Battery Material Market Size, Share & Forecast 2034 | 8.1% CAGR

Global Battery Material Market Size, Share, Analysis Report By Battery Type (Lead acid, Lithium-ion, Others), Material (Anode, Electrolyte, Cathode, Binder, Others), End-User (Consumer Electronics, Automotive, Industrial, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

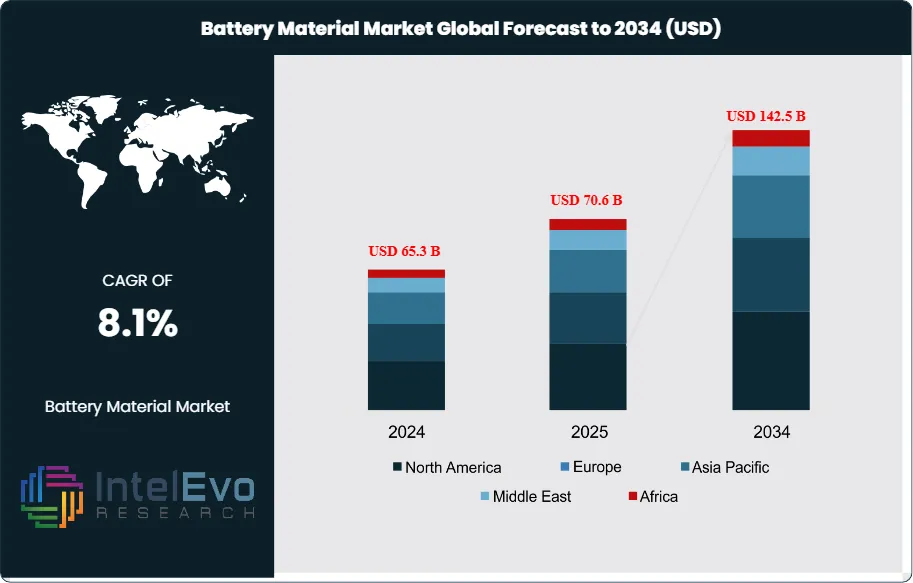

The Battery Material Market size is expected to be worth around USD 142.5 billion by 2034, from USD 65.3 billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. Rising electric vehicle (EV) adoption, growing renewable energy storage demand, and continuous advancements in lithium-ion and solid-state batteries are fueling the growth of the battery material industry worldwide. With sustainability and innovation at its core, the market is paving the way for a cleaner, energy-efficient future.

Get More Information about this report -

Request Free Sample ReportThe global battery material market is experiencing significant growth, propelled by the increasing adoption of electric vehicles (EVs), the expansion of renewable energy storage solutions, and the rising demand for portable electronic devices. Key materials such as lithium, cobalt, nickel, graphite, and manganese are essential components in battery production, particularly for lithium-ion batteries, which dominate the current market. This report provides a comprehensive analysis of the battery material market, including factors influencing its growth, regional dynamics, the impact of COVID-19, and future prospects.

Key trends shaping the future include: Emphasis on ethical and environmentally friendly extraction of raw materials. Development of efficient recycling processes to recover valuable materials and reduce waste. Ongoing research into alternative materials and battery chemistries to enhance performance and reduce costs. Government initiatives and international agreements will influence market dynamics and investment decisions.

The COVID-19 pandemic disrupted the battery material market by causing supply chain interruptions, labor shortages, and reduced industrial activity. Lockdowns and travel restrictions hindered mining operations and delayed the transportation of raw materials, leading to production slowdowns. However, the pandemic also highlighted the importance of resilient supply chains and accelerated the push for domestic manufacturing capabilities. As economies recover, the battery material market is rebounding, with renewed focus on sustainability and supply chain diversification.

Key Takeaways:

- Market Growth: The Battery Material Market is expected to reach USD 142.5 billion by 2034, growing at a robust CAGR of 8.1% from 2024, experience rapid expansion, especially in the automotive and renewable storage segments.

- Battery Type Dominance: Lithium-ion batteries currently dominate the battery material market due to their superior energy density, lightweight profile, and extensive usage across electric vehicles and portable electronics. While lead-acid batteries maintain relevance in stationary applications, lithium-ion is projected to see the fastest growth due to increasing demand from clean energy and EV sectors.

- Material Dominance: Cathode materials dominate the battery material market due to their significant impact on a battery’s capacity, performance, and cost. However, anode materials, particularly innovations like silicon-based anodes, are projected to see substantial growth in the near future due to increasing demand for higher energy density.

- End-User Dominance: The automotive segment leads the battery material market, driven by the surge in electric vehicle (EV) production worldwide. Meanwhile, the consumer electronics segment continues to witness steady growth but is projected to be overtaken in pace by the industrial sector as demand for energy storage systems and grid applications rises.

- Driver: The global shift toward electric mobility and clean energy solutions is driving demand for advanced battery materials. Government incentives, technological innovation, and expansion of renewable energy storage applications further fuel the market.

- Restraint: The battery material market faces limitations such as supply chain instability, ethical sourcing concerns, and price volatility of critical raw materials. These challenges may hinder scalability and pose risks to sustainable growth.

- Opportunity: Advancements in battery chemistries and recycling technologies open promising opportunities in the battery material market. Increasing investment in sustainable sourcing and second-life applications also presents avenues for expansion.

- Trend: The battery material market is witnessing major trends such as localization of supply chains, increased R&D in sustainable chemistries, and digitization of production processes. Demand for low-cost, high-efficiency, and eco-friendly materials continues to shape market direction.

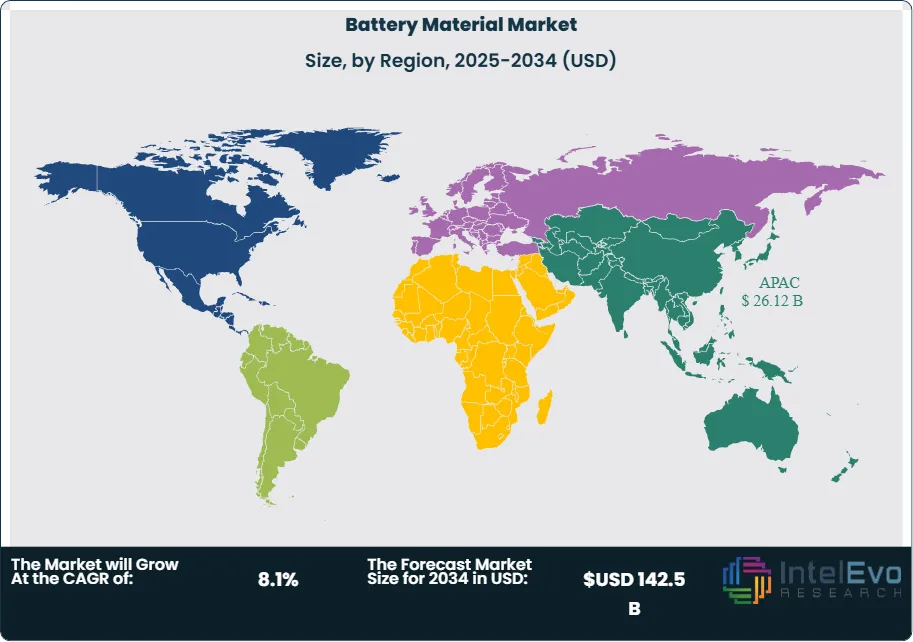

- Regional Analysis: The Asia-Pacific region dominates the global battery material market, driven by large-scale production of batteries in China, Japan, and South Korea, along with rising electric vehicle (EV) and electronics manufacturing.

Battery Type Analysis:

Lithium-ion Leads With more than 60% Market Share In Battery Material Market: The lithium-ion battery segment leads the battery material market and is expected to continue its dominance in the coming years. Lithium-ion batteries are widely used in electric vehicles (EVs), consumer electronics, grid energy storage, and power tools due to their high energy density, long cycle life, and ability to deliver reliable performance under varying environmental conditions. With rapid electrification of transport and industrial sectors, demand for high-performance battery materials like lithium, nickel, cobalt, and manganese has surged, favoring lithium-ion technologies.

In contrast, lead-acid batteries, though older and bulkier, still serve critical roles in backup power systems, automotive starter batteries, and UPS (uninterruptible power supply) applications. However, their lower energy density and shorter lifespan limit their future growth potential.

Looking ahead, lithium-ion is anticipated to witness the fastest growth, especially with increasing R&D in solid-state and cobalt-free lithium-ion variants. This trend is further reinforced by global investments in gigafactories, EV subsidies, and renewable energy storage initiatives.

Material Analysis:

The cathode segment leads the battery material market and accounts for a major share of total battery production costs. Cathodes are critical in determining battery energy density, voltage, and overall performance, making them the most technically and economically influential component. Materials like lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) dominate current cathode chemistries, used extensively in electric vehicles (EVs), consumer electronics, and grid energy storage. Manufacturers are investing heavily in optimizing cathode compositions to improve performance while reducing reliance on scarce and expensive elements like cobalt.

In contrast, the anode segment is poised for rapid growth, especially with increasing research into silicon-based and lithium metal anodes. These materials promise to significantly enhance the energy storage capacity and charging speed of batteries—key demands in both the EV and portable electronics sectors. This growth potential is also supported by major industry collaborations and pilot-scale developments.

End-User Analysis:

The automotive sector dominates the battery material market due to the rapid global adoption of electric vehicles. With governments setting aggressive emission reduction goals and offering incentives for EV purchases, automakers are shifting away from internal combustion engines, thus dramatically increasing the demand for advanced batteries. Lithium-ion battery chemistry is at the core of this revolution, and the need for high-capacity, long-lasting, and safe battery materials—especially cathodes and electrolytes—is more critical than ever. The automotive industry’s scale and capital-intensive nature also make it the most lucrative end-use segment for battery material suppliers.

On the other hand, the industrial segment is expected to experience the fastest growth in the coming years. The rise of renewable energy sources such as solar and wind requires large-scale energy storage systems for grid balancing and backup power. This creates a burgeoning market for industrial-grade batteries, which demand robust, long-life materials. As energy infrastructure modernizes globally and off-grid solutions grow in emerging economies, the industrial segment is poised to become a key driver of the battery material market, potentially reshaping demand trends beyond the automotive and electronics sectors.

Region Analysis:

Asia-Pacific Leads With over 40% Market Share In Battery Material Market: The Asia-Pacific region holds the largest share of the global battery material market, primarily because of China’s leadership in lithium-ion battery manufacturing and supply chain control. Countries like Japan and South Korea also contribute significantly with established battery producers such as Panasonic, LG Energy Solution, and Samsung SDI. The region benefits from easy access to raw materials, technological advancements, and a growing consumer base for electric vehicles and electronics. Government incentives, environmental policies, and local production capabilities create a self-reliant and high-growth market landscape.

Europe, while currently behind in volume, is witnessing the fastest growth. The EU’s Green Deal and push for carbon neutrality by 2050 have resulted in stringent vehicle emission norms, accelerating the transition to EVs. Nations like Germany, France, and the Nordics are heavily investing in battery gigafactories and localized material sourcing, reducing reliance on imports and fostering regional demand for battery materials.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Material Type

- Cathode Materials

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

- Nickel Manganese Cobalt (NMC)

- Nickel Cobalt Aluminum (NCA)

- Others

- Anode Materials

- Natural Graphite

- Synthetic Graphite

- Silicon-based Anodes

- Lithium Titanate (LTO)

- Others

- Electrolytes

- Liquid Electrolytes

- Solid-State Electrolytes

- Polymer Electrolytes

- Separators

- Polyethylene (PE)

- Polypropylene (PP)

- Ceramic-Coated Separators

- Conductive Additives & Binders

By Battery Type

- Lithium-ion Batteries

- Lead-Acid Batteries

- Nickel-Metal Hydride (NiMH) Batteries

- Solid-State Batteries

- Flow Batteries

By Application

- Automotive (Electric Vehicles, Hybrid Vehicles)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (Residential, Commercial, Utility-scale)

- Industrial Equipment and Tools

- Others (Aerospace, Marine, Medical Devices)

By End User

- OEMs

- Battery Manufacturers

- Raw Material Suppliers

- Recycling Companies

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 70.6 B |

| Forecast Revenue (2034) | USD 142.5 B |

| CAGR (2025-2034) | 8.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By (Material Type, Cathode Materials, (Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), Nickel Cobalt Aluminum (NCA), Others), Anode Materials, (Natural Graphite, Synthetic Graphite, Silicon-based Anodes, Lithium Titanate (LTO), Others), Electrolytes, (Liquid Electrolytes, Solid-State Electrolytes, Polymer Electrolytes), Separators, (Polyethylene (PE), Polypropylene (PP), Ceramic-Coated Separators), Conductive Additives & Binders), By Battery Type (Lithium-ion Batteries, Lead-Acid Batteries, Nickel-Metal Hydride (NiMH) Batteries, Solid-State Batteries, Flow Batteries), By Application (Automotive (Electric Vehicles, Hybrid Vehicles), Consumer Electronics (Smartphones, Laptops, Wearables), Energy Storage Systems (Residential, Commercial, Utility-scale), Industrial Equipment and Tools, Others (Aerospace, Marine, Medical Devices)), By End User (OEMs, Battery Manufacturers, Raw Material Suppliers, Recycling Companies) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Asahi Kasei, Umicore Cobalt & Specialty Materials (CSM), BASF SE, Hitachi Chemical Co. Ltd., Toray Industries, Sumitomo Corporation, Johnson Matthey, TCI Chemicals (India) Pvt. Ltd., Kureha Corporation, Mitsubishi Chemical Holdings, Targray Technology International, NEI Corporation, NEO Battery Materials Ltd., NICHIA CORPORATION, 3M, Posco, Shanghai Shanshan Tech Co. Ltd. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date