Botulinum Toxin-A in Urology Market Size, Share & Forecast 2024–2034

Global Botulinum Toxin-A in Urology Market Size, Share, and Growth Analysis by Indication (Overactive Bladder, Neurogenic Detrusor Overactivity, Urinary Incontinence), by End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), by Patient Demographics, by Distribution Channel, Region & Key Players – Industry Trends, Clinical Adoption, Competitive Landscape, Regulatory Insights, and Forecast 2024–2034

Report Overview

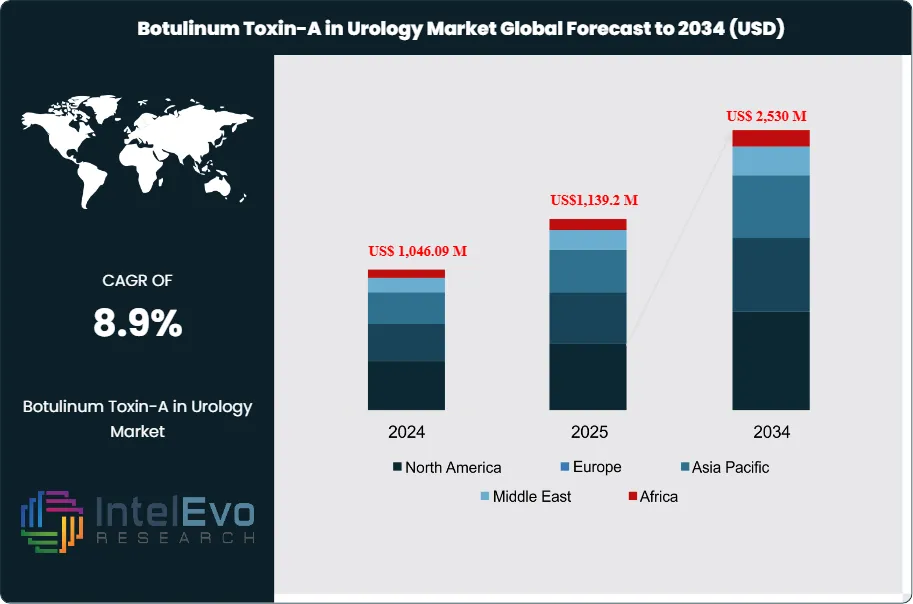

The Botulinum Toxin-A in Urology market is estimated at US$ 1,046.09 million in 2024 and is on track to reach roughly US$ 2,530 million by 2034, implying a compound annual growth rate (CAGR) of 8.9% over 2024–2034. This growth is driven by the rising prevalence of overactive bladder (OAB), neurogenic detrusor overactivity, and other lower urinary tract disorders, particularly among aging populations. Increasing clinical acceptance of minimally invasive treatments, expanding regulatory approvals, and growing patient preference for long-acting therapeutic options are further strengthening adoption across hospital and specialty urology settings.

Get More Information about this report -

Request Free Sample ReportThe market has expanded steadily over the past five years, rising from US$ 820.1 million in 2020 to over US$ 1.0 billion in 2024. This trajectory reflects both rising prevalence of urological disorders and the growing acceptance of minimally invasive interventions among patients and healthcare providers.

Botulinum Toxin-A (BoNT-A) has become a preferred treatment for conditions such as overactive bladder, neurogenic detrusor overactivity, and interstitial cystitis. Its ability to reduce muscle overactivity by temporarily inhibiting nerve signaling provides longer-lasting relief compared with conventional anticholinergic drugs, which are often associated with side effects such as dry mouth, constipation, and cognitive impairment. This therapeutic advantage is particularly relevant for elderly patients, a demographic that is expanding rapidly. According to the World Health Organization, the global population aged 60 years and older will rise from 1 billion in 2020 to 2.1 billion by 2050, with those aged 80 years and above tripling to 426 million. In India alone, the elderly population is projected to account for 20% of the total by mid-century. These demographic shifts are expected to sustain long-term demand for BoNT-A therapies.

Market expansion is further supported by favorable reimbursement frameworks in developed economies. In the United States, Canada, Germany, and the United Kingdom, insurance coverage for BoNT-A procedures reduces patient out-of-pocket costs and accelerates adoption. At the same time, ongoing clinical research is broadening the scope of BoNT-A applications. Trials are investigating new indications, refined dosing strategies, and combination therapies that could extend treatment duration and improve outcomes.

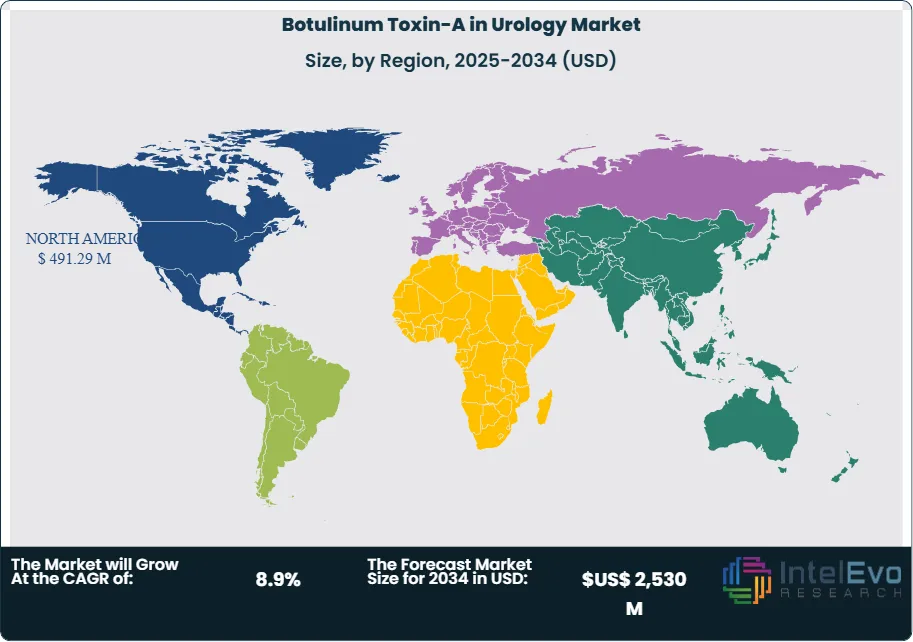

Regional performance highlights North America as the current leader, accounting for 47% of global revenue in 2024, or US$ 491.29 million. Europe follows with strong uptake driven by aging populations and supportive healthcare systems. Asia-Pacific is emerging as the fastest-growing region, supported by rising awareness, expanding healthcare infrastructure, and a rapidly aging demographic base. For investors, Asia-Pacific represents a key growth frontier, while North America and Europe remain stable revenue anchors.

Overall, the market outlook is defined by demographic pressures, clinical advantages over traditional therapies, and expanding research pipelines. These factors position Botulinum Toxin-A as a central component of urological care over the next decade.

Key Takeaways

- Market Growth: The global Botulinum Toxin-A in Urology market was valued at US$ 1,046.09 million in 2024 and is projected to reach US$ 2,490.34 million by 2034, expanding at a CAGR of 8.9%. Growth is driven by rising prevalence of overactive bladder and neurogenic detrusor overactivity, coupled with increasing adoption of minimally invasive therapies.

- Product Type: Botox-branded formulations accounted for 77.2% of total revenue in 2024, reflecting strong physician preference and established clinical efficacy compared with competing brands.

- Indication: Overactive Bladder (OAB) represented the largest application segment with 83.5% market share in 2024, supported by high patient volumes and limited long-term effectiveness of oral anticholinergic drugs.

- End User: Hospitals generated 67.4% of global revenue in 2024, underscoring their role as primary centers for BoNT-A procedures due to specialist availability and reimbursement coverage.

- Driver: The expanding elderly population is a key demand driver. According to WHO, the number of people aged 60 years and older will double from 1 billion in 2020 to 2.1 billion by 2050, significantly increasing the incidence of urological disorders.

- Restraint: High treatment costs remain a barrier in low- and middle-income countries, where limited insurance coverage restricts access and slows adoption despite clinical benefits.

- Opportunity: Asia-Pacific presents the strongest growth potential, with double-digit CAGR expected through 2034. Rising healthcare expenditure, expanding insurance penetration, and a rapidly aging population position the region as a future investment hotspot.

- Trend: Clinical research is expanding BoNT-A applications beyond OAB and NDO. Trials are exploring optimized dosing and combination therapies, which could extend treatment duration and improve patient outcomes, creating new revenue streams for manufacturers.

- Regional Analysis: North America led the market with 47.0% share in 2024, equivalent to US$ 491.29 million, supported by favorable reimbursement and high awareness. Europe followed with strong adoption in Germany and the UK. Asia-Pacific is emerging as the fastest-growing region, while Latin America and the Middle East show gradual uptake tied to healthcare infrastructure improvements.

Type Analysis

The global Botulinum Toxin-A in Urology market remains highly concentrated by product type, with Botox continuing to dominate. In 2024, Botox accounted for 77.2% of total revenue, equivalent to US$ 807.9 million, supported by its established clinical record and broad regulatory approvals for urological conditions such as overactive bladder (OAB) and neurogenic detrusor overactivity (NDO). Its strong brand recognition, extensive clinical validation, and Allergan’s global distribution network have reinforced its leadership position.

Dysport and Xeomin collectively represent a smaller share, with revenues of US$ 163.3 million and US$ 47.7 million respectively in 2024. Both products are gaining traction in select markets due to competitive pricing and expanding clinical evidence, but they remain secondary choices compared with Botox. Other formulations, while present, account for less than 3% of global sales. Looking ahead to 2030, Botox is expected to retain its leadership, though incremental gains by Dysport and Xeomin are anticipated as healthcare systems diversify procurement and as clinical trials expand their approved indications.

The competitive landscape is shaped by product differentiation, safety profiles, and physician familiarity. Botox’s long-standing dominance is unlikely to be challenged in the near term, but regional adoption of alternatives may increase as cost pressures and local manufacturing initiatives influence purchasing decisions.

Application Analysis

Overactive Bladder (OAB) is the largest application segment, representing 83.5% of global revenue in 2024, or US$ 873.4 million. The high prevalence of OAB, particularly among aging populations, underpins this dominance. According to the World Health Organization, the global population aged 60 years and older will reach 2.1 billion by 2050, significantly expanding the patient pool. BoNT-A injections provide symptom relief lasting six to nine months, making them a preferred alternative to oral anticholinergics, which often cause side effects such as dry mouth and cognitive impairment.

Neurogenic Detrusor Overactivity (NDO) accounted for US$ 172.7 million in 2024 and is expected to grow steadily as awareness increases among patients with spinal cord injuries and multiple sclerosis. Clinical research is expanding the use of BoNT-A in NDO, with ongoing trials exploring optimized dosing and combination therapies. This segment, while smaller, represents a critical area of unmet need and is projected to deliver above-average growth rates through 2030.

The application mix highlights the importance of OAB as the primary revenue driver, while NDO offers long-term growth potential as clinical adoption broadens and reimbursement frameworks expand.

End-Use Analysis

Hospitals remain the leading end-user, generating 67.4% of global revenue in 2024, or US$ 705 million. Their dominance is attributed to the availability of specialized urology departments, skilled practitioners, and reimbursement coverage that supports BoNT-A procedures. Hospitals also manage complex cases requiring advanced diagnostic and post-treatment care, reinforcing their central role in the market.

Urology clinics accounted for US$ 282 million in 2024 and are gaining importance as outpatient centers for minimally invasive procedures. Their growth is supported by rising patient preference for shorter treatment times and lower costs compared with hospital-based care. Research institutes, though the smallest segment at US$ 59.1 million in 2024, play a strategic role in advancing clinical trials and expanding therapeutic applications.

By 2030, hospitals will continue to dominate, but urology clinics are expected to capture a larger share as healthcare systems shift toward outpatient models and as insurers expand coverage for clinic-based procedures.

Regional Analysis

North America leads the global market, accounting for 47% of revenue in 2024, or US$ 491.29 million. The United States drives this dominance, with an estimated 33 million individuals affected by OAB, according to the National Institutes of Health. Strong reimbursement policies, FDA approvals, and widespread physician adoption ensure continued growth. Canada also contributes meaningfully, supported by universal healthcare coverage for BoNT-A procedures.

Europe follows as the second-largest market, with Germany, the UK, and France leading adoption. Favorable reimbursement frameworks and an aging population underpin demand. Asia Pacific, while smaller at US$ 423.9 million in 2024, is the fastest-growing region. Rising healthcare expenditure, expanding insurance penetration, and a rapidly aging demographic base in China, Japan, and India are expected to drive double-digit CAGR through 2030.

Latin America and the Middle East & Africa represent smaller but expanding markets. Brazil and Mexico are leading adopters in Latin America, while Gulf states are investing in advanced urology care. These regions face challenges such as limited reimbursement and uneven healthcare infrastructure, but gradual improvements are expected to support steady growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Product Type

- Botox

- Dysport

- Xeomin

- Other Product Types

By Indication

- Overactive Bladder (OAB)

- Neurogenic Detrusor Overactivity (NDO)

By End-User

- Hospitals

- Urology Clinics

- Research Institutes

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | US$ 1,046.09 M |

| Forecast Revenue (2034) | US$ 2,530 M |

| CAGR (2024-2034) | 8.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type, (Botox, Dysport, Xeomin, Other Product Types), By Indication, (Overactive Bladder (OAB), Neurogenic Detrusor Overactivity (NDO)), By End-User, (Hospitals, Urology Clinics, Research Institutes) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Daewoong Pharmaceutical Co., Ltd., AbbVie Inc, Medytox, Galderma (Distributor), Ipsen Pharma, HUGEL, Inc., Merz Pharma, Bio-Med Private Limited |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Botulinum Toxin-A in Urology Market

Published Date : 06 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date