergen Source: Inhaled allergens represented 43% of global revenue in 2023, driven by rising cases of asthma and allergic rhinitis linked to pollen, dust mites, and pet dander exposure in urban populations.

- End Use: Diagnostic laboratories captured 54% of the market in 2023, reflecting their central role in allergy testing infrastructure and their ability to integrate advanced automated platforms for high-throughput analysis.

- Driver: Increasing urban exposure to poor air quality is fueling demand. WHO estimates that 80% of the global population now lives in urban areas, with air pollution strongly correlated to higher allergy incidence.

- Restraint: Limited reimbursement policies and high test costs in emerging economies restrict adoption, with affordability gaps reducing patient access to advanced diagnostic solutions.

- Opportunity: Asia-Pacific is expected to post double-digit CAGR through 2033, supported by rising healthcare investments in China and India and growing awareness of allergy-related conditions.

- Trend: Multiplex assays and AI-driven diagnostic platforms are gaining traction, enabling simultaneous detection of multiple allergens and reducing turnaround times. Companies are investing in digital phenotyping and automated workflows to improve accuracy and efficiency.

- Regional Analysis: North America led with 35% of global revenue in 2023, supported by strong reimbursement frameworks and established diagnostic infrastructure. Asia-Pacific is the fastest-growing region, while Latin America and Southeast Asia present emerging opportunities due to rising allergy prevalence and underpenetrated diagnostic capacity.

Type Analysis

Consumables remain the largest revenue contributor in the allergy diagnostics market, accounting for approximately 45% of global sales in 2024 and expected to maintain dominance through 2030. These include reagents, assay kits, and plates that are essential for routine testing. Their recurring demand reflects the rising global prevalence of allergic conditions, with WHO estimating that over 30% of the global population now suffers from at least one allergy-related disorder. The steady consumption of these products ensures consistent revenue streams for suppliers.

Instruments form the second-largest segment, supported by growing adoption of automated analyzers and integrated testing platforms. These systems improve throughput and accuracy, enabling laboratories to process higher test volumes. With healthcare providers under pressure to deliver faster results, demand for advanced diagnostic equipment is expected to grow at a CAGR above 10% through 2030.

Services, including testing, consultation, and result interpretation, are gaining traction as healthcare systems shift toward integrated care models. Clinical laboratories and allergists provide specialized expertise that complements consumables and instruments. The expansion of outsourced diagnostic services, particularly in Asia-Pacific and Latin America, is expected to accelerate growth in this segment.

Application Analysis

In vivo testing continues to dominate, representing nearly 58% of the market in 2024. Skin prick, intradermal, and patch tests remain the first-line diagnostic tools due to their cost-effectiveness and clinical reliability. Their widespread use in both developed and emerging markets ensures strong demand, particularly in primary care and hospital settings.

In vitro testing, while smaller in share, is expanding rapidly. Blood-based assays such as ELISA, RAST, and allergen microarrays are increasingly adopted for their noninvasive nature and ability to detect allergen-specific IgE antibodies with high precision. This segment is projected to grow at a CAGR above 12% through 2030, driven by rising patient preference for less invasive procedures and the growing role of multiplex testing technologies.

The shift toward faster, more accurate, and patient-friendly diagnostics is expected to balance the market between in vivo and in vitro methods by the end of the decade. This diversification strengthens the overall testing ecosystem and creates opportunities for companies offering hybrid diagnostic solutions.

End-Use Analysis

Diagnostic laboratories accounted for 54% of global revenue in 2024, reflecting their central role in allergy testing infrastructure. Equipped with advanced analyzers and skilled personnel, these facilities handle the majority of test volumes across inhaled, food, and drug allergens. Their dominance is reinforced by the growing trend of outsourcing diagnostic services to specialized labs.

Hospital-based laboratories represent the second-largest segment, providing essential allergy testing within clinical care pathways. Their integration into patient management ensures timely diagnosis and treatment, particularly for acute allergic reactions. Growth in this segment is supported by rising hospital investments in diagnostic automation.

Academic research institutes, while smaller in share, play a critical role in advancing testing methodologies and developing new allergen panels. Their collaborations with diagnostic companies and healthcare providers contribute to the evolution of precision medicine in allergy care. The combined efforts of these end-users are shaping a more comprehensive and efficient diagnostic landscape.

Regional Analysis

North America led the market in 2024 with a 35% revenue share, supported by high allergy prevalence, strong reimbursement frameworks, and advanced healthcare infrastructure. The United States remains the largest contributor, with significant investments in diagnostic technologies and ongoing clinical research.

Europe follows closely, driven by widespread awareness programs, favorable regulatory standards, and government-backed healthcare initiatives. Countries such as Germany, the UK, and France are key contributors, with strong adoption of both in vivo and in vitro testing.

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR above 13% through 2030. Rising urbanization, increasing healthcare expenditure, and growing awareness of allergic diseases in China and India are fueling demand. Latin America and the Middle East & Africa are emerging markets, where improving healthcare infrastructure and rising allergy incidence present untapped opportunities for diagnostic providers.

Overall, regional growth patterns highlight a dual market dynamic: mature regions driving steady revenues through established infrastructure, and emerging economies offering high-growth potential through expanding access and rising demand.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Product & Service

- Consumables

- Instruments

- Services

Test Type

- In Vivo

- In Vitro

Allergen

- Inhaled Allergens

- Food Allergens

- Drug Allergens

- Other Allgerens

End-user

- Diagnostic Laboratories

- Hospital-based Laboratories

- Academic Research Institutes

- Other End-Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 7.9 B |

| Forecast Revenue (2034) | USD 19.6 B |

| CAGR (2024-2034) | 9.6% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product & Service (Consumables, Instruments, Services), Test Type (In Vivo, In Vitro), Allergen (Inhaled Allergens, Food Allergens, Drug Allergens, Other Allgerens), End-user (Diagnostic Laboratories, Hospital-based Laboratories, Academic Research Institutes, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Eurofins Scientific, Siemens Healthcare Diagnostics, Inc., Alerchek Inc., Thermo Fisher Scientific Inc., Omega Diagnostic LLC, bioMérieux SA, Danaher Corporation, Hitachi Chemical Diagnostic Inc., Omega Diagnostics Group PLC |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date