Aviation IoT Market Forecast Size, Trends & Insights| 25.8% CAGR

Global Aviation IoT Market Size, Share & Analysis By Component (Hardware, Software, Services), By Application (Asset Management, Ground Operations, Aircraft Operations, Passenger Experience), By End-User (Airports, Airlines, Aircraft OEM, MRO), Industry Digitization Trends & Forecast 2025–2034

Report Overview

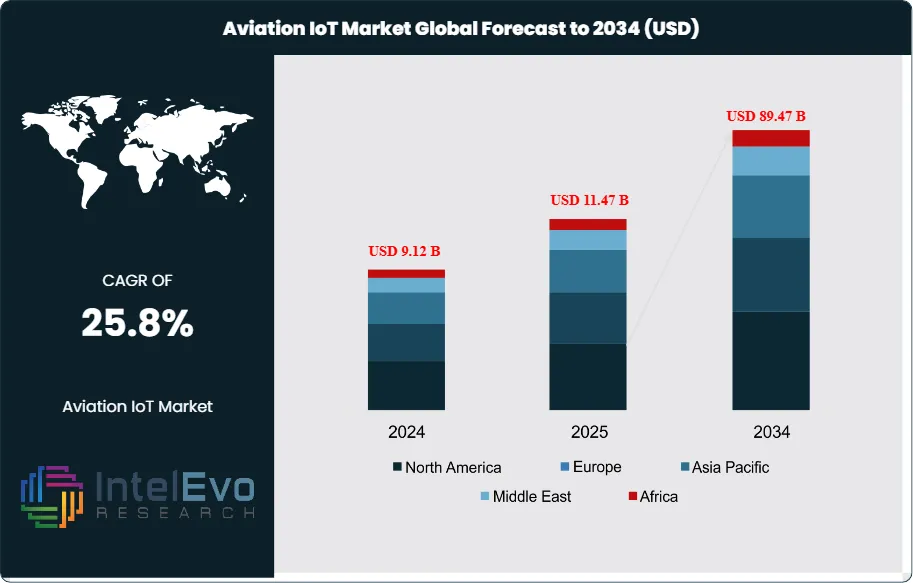

The Aviation IoT Market was valued at approximately USD 9.12 Billion in 2024 and is projected to reach nearly USD 89.47 Billion by 2034, growing at an estimated CAGR of around 25.8% during 2025–2034. AI-driven predictive maintenance, connected aircraft systems, and smart airport infrastructure are accelerating IoT deployment across the aviation ecosystem. From biometric passenger journeys to real-time asset tracking and digital-twin operations, IoT is reshaping efficiency, safety, and profitability. As global air traffic rebounds and airports modernize, Aviation IoT is entering a mass-adoption decade, unlocking powerful new revenue and operational automation opportunities.

Get More Information about this report -

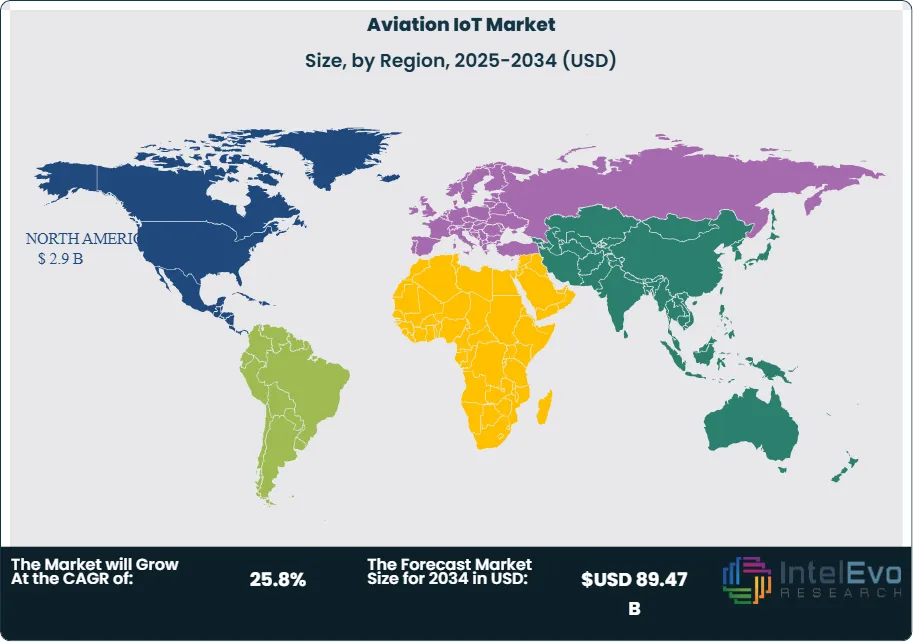

Request Free Sample ReportThis rapid growth reflects the aviation sector’s accelerating adoption of connected technologies to enhance efficiency, safety, and passenger experience. Historically, adoption of digital infrastructure in aviation has lagged behind other sectors, but in recent years the convergence of rising air traffic, operational cost pressures, and regulatory focus on safety has triggered a shift toward IoT-enabled solutions. North America currently leads the market, representing nearly 38% of global revenue in 2024, while Asia-Pacific is expected to emerge as the fastest-growing region as regional carriers and airport authorities expand digitalization efforts.

Multiple factors are propelling this momentum. On the demand side, airlines face persistent challenges around optimizing fuel efficiency, reducing delays, and differentiating customer experiences in an increasingly competitive market. IoT technologies address these pressures through predictive maintenance, real-time aircraft monitoring, biometric passenger processing, and intelligent baggage handling—initiatives that both reduce costs and improve satisfaction. From the supply side, declining sensor costs, improved connectivity, and the maturation of cloud and edge computing platforms have made large-scale IoT deployment more feasible. At the same time, regulatory authorities are encouraging adoption of advanced monitoring and safety systems, adding compliance-driven impetus to investment.

However, the sector also faces challenges, particularly around cybersecurity vulnerabilities, integration with legacy infrastructure, and the capital-intensive nature of large-scale IoT rollouts. Airlines and airports in emerging economies, while highly receptive to IoT, often face financial and operational constraints that can slow adoption. Despite these risks, the long-term opportunity remains compelling.

Technological innovation is at the core of market expansion. The integration of artificial intelligence and machine learning into IoT ecosystems is enabling predictive analytics for maintenance and flight operations, while digital twins are being deployed for real-time simulation of aircraft performance. Smart airport initiatives—from automated check-in kiosks to IoT-driven crowd management—are increasingly viewed as investment hotspots, especially in Asia-Pacific and the Middle East where new airport infrastructure projects are underway. For investors and industry stakeholders, the Aviation IoT market offers a decade of high-growth opportunities, particularly in predictive maintenance, connected airport ecosystems, and passenger experience solutions that are set to redefine the future of global aviation.

Key Takeaways

- Market Growth: The global Aviation IoT market was valued at USD 9.12 Billion in 2024 and is projected to reach USD 89.47 Billion by 2034, expanding at a robust CAGR of 25.8% from 2025 to 2034. Growth is driven by rising demand for predictive maintenance, passenger experience enhancement, and smart airport initiatives.

- Segment Dominance – Hardware: Hardware accounted for the largest share of the market in 2024, representing over 53.3% of global revenue. High adoption of sensors, RFID systems, and connected devices across aircraft and airport operations underscores hardware’s critical role as the backbone of IoT integration.

- Segment Dominance – Application (Asset Management): Asset Management led all applications in 2024 with more than 33.6% market share, reflecting growing reliance on IoT-enabled tracking and monitoring systems to improve fleet utilization, reduce downtime, and optimize airport logistics.

- Segment Dominance – End Use (Airports): Airports captured over 38.5% of market share in 2024, highlighting IoT’s increasing role in airport modernization. Adoption spans across real-time baggage tracking, automated check-ins, and passenger flow management, making airports a primary IoT investment hub.

- Driver: Predictive maintenance powered by IoT-enabled analytics is a major growth accelerator, with airlines reporting up to 30% reduction in unplanned maintenance events. This capability directly enhances safety and reduces operational costs.

- Restraint: Cybersecurity vulnerabilities pose a significant limitation, with aviation industry studies indicating that IoT-related breaches could cost operators millions in compliance, recovery, and reputational damage, slowing adoption among risk-averse players.

- Opportunity: Emerging markets in Asia-Pacific and the Middle East present high-growth potential, with investments in Greenfield airports and connected aviation infrastructure projected to contribute a CAGR above 25% through 2034.

- Trend: Integration of artificial intelligence with IoT platforms is transforming aviation operations, enabling digital twins for aircraft systems and real-time passenger personalization. Industry leaders such as Airbus and Honeywell are already piloting AI-driven IoT ecosystems to enhance efficiency and customer experience.

- Regional Analysis: North America dominated in 2024 with a 37.8% revenue share, generating USD 2.9 billion, supported by advanced digital infrastructure and regulatory support. Asia-Pacific, however, is set to outpace all regions in growth rate, fuelled by rising air traffic, government-backed smart airport projects, and fewer legacy system constraints.

Component Analysis

The hardware segment continues to dominate the Aviation IoT market in 2025, accounting for more than half of total revenues, building on its 53.3% share in 2024. This leadership is underpinned by the indispensable role of sensors, communication modules, and onboard systems that serve as the foundation of connected aviation ecosystems. Airlines and airports are accelerating investments in IoT-enabled hardware as they modernize fleets and ground infrastructure, with global spending on aviation sensors alone projected to surpass USD 12 billion by 2030.

The hardware advantage lies in its direct integration with mission-critical systems. Advanced sensors provide real-time monitoring of aircraft engines, fuel efficiency, and flight parameters, enabling predictive maintenance and regulatory compliance. At the airport level, connected devices track baggage, passenger flows, and security checkpoints, ensuring seamless operations. As digital transformation intensifies, hardware will remain a cornerstone, while software and services gain traction as value-added layers in the IoT ecosystem.

Software and services are, however, forecast to expand at a faster CAGR—exceeding 25% through 2034—driven by demand for analytics platforms, cybersecurity solutions, and cloud-based management systems. As operators increasingly seek to extract actionable insights from massive data volumes, the balance of value creation is expected to gradually shift toward software-enabled intelligence.

Application Analysis

Asset management remains the leading application area, commanding over one-third of the market in 2025, after capturing 33.6% in 2024. Airlines and airports face growing pressure to optimize expensive assets—from aircraft fleets to ground equipment—and IoT-driven tracking and monitoring tools provide the visibility required to minimize downtime. Predictive asset utilization models are projected to reduce maintenance costs by up to 20%, directly boosting profitability.

Beyond asset optimization, IoT adoption in ground operations and aircraft monitoring is accelerating. Ground operations benefit from connected vehicles, automated refueling systems, and real-time logistics coordination, improving turnaround times. Aircraft operations increasingly rely on IoT for continuous health monitoring, reducing unplanned maintenance events by up to 30%. Passenger experience applications are also gaining momentum, particularly with biometric check-ins, smart luggage tracking, and personalized in-flight services, which are becoming differentiators for global carriers.

The growing integration of digital twins in aviation highlights the transformative shift in application scope. By simulating entire airport and aircraft ecosystems, operators can test performance scenarios in real-time, driving operational resilience and efficiency. This convergence signals that applications will evolve beyond asset-centric functions toward a holistic orchestration of the aviation value chain.

End-User Analysis

Airports continue to represent the largest end-user segment in 2025, sustaining their 38.5% market share recorded in 2024. Rapid passenger growth and capacity constraints are compelling airport authorities to adopt IoT for baggage handling, passenger flow optimization, and automated security processes. The International Air Transport Association (IATA) projects passenger volumes to double to nearly 8 billion by 2040, reinforcing airports’ need for scalable digital infrastructure.

Airlines represent another critical end-user group, leveraging IoT to improve operational reliability, safety, and customer loyalty. Predictive analytics, enabled by IoT platforms, allow carriers to preempt disruptions while optimizing fleet performance. Meanwhile, Aircraft OEMs such as Airbus and Boeing are embedding IoT solutions into new aircraft designs, offering operators enhanced connectivity and performance visibility. Maintenance, Repair, and Overhaul (MRO) providers are also emerging as key adopters, using IoT to streamline parts inventory and improve turnaround efficiency.

The convergence of IoT across end-users indicates a shift toward ecosystem collaboration. For instance, integrated platforms that link airlines, airports, and MROs are being piloted to enable data-sharing for improved efficiency and cost savings. This interconnected value network is likely to redefine competitive advantages in the aviation sector over the next decade.

Regional Analysis

North America retains its leading position in 2025, building on its 37.8% share and USD 2.9 billion in revenues from 2024. The region benefits from advanced digital infrastructure, early adoption of IoT by major airlines, and strong regulatory support from bodies such as the FAA. The presence of global technology leaders, combined with high passenger traffic in hubs like Atlanta and Chicago, drives continuous investments in connected aviation solutions.

Europe follows closely, supported by strong emphasis on sustainability and energy-efficient airport operations. European airports are integrating IoT-based energy management systems, reducing energy consumption by up to 20%. Meanwhile, Asia Pacific stands out as the fastest-growing region, with projected CAGRs exceeding 25% through 2034. Large-scale investments in new airport projects in China, India, and Southeast Asia, alongside rising middle-class travel demand, are making the region a hotspot for IoT-enabled aviation infrastructure.

Latin America and the Middle East & Africa are at earlier stages of adoption but offer strong potential. The Middle East is investing heavily in smart airport projects in Dubai, Doha, and Riyadh, while Latin America’s modernization of airports in Brazil and Mexico is laying the groundwork for IoT integration. Collectively, these emerging regions represent significant untapped opportunities for technology providers and investors seeking long-term growth.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Hardware

- Software

- Services

By Application

- Asset Management

- Ground Operations

- Aircraft Operations

- Passenger Experience

By End-User

- Airports

- Airlines

- Aircraft OEM

- MRO

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 9.12 B |

| Forecast Revenue (2034) | USD 89.47 B |

| CAGR (2024-2034) | 25.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Hardware, Software, Services), By Application (Asset Management, Ground Operations, Aircraft Operations, Passenger Experience), By End-User (Airports, Airlines, Aircraft OEM, MRO) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Airbus SE, ZestIoT, Tata Communications Limited, Amazon Web Services, Inc., Argus Systems (AESPL), Cisco Systems, Inc., Oracle Corporation, Huawei Technologies Co., Ltd., IBM Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date