AR/VR in Education Market Size, Share & Growth Forecast | 21.9% CAGR

Global Augmented and Virtual Reality (AR/VR) in Education Market Size, Share & Analysis By Offering (Solutions, Hardware, Services), By Deployment Mode (Cloud, On-Premises), By Application (K-12, Higher Education, Vocational training), By End-User (Institutions, Corporate Training) Industry Regions & Key Players – Immersive Learning Trends & Forecast 2025–2034

Report Overview

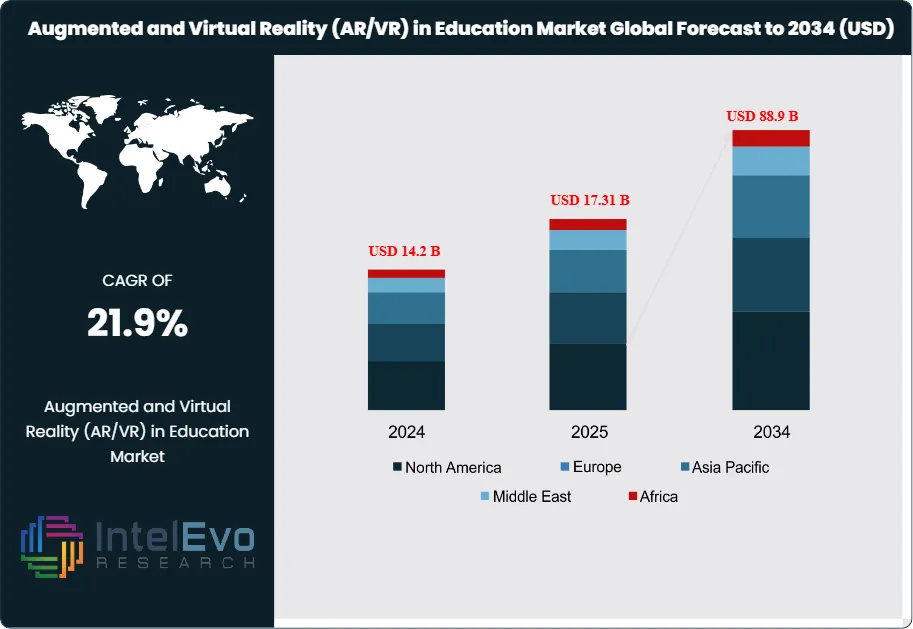

The Augmented and Virtual Reality (AR/VR) in Education Market is projected to grow from USD 14.2 Billion in 2024 to approximately USD 88.9 Billion by 2034, expanding at a CAGR of around 21.9% during 2025–2034. Immersive learning technologies are transforming classrooms into interactive, experience-based environments that improve student engagement and retention. The rise of digital education platforms and remote learning models is accelerating the adoption of AR/VR tools in schools, universities, and corporate training. As hardware becomes more affordable and content ecosystems expand, AR/VR is rapidly emerging as a core pillar of next-generation education worldwide.

Get More Information about this report -

Request Free Sample ReportThe market is undergoing rapid expansion as immersive technologies gain traction across the education ecosystem, reshaping how knowledge is delivered and consumed. Increasing demand for interactive, engaging, and personalized learning experiences is driving adoption, with AR and VR offering innovative methods to simplify complex concepts, simulate real-world scenarios, and foster deeper student engagement. These technologies are now being integrated across K-12 education, higher education, and vocational training, spanning disciplines such as science, history, medicine, and technical skill development.

Technological advancements, coupled with the declining cost of VR headsets and growing availability of immersive content, are making AR/VR solutions more accessible to institutions worldwide. Governments and educational authorities are further accelerating adoption through strategic investments in digital infrastructure and innovation-driven learning initiatives. The shift toward hybrid and remote education, underscored by lessons from the COVID-19 pandemic, has highlighted the importance of AR and VR in enabling continuity of high-quality, interactive learning beyond traditional classrooms.

Despite its strong momentum, the market faces challenges such as limited teacher training, varying institutional budgets, and infrastructure constraints in developing regions. However, the strong endorsement from educators—illustrated by surveys indicating that more than 90% of teachers view VR as valuable in teaching—underscores the market’s long-term potential. Parallel growth in software development is also fueling adoption, with education-focused VR content expected to surpass USD 300 million in revenue by mid-decade.

Regionally, North America leads in early adoption, with projections indicating that over 40% of K-12 schools in the U.S. will integrate AR/VR by 2024. Higher education is also advancing rapidly, with more than half of U.S. colleges expected to offer VR-based courses within the same timeframe. Europe, meanwhile, is emerging as an innovation hub, with VR-focused education startups attracting increased funding, signaling strong investor confidence. In Asia-Pacific, rising digital transformation initiatives and government-backed education reforms are positioning the region as a fast-growing market for immersive learning technologies.

Overall, AR and VR in education represent a transformative force, reshaping pedagogical models and positioning immersive learning as a cornerstone of the global education landscape in the coming decade.

Key Takeaways

- Market Growth: The global AR and VR in education market is projected to grow from USD 14.2 Billion in 2024 to 88.9 Billion by 2034, expanding at a CAGR of 21.9% (2025–2034). Growth is fueled by rising demand for immersive learning experiences, government-backed digital initiatives, and declining costs of VR headsets.

- End Use (Higher Education): The higher education segment is emerging as a leader, with over 60% of U.S. colleges expected to offer at least one VR-based course by 2024, compared to less than 30% in 2022. Universities are leveraging AR/VR for complex subjects such as medicine and engineering, enhancing interactivity and student outcomes.

- Offering (Hardware): Hardware accounted for over 65% of the market share in 2023, driven by strong demand for VR headsets, portable controllers, and interactive devices. The accessibility of affordable VR kits is accelerating adoption at both K-12 and vocational levels.

- Driver: Strong educator endorsement, with 93% of teachers believing VR is helpful in classroom teaching, is accelerating integration into mainstream curricula. This, combined with the shift to hybrid and remote learning models, is reinforcing the role of immersive tools in sustaining engagement.

- Restraint: High initial investment costs, coupled with limited digital infrastructure in developing regions, continue to restrict large-scale adoption, particularly in public schools with constrained budgets.

- Opportunity: Expansion of VR-based career and vocational training programs is a high-growth area, with 70% of U.S. community colleges projected to deploy VR for skill development by 2024. This segment is expected to attract strong funding from both private and public stakeholders.

- Trend: The growing availability of education-focused VR software, projected to surpass USD 300 million in global revenue by 2024, reflects a shift from hardware-driven adoption to content-centric learning. Customized AR/VR content is becoming critical for sustained engagement and differentiation.

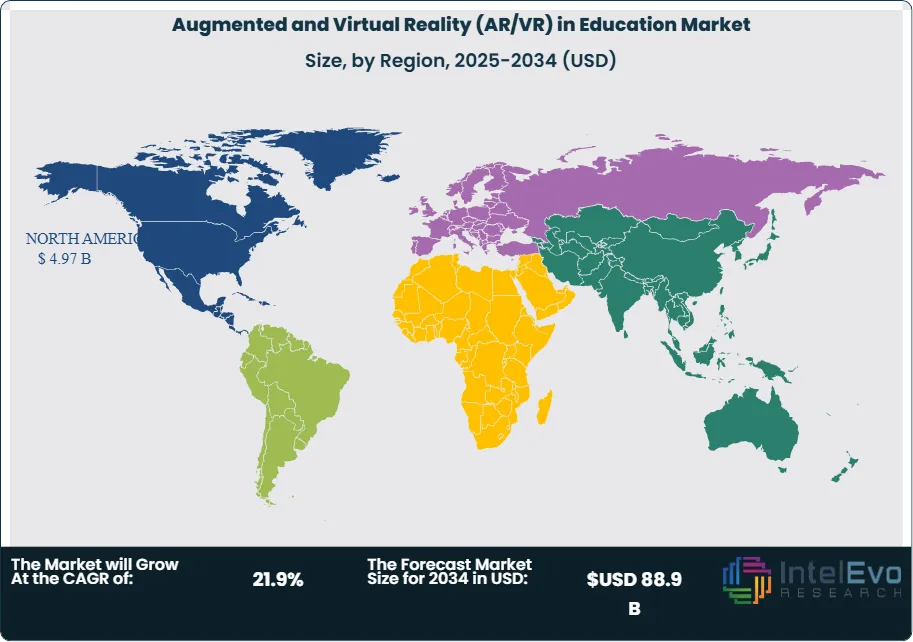

- Regional Analysis: North America held over 35% of the market share in 2023, supported by advanced infrastructure and high institutional spending on EdTech. Europe is witnessing strong momentum, with VR education startups attracting a 30% funding increase in 2023–2024, while Asia-Pacific is emerging as a fast-growth region due to government-led digital education reforms and rising investments in immersive learning solutions.

Offering Analysis

In 2025, the hardware segment continues to lead the AR/VR in education market, accounting for more than two-thirds of total revenue. This dominance reflects the indispensable role of physical devices in delivering immersive learning experiences. Core hardware components—ranging from interactive whiteboards and portable controllers to advanced VR head-mounted displays (HMDs), gesture-tracking devices, and projection systems—form the essential infrastructure enabling educators to integrate digital content seamlessly into classroom environments.

The sustained momentum of this segment is being fueled by ongoing advancements in affordability, portability, and ease of use. Companies such as Meta, HTC, and Lenovo are investing heavily in next-generation VR headsets optimized for educational purposes, while EdTech providers are collaborating with hardware manufacturers to create bundled solutions tailored to institutional needs. As classrooms worldwide continue transitioning toward digital-first models, demand for reliable and cost-effective AR/VR hardware remains central to widespread adoption. Furthermore, the integration of these devices with existing digital ecosystems—such as learning management systems (LMS)—is reducing barriers to implementation and supporting long-term scalability.

Deployment Mode Analysis

Cloud-based deployment has firmly established itself as the leading mode in 2025, representing over 70% of total market share. Educational institutions increasingly favor cloud platforms due to their scalability, affordability, and ability to deliver AR/VR experiences without significant investment in on-premises infrastructure. This model enables schools, universities, and training centers to access immersive content on demand, update resources seamlessly, and ensure consistent user experiences across geographies.

The shift toward cloud solutions is closely tied to the global push for digital transformation in education. Providers such as Google Cloud, Microsoft Azure, and AWS are expanding education-focused offerings, allowing institutions to host virtual labs, collaborative classrooms, and immersive simulations at scale. The inherent flexibility of the cloud—enabling institutions to scale resources based on demand—has become particularly valuable for blended and remote learning environments. As a result, cloud deployment is expected to remain the cornerstone of AR/VR adoption, ensuring high performance and accessibility for learners worldwide.

Application Analysis

By 2025, the higher education sector continues to account for the largest share of AR/VR adoption, capturing nearly 40% of the market. Universities and colleges are leveraging immersive technologies to enrich disciplines such as medicine, architecture, engineering, and design—where realistic simulations and hands-on practice are essential. Virtual anatomy labs, 3D architectural walkthroughs, and engineering simulations have become increasingly common, reducing reliance on costly physical resources while improving student preparedness.

The higher education segment also benefits from stronger funding capacity and greater institutional flexibility to experiment with new pedagogical models. Leading universities in North America and Europe are integrating AR/VR into formal curricula, while institutions in Asia-Pacific are expanding vocational and technical training through immersive platforms. Investments in faculty training and dedicated AR/VR labs underscore the sector’s role as an early adopter, setting benchmarks for broader use across K-12 and vocational training. With growing emphasis on research-driven learning and workforce readiness, higher education remains at the forefront of immersive education innovation.

Regional Analysis

In 2025, North America retains its position as the largest regional market for AR/VR in education, representing over one-third of global revenue. The region’s strength lies in its robust technological infrastructure, extensive funding for digital learning initiatives, and proactive adoption by both private institutions and government-backed programs. The U.S. market alone is being driven by the rapid integration of immersive technologies across K-12 schools and universities, supported by initiatives to advance STEM education and workforce training.

Europe follows as a key growth hub, driven by rising investments in EdTech startups and strong government-led digitalization policies. Countries such as the UK, Germany, and France are seeing accelerated adoption in both higher education and vocational training, particularly in healthcare and engineering disciplines. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, supported by large-scale government reforms in education, increasing penetration of affordable AR/VR devices, and growing partnerships between global technology firms and local institutions. Markets such as China, India, and South Korea are at the forefront of this expansion, positioning the region as a critical future growth engine.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Offering

- Solutions

- Hardware

- Interactive Whiteboards

- Portable Controllers

- VR Devices (HMD, Gesture Tracking devices)

- Projectors & Display walls

- Others

- Services

By Deployment Mode

- Cloud

- On-Premises

By Application

- K-12

- Higher Education

- Vocational training

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 14.2 B |

| Forecast Revenue (2034) | USD 88.9 B |

| CAGR (2025-2034) | 21.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Offering (Solutions, Hardware, Services), By Deployment Mode (Cloud, On-Premises), By Application (K-12, Higher Education, Vocational training) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Meta (Facebook Reality Labs), Google LLC, Microsoft Corporation, Apple Inc., Lenovo Group Limited, HTC Corporation, Samsung Electronics Co., Ltd., Sony Group Corporation, zSpace, Inc., Veative Labs Pvt. Ltd., EON Reality, Inc., Pearson PLC, Avantis Systems Ltd., ClassVR (Avantis Education), Magic Leap, Inc., Barco NV, Panasonic Holdings Corporation, Varjo Technologies Oy, Unity Technologies, Adobe Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Augmented and Virtual Reality (AR/VR) in Education Market?

The AR/VR in Education Market is projected to grow from USD 14.2 Billion in 2024 to USD 88.9 Billion by 2034, at a CAGR of 21.9%. Increasing adoption of immersive learning, remote education platforms, and interactive digital classrooms is driving global market expansion.

Who are the major players in the Augmented and Virtual Reality (AR/VR) in Education Market?

Meta (Facebook Reality Labs), Google LLC, Microsoft Corporation, Apple Inc., Lenovo Group Limited, HTC Corporation, Samsung Electronics Co., Ltd., Sony Group Corporation, zSpace, Inc., Veative Labs Pvt. Ltd., EON Reality, Inc., Pearson PLC, Avantis Systems Ltd., ClassVR (Avantis Education), Magic Leap, Inc., Barco NV, Panasonic Holdings Corporation, Varjo Technologies Oy, Unity Technologies, Adobe Inc.

Which segments covered the Augmented and Virtual Reality (AR/VR) in Education Market?

By Offering (Solutions, Hardware, Services), By Deployment Mode (Cloud, On-Premises), By Application (K-12, Higher Education, Vocational training)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Augmented and Virtual Reality (AR/VR) in Education Market

Published Date : 10 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date