Automotive Predictive Maintenance Market Size, Share & Forecast 2034

Global Automotive Predictive Maintenance Market Size, Share & Industry Analysis By Component (Hardware, Software, Services), By Technology (AI & Machine Learning, IoT Sensors, Big Data Analytics, Cloud Computing), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), By Deployment (On-Premise, Cloud-Based), By End User (OEMs, Fleet Operators, Logistics Providers), Regional Outlook, Competitive Landscape, Market Dynamics, Emerging Trends & Forecast 2025–2034

Report Overview

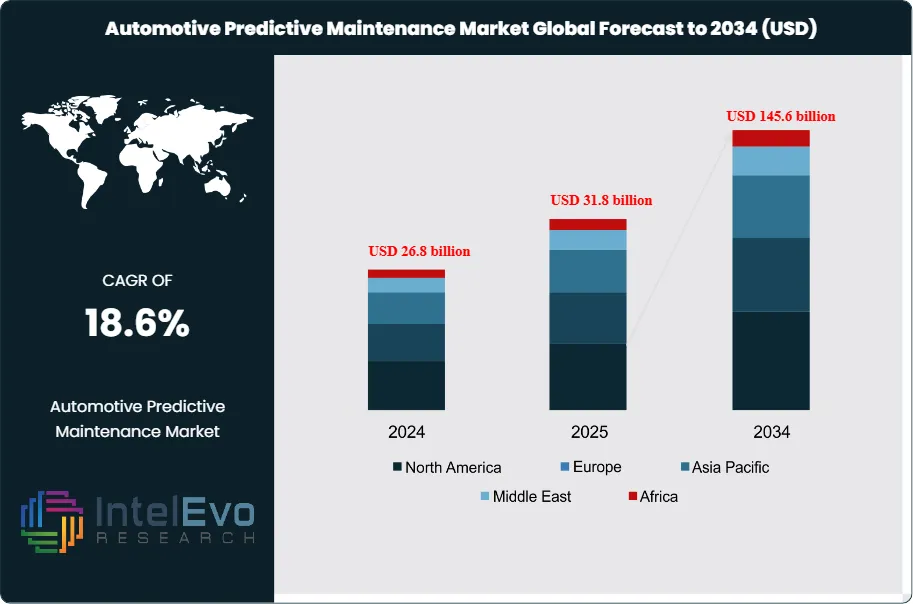

The Automotive Predictive Maintenance Market is estimated at USD 26.8 billion in 2024 and is projected to reach approximately USD 145.6 billion by 2034, registering a compound annual growth rate (CAGR) of 18.6% over the forecast period of 2025–2034. This strong expansion is driven by the accelerating adoption of connected vehicles, AI-powered diagnostics, and real-time sensor analytics across passenger and commercial fleets. OEMs and fleet operators are increasingly leveraging predictive maintenance to reduce unplanned downtime, extend vehicle lifespan, and lower maintenance costs by up to 30%. The integration of predictive maintenance with telematics platforms and electric vehicle ecosystems is further strengthening market momentum, positioning it as a core pillar of next-generation automotive digital transformation.

Get More Information about this report -

Request Free Sample ReportThis rapid expansion reflects the growing reliance on connected vehicles, advanced telematics, and data-driven maintenance strategies that reduce downtime and extend asset life. The market has evolved from early-stage adoption of condition monitoring tools to widespread integration of artificial intelligence and machine learning, which now enable real-time analysis of vehicle performance and predictive insights into component failures.

Demand is being driven by several structural shifts. The global stock of connected vehicles is expected to exceed 400 million units by 2030, generating vast volumes of sensor data that underpin predictive maintenance models. Electric vehicles add further momentum, as their complex battery and drivetrain systems require precise monitoring to ensure efficiency and safety. Regulatory pressure is also significant. Stricter emission standards and road safety mandates in Europe, North America, and parts of Asia are compelling automakers and fleet operators to adopt predictive systems that minimize breakdowns and compliance risks. On the cost side, research indicates predictive maintenance can reduce expenses by 30–40% compared with reactive approaches, and by 8–12% compared with preventive schedules, making it a compelling investment case for fleet managers and OEMs.

Challenges remain. High upfront costs and integration complexity limit adoption among small and mid-sized enterprises. Data quality and interoperability issues also constrain accuracy, particularly in mixed fleets with varying sensor standards. However, falling sensor prices and the expansion of cloud-based analytics platforms are lowering barriers to entry. The rise of mobility-as-a-service models, where uptime is critical to profitability, further strengthens the business case for predictive maintenance.

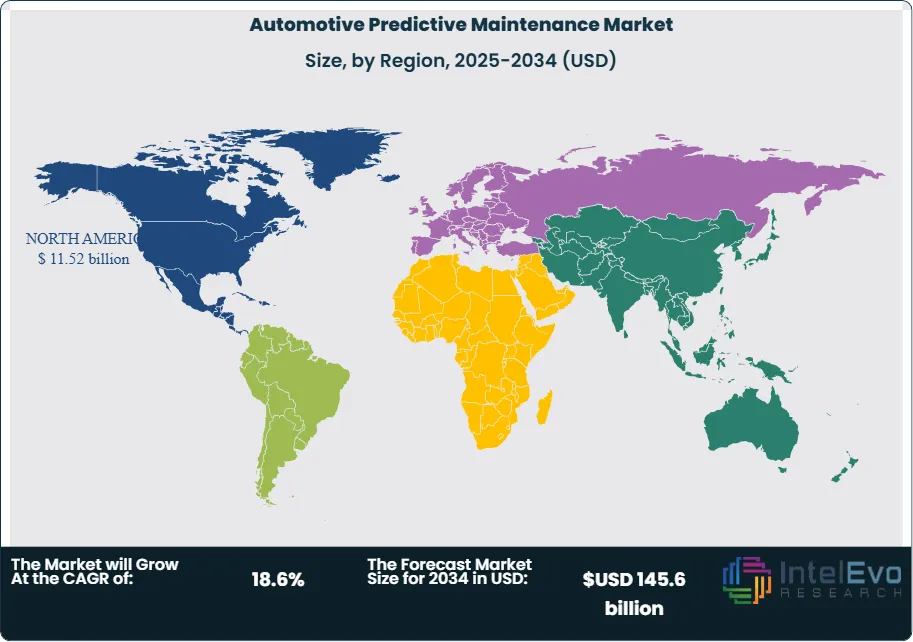

Regionally, North America and Europe currently lead adoption, supported by strong regulatory frameworks and high penetration of connected vehicles. Asia-Pacific is emerging as the fastest-growing region, with China, Japan, and South Korea investing heavily in smart mobility infrastructure. Investors should also watch India and Southeast Asia, where rapid vehicle fleet expansion and digitalization are creating new opportunities. As adoption broadens, predictive maintenance is shifting from a cost-saving tool to a strategic enabler of operational resilience, positioning the market for sustained double-digit growth through the next decade.

Key Takeaways

- Market Growth: The global automotive predictive maintenance market is valued at USD 26.8 billion in 2024 and is projected to reach USD 145.6 billion by 2034, reflecting a CAGR of 18.6%. Growth is driven by rising adoption of connected vehicles, telematics, and AI-enabled maintenance systems.

- Solutions: The Solutions segment accounted for over 62% of total revenues in 2022. Its leadership reflects strong demand for integrated platforms that combine diagnostics, analytics, and predictive scheduling to reduce downtime and extend vehicle life.

- Technology: The Internet of Things (IoT) segment held more than 35% share in 2022. IoT-enabled sensors and telematics units are critical for real-time data collection, enabling predictive algorithms to identify failures before they occur.

- Vehicle Type: Passenger cars represented over 61% of the market in 2022. Rising consumer demand for safety, efficiency, and lower maintenance costs has accelerated adoption of predictive systems in personal vehicles.

- Service Type: Oil change services captured more than 22% share in 2022. Predictive scheduling of oil changes remains a key entry point for adoption, as it directly impacts engine performance and cost savings.

- Driver: The global stock of connected vehicles is expected to surpass 400 million units by 2030. This surge in data-rich vehicles is fueling demand for predictive maintenance platforms that rely on continuous sensor inputs.

- Restraint: High implementation costs and integration complexity limit adoption among small and mid-sized fleet operators. Inconsistent data quality across vehicle models further constrains predictive accuracy.

- Opportunity: Asia-Pacific is projected to record the fastest CAGR through 2032, supported by rapid EV adoption in China, Japan, and South Korea. Expanding fleets in India and Southeast Asia also present untapped growth potential.

- Trend: Predictive maintenance adoption is accelerating in mobility-as-a-service models, where uptime directly impacts profitability. Fleet operators are increasingly investing in AI-driven platforms to minimize unplanned downtime.

- Regional Analysis: North America led the market in 2022 with a 43% share and USD 8.1 billion in revenues, supported by stringent safety regulations and high connected vehicle penetration. Asia-Pacific is emerging as the key growth hub, while Europe remains a mature market with strong regulatory compliance driving adoption.

Type Analysis

High-performance concrete continues to gain traction in 2025 as infrastructure projects demand materials with superior durability and load-bearing capacity. This segment is expected to expand steadily, supported by large-scale transportation and urban development projects in Asia and the Middle East. Governments are prioritizing resilient construction materials to reduce lifecycle costs, which positions high-performance concrete as a preferred choice for highways, bridges, and high-rise structures.

Self-consolidating concrete is also recording strong adoption, particularly in commercial and industrial projects where speed of construction and reduced labor requirements are critical. Its ability to flow easily into complex formworks without vibration enhances efficiency and structural integrity. Industry estimates suggest that self-consolidating concrete will capture a growing share of the market through 2030, driven by its role in precast applications and high-volume construction. Other specialty concrete types, including lightweight and fiber-reinforced variants, are expanding their niche presence, particularly in projects requiring thermal insulation or enhanced crack resistance.

Application Analysis

Pavers represent one of the largest application segments, supported by rapid urbanization and the expansion of smart city projects. Municipal investments in pedestrian pathways, parking areas, and public spaces are fueling demand for durable and aesthetically adaptable concrete pavers. The segment is projected to maintain steady growth, with Asia Pacific and Latin America emerging as key demand centers.

Retaining walls are another critical application, particularly in regions with expanding transportation networks and hillside urban development. The need for soil stabilization in road and rail projects is driving adoption, with reinforced concrete retaining walls expected to dominate due to their cost efficiency and structural reliability. Other applications, including drainage systems and precast elements, are also expanding as construction companies seek standardized, factory-produced components that reduce on-site labor and project timelines.

End-Use Analysis

Residential construction remains the largest end-use segment, accounting for a significant share of global demand in 2025. Rising urban populations and housing shortages in emerging economies are accelerating the use of advanced concrete types in multi-family housing and affordable housing projects. Developers are prioritizing materials that reduce maintenance costs and extend building lifespans, reinforcing demand for high-performance and self-consolidating concrete.

Commercial buildings, including office complexes, retail centers, and institutional facilities, are also driving growth. The segment benefits from the need for durable flooring, structural strength, and architectural flexibility. Industrial construction, while smaller in share, is expanding steadily as manufacturing hubs in Asia and the Middle East invest in warehouses, logistics centers, and production facilities that require robust concrete solutions.

Regional Analysis

North America continues to hold a strong position in 2025, supported by infrastructure rehabilitation programs and stringent building codes that encourage the use of advanced concrete materials. The United States remains the largest contributor, with federal funding for highways and bridges sustaining demand. Europe follows closely, with sustainability regulations and carbon reduction targets accelerating the adoption of low-emission concrete solutions.

Asia Pacific is the fastest-growing regional market, driven by rapid urbanization, large-scale infrastructure investments, and government-backed housing initiatives. China, India, and Southeast Asia are leading demand, with megacity projects and industrial expansion fueling consumption. Latin America is showing steady growth, particularly in Brazil and Mexico, where urban development and transport projects are expanding. The Middle East and Africa are also emerging as high-potential markets, supported by large-scale infrastructure investments in Saudi Arabia, the UAE, and South Africa.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Component

- Solutions

- Integrated

- Standalone

- Services

- Managed Services

- Professional Service

By By Technology

- IoT

- Big Data & Data Analytics

- Business Intelligence (BI)

- Cloud Computing

- 5G

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Duty Trucks

- Buses and Coaches

By Application

- Oil Change

- Transmission Checkup

- Belt Change

- Brake and Tire Inspection

- Coolant Replacement

- Engine Air Filter

- Cabin Filter

- Others Application

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 26.8 billion |

| Forecast Revenue (2034) | USD 145.6 billion |

| CAGR (2024-2034) | 18.6% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, (Solutions, (Integrated, Standalone), Services, (Managed Services, Professional Service)), By By Technology, (IoT, Big Data & Data Analytics, Business Intelligence (BI), Cloud Computing, 5G), By Vehicle Type, (Passenger Cars, Light Commercial Vehicles, Heavy Duty Trucks, Buses and Coaches), By Application, (Oil Change, Transmission Checkup, Belt Change, Brake and Tire Inspection, Coolant Replacement, Engine Air Filter, Cabin Filter, Others Application) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | CHIRON Swiss SA, IBM, Hitachi, Ltd., Amazon Web Services, Inc, Altair Engineering Inc., PTC, SAS Institute Inc., General Electric, RapidMiner Inc, SAP, Operational Excellence (OPEX) Group Ltd, Oracle, Schneider Electric, TIBCO Software Inc, Dingo, Google, Hewlett Packard Enterprise Development LP, Software AG |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Automotive Predictive Maintenance Market

Published Date : 07 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date