Billiards and Snooker Equipment Market Size, Growth | CAGR of 4.1%

Global Billiards and Snooker Equipment Market Size, Share & Sports Goods Analysis By Product Type (Tables, Billiards Tables, Snooker Tables, Pool Tables, Cues, Balls, Accessories), By Material (Wood, Metal, Composite Materials, Others), By Distribution Channel (Offline, Online), Professional League Impact, Material Innovation Trends & Forecast 2025–2034

Report Overview

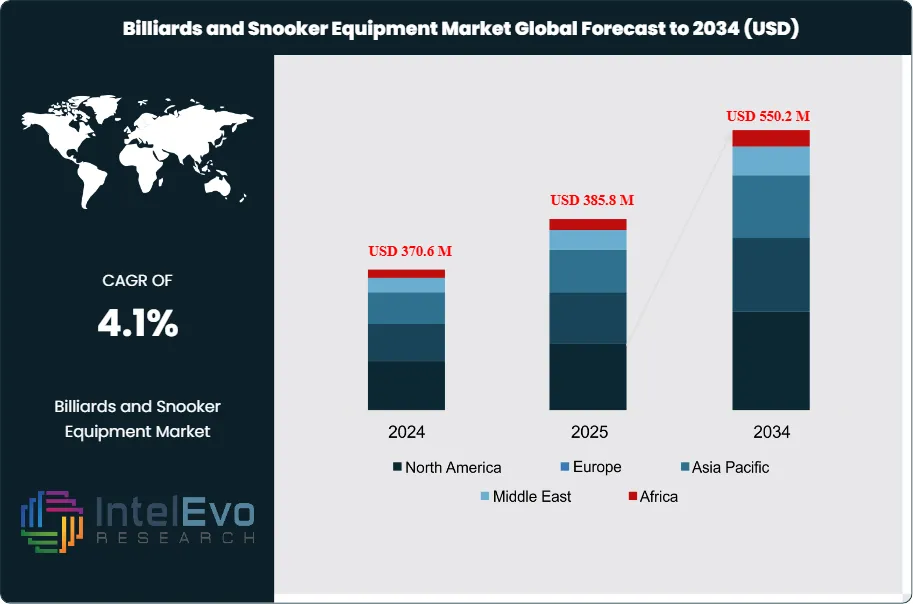

The Billiards and Snooker Equipment Market is estimated at USD 370.6 million in 2024 and is on track to reach roughly USD 550.2 million by 2034, implying a compound annual growth rate (CAGR) of 4.1% over 2025–2034. This steady expansion is supported by the growing popularity of cue sports as recreational and competitive activities, along with increased investments in sports clubs, lounges, and home entertainment setups. Rising interest in professional tournaments, social gaming venues, and premium customized equipment is further enhancing market visibility and long-term demand across both developed and emerging economies.

Get More Information about this report -

Request Free Sample ReportMarket expansion reflects both the enduring appeal of cue sports and the steady diversification of product offerings across professional, recreational, and luxury segments. Historically, the market has grown at a modest pace, supported by strong participation in Europe and Asia, while recent years have seen renewed interest driven by televised tournaments, rising club memberships, and the expansion of organized leagues.

Demand is shaped by a combination of recreational participation and professional competition. In England alone, around 19,300 people actively play snooker, while the World Snooker Federation spans more than 90 member countries, underscoring the sport’s global footprint. Large-scale tournaments such as the BCA Pool League World Championships, which deploys over 500 tables, highlight the scale of equipment demand during competitive events. At the same time, the market benefits from the diversity of billiards formats, with more than 30 recognized game types sustaining a broad consumer base.

Growth drivers include rising consumer spending on leisure activities, the premiumization of sports equipment, and government investment in sports infrastructure. Luxury demand is evident in products such as Bugatti’s £217,000 self-levelling pool table, designed for high-net-worth buyers and superyacht owners. On the supply side, manufacturers face challenges related to raw material costs, adherence to international standards, and the need to balance mass-market affordability with premium product development. Regulatory oversight of sports facilities and equipment specifications also plays a role in shaping competitive dynamics.

Technology is beginning to influence product design and adoption. Digital scorekeeping systems, precision-engineered cues, and advanced table leveling mechanisms are gaining traction, particularly in professional and luxury segments. These innovations enhance performance consistency and appeal to both competitive players and collectors.

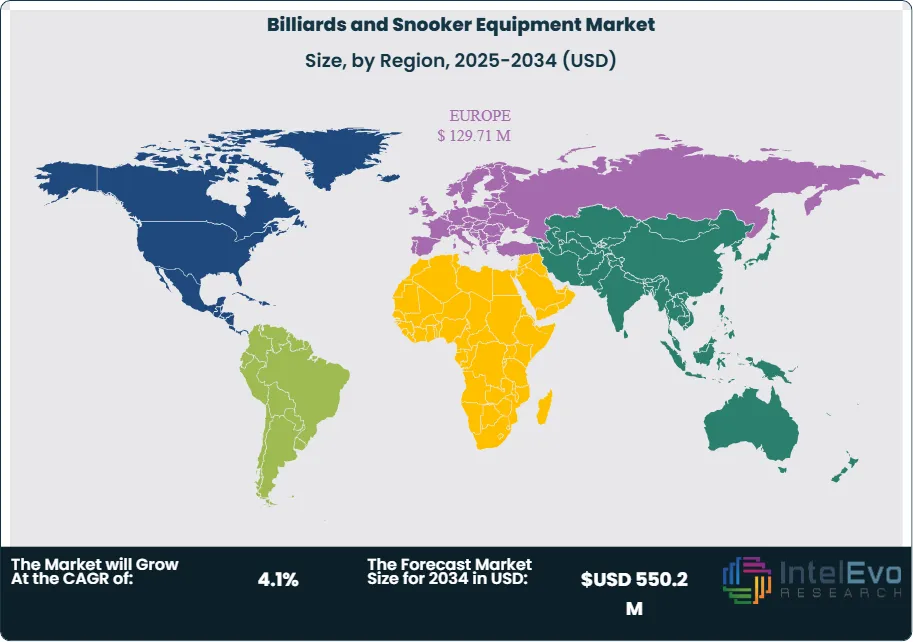

Regionally, Europe remains the largest market, supported by a strong snooker tradition and established clubs. Asia-Pacific is emerging as a key growth hub, with rising participation in China and India creating new opportunities for manufacturers and distributors. North America continues to show steady demand, particularly in pool and recreational billiards. For investors, Asia-Pacific represents the most attractive growth frontier, while Europe and North America remain stable revenue bases.

Overall, the market outlook points to steady expansion, with opportunities concentrated in premium equipment, tournament-driven demand, and emerging participation markets.

Key Takeaways

- Market Growth: The global billiards and snooker equipment market was valued at USD 370.6 million in 2024 and is projected to reach USD 550.2 million by 2034, expanding at a CAGR of 4.1%. Growth is supported by rising recreational participation, professional tournaments, and premium product demand.

- Product Type: Tables accounted for 63.7% of total revenue in 2024, reflecting their indispensable role in both professional and recreational play. High replacement costs and standardized specifications reinforce their dominance in overall market value.

- Material: Wood held 58.2% of the material segment in 2024, driven by its durability, performance consistency, and traditional preference among players. Engineered wood and composite alternatives are gaining traction but remain secondary.

- Distribution Channel: Offline retail captured 72.1% of sales in 2024, as customers continue to prefer in-store product evaluation for high-value items such as tables and cues. Online channels are expanding but remain under 30% of total sales.

- Driver: Global participation in cue sports is expanding, with the World Snooker Federation representing over 90 countries. Large-scale tournaments such as the BCA Pool League World Championships, featuring 500 tables, create recurring demand for professional-grade equipment.

- Restraint: High product costs, particularly for premium tables priced above USD 5,000, limit adoption in price-sensitive markets. Fluctuations in raw material prices, especially hardwood, further constrain manufacturer margins.

- Opportunity: Asia-Pacific presents the strongest growth potential, with rising participation in China and India expected to drive double-digit demand growth. Expanding middle-class spending on leisure activities positions the region as a key investment hotspot.

- Trend: Luxury and technology-driven products are gaining visibility. Examples include Bugatti’s £217,000 self-levelling pool table, which targets ultra-premium buyers, and digital scorekeeping systems that enhance professional play.

- Regional Analysis: Europe remains the largest market, supported by a strong snooker tradition and established clubs. North America maintains a stable base with consistent recreational demand. Asia-Pacific is the fastest-growing region, projected to outpace global CAGR due to expanding player communities and rising disposable incomes.

Product Type Analysis

Tables remain the dominant product category, accounting for 63.7% of global revenues in 2024, and are expected to maintain their lead through 2034. Their central role in gameplay ensures consistent demand across professional tournaments, sports clubs, and private households. Variants such as billiards, snooker, and pool tables cater to different game formats, with professional-grade models commanding premium pricing. Table quality, including surface precision and durability, directly influences player performance, making this segment critical for both recreational and competitive markets.

Cues represent the second-largest category, with steady demand driven by customization in weight, balance, and material composition. Professional players increasingly prefer high-performance cues crafted from advanced composites or hybrid materials, while casual players continue to rely on traditional wooden cues. Balls, though uniform in design, remain indispensable, with sets tailored to specific formats such as snooker or pool. Accessories, including racks, chalk, and protective covers, contribute a smaller share but play a vital role in equipment upkeep and game integrity.

Material Analysis

Wood continues to dominate the material segment, holding 58.2% of the market in 2024, supported by its durability, workability, and traditional association with cue sports. Premium hardwoods such as maple and ash remain the preferred choice for tables and cues, reinforcing the sport’s heritage appeal. This dominance is expected to persist, although rising costs of quality timber may encourage gradual adoption of alternatives.

Metal is primarily used in structural frames and reinforcement components, valued for its strength and stability in high-end tables. Composite materials are gaining traction, particularly in outdoor models and performance cues, due to their resistance to warping and environmental wear. Other materials, including synthetic fabrics for table covers and rubber cushions for rails, are essential for maintaining international gameplay standards and ensuring consistent performance across venues.

Distribution Channel Analysis

Offline retail accounted for 72.1% of global sales in 2024 and remains the preferred channel for high-value purchases such as tables and professional cues. Specialty sports stores, clubs, and direct dealer networks dominate this segment, as customers prioritize physical inspection before committing to large investments. The tactile nature of cues and the visual appeal of tables reinforce the importance of in-person evaluation.

Online channels, while smaller in share, are expanding steadily, particularly in regions with limited access to specialty stores. E-commerce platforms offer broader product ranges and competitive pricing, attracting younger consumers and casual players. However, the offline channel is expected to retain its lead through 2034, given the high replacement costs and the importance of product assurance in premium categories.

By Region

North America remains the largest regional market, supported by a strong cultural affinity for cue sports, high disposable incomes, and the presence of professional leagues. The United States and Canada host major tournaments that drive recurring demand for professional-grade equipment. Continued investment in cue sports infrastructure and the rising popularity of luxury tables are expected to sustain regional growth.

Europe holds a significant share, anchored by the United Kingdom’s long-standing snooker tradition and a dense network of clubs and venues. The region benefits from a loyal fan base and consistent tournament activity, ensuring stable equipment demand. Asia Pacific, however, represents the fastest-growing market, with China and India driving participation growth. Rising middle-class spending and expanding club networks are expected to push the region’s CAGR above the global average.

Latin America and the Middle East & Africa remain smaller but emerging markets. Latin America is witnessing gradual adoption through leisure clubs and sports diversification, while the Middle East is seeing demand from luxury hotels and resorts incorporating cue sports into recreational offerings. Both regions present long-term opportunities as participation broadens and consumer spending on leisure activities increases.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Product Type

- Tables

- Billiards Tables

- Snooker Tables

- Pool Tables

- Cues

- Balls

- Accessories

By Material

- Wood

- Metal

- Composite Materials

- Others

By Distribution Channel

- Offline

- Online

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 370.6 M |

| Forecast Revenue (2034) | USD 550.2 M |

| CAGR (2024-2034) | 4.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Tables, Billiards Tables, Snooker Tables, Pool Tables, Cues, Balls, Accessories), By Material (Wood, Metal, Composite Materials, Others), By Distribution Channel (Offline, Online) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Predator Group, Olhausen Billiard Manufacturing, Inc., Simonis Cloth, McDermott Cue Manufacturing LLC, Riley England, Brunswick Corporation, Aramith (Saluc S.A.), Pechauer Custom Cues, Valley-Dynamo, Inc., Peradon & Fletcher Ltd., Diamond Billiard Products Inc., Fury Cues, Balabushka Cue Company |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Billiards and Snooker Equipment Market

Published Date : 01 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date