Avocado Oil Market 2024–2034 | Growth Outlook & 7.2% CAGR Trends

Global Avocado Oil Market Size, Share & Analysis By Type (Extra Virgin Avocado Oil, Virgin Avocado Oil, Refined Avocado Oil, Crude Avocado Oil, Organic Avocado Oil, Cold-Pressed Avocado Oil), By Application (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Industrial Uses), By Distribution Channel, By Source, By End-User, By Extraction Method, Industry Regions & Key Players – Health & Wellness Trends & Forecast 2025–2034

Report Overview

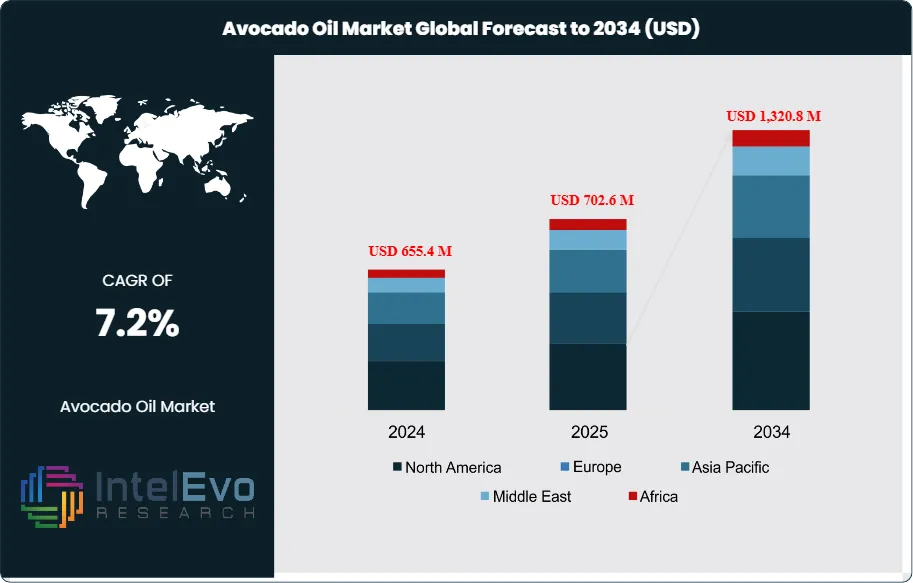

The Avocado Oil Market is valued at approximately USD 655.4 million in 2024 and is projected to reach nearly USD 1,320.8 million by 2034, expanding at a steady CAGR of about 7.2% from 2025–2034. Demand is being driven by rising consumer preference for clean-label, nutrient-rich cooking oils and the increasing use of avocado oil in skincare, nutraceuticals, and premium food segments. Its high smoke point, antioxidant profile, and heart-health benefits continue to attract both health-conscious households and gourmet culinary brands. With social media wellness trends, expanding retail penetration, and the growing popularity of natural beauty oils, the avocado oil market is rapidly trending across food, cosmetic, and functional wellness industries.

Get More Information about this report -

Request Free Sample ReportYou are looking at a category that has shifted from niche to mainstream. Retail shelves and foodservice now carry more cold-pressed and refined lines, while personal care brands add avocado oil into skin and hair formulations. The market tracks the broader avocado supply chain; availability of fruit sets the ceiling for oil output. Trade flows remain supportive. In 2023, global trade in major tropical fruits, including avocados, reached USD 11.2 billion, up 12 percent year over year. Mexico strengthened its position with a 20 percent rise in avocado exports to about 3.0 million metric tons, anchored by resilient U.S. demand. U.S. avocado imports grew at roughly 8 percent per year between 2012 and 2022. In Europe, the Netherlands and Spain expanded import volumes at 14 percent and 20 percent annually, building distribution hubs that matter for oil processors. The Philippines recorded USD 17.11 million in exports to the United States, signaling new routes for buyers to watch.

Health and wellness trends drive demand. Avocado oil’s high share of monounsaturated fats and vitamins underpins premium positioning in cooking oils and cosmetics. Supply-side momentum comes from more efficient extraction and better fruit grading. Producers report yield gains of 2 to 4 percentage points as plants adopt mechanical cold pressing and solvent-free processes. Automation in bottling reduces wastage and improves batch consistency. AI tools support harvest forecasting and line monitoring. Blockchain pilots improve traceability and auditability across farms, mills, and distributors.

You should weigh risks alongside growth. Weather variability, water constraints, and disease cycles can tighten fruit supply and lift prices. Quality dispersion and adulteration risks require strict specifications and third-party testing. Regulatory attention is rising; pesticide residue limits in the EU and labeling requirements in North America tighten compliance needs. Currency swings in Mexico and emerging exporters can affect margins.

Capital will continue to follow scale and logistics. Mexico and the United States remain core. Spain and the Netherlands serve as European gateways. Emerging investment hotspots include Peru, Colombia, and Kenya given expanding acreage and access to ports. For investors, integrated sourcing, certified sustainability, and tech-enabled traceability will differentiate returns over the next decade.

Key Takeaways

- Market Growth: The global avocado oil market was USD 655.4 million in 2024 and is projected to reach USD 1,320.8 million at a 7.2% CAGR. Growth is anchored by health-focused cooking, clean-label personal care, and better supply chain integration.

- Product Type: Extra Virgin Avocado Oil led with 38.4% share in 2023. Cold-press positioning and higher nutrient retention support a price premium and stronger repeat purchase in retail.

- Application: Food and Beverage held 48.5% share in 2023. You see steady household adoption and wider foodservice use for dressings, sautéing, and high–smoke point cooking.

- Driver: Expanding fruit availability and trade flows lift oil throughput. Global trade in major tropical fruits, including avocados, reached USD 11.2 billion in 2023, up 12% year over year; U.S. avocado imports grew about 8% per year from 2012 to 2022.

- Restraint: Supply volatility and compliance risk pressure margins. Weather and disease cycles in key origins can reduce usable fruit by low double digits year to year, while tighter EU residue limits and North American labeling rules raise testing and certification costs.

- Opportunity: Beauty and nutraceutical uses present headroom. These channels could contribute roughly USD 250–300 million of the market’s incremental USD 489 million growth through 2033 if current brand pipeline launches and retail placements sustain.

- Trend: Processing upgrades improve yield and traceability. Mechanical cold pressing and solvent-free lines have delivered 2–4 percentage point oil-yield gains; pilots using AI for harvest forecasting and blockchain for batch-level tracking are scaling across mills and bottlers.

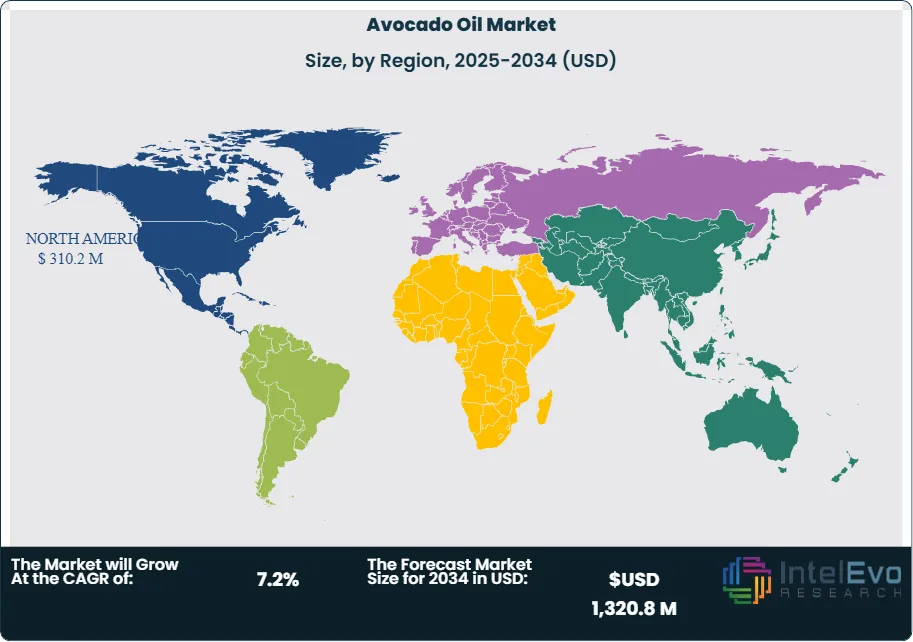

- Regional Analysis: North America led with 51.2% share in 2023, supported by Mexico’s export growth of 20% to around 3.0 million metric tons and resilient U.S. demand. Europe is the next center to watch as the Netherlands and Spain recorded import growth of 14% and 20% annually, while emerging supply from Peru, Colombia, Kenya, and the Philippines (USD 17.11 million in exports to the U.S. in 2023) broadens sourcing options.

Product Type Analysis

Extra Virgin Avocado Oil remains the anchor of category value. It held 38.4% share in 2023 and continues to lead in 2025 as retailers expand cold-pressed assortments and organic lines. You see a clear price ladder. Extra virgin commands a 15–25 percent premium over refined grades in most markets due to minimal processing and stronger flavor cues.

Refined Avocado Oil grows with high-heat cooking and foodservice use. Its neutral taste and higher smoke point suit sautéing and frying, which supports steady volume gains through 2025. Expect private labels and club formats to broaden reach; operators favor refined for cost control and consistent performance.

Virgin Avocado Oil holds a balanced position between price and quality. It attracts value-seeking buyers in both culinary and personal care. Blends with canola, sunflower, or olive oil extend affordability and help brands seed entry-level demand in price-sensitive channels. Blends also help stabilize supply when fruit availability tightens.

Application Analysis

Food and Beverage remains the largest application with 48.5% share in 2023 and sustained growth into 2025. Household adoption rises as consumers shift from seed oils and seek high-monounsaturated options. Refined grades gain traction in hot-prep, while extra virgin grows in dressings and finishing.

Cosmetics and Skincare expand as brands add avocado oil to moisturizers, serums, and hair care for emollient and vitamin E claims. You can expect continued new product introductions and D2C launches that favor traceable, cold-pressed inputs. Batch-level audits and allergen controls have become common buyer requirements.

Pharmaceuticals and Dietary Supplements remain smaller but accelerate as clinical exploration of anti-inflammatory and antioxidant properties advances. Softgels and functional blends with omega-3s add incremental value. Combined, these health-led uses are among the fastest growers toward 2030.

Distribution Channel Analysis

Supermarkets and Hypermarkets held 36.5% share in 2023 and continue to set category pricing and shelf standards. Expanded facings for extra virgin and refined, plus clearer label hierarchies, improve trade-up. Your near-term growth comes from better placement in cooking oil aisles and natural sets.

Convenience Stores contribute stable, impulse-driven sales through smaller packs and travel sizes. Range is narrower than grocery, but proximity and immediacy sustain turns in urban locations. Online Retail scales fastest as shoppers compare prices, formats, and certifications. Subscriptions for pantry staples and beauty items boost repeat rates; online already accounts for a meaningful share in North America and selected EU markets. Other specialty outlets, including health food stores and direct-to-consumer sites, curate organic and non-GMO lines and attract label-sensitive buyers.

Regional Analysis

North America leads with 51.2% share in 2023, or about USD 310.2 million, supported by strong U.S. demand and steady fruit flows from Mexico. You should plan around stable premium retail demand and expanding foodservice use through 2025. Europe follows with rising penetration in the United Kingdom, Germany, Spain, and the Netherlands. Import hubs in Spain and the Netherlands improve availability and shorten lead times for processors.

Asia Pacific delivers the fastest unit growth as middle-income households increase spending on healthier oils and natural beauty. China, Japan, South Korea, and Australia see wider placement across grocery and e-commerce. Local bottling in Australia and emerging Southeast Asian hubs supports price competitiveness.

Latin America builds on supply strengths in Mexico, Peru, Colombia, Chile, and Brazil. MEA remains smaller but grows with premium grocery expansion in the Gulf and niche beauty demand in South Africa. Across origins, producers invest in mechanical cold pressing, solvent-free extraction, and digital traceability. These moves lift yields by 2–4 percentage points and improve quality assurance when harvest volatility tightens supply.

Get More Information about this report -

Request Free Sample ReportMarket Segment

By Type

- Extra Virgin Avocado Oil

- Virgin Avocado Oil

- Refined Avocado Oil

- Crude Avocado Oil

- Organic Avocado Oil

- Cold-Pressed Avocado Oil

By Application

- Food & Beverages

- Cooking oils

- Salad dressings

- Functional & health foods

- Cosmetics & Personal Care

- Skincare formulations

- Haircare products

- Pharmaceuticals

- Topical formulations

- Therapeutic excipients

- Nutraceuticals

- Dietary supplements

- Functional capsules & softgels

- Industrial Uses

- Lubricants

- Specialty bio-based products

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores (Organic & Gourmet)

- Online Retail / E-commerce

- Direct Sales / B2B Retail

By Source

- Hass Avocado

- Fuerte Avocado

- Others

- Bacon

- Zutano

- Pinkerton

- Reed

- Lamb Hass

By End-User

- Household / Residential

- Commercial Foodservice

- Hotels

- Restaurants

- Cafés

- Cosmetic Manufacturers

- Pharmaceutical Companies

- Nutraceutical Companies

By Extraction Method

- Cold Pressed Extraction

- Solvent Extraction

- Centrifugal Extraction

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 655.4 M |

| Forecast Revenue (2034) | USD 1,320.8 M |

| CAGR (2024-2034) | 7.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Extra Virgin Avocado Oil, Virgin Avocado Oil, Refined Avocado Oil, Crude Avocado Oil, Organic Avocado Oil, Cold-Pressed Avocado Oil), By Application (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Industrial Uses), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores (Organic & Gourmet), Online Retail / E-commerce, Direct Sales / B2B Retail), By Source (Hass Avocado, Fuerte Avocado, Others (Bacon, Zutano, Pinkerton, etc.)), By End-User (Household / Residential, Commercial Foodservice (Hotels, Restaurants, Cafés), Cosmetic Manufacturers, Pharmaceutical Companies, Nutraceutical Companies), By Extraction Method (Cold Pressed Extraction, Solvent Extraction, Centrifugal Extraction) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Grupo Industrial Batellero, Spectrum Organics Products, LLC, The Village Press, Olivado USA, Sesajal S.A de C.V., Bella Vado Inc., La Tourangelle, Inc., Proteco Gold Pty Ltd., Grove Avocado Oil, Cibaria International |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date