Aviation Infrastructure Market Size, Forecast, Trends | CAGR 6.2%

Global Aviation Infrastructure Market Size, Share & Analysis Report by Technology (Enabling – IoT, AI, Digital Twins; Operational Tech, Smart Sensors, Cloud Platforms), Component (Hardware, Software, Services), Verticals (Commercial, Cargo, General Aviation, Military), Enterprise Size (Large Enterprises, Government, SMEs), Region & Key Players – Overview, Dynamics, Trends & Forecast 2025–2034

Report Overview

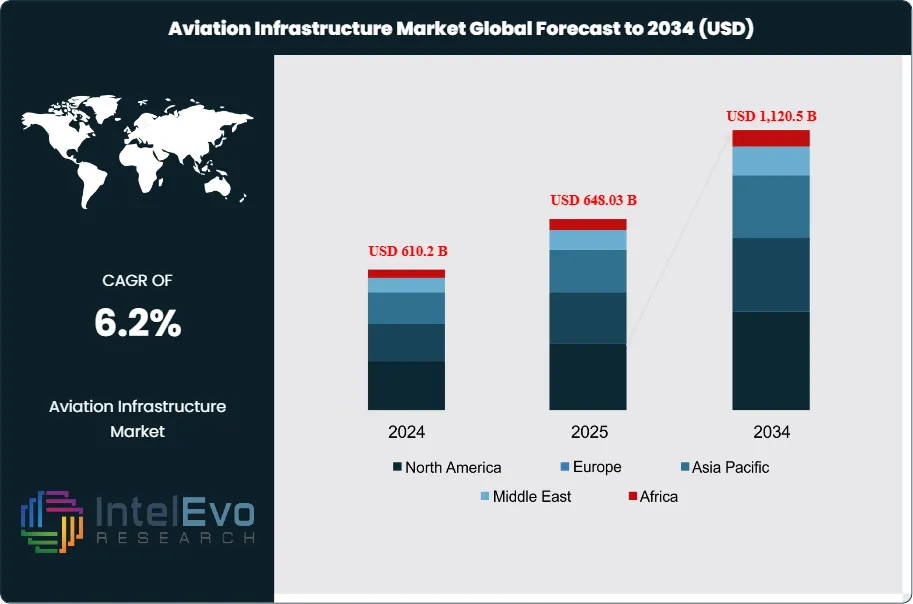

The Aviation Infrastructure Market is projected to reach USD 1,120.5 Billion by 2034, up from USD 610.2 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2024 to 2034. The aviation infrastructure market encompasses the development, modernization, and management of physical and digital assets that support air transportation. This includes airports, runways, terminals, air traffic control systems, ground handling facilities, fueling systems, and integrated digital platforms for operations and passenger management. The ecosystem serves commercial airlines, cargo operators, airport authorities, government agencies, and service providers, enabling safe, efficient, and scalable air travel worldwide.

Get More Information about this report -

Request Free Sample ReportThe market is experiencing robust growth driven by rising global air passenger and cargo traffic, the need for airport capacity expansion, and increasing investments in digital transformation and sustainability. Key growth catalysts include the integration of smart technologies such as IoT, AI, and digital twins for real-time monitoring, predictive maintenance, and passenger experience enhancement. The market also benefits from government initiatives to modernize aviation infrastructure, public-private partnerships, and the growing focus on green airports and carbon-neutral operations.

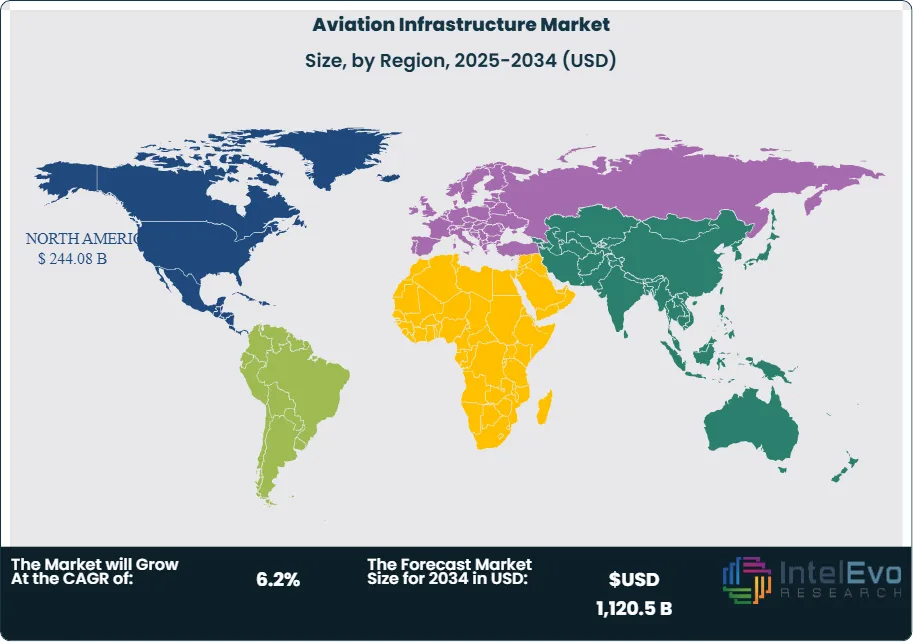

North America maintains its position as the leading regional market for aviation infrastructure, commanding the largest global market share and generating the highest revenues within the sector. This dominance is attributed to early adoption of advanced technologies, a mature aviation ecosystem, and significant capital investments in airport modernization. The United States serves as the primary contributor to North America's market leadership, with substantial revenue generation and strong growth projections. Meanwhile, the Asia-Pacific region emerges as the most rapidly expanding market segment, propelled by rapid urbanization, expanding middle-class populations, and large-scale airport development projects.

The COVID-19 pandemic accelerated digital transformation and automation in aviation infrastructure, as operators sought to ensure operational continuity, passenger safety, and regulatory compliance during periods of reduced travel and heightened health concerns. The crisis highlighted the importance of contactless technologies, remote monitoring, and flexible infrastructure planning. While initial disruptions affected project timelines and funding, the long-term impact has been positive, with increased recognition of digital and resilient infrastructure’s value in supporting recovery and future growth. Rising geopolitical tensions, regulatory changes, and sustainability mandates are influencing investment patterns and technology adoption in the aviation sector. Companies and authorities are prioritizing supply chain resilience, cybersecurity, and compliance with international safety and environmental standards. Additionally, the growing focus on passenger experience, seamless travel, and integrated mobility is driving demand for smart infrastructure solutions that connect air travel with other modes of transportation.

Key Takeaways

- Market Growth: The Aviation Infrastructure Market is expected to reach USD 1,120.5 Billion by 2034, fueled by growing air traffic, airport expansion, and digital transformation.

- Technology Dominance: Enabling technologies such as IoT, AI, and digital twins lead the segment, due to their foundational role in smart infrastructure and operational optimization.

- Component Dominance: Hardware components dominate, driven by the essential role of physical assets (runways, terminals, control towers) and supporting digital systems.

- Enterprise Size Dominance: Large enterprises and government authorities lead, primarily due to higher investment capacity and complex operational requirements.

- Verticals Dominance: Commercial aviation holds the largest share, owing to broad application scope and high passenger/cargo volumes.

- Driver: Key drivers accelerating growth include rising air traffic and the need for capacity expansion, as well as digital transformation for operational efficiency.

- Restraint: Growth is hindered by high capital investment requirements and regulatory complexity, which create barriers to new projects and modernization.

- Opportunity: The market is poised for expansion due to opportunities like smart airport development, sustainability initiatives, and emerging market penetration.

- Trend: Emerging trends including digital twins, contactless technologies, and green airport initiatives are reshaping the market by enabling real-time simulation, seamless travel, and sustainable operations.

- Regional Analysis: North America leads owing to early technology adoption and established aviation infrastructure. Asia-Pacific shows high promise due to rapid urbanization and large-scale airport projects.

Technology Analysis

Enabling Technologies: Enabling technologies such as IoT, artificial intelligence, digital twins, and advanced analytics are at the core of the aviation infrastructure market’s transformation. These technologies empower airports and aviation authorities to monitor operations in real time, predict maintenance needs for critical assets, and enhance the passenger experience through automation and data-driven insights. For example, IoT sensors track everything from runway conditions to baggage flows, while AI algorithms optimize scheduling and resource allocation. Digital twins create virtual replicas of airport systems, allowing operators to simulate scenarios and plan upgrades without disrupting actual operations. The ongoing evolution of smart sensors, cloud computing, and integrated digital platforms is accelerating the adoption of these technologies, fostering continuous innovation and enabling airports to operate more efficiently, safely, and sustainably.

Component Analysis:

Hardware Components: Hardware components form the backbone of aviation infrastructure, playing a crucial role in the construction, operation, and modernization of airports and air traffic systems. This category encompasses runways, terminals, air traffic control towers, baggage handling systems, security screening equipment, and digital communication networks. The demand for robust, high-capacity, and technologically advanced physical assets is driven by the need to ensure safe, efficient, and scalable airport and airspace operations. As air traffic volumes grow and passenger expectations rise, investments in durable and innovative hardware are essential for supporting modernization projects, accommodating new aircraft technologies, and maintaining high standards of safety and service.

Enterprise Size Analysis:

Large Enterprises and Government Authorities Lead Adoption: Large enterprises, airport authorities, and government agencies are the primary drivers of growth in the aviation infrastructure market. Their substantial financial resources, regulatory expertise, and operational complexity position them at the forefront of digital transformation and infrastructure modernization. These organizations are responsible for managing large-scale projects, ensuring compliance with international safety and security standards, and delivering seamless passenger experiences. Their leadership is further reinforced by the need to coordinate multi-stakeholder initiatives, invest in cutting-edge technologies, and maintain a competitive edge in a rapidly evolving industry. As a result, large enterprises and government authorities set the pace for innovation and best practices across the sector.

Verticals Analysis:

Commercial Aviation: Commercial aviation is the dominant vertical within the aviation infrastructure market, driven by the sheer volume of passenger and cargo traffic, frequent airport upgrades, and the imperative for efficient, scalable operations. This segment includes major international and regional airports, terminal expansions, runway construction, air traffic management, and advanced passenger processing systems. The prominence of commercial aviation is underpinned by significant investments in modernization, safety enhancements, and passenger experience improvements. As global air travel continues to recover and expand, commercial aviation will remain the primary focus for infrastructure development and technological innovation.

Region Analysis:

North America leads the global aviation infrastructure market, accounting for nearly 40% of total market share. This leadership is supported by a well-developed network of airports, early adoption of smart technologies, and substantial investments in modernization and expansion. The United States, in particular, plays a pivotal role through large-scale airport projects, digital transformation initiatives, and regulatory leadership that shapes industry standards. Asia-Pacific is the fastest-growing region, propelled by rapid urbanization, a burgeoning middle class, and ambitious airport development programs in countries like China, India, and across Southeast Asia. Governments and private investors in the region are accelerating the construction and modernization of aviation infrastructure to meet rising demand. Europe maintains a strong presence with established aviation hubs, stringent safety and environmental standards, and a focus on sustainability. The region’s adoption of smart infrastructure is influenced by regulatory frameworks, cross-border mobility needs, and active participation from leading technology providers, ensuring continued innovation and competitiveness.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Technology

- Enabling Technology (IoT, AI, Digital Twins)

- Operational Technology

- Smart Sensors

- Cloud Platforms

Component

- Hardware (Runways, Terminals, Control Towers)

- Software (Management Systems, Analytics)

- Services (Consulting, Maintenance)

Verticals

- Commercial Aviation

- Cargo & Logistics

- General Aviation

- Military & Defense

Enterprise Size

- Large Enterprises & Government Authorities

- Small and Medium Enterprises

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 648.03 B |

| Forecast Revenue (2034) | USD 1,120.5 B |

| CAGR (2025-2034) | 6.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Technology (Enabling Technology (IoT, AI, Digital Twins), Operational Technology, Smart Sensors, Cloud Platforms) Component (Hardware (Runways, Terminals, Control Towers), Software (Management Systems, Analytics), Services (Consulting, Maintenance)), Verticals (Commercial Aviation, Cargo & Logistics, General Aviation, Military & Defense) Enterprise Size (Large Enterprises & Government Authorities, Small and Medium Enterprises) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | AECOM, Honeywell International Inc., Siemens AG, Vinci Airports, Ferrovial, GMR Airports, Changi Airports International, Jacobs Engineering Group, SITA, Amadeus IT Group, TAV Airports, Fraport AG, Beijing Capital International Airport Co. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Aviation Infrastructure Market

Published Date : 04 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date