Asia Pacific & MEA Frozen Pizza Market Size | CAGR 7.5%

Asia Pacific and Middle East & Africa Frozen Pizza Market Size, Share & Consumer Food Analysis By Crust Type (Thin Crust, Thick Crust, Stuffed, Others), By Type (Non-Veg, Veg), By Toppings (Meat, Vegetables, Cheese, Others), By Size (Regular, Medium, Large), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), Changing Dietary Trends, Cold Chain Expansion, Competitive Landscape & Forecast 2025–2034

Report Overview

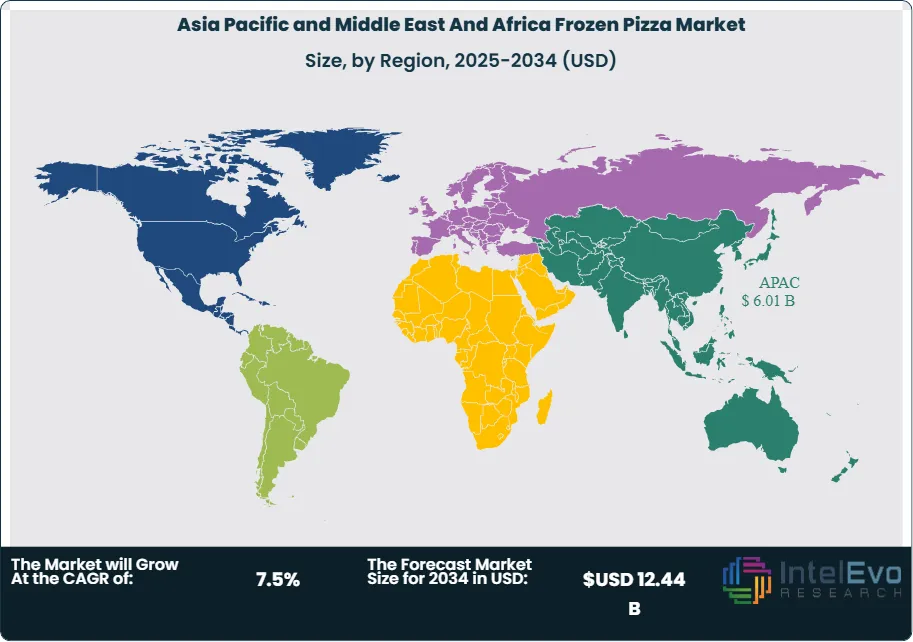

The Asia Pacific and Middle East & Africa frozen pizza market is estimated at USD 7.61 billion in 2024 and is on track to reach roughly USD 12.44 billion by 2034, implying a compound annual growth rate (CAGR) of 7.5% over 2025–2034. This growth is driven by rapid urbanization, rising disposable incomes, and increasing adoption of Western-style convenience foods across emerging economies. Expanding cold-chain infrastructure, greater penetration of modern retail and e-commerce grocery platforms, and growing demand from younger, working populations are further accelerating frozen pizza consumption in both regions.

-Size-by-Region.png.png)

You’re looking at a market that’s doubling in size over a decade. Frozen pizza demand is rising fast, driven by urbanization, changing meal habits, and better cold chain infrastructure. Between 2018 and 2023, the region saw a steady uptick in frozen food consumption, with frozen pizza volumes growing at an average annual rate of 4.2%. That pace is accelerating. By 2030, frozen pizza is expected to account for over 18% of total frozen ready-meal sales in Asia Pacific alone.

Convenience is the key driver. As more households juggle work and family schedules, frozen pizza offers a reliable, quick meal with minimal prep. Brands are responding with wider assortments—thin crust, gluten-free, plant-based toppings, and premium cheese blends. In India, SKUs with local flavors like paneer tikka and tandoori chicken are gaining traction. In the UAE, premium imports from Europe are seeing double-digit growth.

Technology is reshaping product quality. Advanced flash-freezing and modified atmosphere packaging have narrowed the gap between frozen and fresh. AI-driven inventory systems and automated production lines are helping manufacturers reduce waste and improve shelf-life. These upgrades are critical in hot-climate markets where cold chain reliability is a challenge.

You’ll find the strongest growth in Southeast Asia and the Gulf Cooperation Council (GCC) countries. Indonesia, Vietnam, and the Philippines are seeing rising penetration in tier-2 cities. In the Middle East, Saudi Arabia and the UAE are leading with high per capita consumption and expanding retail footprints. Investors should watch for private label expansion in supermarket chains and cross-border e-commerce growth, especially in frozen halal-certified offerings.

Regulatory hurdles remain. Import tariffs, labeling requirements, and fragmented distribution networks can slow market entry. But rising consumer acceptance and retail modernization are offsetting these risks. With the right mix of localized flavors, efficient logistics, and quality assurance, your entry into this market could be well-timed.

Key Takeaways

- Market Growth: The Asia Pacific and Middle East & Africa frozen pizza market reached USD 7.61 billion in 2024 and is projected to hit USD 12.44 billion by 2034, registering a CAGR of 7.5%. Growth is driven by rising demand for convenient meal options and expanding retail infrastructure.

- Crust Type: Thin crust frozen pizzas led the market with a 41.3% share in 2024, supported by consumer preference for lighter formats and faster cooking times.

- Product Type: Non-vegetarian frozen pizzas accounted for 60.8% of total sales in 2024, reflecting strong demand for protein-rich options across urban and semi-urban markets.

- Toppings: Meat-based toppings held a dominant 56.8% market share in 2024, with chicken and pepperoni variants driving repeat purchases in both premium and value segments.

- Size: Regular-sized frozen pizzas captured 47.4% of revenue in 2024, favored for their balance between portion size and price point in family and single-serve formats.

- Driver: Supermarkets and hypermarkets are expanding frozen food shelf space, with this channel expected to command 55.1% of market share by 2034. Retail promotions and in-store visibility are accelerating product trials.

- Restraint: Cold chain limitations in tier-2 and tier-3 cities continue to restrict product availability and shelf-life, impacting penetration rates outside metro clusters.

- Opportunity: Southeast Asia and GCC countries present high-growth potential, with frozen pizza sales in Indonesia and Saudi Arabia projected to grow at over 8% CAGR through 2030.

- Trend: Manufacturers are investing in advanced freezing and packaging technologies to improve texture retention and reduce preservatives. AI-enabled inventory systems are helping streamline distribution and reduce spoilage.

- Regional Analysis: Asia Pacific leads in volume, while Middle East & Africa shows faster growth. The UAE and Saudi Arabia are key consumption hubs, while Vietnam and the Philippines are emerging as new demand centers.

Type Analysis

The Asia Pacific and Middle East & Africa (MEA) frozen pizza market is transforming rapidly, driven by evolving consumer lifestyles and increasing demand for diversity in pizza offerings. In both regions, thin crust pizzas dominate, holding over 41% market share in 2024. These pizzas, celebrated for their crispness and lighter profiles, appeal to consumers who favour modern, healthier alternatives to traditional thick or pan crusts. Regular/traditional crusts persist due to their accessible price points and broad appeal, especially among families and value-oriented shoppers. Stuffed crusts, while a smaller segment, are showing the fastest CAGR (over 7% globally through 2030), reflecting rising tastes for premium, indulgent experiences and willingness to pay for artisanal-style crusts. Notably, plant-based and gluten-free crust innovations are advancing in both regions as manufacturers compete to meet dietary needs and wellness trends.

The product tier segmentation reveals a marked shift toward premium and gourmet frozen pizza varieties across Asia Pacific and MEA. While regular frozen pizza retains the largest base, accounting for nearly half of all units sold in Asia Pacific in 2024, premium and gourmet segments are expanding at a faster pace. Premium offerings—boasting artisanal crusts, imported cheeses, plant-based toppings, and clean-label ingredients—appeal strongly to higher-income urban cohorts and young professionals demanding restaurant-quality at home. In 2025, premium frozen pizzas are forecasted to grow at a CAGR above 6.5% through 2030 in major cities like Shanghai, Sydney, and Dubai, reflecting the convergence of rising incomes and exposure to international food culture. Gourmet products, while still niche, are increasingly visible in high-end retailers and contribute to the sector’s “premiumization.” Brands such as Dr. Oetker (Ristorante) and Nestlé (DiGiorno) have launched limited-edition tavern-style, Neapolitan, and organic variants to bolster their edge in this fast-growing segment.

Meat remains the favored topping in both regions, accounting for roughly 57% of Asia Pacific and MEA frozen pizza market value in 2024. Pepperoni, chicken, and regional specialties like barbecue lamb or tandoori chicken cater to local palates, underlining the significance of flavour localization in product innovation. Cheese-only pizzas account for close to 37% of market share, benefitting from household consumption and children’s dietary preferences, while vegetable-topped and plant-based pizzas post the highest y-o-y growth as consumer interest in health and sustainability spikes. The adoption of alternative proteins and plant-based cheese has further expanded the “type” segmentation beyond traditional boundaries, positioning frozen pizza as an inclusive, customizable meal choice across both developed and emerging consumer groups within Asia Pacific and MEA.

Application Analysis

Retail (supermarket, hypermarket, convenience store) is the dominant application channel in the frozen pizza sector for Asia Pacific and MEA, capturing over 56% of sales in 2024. The prevalence of frozen pizza in large retail formats is driven by improvements in cold-chain logistics, extensive shelf space, rising disposable incomes, and consumer demand for convenient meal solutions. Modern trade enables rapid inventory turnover and access to mainstream, premium, and private-label brands at scale. Consumers in rapidly expanding urban centers—such as Jakarta, Mumbai, Riyadh, and Cape Town—are increasingly turning to supermarket freezers for quick-to-prepare meals, propelled by dual-income households and shrinking meal preparation windows.

Online retail has emerged as the fastest-growing channel. With a CAGR above 12% projected in Asia Pacific through 2030, online grocery and food delivery platforms are accelerating frozen pizza penetration into new demographics, including tech-savvy urban dwellers and “convenience-driven” middle-income segments. The proliferation of e-commerce—exemplified by Meituan (China), Zomato (India), Lazada (Southeast Asia), Talabat (UAE), and Takealot (South Africa)—is enabling broader assortment, targeted marketing, and home delivery of frozen pizzas, further boosting their appeal as a flexible meal or snack. In response, brands are investing in AI-driven marketing, influencer partnerships, and direct-to-consumer models to capture digitally native consumers, particularly among younger generations in cities like Seoul, Singapore, and Nairobi.

The foodservice channel—especially HoReCa (hotel, restaurant, café), QSRs (quick service restaurants), and institutional catering—plays a steadily growing application role in both regions, accounting for a rising share of frozen pizza orders post-pandemic. Quick-service restaurant chains and independent cafés use frozen pizza to standardize quality, speed up service, and manage peak-hour demand, while catering businesses rely on frozen pizzas for consistent, scalable solutions at corporate events, schools, and hospitals. In Asia Pacific, foodservice-driven demand is amplified by aggressive QSR expansion and menu diversification, with large groups such as Domino’s, Pizza Hut, and local operators integrating frozen pizza formats to meet delivery and takeaway orders at scale. In MEA, the hospitality sector’s recovery post-pandemic and the surge in themed events have further elevated the use of premium or portioned frozen pizza as an on-demand option. Current trends show HoReCa utilization is highest in the UAE, Saudi Arabia, Australia, South Africa, and key Indian metros, and it is forecasted to accelerate in regional tier 2 and tier 3 urban nodes through 2030.

End-Use Analysis

The household segment constitutes the largest end-use category for frozen pizza in both the Asia Pacific and MEA markets. Rising affluence, time-constrained lifestyles, and urbanization underpin sustained demand for ready-to-cook meal options at home. By 2025, over 60% of frozen pizza sales in Asia Pacific are projected to be consumed in-home, thanks to mass adoption by younger, nuclear families, students, and Gen Z/Millennials seeking affordable indulgence and Western dining experiences. Regular and medium-sized pizzas remain the dominant formats, favored for solo, family, and casual group dining. Manufacturers are leveraging household consumption patterns by offering multi-packs, variety boxes, and budget-friendly SKUs to maximize market coverage. The penetration of frozen pizza among single-person and dual-income households is especially strong in Japan, South Korea, Australia, Singapore, China, and rapidly in India and Indonesia.

Quick Service Restaurants (QSRs) and foodservice operators are driving the fastest growth in end-use, benefiting from kitchen automation, standardized menus, and dynamic delivery models. Frozen pizza in QSR helps maintain consistent product quality, shortens preparation times, and ensures menu flexibility, giving operators a competitive edge amid rapid changes in footfall and consumer preferences. Asia Pacific, notably India and China, is witnessing annual double-digit growth in QSR pizza, as homegrown and international chains expand aggressively to serve increasingly urban, digitally connected populations. In MEA, QSRs in the UAE, Saudi Arabia, and Egypt are targeting young, cosmopolitan consumers and Western expatriates with frozen pizza as part of combo meals, meal kits, and late-night dining menus. Table 1 profiles recent QSR expansion strategies in key regional cities.

QSR applications are complemented by growing use in the HoReCa channel—hotels, corporate cafeterias, airline catering, and leisure facilities—across both regions. The credibility of frozen pizza’s quality, portion control, and menu versatility have led to increased inclusion in buffet offerings, banquet portfolios, and children’s meal solutions. Innovations such as chef-inspired or locally customized frozen pizzas help premium hotels, event venues, and catering services offer Western-style dining with operational efficiency. This segment is vital in the Gulf countries for premium hotel chains and in Southeast Asia for international school canteens and airline lounges.

Regional Analysis

The Asia Pacific market accounted for about 79% of combined Asia Pacific and MEA frozen pizza sales in 2024, reaching a value of USD 4.87 billion and forecasted to rise at a CAGR of 3.9% to approximately USD 6.90 billion by 2033. The region is shaped by deep urbanization, Western dietary influences, and a surging middle class in China, India, Japan, Australia, South Korea, and Southeast Asia. China alone holds a 28.8% revenue share owing to its urban mass, retail modernization, and rapid acceptance of on-the-go foods. Japanese adoption is propelled by lone-household growth and a preference for premium, gourmet-style frozen pizza variants, while Australia and South Korea benefit from wellness-driven innovation—gluten-free, plant-based, and whole-wheat options that appeal to fitness-conscious and time-poor lifestyles. India, although behind in per capita consumption, is posting one of the fastest volume growth rates, driven by a tech-savvy youth demographic, rapid QSR expansion, and e-commerce adoption in metro and tier 2 cities.

Southeast Asia—including Indonesia, Vietnam, Philippines, Malaysia, Singapore, and Thailand—shows some of the region’s strongest growth potential, as rising annual incomes, extensive retail modernization, and cross-border flavor migration boost frozen pizza acceptance. Markets like Indonesia and Vietnam are seeing significant penetration due to family-size products, robust convenience store networks, and targeted educational and promotional initiatives to change traditional perceptions of frozen foods.

The Middle East & Africa (MEA) market, albeit smaller, is experiencing a robust CAGR above 6.5% for 2025-2034, with a forecasted value of over USD 1.35 billion by 2034. Expatriate-driven urbanization, rising disposable incomes, and the institutionalization of retail (e.g., Carrefour, Lulu Hypermarket, Spinneys) have catapulted demand, especially in the Gulf Cooperation Council (GCC: UAE, Saudi Arabia, Qatar, Kuwait). Halal-certified, premium, and international-origin frozen pizzas are high in demand, reflecting the market’s complex regulatory and cultural requirements. The MEA market also benefits from young populations, growing QSR penetration, and increased Western food exposure through tourism, international schools, and media. South Africa is leading African demand, led by urban consolidation, branded retail development, and support from private label pizza innovation, with forecasts projecting a double-digit growth pace in frozen pizza sales through 2028.

A critical trend regionally is “flavour localization”—manufacturers are customizing toppings, sauces, ingredients, and product forms to meet local and religious preferences. In China, for example, brands have launched spicy Szechuan and seafood pizzas; in India, paneer tikka and vegetarian variants dominate; in the Gulf, halal meat and barbecue chicken are favored over pork-based options. Packaging is also becoming more eco-friendly and suited to local supply chain constraints, while e-commerce initiatives are bridging urban-rural distribution gaps and enabling on-demand retail.

Country-level strategies are crucial as import restrictions, cold chain infrastructure, and distribution efficiency still vary widely. Japan and Australia dominate on per capita spend, China and India on volume, while UAE and South Africa set the pace for premiumization and QSR-foodservice synergies. Successful players in these regions—such as Nestlé, Dr. Oetker, Bellisio Foods, Schwan’s, and domestic leaders like Jubilant Foodworks and Sunbulah Group—continue to emphasize multi-tier portfolios, retail partnerships, and resilient cold chain logistics to capitalize on regional fragmentation and rapid urban growth.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Crust Type

- Thin Crust

- Thick Crust

- Stuffed

- Others

By Type

- Non-Veg

- Veg

By Toppings

- Meat

- Vegetables

- Cheese

- Others

By Size

- Regular

- Medium

- Large

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Regions

- East Asia And Pacific

- Sea And South Asia

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 7.61 B |

| Forecast Revenue (2034) | USD 12.44 B |

| CAGR (2024-2034) | 7.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Crust Type (Thin Crust, Thick Crust, Stuffed, Others), By Type (Non-Veg, Veg), By Toppings (Meat, Vegetables, Cheese, Others), By Size (Regular, Medium, Large), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | McCain Foods Limited, Amy’s Kitchen, Inc, Gujarat Cooperative Milk Marketing Federation Limited (GCMMF), California Pizza Kitchen, Freiberger Lebensmittel GmbH, Sunbulah Group, General Mills, Inc., Daiya Foods Inc., Nestlé S.A, Bellisio Foods, Inc, Milky Mist Dairy, Conagra Brands, The Simply Good Foods Company, August Oetker AG, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Asia Pacific and Middle East And Africa Frozen Pizza Market

Published Date : 31 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date