Aquaculture Market Size, Share & Growth Forecast | 6.5% CAGR

Global Aquaculture Market Size, Share & Analysis By Environment (Marine Water, Fresh Water, Brackish Water), By Species (Aquatic Plants , Aquatic Animals), By End-use (Food Industry, Agriculture, Animal Feed) Industry Regions & Key Players – Sustainable Protein Demand & Forecast 2025–2034

Report Overview

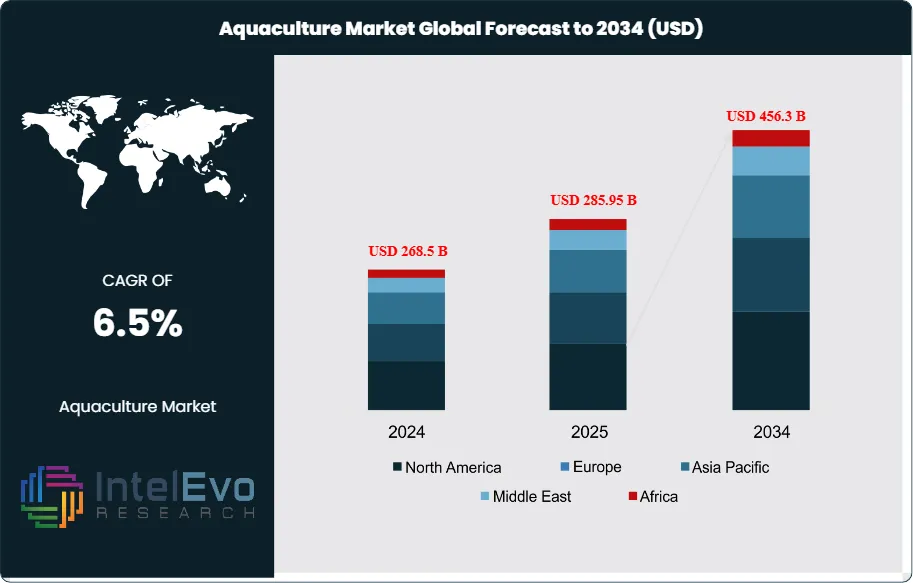

The Aquaculture Market, valued at USD 268.5 billion in 2024, is projected to reach USD 456.3 billion by 2034, advancing at a CAGR of 6.5% during 2025–2034, driven by rising seafood demand and sustainability concerns, offering strategic opportunities for stakeholders across food production, technology, and investment sectors. Aquaculture has evolved into one of the most critical pillars of global food security, providing a reliable and regulated alternative to capture fisheries. With wild fish stocks under increasing pressure from overfishing and environmental degradation, controlled breeding, rearing, and harvesting of aquatic species such as fish, crustaceans, mollusks, and seaweed have become essential to ensuring a stable seafood supply. The industry now accounts for over half of the world’s seafood production, underscoring its growing role in meeting the dietary needs of a rapidly expanding population.

Get More Information about this report -

Request Free Sample ReportMarket growth is supported by multiple drivers, most notably the rising demand for protein-rich diets as the global population heads toward 10.7 billion by 2050. Seafood consumption is further reinforced by consumer preference for nutritious, heart-healthy, and sustainable food sources. In addition, supportive government initiatives—including subsidies, tax incentives, and policies promoting sustainable aquaculture practices—are fostering long-term industry resilience and encouraging adoption in both developed and emerging economies.

Technological innovation remains a defining force in shaping market dynamics. Advanced systems such as recirculating aquaculture systems (RAS), integrated multi-trophic aquaculture (IMTA), offshore farming platforms, and genetically improved species are enabling higher yields, improved disease resistance, and reduced environmental impact. The emergence of alternative feed solutions, including insect- and algae-based proteins, is also addressing ecological challenges tied to fishmeal dependency, ensuring more sustainable supply chains.

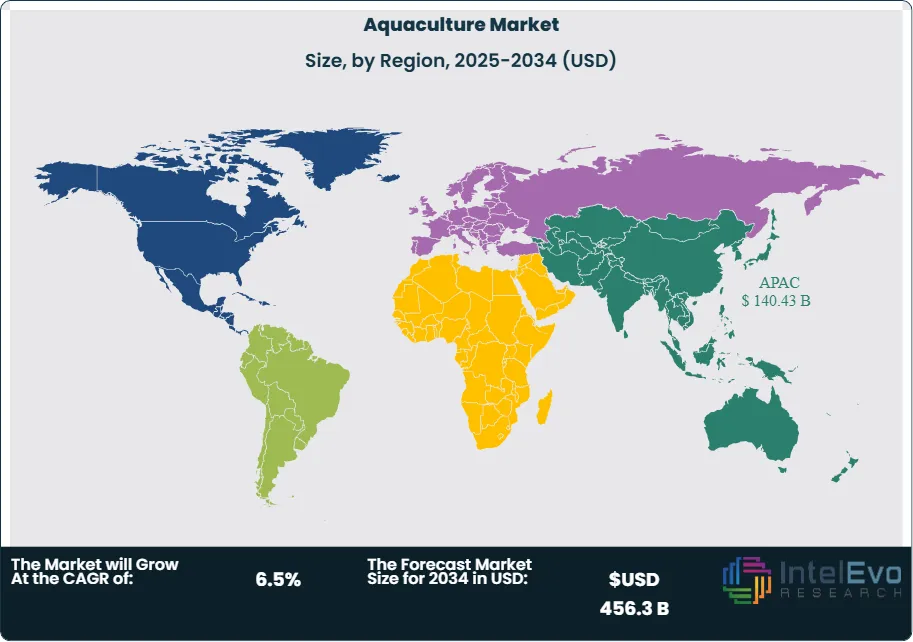

Regionally, Asia-Pacific dominates the market, with China, India, and Vietnam spearheading production due to favorable climatic conditions, strong domestic demand, and technology adoption. Norway remains a global leader in salmon aquaculture, while opportunities are emerging in Africa and Latin America, where abundant water resources and improving infrastructure are attracting investor interest.

Looking ahead, the aquaculture industry is poised for sustained expansion, shaped by the dual imperatives of meeting rising seafood demand and ensuring environmental sustainability. Opportunities in premium organic seafood, aquaponics-based integrated farming, and biotechnology-driven productivity improvements are expected to define the next phase of growth, positioning aquaculture as a cornerstone of the future global food economy.

Key Takeaways

- Market Growth: The global Aquaculture Market is projected to grow from USD 268.5 billion in 2024 to USD 456.3 billion by 2034, advancing at a CAGR of 6.5%. Growth is fueled by rising seafood consumption, overexploitation of wild fisheries, and the shift toward sustainable protein sources.

- Culture Environment: Freshwater aquaculture leads the market, accounting for over 48.6% of total revenue in 2024. Its dominance is attributed to ease of accessibility, lower operational costs, and the widespread farming of species such as carp, tilapia, and catfish.

- Species: Aquatic animals represented the largest share, capturing more than 81.3% in 2024. Fish species remain the primary contributor, with salmon, carp, and tilapia driving volume due to high demand across global food supply chains.

- By End Use: The food industry dominates aquaculture applications, holding more than 71.2% market share in 2024. This is driven by growing global demand for seafood as a staple protein source, supported by retail expansion and international trade.

- Driver: Rising global population and growing preference for protein-rich, health-focused diets are accelerating aquaculture adoption. In 2022, aquaculture already accounted for over 50% of seafood consumed worldwide, a figure expected to climb further.

- Restraint: Environmental and disease management challenges, including water pollution and the spread of pathogens in densely stocked farms, pose risks to productivity and sustainability, limiting potential output in certain regions.

- Opportunity: Offshore aquaculture and alternative feed solutions, such as algae- and insect-based proteins, present significant growth opportunities by addressing ecological concerns and enabling large-scale, sustainable production.

- Trend: Advanced farming technologies—including recirculating aquaculture systems (RAS), integrated multi-trophic aquaculture (IMTA), and biotechnology for disease-resistant species—are reshaping industry efficiency and reducing environmental impact.

- Regional Analysis: Asia-Pacific dominates the market with a 52.3% share in 2024, valued at USD 137.7 billion, led by China, India, and Vietnam. Meanwhile, Africa and Latin America are emerging hotspots due to favorable climatic conditions and untapped water resources attracting new investments.

Environment Analysis

Freshwater Aquaculture: As of 2025, freshwater aquaculture continues to represent the largest share of the global market, accounting for nearly half of overall production. Its dominance stems from the abundance of inland water bodies, relatively low capital requirements, and operational efficiencies compared to marine and brackish systems. Popular species such as carp, tilapia, and trout thrive in ponds, lakes, and controlled tank systems, making this environment highly adaptable and scalable. Rising consumer demand for affordable, protein-rich fish varieties, especially across Asia and Africa, is expected to sustain long-term growth.

Marine Water Aquaculture: Marine water farming, or mariculture, remains a high-value segment, supported by strong global demand for premium seafood such as salmon, shrimp, and oysters. While it accounts for a smaller share compared to freshwater aquaculture, this segment benefits from its ability to command higher prices in international markets. Advances in offshore farming systems, cage technologies, and digital monitoring tools are enabling sustainable production at scale, helping countries like Norway, Chile, and Japan strengthen their leadership in marine aquaculture. With rising pressure on wild fisheries, mariculture is expected to gain further prominence in the next decade.

Brackish Water Aquaculture: Brackish water systems occupy a niche yet growing share of the aquaculture market, particularly in coastal regions with natural estuaries or artificially managed salinity levels. Species such as barramundi and seabass dominate this category due to their preference for mixed-salinity habitats. In 2025, this environment is gaining traction as producers increasingly adopt hybrid farming systems that leverage transitional water zones for efficiency. The segment also benefits from consumer interest in diverse, nutrient-rich fish varieties, positioning it as an attractive growth area for markets in Southeast Asia and the Middle East.

Species Analysis

Aquatic Animals: Aquatic animals remain the cornerstone of global aquaculture, representing more than 80% of market share in 2025. Fish species—including carp, salmon, tilapia, and catfish—continue to dominate production, while crustaceans such as shrimp and crabs, along with mollusks like mussels and oysters, expand the segment’s diversity. Strong consumer demand for protein-rich diets, coupled with improved breeding, vaccination, and water quality management systems, has enhanced productivity and disease resistance across species. Global leaders such as Mowi ASA, Cooke Aquaculture, and China’s aquaculture cooperatives are investing in advanced hatcheries and sustainable farming models to meet surging seafood demand.

Aquatic Plants: Although smaller in scale, the aquatic plant segment—encompassing seaweed and microalgae—is experiencing rapid growth. Demand is being driven by applications in pharmaceuticals, nutraceuticals, cosmetics, and alternative proteins. Seaweed farming, in particular, is gaining momentum in countries like South Korea, China, and Indonesia, where government incentives and sustainability initiatives support large-scale cultivation. Microalgae are increasingly used in biofuel development, high-value nutritional supplements, and eco-friendly packaging. By 2025, technological innovations such as automated harvesting and bioreactor systems are positioning aquatic plants as a critical growth frontier in aquaculture.

End Use Analysis

Food Industry: The food industry remains the dominant end-use sector, accounting for over 70% of aquaculture demand in 2025. Rising global seafood consumption, coupled with growing health awareness around omega-3 fatty acids and lean proteins, continues to drive this segment. Farmed salmon, tilapia, and shrimp are widely integrated into retail, hospitality, and export supply chains, ensuring aquaculture’s central role in global food security. The sector is also benefiting from consumer shifts toward traceable and sustainably certified seafood, encouraging adoption of eco-labeling and blockchain-enabled transparency.

Agriculture: Agriculture applications are gaining ground through aquaponics, where fish farming is combined with hydroponic plant cultivation. Although relatively small in market share, this segment appeals to urban farmers and eco-conscious consumers seeking resource-efficient systems that recycle water and minimize chemical fertilizers. Cities across North America, Europe, and the Middle East are witnessing increased investment in aquaponics as part of controlled-environment agriculture (CEA) strategies.

Animal Feed: Aquaculture by-products play a vital role in the animal feed industry. Fishmeal and fish oil derived from processing remain highly valued for poultry, swine, and livestock feed, thanks to their high protein and omega-3 content. As global demand for feed-grade fishmeal rises, producers are also exploring alternatives such as algae-based and insect-based ingredients to reduce reliance on wild-caught fish. This shift is expected to improve sustainability while maintaining nutritional integrity across feed supply chains.

Regional Analysis

Asia-Pacific: Asia-Pacific leads the global aquaculture market, accounting for over half of total production and expected to surpass USD 140.43 Billion by 2024. China, India, Vietnam, and Indonesia dominate due to extensive water resources, favorable climates, and government-driven policies supporting sustainable practices. Rapid urbanization and rising seafood consumption across the region further reinforce demand. Investments in advanced hatcheries, integrated aquaculture systems, and offshore farming technologies are expanding production capacity, making Asia-Pacific the undisputed growth hub of the industry.

North America: North America is witnessing accelerated growth driven by technological innovation, sustainable farming initiatives, and increasing consumer preference for locally sourced seafood. The U.S. and Canada are investing in recirculating aquaculture systems (RAS) to reduce dependence on imports and minimize environmental impacts. Regulatory support and private investments in sustainable salmon and trout farming are also strengthening regional market prospects.

Europe: Europe remains a mature yet innovation-driven market, shaped by stringent sustainability regulations and strong demand for premium seafood. Norway leads the region with large-scale salmon farming, while countries such as Scotland, Spain, and Greece are key players in marine and brackish water production. The European Union’s emphasis on green aquaculture practices, coupled with funding for R&D in aquaponics and offshore systems, ensures continued expansion.

Emerging Regions: Latin America and Africa are increasingly viewed as high-potential markets due to favorable climatic conditions, untapped water resources, and rising investment in aquaculture infrastructure. Chile has established itself as a global salmon hub, while nations like Brazil, Kenya, and Nigeria are ramping up production to enhance food security and create export opportunities. These emerging regions are expected to play a critical role in diversifying global supply chains in the coming decade.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Environment

- Marine Water

- Fresh Water

- Brackish Water

By Species

- Aquatic Plants

- Seaweed

- Microalgae

- Aquatic Animals

- Fish

- Crustaceans

- Mollusks

- Others

By End-use

- Food Industry

- Agriculture

- Animal Feed

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 268.5 B |

| Forecast Revenue (2034) | USD 456.3 B |

| CAGR (2025-2034) | 6.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Environment (Marine Water, Fresh Water, Brackish Water), By Species (Aquatic Plants , Aquatic Animals), By End-use (Food Industry, Agriculture, Animal Feed, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Thai Union Group Plc, Cooke Aquaculture Inc., Grieg Seafood, Leroy Seafood Group, Promarisco, Mowi ASA, Huon Aquaculture Group Pty Ltd., Cermaq Group AS, Eastern Fish Company, Asmak, Blue Ridge Aquaculture, Inc., Nireus Aquaculture S.A., Bakkafrost Scotland, SalMar, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Aquaculture Market?

The Aquaculture Market is expected to grow from USD 268.5 Billion in 2024 to USD 456.3 Billion by 2034, at a CAGR of 6.5%. Rising global seafood demand and sustainability initiatives are driving expansion, creating opportunities across food production, technology, and investment sectors.

Who are the major players in the Aquaculture Market?

Thai Union Group Plc, Cooke Aquaculture Inc., Grieg Seafood, Leroy Seafood Group, Promarisco, Mowi ASA, Huon Aquaculture Group Pty Ltd., Cermaq Group AS, Eastern Fish Company, Asmak, Blue Ridge Aquaculture, Inc., Nireus Aquaculture S.A., Bakkafrost Scotland, SalMar, Other Key Players

Which segments covered the Aquaculture Market?

By Environment (Marine Water, Fresh Water, Brackish Water), By Species (Aquatic Plants , Aquatic Animals), By End-use (Food Industry, Agriculture, Animal Feed, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date