Autonomous Mobile Robots Market Size, Growth & Forecast | 18.9% CAGR

Global Autonomous Mobile Robots (AMR) Market Size, Share & Analysis Components (Software, Hardware, Services), Type (Autonomous Inventory Robots, Self-driving Forklifts, Goods-to-person picking robots, Unmanned Aerial Vehicles), Battery Type (Lithium-Ion Battery, Lead Battery, Nickel-Based Battery), End-Use Industry (Automotive, Chemical, Electronics, Aerospace, Pharmaceuticals, Defense, FMCG), Industry Regions & Key Players – Automation Trends & Forecast 2025–2034

Report Overview

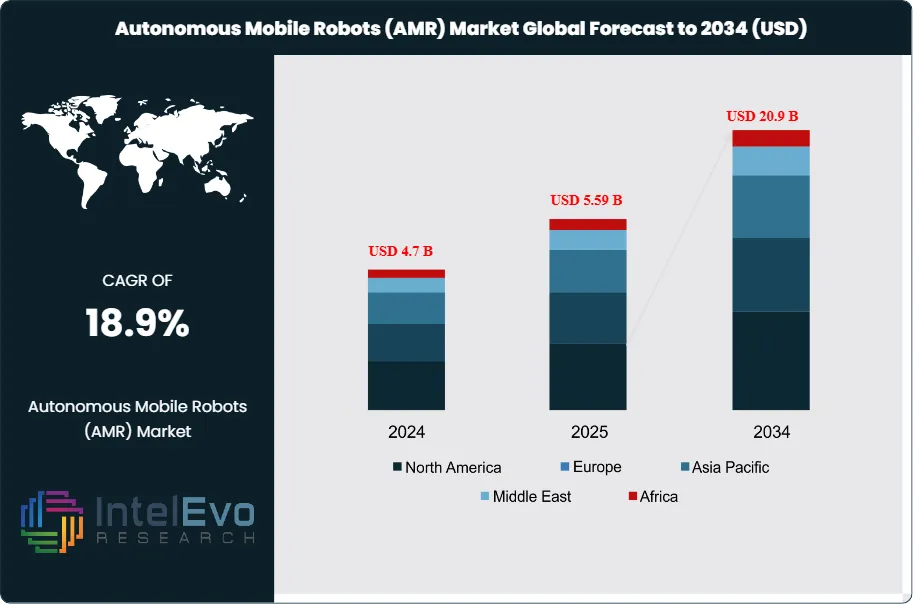

The Autonomous Mobile Robots (AMR) Market is projected to rise from USD 4.7 Billion in 2024 to approximately USD 20.9 Billion by 2034, growing at a CAGR of around 18.9% during 2025–2034. Growing automation in warehousing, logistics, and manufacturing is accelerating the adoption of AMRs across industries. AI-driven navigation, real-time fleet management, and integration with Industry 4.0 platforms are enhancing performance and scalability. As labor costs rise and efficiency demands increase, AMRs are becoming a core pillar of next-generation smart factory and supply chain ecosystems. Market has entered a phase of rapid expansion, driven by the accelerating demand for automation across diverse industries. This remarkable trajectory reflects a growing reliance on autonomous systems to streamline operations, reduce costs, and enhance efficiency in increasingly complex supply chains.

Get More Information about this report -

Request Free Sample ReportAutonomous mobile robots are equipped with advanced technologies such as sensors, cameras, facility mapping systems, and intelligent software that enable seamless navigation and task execution within dynamic industrial environments. Their ability to perform critical functions—including sorting, transporting, and picking products—positions them as vital assets for modern manufacturing and logistics facilities. Compared with traditional manual labor, AMRs offer compelling advantages such as lower operational costs, minimized risk of product damage, continuous process automation, and significant improvements in throughput and workplace safety. These benefits are prompting rapid adoption across both established enterprises and emerging market players.

Industry uptake of AMRs spans a wide array of verticals, underscoring their versatility and transformative impact. Key adopters include the automotive and aerospace sectors, where precision and efficiency are paramount, as well as the pharmaceutical and electronics industries, which require consistent handling and high accuracy in sensitive environments. In addition, FMCG, chemical, and defense organizations are increasingly turning to AMRs to support large-scale, time-sensitive operations. This cross-sector adoption highlights the critical role of robotics in reshaping production and supply chain strategies globally.

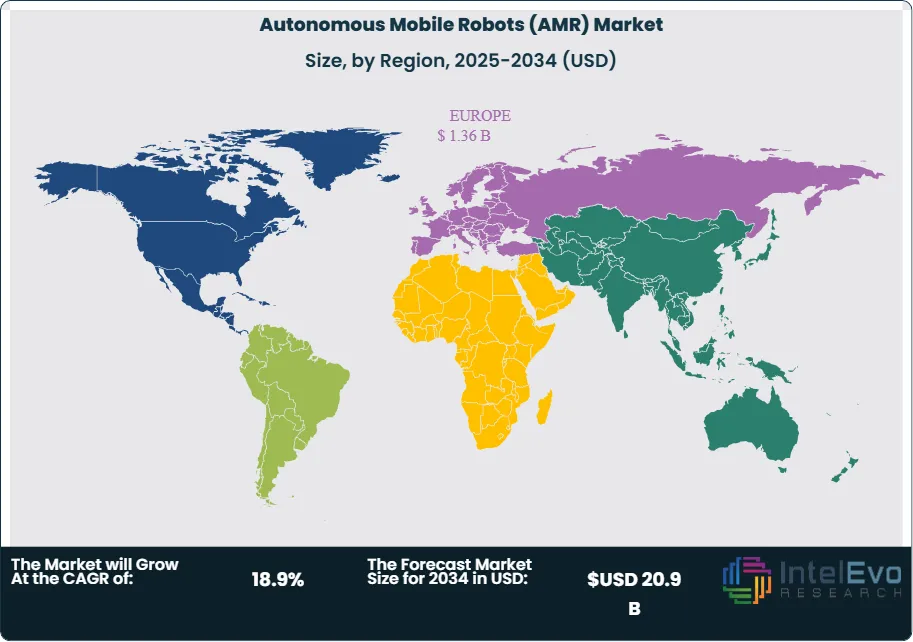

Regionally, North America currently leads the AMR market, driven by strong investments in smart manufacturing and the early integration of Industry 4.0 technologies. Europe follows closely, supported by regulatory pushes for automation and sustainability across industrial sectors. Meanwhile, Asia-Pacific is emerging as the fastest-growing market, propelled by rapid industrialization, expanding e-commerce logistics, and government initiatives favoring automation in manufacturing hubs such as China, Japan, and India.

As industries continue to prioritize efficiency, safety, and cost competitiveness, autonomous mobile robots are set to become indispensable to modern operations. The combination of technological advancements, expanding applications, and favorable regional dynamics ensures a strong growth outlook for the AMR market over the coming decade.

Key Takeaways

- Market Growth: The Autonomous Mobile Robots (AMR) Market was valued at USD 4.3 billion in 2023 and is projected to reach USD 18.2 billion by 2034, growing at a strong CAGR of 18.1%. Rising automation demand, e-commerce expansion, and the pursuit of operational efficiency are key growth drivers.

- Type: Goods-to-person picking robots hold the largest share, capturing 46.6% of market revenue, owing to their ability to optimize warehouse navigation, reduce labor dependency, and improve order fulfillment efficiency.

- Components: Hardware leads the components category with 63.4% of total market revenue, supported by demand for advanced sensors, navigation systems, and durable chassis designs enabling high-precision industrial operations.

- Battery Type: Lead-acid batteries remain the most widely used, accounting for 48.6% of the market, as they provide cost-effective power solutions with stable performance, though lithium-ion batteries are gaining traction for longer life cycles and faster charging.

- End-Use Industry: The automotive sector is a major adopter, leveraging AMRs for tasks such as material handling, assembly line automation, painting, and lifting, thereby reducing production cycle times and enhancing workforce safety.

- Driver: The integration of Industry 4.0 and smart factory initiatives is accelerating AMR adoption, as companies seek to enhance scalability, minimize downtime, and achieve consistent productivity.

- Restraint: High upfront investment and ongoing maintenance costs restrict adoption among small and medium enterprises, particularly in emerging markets with tighter capital budgets.

- Opportunity: The surge in global e-commerce and last-mile logistics is creating significant opportunities for AMRs in warehouses, fulfillment centers, and distribution hubs to handle rising parcel volumes and complex order flows.

- Trend: There is a growing shift toward AI-enabled AMRs capable of self-learning, dynamic route optimization, and fleet management, with major companies such as Amazon Robotics and Geek+ pioneering advanced deployments.

- Regional Analysis: Europe currently leads the AMR market with 29.4% revenue share, supported by strong automation mandates and industrial modernization, while Asia-Pacific is forecast to register the fastest growth, driven by large-scale manufacturing hubs in China, Japan, South Korea, and India.

Component Analysis

The autonomous mobile robots (AMR) market is segmented into hardware, software, and services, with hardware maintaining the largest revenue share as of 2025. Contributing more than 63% of total market value, hardware growth is fueled by demand for critical components such as sensors, motors, brakes, and batteries. These systems form the backbone of AMRs, enabling safe navigation and precise operations in dynamic environments. Companies like SICK AG (sensors), Maxon Motor (drive systems), and BYD (industrial batteries) are playing key roles in advancing the hardware ecosystem.

In contrast, software is emerging as the fastest-growing segment. Intelligent platforms are increasingly critical for real-time fleet management, AI-based navigation, and integration with enterprise systems. Vendors such as BlueBotics (autonomous navigation software) and Amazon Robotics (cloud-enabled orchestration for warehouse robots) are driving innovation. As industries move toward Industry 4.0, the ability to upgrade AMRs via software updates rather than hardware replacement is expected to further accelerate adoption.

Type Analysis

Among different AMR types, goods-to-person picking robots dominate with nearly 47% of revenue share in 2025. Their ability to autonomously retrieve items and deliver them to human workers has revolutionized warehousing and e-commerce fulfillment. Companies like Geek+, GreyOrange, and Locus Robotics have become leaders in this space, deploying thousands of robots across global fulfillment centers for clients such as Walmart and DHL. Their efficiency in reducing errors and increasing throughput is a key driver of adoption.

Self-driving forklifts are another fast-growing category, particularly in automotive and heavy industries. Unlike traditional forklifts, these robots automate repetitive material handling while reducing workplace accidents. Companies such as Toyota Material Handling, Seegrid, and Balyo are pioneering these solutions, offering AI-enabled forklifts that can operate safely alongside human workers. Their role in supporting high-volume, 24/7 operations is expected to accelerate demand across sectors like automotive, electronics, and FMCG.

Battery Type Analysis

From a power source perspective, lead-acid batteries currently hold the largest share at approximately 48.6%. Their cost-effectiveness, stable voltage delivery, and mature technology make them attractive for companies seeking budget-friendly solutions. However, their shorter life cycle and longer charging times limit scalability for operations requiring 24/7 uptime.

In contrast, lithium-ion batteries are rapidly gaining ground. Offering higher energy density, faster charging, and longer operational lifespans, they are becoming the preferred choice for advanced AMR deployments. Companies like Tesla’s Energy Division, Panasonic, and CATL are pushing innovation in lithium-ion solutions, while robotics providers such as ABB and KUKA increasingly integrate them into next-generation AMRs. As sustainability and operational efficiency rise to the forefront, lithium-ion adoption is forecast to overtake lead-acid by the end of the decade.

End-User Analysis

The automotive industry remains the largest adopter of AMRs, deploying them for applications ranging from assembly line automation and material handling to painting and coating. Companies such as BMW and Toyota are leveraging AMRs to optimize production cycles, reduce errors, and enhance workforce safety. By 2025, automotive facilities worldwide are investing heavily in robotics to meet the rising demand for electric vehicles and shorten time-to-market.

Other sectors are also expanding adoption. In aerospace and defense, firms like Airbus and Lockheed Martin utilize AMRs for heavy-load handling and precision assembly. In pharmaceuticals, AMRs deployed by companies like Pfizer and Novartis ensure sterile material movement in cleanroom environments, reducing contamination risks. The growing versatility of AMRs across industries highlights their role as a foundational tool for digital transformation and operational resilience.

Regional Analysis

Europe continues to lead the global AMR market in 2025, capturing around 29% of revenue. Germany and France remain key hubs due to their strong automotive and logistics sectors, with firms like BMW, Volkswagen, and DHL pioneering large-scale AMR deployments. The European Union’s push for smart manufacturing and worker safety regulations further supports the region’s leadership. Asia-Pacific, however, is the fastest-growing region. China is at the forefront, with companies like Geek+ and Quicktron deploying AMRs across mega-warehouses and manufacturing hubs. Japan’s robotics giants such as Fanuc and Omron are expanding AMR applications in precision industries, while India and South Korea are rapidly investing in automation to meet surging e-commerce demand. In North America, adoption is fueled by logistics giants such as Amazon and FedEx, which continue to expand robotic fleets across distribution centers. The region also benefits from strong innovation pipelines, with U.S.-based startups like Locus Robotics and 6 River Systems (acquired by Shopify) scaling globally. Together, these dynamics position the global AMR market for accelerated adoption and technological advancement through 2034 and beyond.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Components

- Software

- Hardware

- Services

Type

- Autonomous Inventory Robots

- Self-driving Forklifts

- Goods-to-person picking robots

- Unmanned Aerial Vehicles

Battery Type

- Lithium-Ion Battery

- Lead Battery

- Nickel-Based Battery

- Other Battery Types

End-Use Industry

- Automotive

- Chemical

- Electronics

- Aerospace

- Pharmaceuticals

- Defense

- FMCG

- Other End-Use Industries

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 5.59 B |

| Forecast Revenue (2034) | USD 20.9 B |

| CAGR (2025-2034) | 18.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Components (Software, Hardware, Services), Type (Autonomous Inventory Robots, Self-driving Forklifts, Goods-to-person picking robots, Unmanned Aerial Vehicles), Battery Type (Lithium-Ion Battery, Lead Battery, Nickel-Based Battery, Other Battery Types), End-Use Industry (Automotive, Chemical, Electronics, Aerospace, Pharmaceuticals, Defense, FMCG, Other End-Use Industries) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IAM Robotics, Boston Dynamics, Clearpath Robotics Inc., GreyOrange, Harvest Automation, Stanley Robotics, KUKA AG, Teradyne Inc., ABB Ltd, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Autonomous Mobile Robots (AMR) Market?

The Autonomous Mobile Robots (AMR) Market is projected to grow from USD 4.7 Billion in 2024 to USD 20.9 Billion by 2034, at a CAGR of 18.9%. Rising automation, AI-driven navigation, and Industry 4.0 integration are accelerating AMR adoption in logistics and manufacturing.

Who are the major players in the Autonomous Mobile Robots (AMR) Market?

IAM Robotics, Boston Dynamics, Clearpath Robotics Inc., GreyOrange, Harvest Automation, Stanley Robotics, KUKA AG, Teradyne Inc., ABB Ltd, Other Key Players

Which segments covered the Autonomous Mobile Robots (AMR) Market?

Components (Software, Hardware, Services), Type (Autonomous Inventory Robots, Self-driving Forklifts, Goods-to-person picking robots, Unmanned Aerial Vehicles), Battery Type (Lithium-Ion Battery, Lead Battery, Nickel-Based Battery, Other Battery Types), End-Use Industry (Automotive, Chemical, Electronics, Aerospace, Pharmaceuticals, Defense, FMCG, Other End-Use Industries)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Autonomous Mobile Robots (AMR) Market

Published Date : 06 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date