Asparaginase Market Size, Share & Growth Forecast | CAGR 18.70%

Global Asparaginase Market Size, Share & Oncology Drug Analysis By Type (Native, Pegylated, Recombinant), By Indication (Acute Lymphoblastic Leukemia, Rare Hematologic Disorders), By Distribution Channel, Orphan Drug Development, Biotech Innovation, Regional Healthcare Access, Key Manufacturers & Forecast 2025–2034

Report Overview

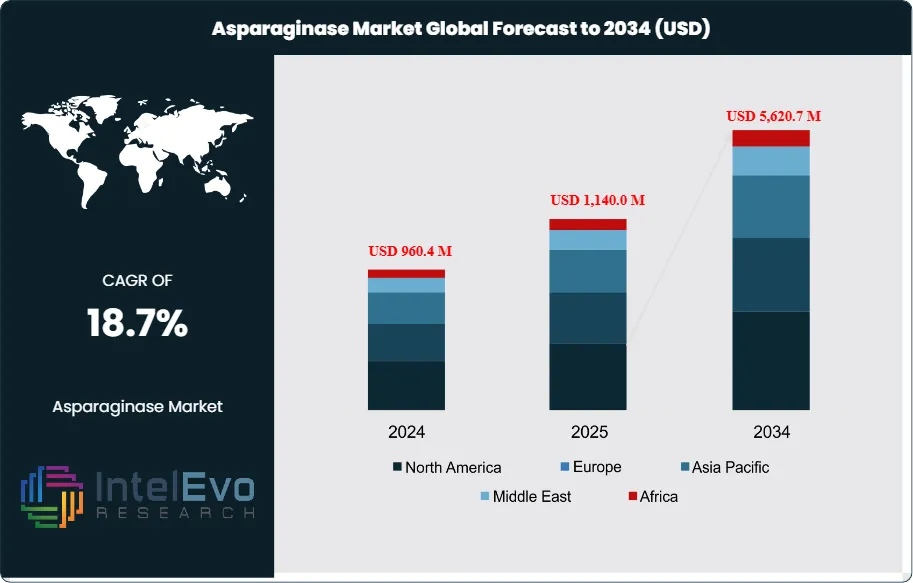

The Asparaginase Market is estimated at USD 960.4 million in 2024 and is projected to reach approximately USD 5,620.7 million by 2034, registering a robust compound annual growth rate (CAGR) of 18.7% during 2025–2034. This accelerated growth reflects the rising global incidence of acute lymphoblastic leukemia (ALL), particularly in pediatric populations, alongside expanding treatment access in emerging healthcare markets. Increasing adoption of pegylated and recombinant asparaginase formulations—driven by improved safety profiles and longer half-life—is further strengthening market momentum. In parallel, favorable regulatory approvals, expanding oncology drug pipelines, and growing investments in biologics manufacturing are positioning asparaginase as a critical component of modern leukemia treatment protocols worldwide.

Get More Information about this report -

Request Free Sample ReportThis sharp expansion reflects both the widening use of asparaginase in oncology and its growing role in food safety applications. Historically, the market was concentrated in pharmaceutical oncology treatments, particularly for acute lymphoblastic leukemia (ALL), where asparaginase remains a frontline therapy. Over the past decade, demand has accelerated as clinical adoption expanded to other hematologic malignancies such as acute myeloid leukemia (AML) and non-Hodgkin’s lymphoma. At the same time, regulatory recognition of acrylamide as a carcinogenic risk in starchy foods has driven uptake of asparaginase in food processing, creating a dual demand base that strengthens long-term growth prospects.

On the demand side, rising global cancer incidence is a critical driver. The World Health Organization projects cancer cases to increase by more than 47% by 2040, intensifying the need for effective enzyme-based therapies. On the supply side, manufacturers face challenges in ensuring consistent production from bacterial strains such as Escherichia coli and Erwinia chrysanthemi, while also addressing adverse effects including hypersensitivity, pancreatitis, and neurological complications. These risks have prompted research into encapsulated formulations and recombinant variants that improve stability and reduce toxicity, signaling a shift toward more efficient delivery methods.

Technological advances are shaping adoption. Encapsulation techniques, recombinant DNA methods, and AI-driven drug development platforms are enabling more precise formulations and faster clinical trial designs. In the food industry, automated enzyme dosing systems are being deployed to reduce acrylamide levels in baked goods and snacks, aligning with stricter regulatory thresholds in Europe and North America.

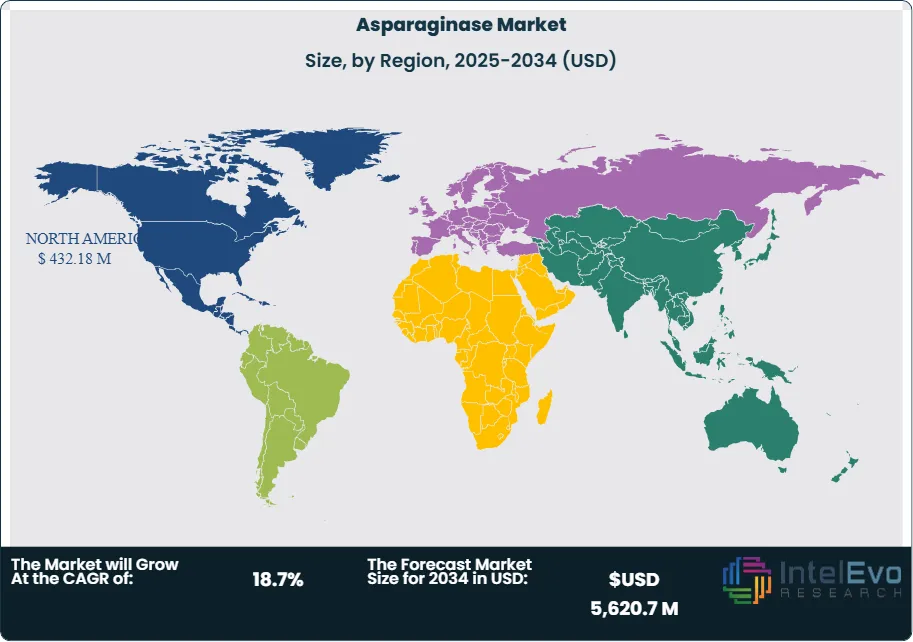

Regionally, North America accounts for the largest revenue share, supported by strong oncology drug pipelines, favorable reimbursement frameworks, and high healthcare spending. Western Europe follows closely, driven by stringent food safety regulations and established cancer treatment protocols. The Asia-Pacific excluding Japan (APEJ) region is emerging as a high-growth market, with rising cancer prevalence, expanding pharmaceutical manufacturing capacity, and increasing regulatory alignment with international food safety standards. For investors, APEJ represents a key growth frontier, while established markets in North America and Europe continue to provide stable returns.

Overall, the asparaginase market is positioned for sustained expansion, underpinned by dual-use applications, advancing biotechnologies, and widening regional adoption. The combination of rising oncology demand and regulatory-driven food safety measures ensures a robust trajectory through 2034.

Key Takeaways

- Market Growth: The global asparaginase market is valued at USD 960.4 million in 2024 and is projected to reach USD 5,620.7 million by 2034, expanding at a CAGR of 18.7%. Growth is driven by rising cancer incidence and regulatory pressure to reduce acrylamide levels in food products.

- Source: Escherichia coli-derived asparaginase accounted for 67.1% of global revenue in 2023. Its dominance reflects established clinical use, broad availability, and lower production costs compared with Erwinia-based alternatives.

- Route of Administration: Intravenous administration represented 61.2% of sales in 2023 and is expected to grow steadily through 2033. The segment benefits from higher efficacy in oncology treatment protocols and widespread hospital adoption.

- Application: Acute lymphoblastic leukemia (ALL) treatments generated 42.1% of market revenue in 2023. The segment remains the largest due to asparaginase’s role as a standard therapy in pediatric and adult ALL protocols.

- Distribution Channel: Hospital pharmacies captured 52.5% of revenue in 2023. This reflects the concentration of oncology treatments in hospital settings and the need for controlled administration of enzyme-based therapies.

- Driver: Rising global cancer prevalence, with WHO projecting a 47% increase in new cases by 2040, is a key demand driver. Expanding oncology pipelines and inclusion of asparaginase in essential medicine lists further support adoption.

- Restraint: Adverse effects such as hypersensitivity, pancreatitis, and neurological complications limit broader use. Clinical data indicates that up to 30% of patients may develop allergic reactions, creating demand for safer formulations.

- Opportunity: Asia-Pacific markets, particularly India and China, are expected to post double-digit growth rates through 2033. Expanding healthcare infrastructure and increasing affordability of biologics position these countries as high-potential investment destinations.

- Trend: Encapsulation technologies and recombinant DNA methods are improving enzyme stability and reducing toxicity. Companies are investing in long-acting formulations to enhance patient compliance and treatment outcomes.

- Regional Analysis: North America led with 45.1% share and USD 350.7 million revenue in 2023, supported by strong oncology pipelines and reimbursement frameworks. Asia-Pacific excluding Japan is the fastest-growing region, with rising cancer incidence and expanding pharmaceutical manufacturing capacity.

Type Analysis

The asparaginase market continues to be dominated by Escherichia coli-derived formulations, which accounted for nearly 67% of global revenue in 2024 and are projected to maintain a leading position through 2030. These products remain the standard of care in multi-agent chemotherapy regimens for acute lymphoblastic leukemia (ALL), particularly in pediatric cases. Commercial brands such as Elspar have established strong clinical adoption due to proven efficacy in tumor suppression.

However, the reliance on E. coli strains presents challenges. A significant proportion of patients develop hypersensitivity or allergic reactions, prompting the need for alternative sources. Erwinia chrysanthemi-based asparaginase, while representing a smaller share of the market, is gaining traction as a substitute for patients intolerant to E. coli products. The introduction of pegylated and recombinant variants is expected to further diversify the product mix, reduce immunogenicity, and extend dosing intervals, creating new growth opportunities for manufacturers.

Looking ahead, the competitive landscape will likely shift toward advanced formulations that balance efficacy with improved safety profiles. Companies investing in recombinant DNA technology and encapsulation methods are positioned to capture market share as demand for safer, longer-acting therapies accelerates.

Application Analysis

Acute lymphoblastic leukemia (ALL) remains the single largest application segment, accounting for over 42% of global revenue in 2024. The high prevalence of ALL, particularly among children, continues to drive demand. According to the American Cancer Society, leukemia represented nearly 25% of all childhood cancers in the United States in 2024, underscoring the critical role of asparaginase in frontline treatment protocols.

Lymphoblastic lymphoma (LBL) represents a smaller but steadily expanding segment. Clinical guidelines increasingly recommend asparaginase-based regimens for LBL, particularly in younger patients, which is expected to support double-digit growth rates through 2030. Other applications, including acute myeloid leukemia (AML) and off-label uses in food processing to reduce acrylamide formation, are gradually contributing to market expansion.

The outlook for applications is shaped by ongoing clinical trials exploring broader oncology indications. If successful, these studies could expand the therapeutic footprint of asparaginase beyond hematologic malignancies, further strengthening its role in oncology pipelines.

End-Use Analysis

Hospital pharmacies remain the dominant distribution channel, accounting for more than 52% of global revenue in 2024. The concentration of oncology treatments in hospital settings, combined with the need for controlled administration of enzyme-based therapies, ensures continued reliance on this channel.

Online pharmacies are emerging as the fastest-growing segment, supported by rising digital adoption and patient preference for home delivery of specialty drugs. This trend is particularly evident in Asia Pacific, where e-pharmacy penetration is accelerating. Retail pharmacies, while holding a smaller share, continue to play a role in developing economies where hospital infrastructure is less accessible.

For end-use industries, healthcare remains the primary driver, but food manufacturing is an emerging contributor. Regulatory pressure to reduce acrylamide levels in baked and fried products is prompting food processors to adopt asparaginase, creating a secondary demand stream outside oncology.

Regional Analysis

North America led the global market with a 45% revenue share in 2024, valued at approximately USD 432 million. The region benefits from advanced healthcare infrastructure, high cancer incidence rates, and favorable reimbursement policies. The United States remains the largest single-country market, supported by strong oncology pipelines and FDA approvals of new asparaginase formulations.

Europe follows closely, with demand driven by stringent food safety regulations and established cancer treatment protocols. Germany, France, and the United Kingdom represent key markets, with ongoing clinical research further supporting adoption.

Asia Pacific is the fastest-growing region, projected to record a CAGR above 18% through 2030. Rising cancer prevalence, expanding pharmaceutical manufacturing capacity, and increasing healthcare spending in China and India are driving growth. Latin America and the Middle East & Africa remain smaller markets but present long-term opportunities as healthcare access improves and regulatory frameworks align with global standards.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Source

- Escherichia Coli

- Erwinia Chrysanthemi

Route of Administration

- Intravenous

- Intramuscular

Application

- Acute Lymphoblastic Leukemia (ALL)

- Lymphoblastic Lymphoma (LBL)

- Others

Distibution Channels

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 960.4 M |

| Forecast Revenue (2034) | USD 5,620.7 M |

| CAGR (2024-2034) | 18.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Source (Escherichia Coli, Erwinia Chrysanthemi), Route of Administration (Intravenous, Intramuscular), Application (Acute Lymphoblastic Leukemia (ALL), Lymphoblastic Lymphoma (LBL), Others), Distibution Channels (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Servier Pharmaceuticals LLC, Taj Pharmaceuticals Ltd., Novus Biologicals LLC, Jazz Pharmaceuticals, Kyowa Hakko Kirin Co., Ltd., Medac GmbH, Actiza Pharmaceutical Pvt. Ltd., Merck (Germany), LGM Pharma, Gennova Biopharmaceuticals |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date