Blended Cement Market Size, Trends & Forecast 2034 | 4.5% CAGR

Global Blended Cement Market Size, Share, Analysis Report By Type (Composite cement, Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC), Other), Application (Cast-in-place Construction, Precast Construction), End-User (Infrastructure, Building Construction), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

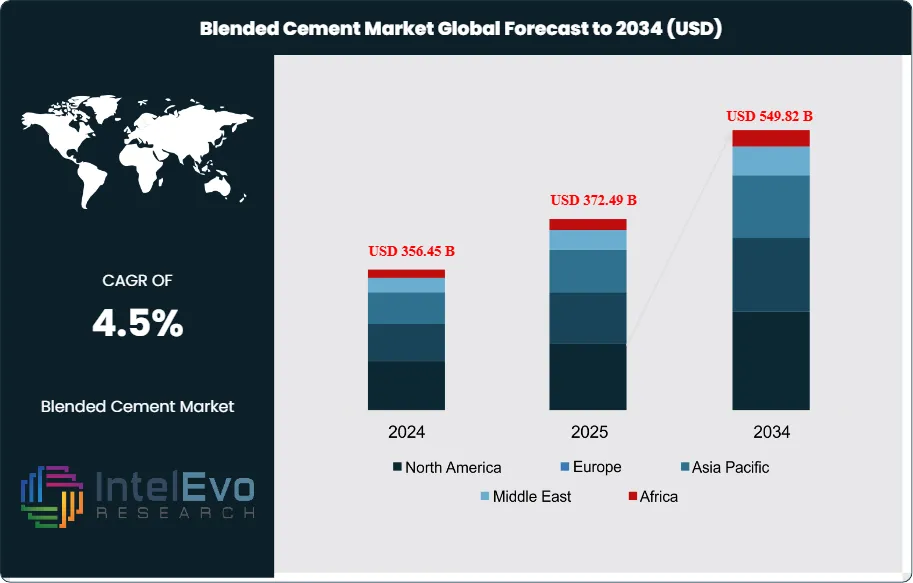

The Blended Cement Market size is projected to reach approximately USD 549.82 Billion by 2034, up from USD 356.45 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034. This growth is driven by the increasing focus on sustainable construction materials, the rise of green building initiatives, and the widespread use of supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume to reduce carbon emissions. The ongoing urbanization, coupled with strong infrastructure investments in emerging economies and the global push toward low-carbon cement technologies, is expected to reshape the cement industry landscape. The adoption of blended cement is becoming central to environmentally responsible and cost-efficient construction practices worldwide.

Get More Information about this report -

Request Free Sample ReportThe blended cement market encompasses a variety of cement types mixed with supplementary materials such as fly ash, slag, or pozzolanic materials. This composition enhances performance characteristics such as workability, strength, and environmental sustainability. Blended cements are increasingly being adopted for their durability and low carbon footprint, making them a preferred option for sustainable construction. Rising urbanization, infrastructure projects, and increased demand for energy-efficient building materials are driving the market forward.

Several factors affect the growth of the blended cement market. Environmental regulations encouraging the reduction of carbon emissions and energy consumption in the construction sector have made blended cements more favorable compared to traditional cement. Additionally, growing investments in infrastructure and smart city developments further propel demand. However, market growth is also influenced by fluctuations in raw material availability and supply chain disruptions.

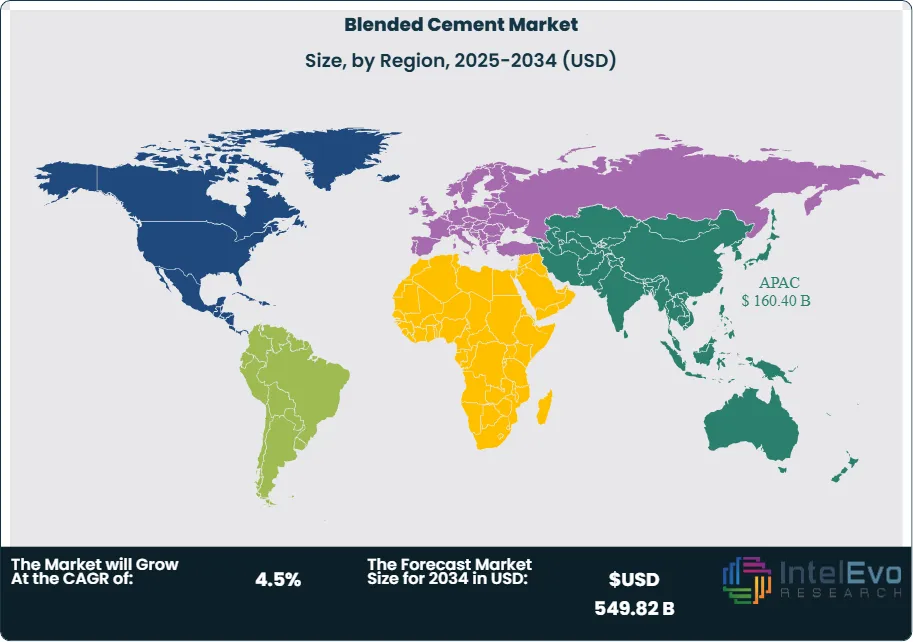

Asia-Pacific holds the largest share of the blended cement market, driven by rapid urban development, government investments in infrastructure, and the growing construction industry in countries such as India and China. Europe and North America are also witnessing significant adoption due to stringent environmental regulations and sustainable building initiatives.

The COVID-19 pandemic caused short-term disruptions in the blended cement market due to halted construction projects, labor shortages, and supply chain interruptions. However, recovery has been swift, supported by resumed infrastructure projects and increased focus on green construction post-pandemic.

Key Takeaways:

- Market Growth: The Blended Cement Market is expected to reach USD 549.82 Billion by 2034, driven by sustainability demands and infrastructure development across emerging economies.

- Type Dominance: Portland Pozzolana Cement (PPC) leads the type segment due to its high durability, cost-efficiency, and environmental friendliness.

- Application Dominance: Cast-in-place construction dominates the application segment, as it allows for flexible on-site concrete work, suitable for large infrastructure projects.

- End-User Dominance: Building construction remains the leading end-user industry due to ongoing urbanization and residential projects.

- Driver: Growing demand for sustainable construction materials and increased infrastructure spending are key market drivers.

- Restraint: Inconsistent availability of raw materials and high initial costs may hinder market growth.

- Opportunity: Expansion into emerging economies and innovations in eco-friendly materials present significant opportunities.

- Trend: Increased adoption of green building codes and technological advancements in cement manufacturing are key market trends.

- Regional Analysis: Asia-Pacific leads due to population growth, urban expansion, and supportive regulations. The PPC segment is expected to see continued growth.

Type Analysis:

Portland Pozzolana Cement (PPC) stands as the dominant type in the blended cement market. Its superiority stems from its excellent resistance to chemical attacks and reduced permeability, making it ideal for hydraulic and marine constructions. PPC also generates less heat during hydration, reducing the risk of thermal cracking. Its eco-friendly composition using fly ash as a key component aligns with global sustainability goals. Composite cement and Portland Slag Cement (PSC) also have significant market shares, but PPC’s cost-effectiveness and compatibility with modern construction techniques place it ahead.

Application Analysis:

Cast-in-place Construction Leads With over 60% Market Share In Blended Cement Market. Cast-in-place construction leads the application segment due to its adaptability and cost-efficiency in large-scale projects. This method enables construction teams to mold cement directly on-site, ensuring greater structural integrity and flexibility. With the rise in infrastructure projects like bridges, highways, and dams, cast-in-place concrete has become essential. Precast construction, while beneficial for rapid development, often lacks the customized fit and durability of cast-in-place methods, giving the latter a competitive edge.

End-User Analysis:

Building construction is the primary consumer of blended cement, driven by urbanization, rising residential needs, and government-backed affordable housing initiatives. Developers are increasingly shifting to blended cement for its durability, thermal insulation, and sustainability, making it an ideal choice for modern buildings. Infrastructure development is also a significant contributor, but it trails building construction in sheer volume and frequency of usage.

Region Analysis:

Asia-Pacific Leads With approximately 45% Market Share In Blended Cement Market, Asia-Pacific is the leading region in the global blended cement market. The dominance is underpinned by large-scale urban infrastructure development in India, China, and Southeast Asia. Governments in the region are investing heavily in highways, smart cities, and housing schemes. Additionally, rising environmental awareness and supportive legislation are fostering the adoption of eco-friendly construction materials, including blended cement. Among the various cement types, Portland Pozzolana Cement (PPC) has gained substantial traction in this region due to its performance in tropical and humid conditions. Building construction is expected to continue its lead in demand, supported by population growth, urban migration, and real estate development. Europe and North America follow Asia-Pacific, driven by green building codes and innovations in cement technology.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- Portland Pozzolana Cement (PPC)

- Portland Slag Cement (PSC)

- Fly Ash Blended Cement

- Silica Fume Blended Cement

- Limestone Blended Cement

- Composite cement

- Others (Natural Pozzolana, Metakaolin Blends)

By Material Type

- Fly Ash

- Slag

- Silica Fume

- Limestone

- Others

By Application

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure (Bridges, Roads, Dams)

- Others (Marine, Tunnel Projects)

By End User

- Construction Companies

- Ready-Mix Concrete Manufacturers

- Infrastructure Developers

- Government and Public Works Departments

- Real Estate and Contractors

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 372.49 B |

| Forecast Revenue (2034) | USD 549.82 B |

| CAGR (2025-2034) | 4.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC), Fly Ash Blended Cement, Silica Fume Blended Cement, Limestone Blended Cement, Composite cement, Others (Natural Pozzolana, Metakaolin Blends)), By Material Type (Fly Ash, Slag, Silica Fume, Limestone, Others), By Application (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Bridges, Roads, Dams), Others (Marine, Tunnel Projects)), By End User (Construction Companies, Ready-Mix Concrete Manufacturers, Infrastructure Developers, Government and Public Works Departments, Real Estate and Contractors) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Ambuja Cements Ltd, Buzzi Unicem SpA, Cement Australia, CEMEX S.A.B DE C.V., Birla Corporation, CRH Plc, Dalmia Bharat Limited, Dyckerhoff, Heidelberg, Holcim, China National Building Material Company Limited, RMC, St. Marys Cement, Anhui Conch Cement Company Limited, UltraTech Cement Limited, Zuari Cements, Adani Group |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date