Aviation Passenger Service System Market Size, Share | CAGR of 7.53%

Global Aviation Passenger Service System Market Size, Share, Analysis Report By Component (Services, Software), Deployment Type (On-premise, Cloud-based), Application Area (Departure Control Systems, Reservation Systems, Inventory Control Systems), End User (Airlines, Airport Authorities, Travel Agencies, Ground Handling Services) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

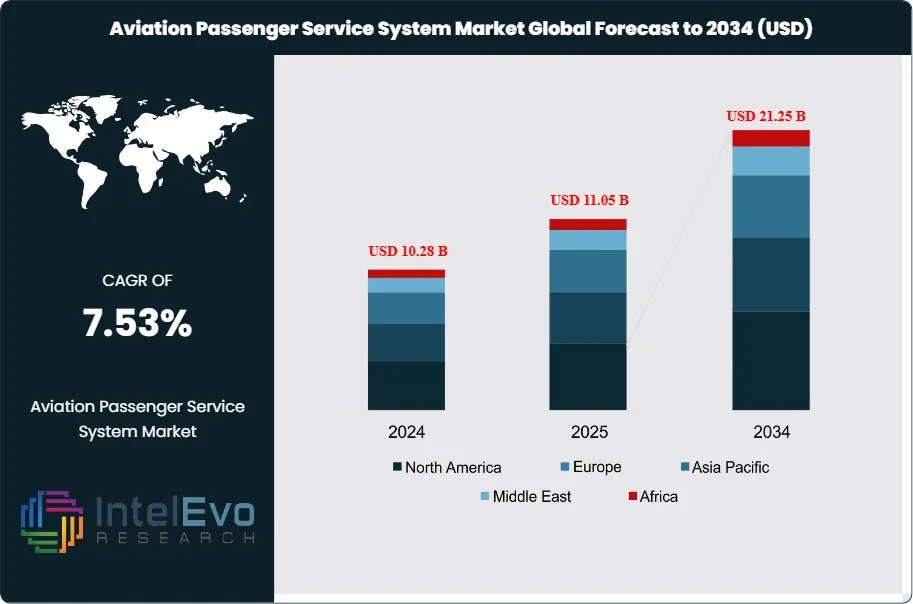

The Aviation Passenger Service System Market size is expected to be worth around USD 21.25 Billion by 2034, from USD 10.28 Billion in 2024, growing at a CAGR of 7.53% during the forecast period from 2024 to 2034. The Aviation Passenger Service System (PSS) market comprises integrated software and service solutions that enable airlines to effectively manage passenger-related operations, from booking to boarding. These systems unify various functionalities including reservation management, departure control, inventory, and customer service into comprehensive platforms that streamline airline workflows while enhancing passenger experiences. The market is witnessing robust growth due to rising global air travel demand, accelerated digital transformation within the aviation sector, and a strong emphasis on operational efficiency.

Get More Information about this report -

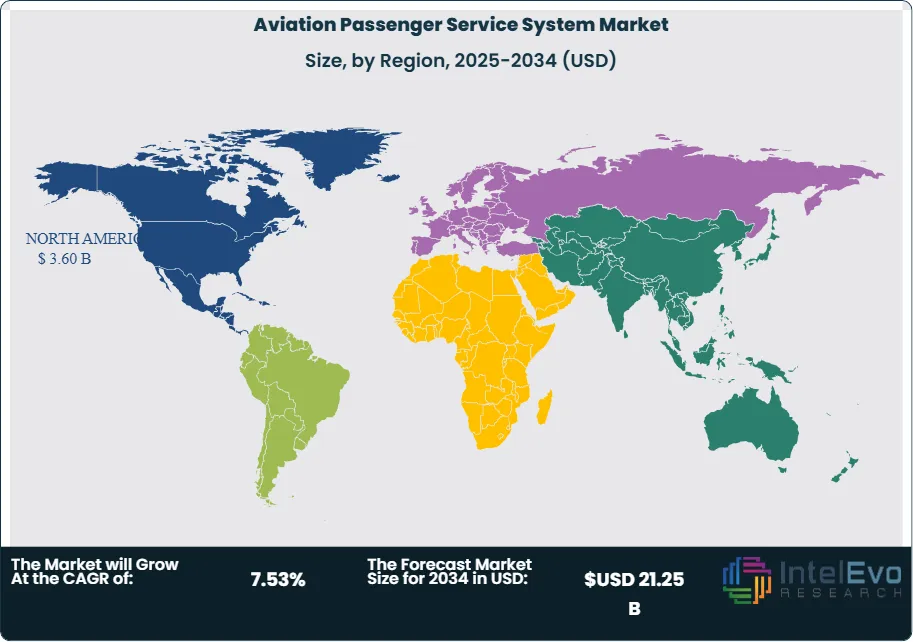

Request Free Sample ReportNorth America holds a dominant position in the market, this leadership stems from the region’s advanced aviation infrastructure, the presence of major airline carriers, early adoption of innovative technologies, and stringent regulatory standards focused on security and data privacy. Airlines and airports in North America are heavily investing in upgrading PSS platforms to support increased passenger traffic, enhance operational agility, and provide personalized travel experiences through cloud computing, mobile solutions, AI, and machine learning applications. Asia-Pacific emerges as the fastest-growing region, propelled by expanding middle-class populations, greater air travel accessibility, and substantial infrastructure investments in emerging economies such as India, China, and Japan. The regional growth is further catalyzed by rapid digitalization and airlines’ efforts to modernize their systems to address rising passenger volumes and evolving service expectations.

The COVID-19 pandemic served as a pivotal moment, accelerating adoption of contactless services, self-service kiosks, and cloud-based PSS solutions to minimize physical interactions and improve hygiene protocols. These digital shifts have helped restore passenger confidence and enhance operational resilience across the industry.

However, recent geopolitical tensions and US tariffs have increased implementation costs and complicated vendor selection strategies. Airlines increasingly seek diversified technology partnerships and regional alternatives to mitigate supply chain disruptions and maintain continuous service delivery. Despite these challenges, the PSS market outlook remains positive, supported by ongoing technological innovations such as AI-driven predictive analytics, real-time personalization, and enhanced security measures, which are enabling airlines to boost customer satisfaction, reduce costs, and maintain competitive advantage in a dynamic aviation landscape. The global Aviation Passenger Service System market is expected to grow steadily over the coming decade, reflecting its critical role in the future of air travel management and passenger experience enhancement.

Key Takeaways

- Market Growth: The Aviation Passenger Service System Market is expected to reach USD 21.25 Billion by 2034, due to its advanced infrastructure, major airline presence, early tech adoption, and strict security regulations, with significant investments in next-gen digital solutions.

- Component Dominance: Software leads the component segment due to comprehensive functionality and cost-effectiveness.

- Deployment Type Dominance: Cloud-based solutions dominate the deployment segment, driven by flexibility and reduced infrastructure requirements.

- Application Area Dominance: Reservation systems hold the largest share in the application segment, owing to their core business functionality.

- End User Dominance: Airlines are the leading users, leveraging PSS for efficient passenger management and enhanced customer experience, while airport authorities and ground handling services use these systems to streamline operations.

- Drivers: Key drivers accelerating growth include digital transformation initiatives and increasing air travel demand, which boost market expansion through operational efficiency improvements and enhanced passenger experiences.

- Restraints: Growth is hindered by high implementation costs and system integration complexities, which create challenges such as extended deployment timelines and resource allocation difficulties.

- Opportunities: The market is poised for expansion due to opportunities like AI integration and emerging market growth, which enable advanced personalization and operational optimization.

- Trends: Emerging trends including cloud migration and AI implementation are reshaping the market by enhancing system capabilities and reducing operational dependencies.

- Regional Leader: North America leads owing to established infrastructure and technology adoption. Asia-Pacific and Latin America show high promise due to expanding aviation sectors and infrastructure investments.

Component Analysis:

The component segment divides into software and services, with software commanding the dominant position due to its comprehensive functionality and cost-effectiveness. Software solutions provide integrated platforms that manage multiple passenger service functions simultaneously, offering airlines scalable solutions that can adapt to varying operational requirements. The software segment's leadership stems from its ability to deliver immediate operational benefits, reduce manual processes, and provide data-driven insights that enhance decision-making capabilities across airline operations.

Deployment Type Analysis:

Cloud-based deployment has emerged as the leading approach, capturing majority market share through its superior flexibility, reduced infrastructure requirements, and enhanced accessibility. Airlines are increasingly migrating from traditional on-premise systems to cloud-based solutions to achieve better scalability, cost-effectiveness, and operational agility. This shift enables airlines to respond more quickly to market changes, reduce IT infrastructure costs, and access advanced features without significant hardware investments, making cloud deployment the preferred choice for both established carriers and emerging airlines.

Application Area Analysis:

Reservation Systems Leads With over 40% Market Share In Aviation Passenger Service System Market: Reservation systems maintain their position as the largest application segment, serving as the core revenue-generating function that directly impacts airline profitability and customer satisfaction. These systems handle booking management, pricing optimization, inventory control, and customer relationship management, making them essential for airline operations. The segment's dominance reflects the critical importance of reservation functionality in airline business models, where efficient booking processes directly translate to revenue optimization and enhanced customer experiences that drive competitive advantage.

End User Analysis:

Airlines remain the primary end users in the Aviation Passenger Service System market, investing heavily in advanced solutions to manage bookings, check-ins, and passenger services efficiently. Airport authorities utilize PSS to coordinate operations like ticketing, baggage handling, and resource allocation to improve airport efficiency. Travel agencies rely on PSS for seamless access to multiple airline reservation systems, enabling superior customer service and fare management. Ground handling services use these systems to optimize turnaround times and service quality for aircraft and passengers. Together, these end users drive strong demand for integrated and technologically advanced PSS solutions that enhance operational efficiency, improve passenger experience, and support the aviation industry's rapid growth and digitization trends.

Regional Analysis:

North America Leads With more than 35% Market Share In Aviation Passenger Service System Market: North America leads the global Aviation Passenger Service System market with a commanding significant market share, driven by its mature aviation infrastructure, high air traffic volumes, and early adoption of advanced technologies. The region benefits from established airline operations, stringent regulatory requirements that necessitate sophisticated systems, and a strong technology ecosystem that supports innovation. Major airlines like American Airlines, Delta, and United maintain significant global market presence, driving demand for advanced passenger service solutions.

Asia-Pacific represents the fastest-growing regional market, fueled by rapidly expanding middle-class populations, increasing air travel accessibility, and substantial infrastructure investments across emerging economies. Countries like India are planning to construct 100 new airports with investments approaching $60 billion, creating significant opportunities for passenger service system providers. The region's growth is supported by rising disposable incomes, urbanization trends, and government initiatives to enhance aviation connectivity.

Europe maintains a stable market position with steady growth driven by established aviation networks, regulatory harmonization, and technological advancement initiatives. Latin America and the Middle East & Africa regions show moderate growth potential, supported by ongoing aviation sector developments and increasing air travel demand, though growth rates remain below those of Asia-Pacific markets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Component:

- Services

- Software

Deployment Type:

- On-premise

- Cloud-based

Application Area:

- Departure Control Systems

- Reservation Systems

- Inventory Control Systems

End User:

- Airlines

- Airport Authorities

- Travel Agencies

- Ground Handling Services

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 11.05 B |

| Forecast Revenue (2034) | USD 21.25 B |

| CAGR (2025-2034) | 7.53% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Services, Software), Deployment Type (On-premise, Cloud-based), Application Area (Departure Control Systems, Reservation Systems, Inventory Control Systems), End User (Airlines, Airport Authorities, Travel Agencies, Ground Handling Services) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Amadeus IT Group, SITA NV, Sabre Corporation, Travelport Worldwide, Radixx International, IBS Software Services, Hitit Computer Services, Bravo Passenger Solutions, KIU System Solutions, TravelSky Technology Ltd., Hexaware Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Aviation Passenger Service System Market

Published Date : 18 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date