B2B Laptop & PC Market Size, Share & Growth Forecast | 7.9% CAGR

Global B2B Laptop & PC Market Size, Share & Analysis By Product (Laptops, Desktop PCs, Workstations, Netbooks, Tablet PCs, HDMIs, Handheld Computers), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical (IT & Telecommunication, Financial Services, Healthcare, Education, Manufacturing, Retail & E-commerce, Media & Entertainment) Industry Regions & Key Players – Enterprise IT Refresh Cycles & Forecast 2025–2034

Report Overview

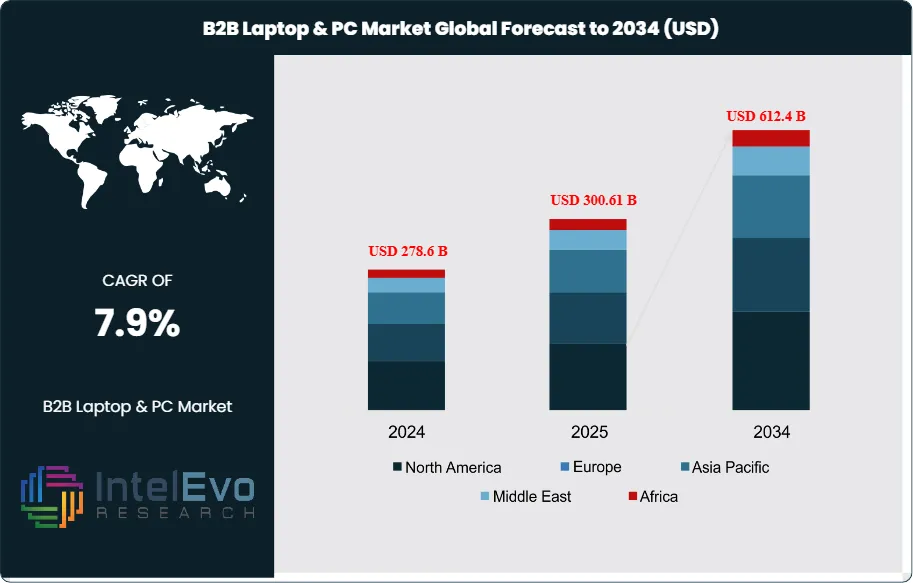

The B2B Laptop & PC Market is projected to grow from USD 278.6 Billion in 2024 to approximately USD 612.4 Billion by 2034, expanding at a CAGR of around 7.9% during 2025–2034. Business digital transformation and remote work adoption continue to boost corporate demand for high-performance laptops and PCs. The rise of AI-enabled devices, cloud computing integration, and enterprise-grade security systems is reshaping procurement preferences. Growing IT spending across SMEs and large enterprises globally is further accelerating market expansion. This driven by accelerated digital transformation and enterprise adoption of hybrid work models, offering strategic opportunities for technology providers, investors, and IT infrastructure leaders.

Get More Information about this report -

Request Free Sample ReportThe market is undergoing rapid expansion as businesses across industries increasingly rely on digital platforms to streamline operations, strengthen productivity, and secure data-driven decision-making. Enterprises are prioritizing hardware upgrades to align with cloud-first strategies and advanced analytics initiatives, making high-performance laptops and PCs essential for day-to-day operations. The growing influence of hybrid and remote working has further heightened demand for portable, secure, and scalable computing solutions capable of ensuring seamless connectivity across distributed teams.

A key driver of market growth is the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics into enterprise workflows. Business-grade devices are increasingly being equipped with AI-driven functionalities, including predictive maintenance, automated security, and intelligent power optimization, which enhance both productivity and long-term device efficiency. Simultaneously, the adoption of bring-your-own-device (BYOD) policies is reinforcing the need for enterprise-ready hardware with robust security frameworks and cloud integration.

The competitive landscape is also shaped by rising demand from small and medium-sized enterprises (SMEs), which are scaling digital infrastructure to compete in a data-centric economy. This is driving preferences for lightweight, durable, and energy-efficient laptops designed to support complex business applications at cost-effective price points. Sustainability has emerged as another critical market force, with nearly one-quarter of B2B buyers factoring environmental impact into procurement decisions by 2023. Manufacturers are responding with eco-certified designs, recycled materials, and energy-efficient processors, aligning with corporate ESG objectives and regulatory requirements.

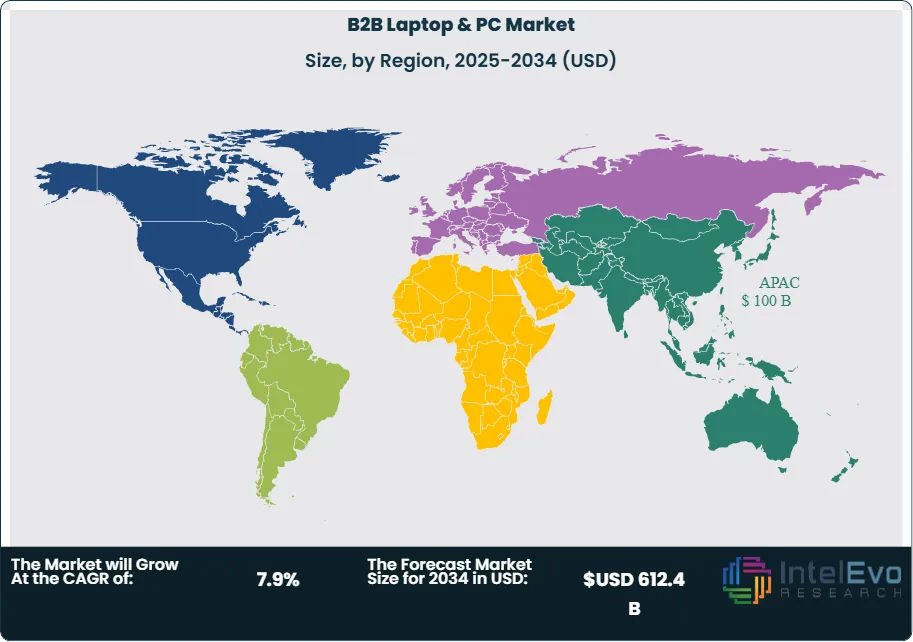

Regionally, North America and Europe remain leading markets due to early AI adoption and strict compliance standards, while Asia Pacific is the fastest-growing hub, supported by SME expansion, IT outsourcing, and government-backed digitalization initiatives. Industries such as finance, engineering, and creative sectors are fueling demand for premium devices with advanced processing power and security, further elevating opportunities for innovation.

Overall, the B2B Laptop & PC Market in 2025 and beyond is defined by the convergence of performance, security, sustainability, and AI innovation. Companies that align product portfolios with these evolving enterprise needs are best positioned to capture sustained demand and global investment momentum.

Key Takeaways

- Market Growth: The Global B2B Laptop & PC Market is projected to reach USD 612.4 Billion by 2034, up from USD 278.6 Billion in 2024, registering a CAGR of 7.9% during 2025–2035. Growth is driven by digital transformation initiatives, hybrid work adoption, and enterprise demand for secure, high-performance devices.

- Product Type: Laptops accounted for over 38.5% of total market share in 2023, driven by enterprise demand for mobility, lightweight form factors, and longer battery life. PCs continue to serve specialized applications requiring higher processing power.

- Enterprise Size: Large enterprises led the market in 2023 with a 69.4% share, reflecting greater investment capacity in advanced IT infrastructure and premium business laptops with enhanced security features. SMEs, however, represent a fast-growing segment as they digitize operations.

- Industry Vertical: The IT & Telecommunications sector captured more than 28.5% of market revenue in 2023, supported by strong demand for scalable computing solutions and rapid workforce expansion in global tech hubs. Finance and engineering sectors also exhibit significant demand for premium, high-performance laptops.

- Driver: The accelerated shift toward cloud computing and adoption of AI, ML, and analytics platforms is compelling businesses to upgrade hardware, fostering continuous demand for advanced B2B laptops and PCs.

- Restraint: High device replacement costs and increasing reliance on mobile-first solutions, such as tablets and smartphones, are limiting market penetration in cost-sensitive regions.

- Opportunity: Sustainability-focused procurement is creating opportunities for manufacturers offering energy-efficient, recyclable, and eco-certified devices. As of 2023, 25% of B2B buyers considered environmental impact a key purchasing criterion.

- Trend: AI integration is a rising trend, with over 41% of B2B laptops and PCs expected to feature AI-driven functionalities such as predictive maintenance and automated security by 2024, enhancing efficiency and security for enterprises.

- Regional Analysis: North America and Europe remain leading markets due to mature IT ecosystems and strict data compliance regulations, while Asia Pacific is emerging as the fastest-growing region, fueled by SME expansion, digital infrastructure investment, and rising IT outsourcing hubs in India, China, and Southeast Asia.

Product Segment Analysis

As of 2025, laptops continue to lead the global B2B Laptop & PC Market, accounting for more than one-third of overall revenue. Their dominance is supported by the ongoing shift toward hybrid work, the need for lightweight yet high-performance devices, and growing enterprise adoption of mobility-driven solutions. Desktop PCs maintain a sizeable market share, particularly in corporate environments that value cost efficiency, hardware durability, and ease of scaling through bulk deployments.

Workstations retain a stable presence, serving industries that rely on high-end computing power, including engineering, architecture, finance, and media production. Tablet PCs are steadily gaining traction due to their portability and ability to integrate seamlessly with mobile enterprise applications, making them well-suited for education, retail, and field operations. Meanwhile, netbooks and handheld computers remain niche categories, targeting budget-conscious organizations and industries such as logistics and warehousing where mobility and real-time data access are critical. In addition, demand for HDMIs and related peripherals continues to expand as enterprises embrace multi-monitor setups to enhance productivity in hybrid offices. Collectively, these product segments illustrate how functionality, mobility, and cost-efficiency are shaping B2B hardware adoption.

Enterprise Size Segment Analysis

Large enterprises continue to dominate the B2B laptop and PC space in 2025, representing more than two-thirds of global demand. Their leadership stems from substantial IT budgets, global workforce expansion, and extensive digital transformation strategies that require robust investments in laptops, desktops, and workstations. Multinational corporations are increasingly procuring premium business laptops equipped with advanced security features, AI-driven performance optimization, and enhanced durability to align with long-term IT infrastructure planning.

Small and Medium Enterprises (SMEs), while a smaller segment in absolute terms, represent the fastest-growing demand base. Their growth is fueled by the adoption of cost-effective laptops and tablet PCs that support mobility, cloud-based operations, and flexible working environments. SMEs are also showing increasing interest in sustainable computing solutions, balancing affordability with eco-friendly procurement practices. Together, both enterprise segments highlight contrasting yet complementary growth patterns: large firms drive volume and high-value purchases, while SMEs shape demand through agility and rapid technology adoption.

Industry Vertical Segment Analysis

By 2025, IT & Telecommunications continues to hold the largest share of the B2B Laptop & PC Market, accounting for over 28% of revenue. The sector’s reliance on advanced computing solutions for software development, data centers, and network infrastructure makes it a consistent growth driver. Financial services represent another key vertical, as institutions invest heavily in secure, high-speed systems to support analytics, regulatory compliance, and real-time transactions.

Healthcare organizations are expanding their reliance on laptops and tablets to support electronic health records (EHRs), diagnostic imaging, and telemedicine platforms. Education is another fast-growing vertical, with institutions scaling digital learning initiatives and equipping teachers and students with portable devices. Manufacturing firms continue to leverage high-performance desktops and workstations to enable automation, product design, and digital twin applications, while retail and e-commerce players adopt portable solutions for supply chain management, inventory tracking, and customer engagement. Media & Entertainment industries remain among the highest users of specialized workstations for content creation, visual effects, and video editing. Beyond these, diverse sectors such as government and logistics also contribute steadily to overall market demand, reinforcing the universal role of computing hardware in enterprise operations.

Regional Analysis

In 2025, Asia-Pacific stands out as the fastest-growing regional market, expected to surpass USD 100 Billion in value by the end of the year. The region benefits from rapid industrialization, widespread SME digitization, and rising IT expenditure in China, India, and Southeast Asian economies. Government-led initiatives supporting digital infrastructure and education also add momentum to the adoption of enterprise-grade laptops and PCs.

North America continues to account for roughly one-third of global market revenue, supported by advanced IT infrastructure, strong enterprise procurement, and early adoption of AI-driven computing systems. Europe, meanwhile, is distinguished by its strong emphasis on sustainability, where enterprises are increasingly demanding energy-efficient and eco-certified devices to align with environmental regulations. Latin America and the Middle East & Africa, while still emerging markets, are showing steady growth as enterprises in these regions ramp up IT spending to modernize operations and integrate digital solutions. Collectively, regional variations reflect a balance between mature markets focused on sustainability and performance, and fast-emerging economies driving volume growth through expanding digital ecosystems.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product

- Laptops

- Desktop PCs

- Workstations

- Netbooks

- Tablet PCs

- HDMIs

- Handheld Computers

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- IT & Telecommunication

- Financial Services

- Healthcare

- Education

- Manufacturing

- Retail & E-commerce

- Media & Entertainment

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 278.6 B |

| Forecast Revenue (2034) | USD 612.4 B |

| CAGR (2024-2034) | 7.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Laptops, Desktop PCs, Workstations, Netbooks, Tablet PCs, HDMIs, Handheld Computers), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical (IT & Telecommunication, Financial Services, Healthcare, Education, Manufacturing, Retail & E-commerce, Media & Entertainment, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | HP Inc., Lenovo Group Limited, Sony Corporation, ASUSTek Computer Inc., Apple Inc., Toshiba Corporation, Acer Inc., Dell Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the B2B Laptop & PC Market?

The B2B Laptop & PC Market is expected to grow from USD 278.6 Billion in 2024 to USD 612.4 Billion by 2034, at a CAGR of 7.9%. Increasing enterprise digital transformation, remote work expansion, and adoption of AI-enabled computing are driving strong market growth worldwide.

Who are the major players in the B2B Laptop & PC Market?

HP Inc., Lenovo Group Limited, Sony Corporation, ASUSTek Computer Inc., Apple Inc., Toshiba Corporation, Acer Inc., Dell Inc., Other Key Players

Which segments covered the B2B Laptop & PC Market?

By Product (Laptops, Desktop PCs, Workstations, Netbooks, Tablet PCs, HDMIs, Handheld Computers), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical (IT & Telecommunication, Financial Services, Healthcare, Education, Manufacturing, Retail & E-commerce, Media & Entertainment, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date