Biologics CDMO Market Size, Trends, Growth & Forecast|CAGR 13.50%

Global Biologics CDMO Market Size, Share, Analysis Report By Service (Process Development, Manufacturing, Analytical & Quality Control, Fill & Finish) Platform (Mammalian Cell Culture, Microbial Fermentation, Cell & Gene Therapy) End-Use (Biopharma & Biotech Companies, Small & Mid-sized Pharma, Academic & Research Institutes) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

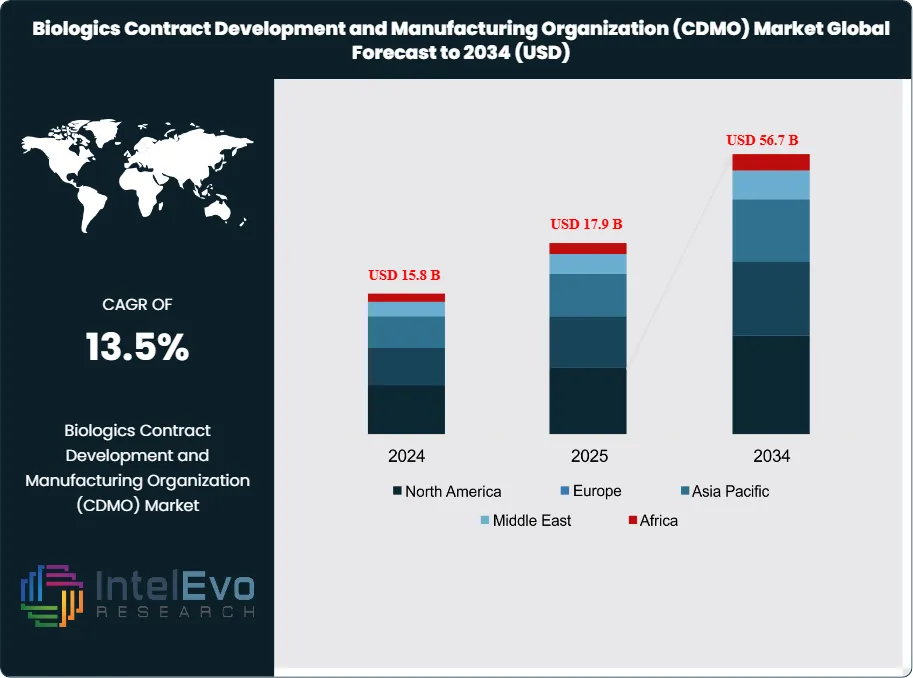

The Biologics Contract Development and Manufacturing Organization (CDMO) Market is projected to reach approximately USD 56.7 Billion by 2034, up from USD 15.8 Billion in 2024, growing at a CAGR of 13.5% during the forecast period from 2024 to 2034. The biologics CDMO market represents a dynamic and rapidly evolving sector within the broader pharmaceutical outsourcing industry, encompassing specialized service providers that support the development and manufacturing of complex biologic drugs. These include monoclonal antibodies, recombinant proteins, vaccines, cell and gene therapies, and other advanced biologics.

Get More Information about this report -

Request Free Sample ReportThe market has experienced remarkable growth, driven by the increasing complexity of biologic drug pipelines, the rise of personalized medicine, and the growing trend among pharmaceutical and biotechnology companies to outsource non-core activities to expert partners. The integration of single-use technologies, digital manufacturing, and advanced analytics has significantly improved process efficiency, scalability, and regulatory compliance, making CDMOs indispensable to the global biopharma supply chain.

Several key factors are shaping the market trajectory, including the surge in biologics approvals, the expansion of cell and gene therapy pipelines, and the need for flexible, scalable manufacturing solutions. The market is also influenced by regulatory changes, evolving intellectual property landscapes, and the increasing demand for speed-to-market in a highly competitive environment. Additionally, the COVID-19 pandemic has underscored the importance of agile, resilient manufacturing networks, further accelerating the adoption of CDMO partnerships across the industry.

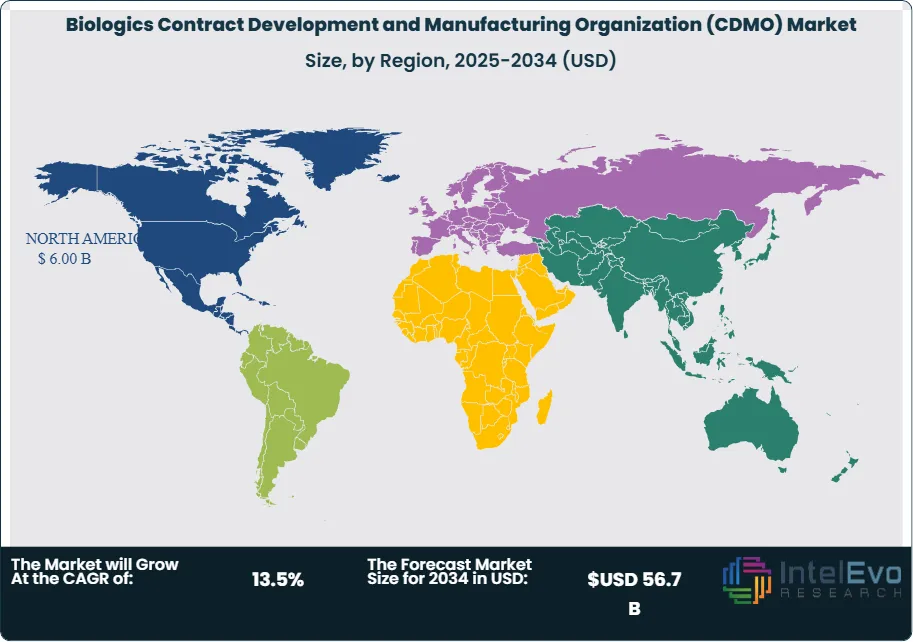

Regional analysis reveals North America as the dominant market, with approximately 38-40% market share in 2024, driven by a robust biopharma ecosystem, high R&D investment, and a strong presence of leading CDMOs. Europe follows as the second-largest market, with Asia-Pacific emerging as the fastest-growing region due to rapid biomanufacturing expansion, government support, and increasing clinical trial activity.

The pandemic initially disrupted global supply chains and clinical development timelines, but also highlighted the critical role of CDMOs in vaccine and therapeutic production. The market has demonstrated remarkable resilience and adaptability, with many CDMOs investing in capacity expansion, digital transformation, and advanced therapy manufacturing capabilities.

Key Takeaways

- Market Growth: The Global Biologics CDMO Market is expected to reach USD 56.7 Billion by 2034, propelled by the expansion of biologics pipelines, the rise of advanced therapies, and the increasing trend toward outsourcing.

- Service Dominance: Manufacturing services, particularly mammalian cell culture and microbial fermentation, remain the dominant segment, supported by the growing demand for monoclonal antibodies and recombinant proteins.

- Platform Dominance: Mammalian expression systems are the preferred platform, driven by their versatility and ability to produce complex biologics. Microbial and cell & gene therapy platforms are gaining traction.

- End-Use Dominance: Biopharma and biotech companies account for the majority of CDMO partnerships, with small and mid-sized firms increasingly relying on CDMOs for end-to-end solutions.

- Driver: The need for flexible, scalable, and compliant manufacturing solutions, coupled with the complexity of biologics, is a major driver of CDMO market adoption.

- Restraint: High capital requirements, regulatory complexity, and capacity constraints present challenges to market growth.

- Opportunity: Expansion into emerging markets, investment in advanced therapy manufacturing, and the adoption of digital and single-use technologies offer significant growth potential.

- Trend: The convergence of biologics and advanced therapies, digitalization, and the rise of integrated, end-to-end CDMO service models are reshaping the market landscape.

- Regional Analysis: North America leads in revenue and innovation, while Europe focuses on regulatory harmonization and advanced therapy manufacturing. Asia-Pacific, propelled by China, South Korea, and India, is the fastest-growing region, offering substantial untapped potential.

Service Type Analysis

Manufacturing Services Lead With Over 60% Market Share in the Biologics CDMO Market.

Manufacturing services remain the cornerstone of the biologics CDMO market. These services encompass the large-scale production of monoclonal antibodies, recombinant proteins, vaccines, and other biologics using mammalian, microbial, and other expression systems. Leading CDMOs such as Lonza, Samsung Biologics, and WuXi Biologics have established strong reputations for quality, scalability, and regulatory compliance. The segment’s leadership is reinforced by several factors. Firstly, the increasing complexity and scale of biologics manufacturing require specialized infrastructure, expertise, and quality systems that many biopharma companies prefer to access through outsourcing. Secondly, the rise of biosimilars and the expansion of cell and gene therapy pipelines are driving demand for flexible, multi-modal manufacturing capabilities. Thirdly, the adoption of single-use technologies and continuous manufacturing is improving process efficiency and reducing time-to-market.

Process development and analytical services are also critical, enabling clients to optimize upstream and downstream processes, ensure product quality, and meet regulatory requirements. Fill & finish services, including aseptic filling, lyophilization, and packaging, are gaining importance as the final step in the biologics supply chain.

Platform Analysis

Mammalian Expression Systems Dominate the Market. Mammalian cell culture platforms, particularly Chinese Hamster Ovary (CHO) cells, are the preferred choice for the production of complex biologics such as monoclonal antibodies and fusion proteins. These systems offer high productivity, scalability, and the ability to produce proteins with human-like post-translational modifications. Leading CDMOs have invested heavily in large-scale mammalian cell culture facilities, single-use bioreactors, and advanced process control systems.

Microbial expression systems, such as E. coli and yeast, are widely used for the production of smaller proteins, enzymes, and certain vaccines. The segment is characterized by shorter development timelines and lower production costs, making it attractive for specific applications.

Cell and gene therapy platforms are the fastest-growing segment, driven by the surge in clinical trials and approvals for advanced therapies. CDMOs are expanding their capabilities in viral vector manufacturing, cell processing, and gene editing to meet rising demand.

End-Use Analysis

Biopharma and Biotech Companies Drive CDMO Demand. Biopharma and biotech companies, ranging from large multinationals to emerging startups, are the primary clients of biologics CDMOs. The increasing complexity of biologic drugs, coupled with the need for speed-to-market and cost efficiency, is driving companies to outsource development and manufacturing activities. Small and mid-sized firms, in particular, rely on CDMOs for end-to-end solutions, from cell line development to commercial-scale production.

Academic and research institutes are also engaging CDMOs for clinical trial material production, process development, and technology transfer, especially in the context of advanced therapies and personalized medicine.

Region Analysis

North America Leads With Over 38% Market Share in the Biologics CDMO Market. North America is the dominant region, accounting for approximately 38-40% of global biologics CDMO revenue in 2024. The region’s leadership is anchored by a robust biopharma ecosystem, high R&D investment, and the presence of leading CDMOs such as Catalent, Thermo Fisher Scientific, and Lonza. The United States, in particular, benefits from a strong pipeline of biologics, a favorable regulatory environment, and significant government and private sector investment in advanced therapy manufacturing.

Europe is the second-largest market, with strengths in biosimilars, advanced therapy medicinal products (ATMPs), and regulatory harmonization. Countries such as Germany, Switzerland, and the UK are investing in biomanufacturing infrastructure and innovation. The region’s focus on quality, compliance, and sustainability is driving demand for advanced CDMO services.

Asia-Pacific is the fastest-growing region, propelled by rapid biomanufacturing expansion in China, South Korea, India, and Singapore. Government support, increasing clinical trial activity, and the emergence of local biopharma companies are creating new opportunities for CDMOs. The region is also attracting global clients seeking cost-effective, high-quality manufacturing solutions.

Latin America and the Middle East & Africa are emerging markets, with growing demand for biologics, vaccines, and advanced therapies. Investments in local manufacturing capacity and regulatory harmonization are supporting market growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Service

- Process Development

- Manufacturing (Mammalian, Microbial, Cell & Gene Therapy)

- Analytical & Quality Control

- Fill & Finish

Platform

- Mammalian Cell Culture

- Microbial Fermentation

- Cell & Gene Therapy

- Others

End-Use

- Biopharma & Biotech Companies

- Small & Mid-sized Pharma

- Academic & Research Institutes

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 15.8 B |

| Forecast Revenue (2034) | USD 56.7 B |

| CAGR (2025-2034) | 13.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Service: (Process Development, Manufacturing (Mammalian, Microbial, Cell & Gene Therapy), Analytical & Quality Control, Fill & Finish) Platform: (Mammalian Cell Culture, Microbial Fermentation, Cell & Gene Therapy, Others) End-Use: (Biopharma & Biotech Companies, Small & Mid-sized Pharma, Academic & Research Institutes) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Lonza Group Ltd., Samsung Biologics, WuXi Biologics / WuXi AppTec, Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim BioXcellence, Catalent Inc., Thermo Fisher Scientific, AGC Biologics, Rentschler Biopharma, AbbVie CMO, Eurofins / Amatsigroup, Siegfried Holding AG, Recipharm AB, Binex Co. Ltd., Celonic Group (JRS Pharma), Icon plc, Parexel Intl., Toyobo Co., Ltd., Just-Evotec Biologics, Cellares |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Biologics Contract Development and Manufacturing Organization (CDMO) Market

Published Date : 21 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date