Blockchain in Media, Advertising & Entertainment Market Size | CAGR 47.8%

Global Blockchain in Media, Advertising and Entertainment Market Size, Share & Analysis By Type (Public, Private, Consortium), By Enterprise Size (SMEs, Large Enterprises), By Application (Licensing and Rights Management, Digital Advertising, Online gaming, Content Security, Payments), Web3 Adoption Trends & Forecast 2025–2034

Report Overview

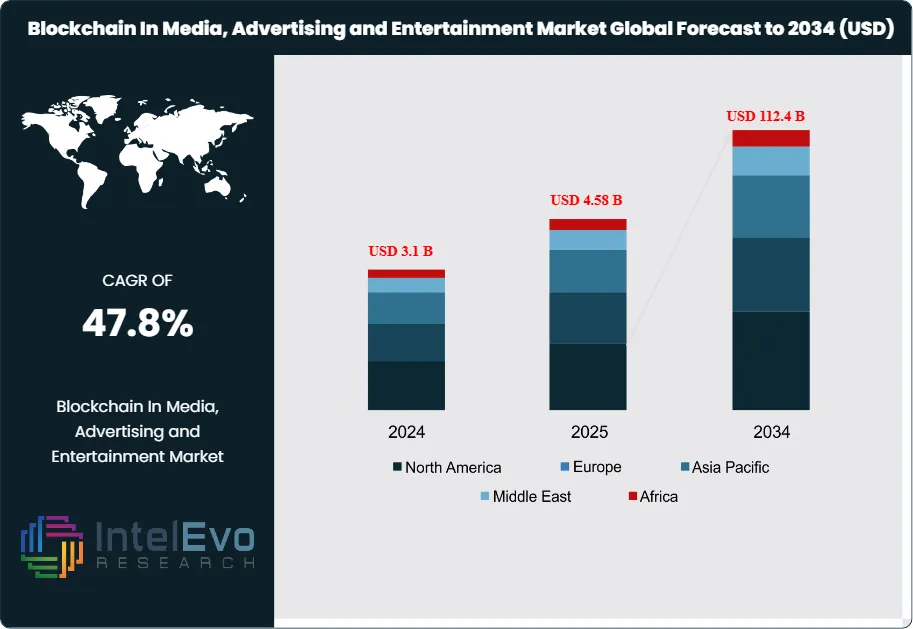

The Blockchain in Media, Advertising, and Entertainment Market is valued at approximately USD 3.1 billion in 2024 and is projected to reach nearly USD 112.4 billion by 2034, registering a robust CAGR of around 47.8% during 2025–2034. This surge reflects the rapid adoption of decentralized content management, transparent advertising ecosystems, and tokenized revenue models across global media platforms.

Get More Information about this report -

Request Free Sample ReportThis significant growth trajectory underscores the transformative impact blockchain is having across the creative and digital content ecosystems. Historically plagued by piracy, ad fraud, and opaque compensation models, the media, advertising, and entertainment sectors are now increasingly leveraging blockchain to drive transparency, streamline operations, and protect intellectual property. The demand for verifiable and tamper-proof records is accelerating blockchain adoption, especially in areas like content licensing, royalty distribution, and digital rights management. The shift toward direct creator-to-consumer distribution is also gaining momentum, empowering artists to monetize their work independently and securely, without intermediaries.

The market’s evolution is tightly linked to broader advances in blockchain infrastructure. Global blockchain technology itself is projected to expand rapidly—from approximately USD 160 billion in 2024 to over USD 14,800 billion by 2034, reflecting an expected CAGR exceeding 60%. In parallel, generative AI in media and entertainment is anticipated to grow from USD 1,720 million in 2024 to nearly USD 13,900 million by 2034, at a CAGR of around 25–26%. These intersecting innovations are fostering a wave of automation, personalization, and content authenticity that was previously unattainable.

However, the path forward is not without obstacles. Integration with legacy systems remains complex and resource-intensive. A shortage of skilled professionals continues to challenge implementation at scale, while scalability and energy consumption remain pressing concerns—particularly in public blockchain networks. These hurdles may slow adoption, especially among smaller players with limited technical or financial capacity.

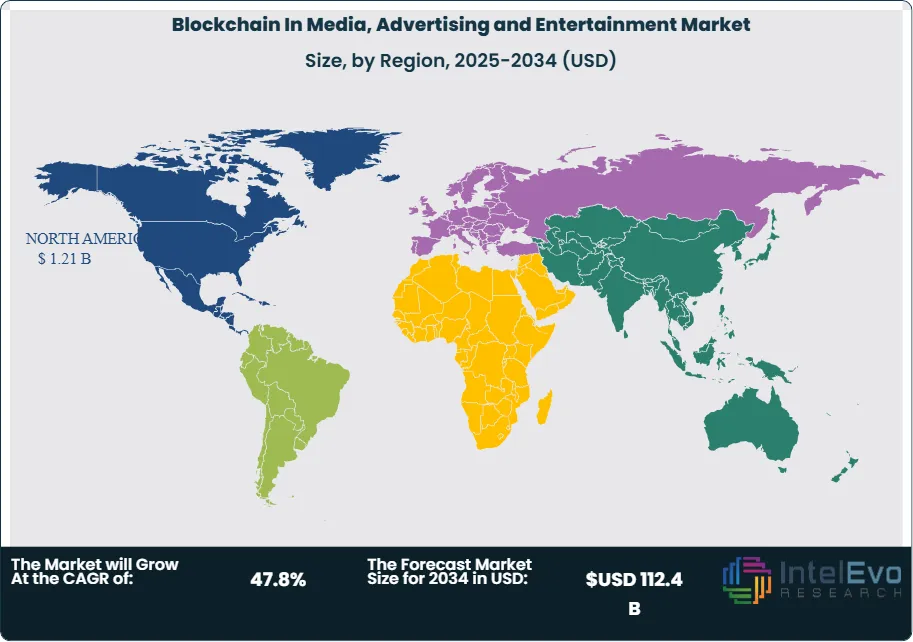

Regionally, North America leads the charge, fueled by a concentration of tech giants, strong IP laws, and early-stage investment. Europe and Asia-Pacific are rapidly emerging as innovation hubs, with governments increasingly supporting blockchain experimentation in media and digital ecosystems. These regions are also witnessing heightened investor interest, particularly in startups developing blockchain-based content platforms and advertising solutions.

As blockchain merges with AI-driven content creation, metaverse ecosystems, decentralized data ownership, and tokenized media structures, the global entertainment landscape is entering a new era characterized by security, transparency, automation, and creative monetization—marking this sector as one of the most promising digital investment frontiers of the coming decade.

Key Takeaways

- Market Growth: The global Blockchain in Media, Advertising, and Entertainment market is set to expand from USD 3.1 billion in 2024 to USD 112.4 billion by 2034, reflecting a CAGR of 47.8% (2025–2034). Growth is driven by rising demand for secure content distribution, transparent advertising workflows, rights management, and automated royalty systems.

- Network Type: The Private blockchain segment led the market in 2024 with a revenue share of over 52%, attributed to high security, scalability, and controlled access — crucial for protecting digital assets and sensitive media rights.

- Enterprise Size: Large Enterprises held an estimated 58% share in 2024, given their financial capacity, global operations, and need for transparent multi-party digital rights management.

- Application: The Payments segment accounted for 36% of market revenue in 2024, driven by growing adoption of blockchain-based micropayments, automated smart contract settlements, and real-time cross-border transactions.

- Driver: Increasing global losses due to digital piracy and ad fraud (over USD 100B annually) make blockchain’s immutability essential for copyright protection, impression verification, and creator compensation transparency.

- Restraint: Scalability limitations—especially on public chains—and high implementation costs restrict adoption for SMEs and high-volume advertisers or streaming platforms.

- Opportunity: Asia-Pacific shows the highest growth potential, with government-backed blockchain programs and fast-growing decentralized content ecosystems leading to adoption across music, gaming, and digital advertising markets.

- Trend: Blockchain + AI convergence is reshaping media creation and distribution. With the Blockchain-AI market projected to grow from USD 420M in 2024 to USD 3.5B by 2034, integrated systems are powering intelligent rights management and automated ad-tech ecosystems.

- Regional Outlook: North America led the global market with ~39% share in 2024, supported by enterprise adoption and strong IP policies. Europe and Asia-Pacific are rapidly emerging through Web3 innovation hubs, digital content startups, and cross-border blockchain regulatory frameworks.

Type Analysis

As of 2025, the private blockchain segment remains the most dominant in the media, advertising, and entertainment market, accounting for over 52% of global revenue share. This continued leadership is attributed to the high level of control, security, and scalability that private blockchain networks offer—features that are essential when managing sensitive digital assets and proprietary content. In industries frequently exposed to copyright infringements, piracy, and fraud, the ability to restrict access to verified participants ensures a safer environment for content distribution and licensing.

Private blockchains are particularly attractive to large media firms due to their high throughput capacity and ability to support enterprise-grade applications, including real-time royalty tracking, digital rights enforcement, and fraud-resistant advertising verification. Unlike public blockchains, which are open and slower, private networks allow for faster transactions and minimal latency—critical features for digital media operations that process thousands of transactions per minute.

Additionally, private blockchain solutions integrate more seamlessly with existing IT infrastructures, which reduces transition costs and operational disruption. As organizations continue to customize blockchain deployments to suit their unique business models, the private segment is expected to witness sustained demand, especially among global content platforms, broadcasters, and studios that prioritize data sovereignty and compliance.

Application Analysis

The Payments segment led the blockchain application landscape in 2025, commanding more than 36% of total market value. This dominance reflects the strategic value blockchain brings in modernizing financial workflows in the media ecosystem—from automating royalty disbursements to streamlining cross-border payments. With smart contracts, media companies can initiate automated transactions based on predefined triggers such as streaming counts, ad views, or usage rights, significantly reducing administrative delays and disputes.

Blockchain's immutable ledger system also enhances trust and accuracy in financial reporting, which is vital for creators, advertisers, and production studios managing complex multi-party agreements. For global firms operating in multiple jurisdictions, blockchain enables real-time settlement in multiple currencies, reducing forex conversion overheads and compliance challenges. This application is increasingly integrated into platforms like Spotify, YouTube, and decentralized streaming services aiming to offer transparent compensation models to artists and rights holders.

Other applications such as Licensing and Rights Management and Digital Advertising are also rapidly growing, supported by increased demand for IP protection and ad fraud mitigation. These segments are expected to gain momentum with the proliferation of Web3 platforms and decentralized content ecosystems.

Enterprise Analysis Size

In 2025, large enterprises continue to dominate blockchain adoption in the media, advertising, and entertainment sectors, holding an estimated 58% market share. These organizations possess the infrastructure, capital, and strategic alignment necessary to deploy blockchain technologies at scale. Their operations often span international markets and complex supply chains, which creates demand for secure, transparent systems to manage digital rights, ad delivery verification, and payments.

Blockchain adoption among large enterprises is often part of broader digital transformation initiatives, allowing these companies to establish leadership in emerging content monetization models, such as tokenized media and NFT-based licensing. Media giants like Warner Bros. Discovery and NBCUniversal are exploring blockchain for secure content distribution and audience engagement, driving mainstream use cases and setting standards that smaller players follow.

While SMEs show rising interest, especially in creative industries and independent content production, they face barriers including high implementation costs and limited technical expertise. However, as blockchain-as-a-service (BaaS) platforms become more accessible and user-friendly, adoption among SMEs is expected to increase steadily in the second half of the decade.

Regional Analysis

North America retains its position as the global leader in the blockchain in media, advertising, and entertainment market, contributing over 39% of total revenue in 2025. The region benefits from a robust ecosystem of blockchain innovators, established media conglomerates, and a supportive regulatory environment. U.S.-based firms are at the forefront of deploying blockchain to manage IP rights, automate ad billing, and combat streaming piracy.

Major partnerships between tech firms (like IBM and Microsoft) and content platforms continue to accelerate blockchain integration across North America. Regulatory frameworks such as the Digital Millennium Copyright Act (DMCA) also support blockchain’s role in securing intellectual property and enforcing licensing agreements. Moreover, North American startups are leading the charge in Web3-native content distribution platforms, positioning the region as an incubator for decentralized media innovation.

Meanwhile, Asia Pacific is emerging as the fastest-growing region, driven by high digital content consumption, expanding creative economies, and government-backed blockchain pilots in countries like China, South Korea, and Singapore. Regions such as Europe are focused on regulatory harmonization and cross-border blockchain projects, while Latin America and the Middle East & Africa are gradually adopting blockchain to solve legacy challenges in payment processing and IP management in their creative sectors. As infrastructure matures globally, these emerging regions are likely to experience a sharp uptick in blockchain-based media applications through 2034.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Public

- Private

- Consortium

By Enterprise Size

- SMEs

- Large Enterprises

By Application

- Licensing and Rights Management

- Digital Advertising

- Online gaming

- Content Security

- Payments

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.1 B |

| Forecast Revenue (2034) | USD 112.4 B |

| CAGR (2024-2034) | 47.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Public, Private, Consortium), By Enterprise Size (SMEs, Large Enterprises), By Application (Licensing and Rights Management, Digital Advertising, Online gaming, Content Security, Payments, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Accenture, Amazon Web Services, IBM, Oracle, ClearCoin, SAP, Microsoft, Infosys Limited |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Blockchain In Media, Advertising and Entertainment Market

Published Date : 01 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date