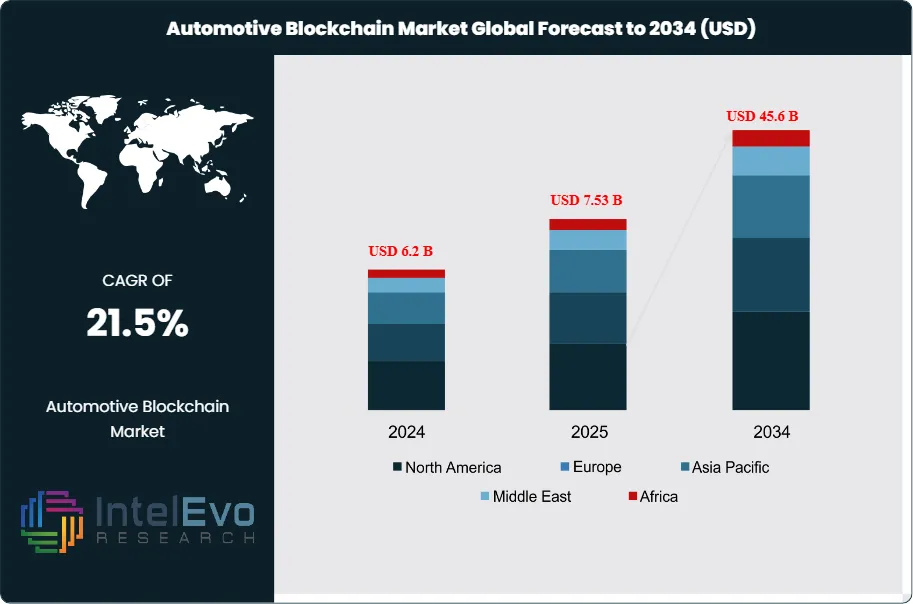

Automotive Blockchain Market to Reach $45.6 Bn by 2034 | 21.5% CAGR

Global Automotive Blockchain Market Size, Share, Analysis Report By Technology (Public Blockchain, Permissioned Blockchain, Hybrid Blockchain), Component (Platform, Application Software, Services), Verticals (OEMs, Suppliers, Mobility Service Providers, Dealerships, Aftermarket), Enterprise Size (Small and Medium Enterprises, Large Enterprises) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

The Automotive Blockchain Market is projected to be worth around USD 45.6 Billion by 2034, up from USD 6.2 Billion in 2024, growing at a CAGR of 21.5% during the forecast period from 2024 to 2034. The automotive blockchain market encompasses a wide range of digital solutions leveraging distributed ledger technology (DLT) to enhance transparency, security, and efficiency across the automotive value chain.

Get More Information about this report -

Request Free Sample ReportThis market includes blockchain platforms and applications for supply chain management, vehicle identity and history, mobility services, payments, insurance, and data sharing. The ecosystem serves diverse automotive industry verticals, including OEMs, suppliers, mobility providers, dealerships, and aftermarket service providers, enabling secure data exchange, fraud prevention, and process automation throughout the vehicle lifecycle.

The automotive blockchain market is experiencing robust growth driven by the increasing need for secure, tamper-proof data management and the rising complexity of automotive supply chains. Key growth catalysts include the integration of blockchain with IoT, AI, and telematics, which enable real-time tracking, smart contracts, and automated transactions. The market benefits from growing demand for vehicle provenance, digital identity, and secure over-the-air (OTA) updates, as well as the expansion of shared mobility and connected vehicle ecosystems.

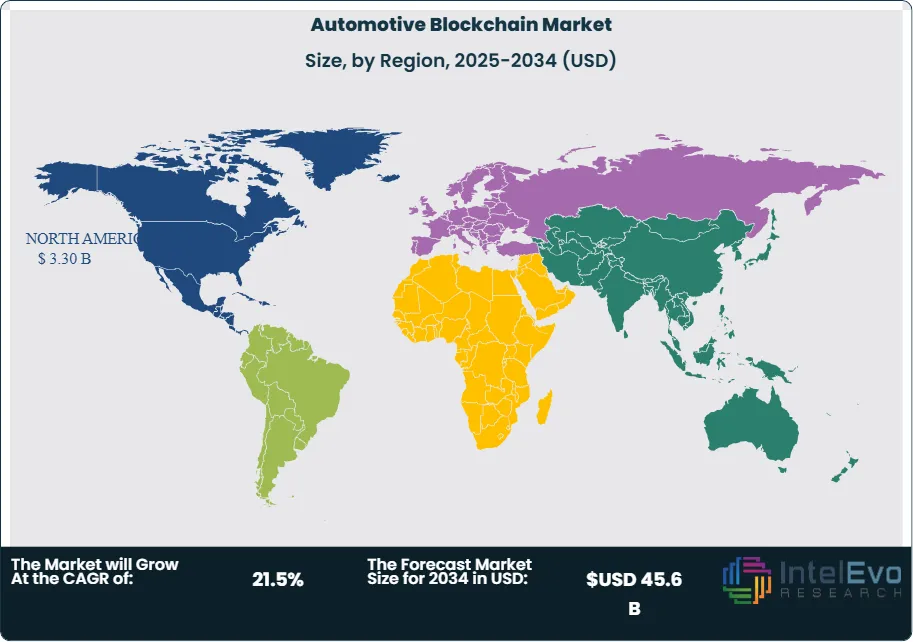

North America maintains its position as the leading regional market for automotive blockchain applications, commanding the largest global market share and generating the highest revenues within the sector. This dominance is attributed to early adoption of blockchain technology, a strong presence of automotive and technology giants, and significant investments in digital transformation. The United States serves as the primary contributor to North America's market leadership, with substantial revenue generation and strong growth projections. Meanwhile, the Asia-Pacific region emerges as the most rapidly expanding market segment, propelled by rapid digitalization, expanding automotive production, and government initiatives supporting blockchain adoption in smart mobility and supply chain transparency.

The COVID-19 pandemic accelerated digital transformation initiatives across the automotive industry as companies sought resilient, transparent, and automated solutions to manage supply chain disruptions and ensure business continuity. The crisis highlighted the importance of blockchain-enabled systems for real-time tracking, secure data sharing, and fraud prevention. While initial investment slowdowns were observed, the long-term impact has been positive, with increased recognition of blockchain’s value in building operational resilience and enabling new business models. Rising geopolitical tensions and trade restrictions have influenced blockchain adoption patterns in the automotive sector, with companies seeking to reduce dependency on single-source suppliers and enhance supply chain traceability. International regulations and data sovereignty concerns have created opportunities for domestic blockchain solution providers, while also challenging global interoperability. Additionally, the increasing focus on data privacy, cybersecurity, and regulatory compliance is driving demand for permissioned blockchain networks and industry-wide standards.

Key Takeaways

- Market Growth: The Automotive Blockchain Market is expected to reach USD 45.6 Billion by 2034, fueled by growing demand for secure data management, supply chain transparency, and digital transformation across the automotive industry.

- Technology Dominance: Public and permissioned blockchain platforms lead the segment, due to their foundational role in enabling secure, decentralized applications.

- Component Dominance: Platform and application software dominate, driven by the need for scalable, customizable blockchain solutions.

- Enterprise Size Dominance: Large enterprises lead the segment, primarily due to higher investment capacity and complex operational requirements.

- Verticals Dominance: OEMs and mobility service providers hold the largest share, owing to broad application scope and the need for secure, automated processes.

- Driver: Key drivers accelerating growth include supply chain transparency and fraud prevention, which boost market expansion through enhanced trust and operational efficiency.

- Restraint: Growth is hindered by high implementation costs and interoperability challenges, which create barriers for smaller players and cross-industry collaboration.

- Opportunity: The market is poised for expansion due to opportunities like integration with IoT and AI, and emerging market penetration, which enable advanced analytics and new mobility business models.

- Trend: Emerging trends including smart contracts, decentralized mobility platforms, and tokenization are reshaping the market by enabling automated, secure, and data-driven automotive ecosystems.

- Regional Analysis: North America leads owing to early technology adoption and established automotive infrastructure. Asia-Pacific shows high promise due to rapid digitalization and expanding automotive production.

Technology Analysis

In the technology segment, permissioned blockchain platforms maintain a commanding position, mirroring the trajectory of technology consulting in management consulting, due to their ability to deliver privacy, regulatory compliance, and scalable enterprise applications. These platforms are increasingly favored by OEMs, suppliers, and mobility service providers for use cases such as secure data sharing, warranty management, and digital vehicle identity, while public blockchains are leveraged for open, decentralized applications like vehicle history tracking and peer-to-peer mobility. Hybrid blockchains are gaining traction for their flexibility, enabling selective transparency and privacy in complex automotive ecosystems.

Component Analysis

From a component perspective, platform solutions form the backbone of the market, providing the essential infrastructure for building and deploying blockchain applications across the automotive value chain. Application software is the most rapidly expanding segment, driven by exceptional demand for digital transformation, automated payments, and decentralized mobility services. This mirrors the surge in technology consulting, as automotive organizations increasingly require specialized blockchain applications to maintain competitiveness in a digitalized environment. The services segment, encompassing consulting, integration, and ongoing support, is also critical, as companies rely on expert partners to navigate the complexity of blockchain adoption and ensure successful implementation.

Verticals Analysis

In terms of verticals, OEMs and suppliers lead the market, reflecting their intricate operational demands and the need for end-to-end supply chain transparency, counterfeit prevention, and secure over-the-air updates. Mobility service providers are rapidly adopting blockchain for identity management, automated billing, and decentralized ride-sharing, while dealerships and aftermarket players benefit from improved vehicle history tracking, parts authentication, and warranty management. This vertical leadership is reinforced by the essential role blockchain plays in addressing regulatory compliance, operational efficiency, and customer trust.

Enterprise Size Analysis

Large enterprises maintain a dominant position in the automotive blockchain market, paralleling their role in management consulting, due to their significant investment capacity, complex global operations, and extensive regulatory responsibilities. These organizations drive market growth through their ability to finance large-scale blockchain projects, execute organization-wide digital transformation, and apply blockchain solutions across multiple business units and international markets. While small and medium enterprises are increasingly participating—supported by blockchain-as-a-service offerings and industry consortia—large enterprises remain the primary consumers of advanced blockchain solutions.

Region Analysis

North America leads the global automotive blockchain market, establishing unparalleled market leadership through early technology adoption, strong collaboration between automotive and technology firms, and substantial revenue generation. The United States, in particular, demonstrates exceptional growth potential and market maturity, driving innovation and standard-setting across the industry. Asia-Pacific emerges as the most rapidly expanding regional market, propelled by accelerated economic development, digitalization initiatives, and expanding automotive production in major economies such as China, India, and Southeast Asia. Europe maintains a substantial and influential presence, supported by mature automotive hubs, comprehensive regulatory frameworks, and established partnerships between technology providers and major manufacturers. Latin America and the Middle East & Africa are emerging markets, with growing interest in blockchain for supply chain transparency, fraud prevention, and smart mobility projects, signaling future growth opportunities as digital infrastructure matures.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Technology

- Public Blockchain

- Permissioned Blockchain

- Hybrid Blockchain

Component

- Platform

- Application Software

- Services

Verticals

- OEMs

- Suppliers

- Mobility Service Providers

- Dealerships

- Aftermarket

Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 7.53 B |

| Forecast Revenue (2034) | USD 45.6 B |

| CAGR (2025-2034) | 21.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Technology (Public Blockchain, Permissioned Blockchain, Hybrid Blockchain), Component (Platform, Application Software, Services), Verticals (OEMs, Suppliers, Mobility Service Providers, Dealerships, Aftermarket), Enterprise Size (Small and Medium Enterprises, Large Enterprises) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM Corporation, Microsoft Corporation, Accenture, Consensys, VeChain, CarVertical, Helbiz, BigchainDB, Tech Mahindra, HCL Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Automotive Blockchain Market

Published Date : 31 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date