API Testing Market Size, Share & Growth Forecast | 24.5% CAGR

Global API Testing Market Size, Share & Analysis By Component (API Testing Tools/Software, API Testing Services), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Government, Manufacturing, Other Industry Verticals) Industry Regions & Key Players – DevOps Adoption Trends & Forecast 2025–2034

Report Overview

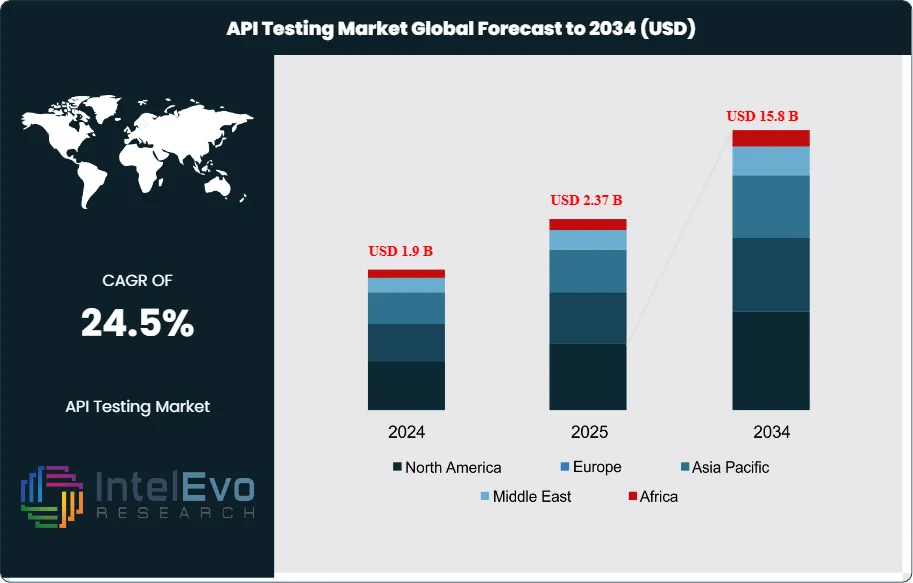

The API Testing Market size is expected to be worth around USD 1.9 Billion in 2024 and is projected to reach USD 15.8 Billion by 2034, growing at a CAGR of 24.5% during 2025–2034., driven by the rising adoption of microservices and cloud-based architectures, offering strategic opportunities for technology providers, enterprises, and investors. This rapid expansion reflects the critical role APIs play as the backbone of modern digital ecosystems, enabling seamless connectivity across software platforms, mobile applications, cloud systems, and IoT environments.

Get More Information about this report -

Request Free Sample ReportThe market has evolved significantly over the past decade as organizations prioritize digital transformation initiatives that demand robust, reliable, and secure API integrations. Inadequate testing can result in performance failures or security vulnerabilities, underscoring the importance of specialized tools and frameworks that ensure functional consistency, compliance, and resilience. The growth trajectory is reinforced by increasing enterprise reliance on APIs for core operations, with more than 90% of executives classifying APIs as mission-critical to business success. However, widespread adoption has also introduced challenges, particularly in the areas of security testing, governance, and scalability, where 94% of organizations report encountering API-related risks.

Technological advancements are reshaping the API testing landscape, particularly through the integration of artificial intelligence and machine learning. These innovations enable predictive analytics, automation of complex test scenarios, and faster identification of potential points of failure, significantly improving testing efficiency and accuracy. The rise of IoT ecosystems further broadens the testing scope, as billions of connected devices rely on API-driven communication, increasing the demand for adaptive and scalable solutions.

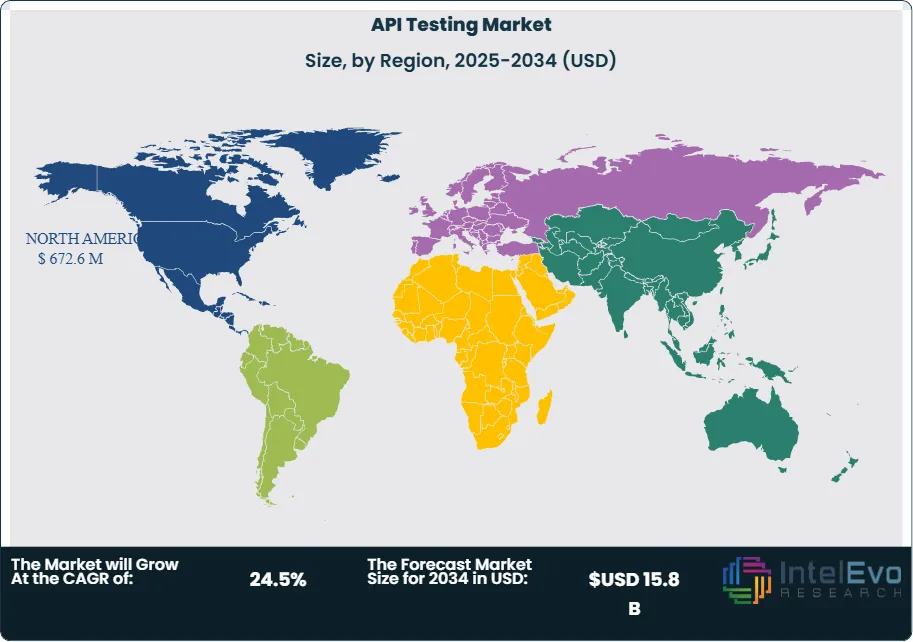

Regionally, North America held a commanding 36.4% share in 2023, underpinned by advanced digital infrastructure, early adoption of cloud technologies, and strong regulatory focus on cybersecurity. Meanwhile, Asia Pacific is emerging as a high-growth region, supported by rapid enterprise digitization, expanding e-commerce, and rising investments in IT modernization. Europe also presents lucrative opportunities, particularly in sectors governed by stringent data privacy and compliance frameworks.

Overall, the API testing market is positioned at the intersection of enterprise digitalization, innovation, and risk management. As businesses continue to prioritize seamless integrations and secure system interactions, demand for next-generation testing solutions will accelerate, making this market a critical enabler of global digital transformation.

Key Takeaways

- Market Growth: The Global API Testing Market is forecast to grow from USD 1.9 Billion in 2024 to USD 15.8 Billion by 2034, registering a strong CAGR of 24.5% during 2025–2034. Growth is fueled by the rising adoption of microservices, cloud-native applications, and the need for robust digital integration.

- Tools/Software: API Testing Tools and Software held the largest share in 2023, accounting for over 65.9% of the global market. The dominance reflects increasing enterprise demand for automated solutions that reduce testing complexity and improve efficiency.

- Deployment Model: Cloud-based API testing solutions captured more than 68.5% of the market share in 2023, underscoring the preference for scalable, flexible, and cost-efficient platforms aligned with enterprise cloud migration strategies.

- End Use: The IT and Telecommunications sector represented the leading end-use industry with a 23.1% market share in 2023, driven by high volumes of API integrations supporting connectivity, data exchange, and digital service delivery.

- Driver: The widespread reliance on APIs as mission-critical business assets—cited by over 90% of executives—alongside rising demand for interoperability across enterprise systems, continues to accelerate the need for comprehensive API testing frameworks.

- Restraint: Persistent security challenges, with 94% of organizations reporting API-related vulnerabilities, remain a key restraint, as breaches threaten system integrity, customer trust, and compliance with data protection regulations.

- Opportunity: The integration of artificial intelligence and machine learning into API testing tools offers significant potential, enabling predictive analytics, automated scenario generation, and faster fault detection for next-generation testing solutions.

- Trend: A notable trend shaping the market is the surge in API testing demand from IoT ecosystems, as billions of connected devices rely on API-driven communication, expanding the scope of testing to more complex and high-volume environments.

- Regional Analysis: North America led the market in 2023 with a 35.4% share, supported by advanced digital infrastructure and strong vendor presence. Asia Pacific is poised for the fastest growth, driven by rapid enterprise digitization, e-commerce expansion, and increasing IT modernization investments.

Component Analysis

In 2025, API Testing Tools and Software continue to dominate the market landscape, accounting for well over two-thirds of total industry revenues. This segment’s strength is closely linked to the increasing reliance on automated, scalable, and security-focused testing solutions across industries where APIs underpin critical digital interactions. Enterprises are investing heavily in advanced tools capable of managing complex integrations across e-commerce, finance, and healthcare ecosystems, ensuring that APIs perform reliably under diverse operational environments.

The widespread use of microservices and distributed architectures has reinforced the role of automated testing platforms. These tools are particularly valued for their ability to streamline repetitive testing, identify issues early in the development cycle, and simulate varying user conditions to ensure robustness. Companies such as Postman, SmartBear, and Tricentis are expanding their tool capabilities with AI-powered analytics, predictive modeling, and continuous testing features that align with DevOps practices. This evolution ensures shorter release cycles without compromising quality.

Growth is further bolstered by the strong adoption of cloud-native testing environments. Cloud deployment enhances the scalability of API testing tools, providing enterprises with the flexibility to test large volumes of transactions and complex workflows in real time. The expanding role of APIs in IoT ecosystems, mobile-first applications, and cross-platform integrations positions advanced software tools as a critical enabler of enterprise digital resilience.

Deployment Mode Analysis

The cloud-based deployment model has firmly established itself as the preferred choice for API testing in 2025, representing close to 70% of global revenues. Businesses increasingly favor cloud-based platforms for their scalability, cost-efficiency, and ability to integrate seamlessly with agile development pipelines. Unlike traditional on-premise solutions that require significant infrastructure investments, cloud-based models offer flexible pay-as-you-go structures that appeal to both startups and large enterprises.

The shift toward digital transformation, coupled with the acceleration of continuous integration/continuous deployment (CI/CD) practices, has intensified the relevance of cloud testing platforms. These solutions enable real-time updates, continuous monitoring, and distributed testing environments accessible from any location. This flexibility not only accelerates time-to-market but also reduces the risks of post-deployment failures. Companies such as Sauce Labs and AWS have further expanded their cloud testing services to meet rising enterprise demand for end-to-end testing across complex multi-cloud infrastructures.

While on-premise deployments continue to serve industries with strict compliance requirements, such as government and defense, their relative share is gradually declining. The expanding adoption of hybrid and fully cloud-native architectures across sectors like BFSI, retail, and telecommunications underscores the long-term trajectory toward cloud-based testing dominance.

Industry Vertical Analysis

In 2025, the IT and Telecommunications sector remains the leading vertical for API testing adoption, holding more than 23% of the global market share. APIs form the backbone of service delivery in this sector, supporting everything from network integration to digital communication platforms. With the global rollout of 5G, increasing IoT connectivity, and the proliferation of cloud-native applications, telecom operators and IT service providers face mounting complexity that necessitates rigorous API validation.

Telecommunications companies, in particular, process massive amounts of real-time data across interconnected systems. API malfunctions in this sector can disrupt services and erode customer trust, making robust testing indispensable. Continuous deployment environments also heighten the need for flexible testing practices, as APIs are frequently updated to maintain compatibility with evolving technologies.

Beyond IT and telecommunications, industries such as BFSI and healthcare are experiencing rapid growth in API testing adoption. In BFSI, APIs are central to digital banking, fintech services, and payment gateways, where security and compliance are paramount. In healthcare, the rise of telemedicine and electronic health record (EHR) systems has amplified the demand for secure and interoperable API frameworks. Retail and e-commerce players also increasingly rely on APIs to power digital storefronts, payment integrations, and omnichannel customer experiences, further contributing to market expansion.

Regional Analysis

North America continues to lead the global API testing market in 2025, representing more than one-third of total industry revenues. The region’s dominance is underpinned by its concentration of leading software developers, advanced digital infrastructure, and a strong ecosystem of enterprises integrating APIs into mission-critical applications. Companies headquartered in the U.S. and Canada, such as IBM, Google, and Oracle, are at the forefront of developing and adopting advanced testing frameworks to safeguard application performance and security.

Regulatory compliance has also been a key driver. With stringent data protection mandates such as the California Consumer Privacy Act (CCPA) and cross-border GDPR obligations, organizations in North America are compelled to adopt rigorous testing practices to mitigate risks. The growing integration of IoT devices and smart infrastructure, particularly in sectors like healthcare, retail, and automotive, further underscores the critical importance of API testing in this region.

Looking ahead, Asia Pacific is projected to be the fastest-growing region, driven by rapid digitization, expanding e-commerce ecosystems, and large-scale adoption of cloud-based services in countries such as India, China, and Southeast Asian nations. Meanwhile, Europe continues to emphasize compliance-focused API testing, particularly in highly regulated industries such as BFSI and healthcare. Collectively, these dynamics reinforce the global nature of demand for advanced API testing solutions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- API Testing Tools/Software

- API Testing Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Industry Vertical

- IT and Telecommunications

- BFSI

- Healthcare

- Retail and E-Commerce

- Government

- Manufacturing

- Other Industry Verticals

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.9 B |

| Forecast Revenue (2034) | USD 15.8 B |

| CAGR (2025-2034) | 24.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (API Testing Tools/Software, API Testing Services), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Government, Manufacturing, Other Industry Verticals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SmartBear Software, Tricentis, Katalon, Inc., Qualitest, Postman, Inc., Broadcom Inc., Testlio, IBM Corporation, Parasoft, LogiGear Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the API Testing Market?

The API Testing Market is expected to grow from USD 1.9 Billion in 2024 to USD 15.8 Billion by 2034, at a CAGR of 24.5%. Rising adoption of microservices, cloud architectures, and connected digital ecosystems is accelerating demand for scalable API validation and automation solutions.

Who are the major players in the API Testing Market?

SmartBear Software, Tricentis, Katalon, Inc., Qualitest, Postman, Inc., Broadcom Inc., Testlio, IBM Corporation, Parasoft, LogiGear Corporation, Other Key Players

Which segments covered the API Testing Market?

By Component (API Testing Tools/Software, API Testing Services), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Government, Manufacturing, Other Industry Verticals)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date