Bulk Food Dispensers Market Size, Growth Outlook | 13.7% CAGR

Global Bulk Food Dispensers Market Size, Share & Analysis By Material Type (Plastics, Metal, Glass), By Type (Gravity-fed, Scoop bins, Pre-Packaged Bulk Food Dispenser), By Installation Type (Countertop, Wall-Mounted, Floor-Standing), By Capacity (Up to 3 Gallon, 3 to 6 Gallon, Above 6 Gallon), By End-user (Hypermarkets & Supermarkets, Retail Stores, Food Service, Residential), Sustainability Trends, Cost Efficiency, Key Players & Forecast 2025–2034

Report Overview

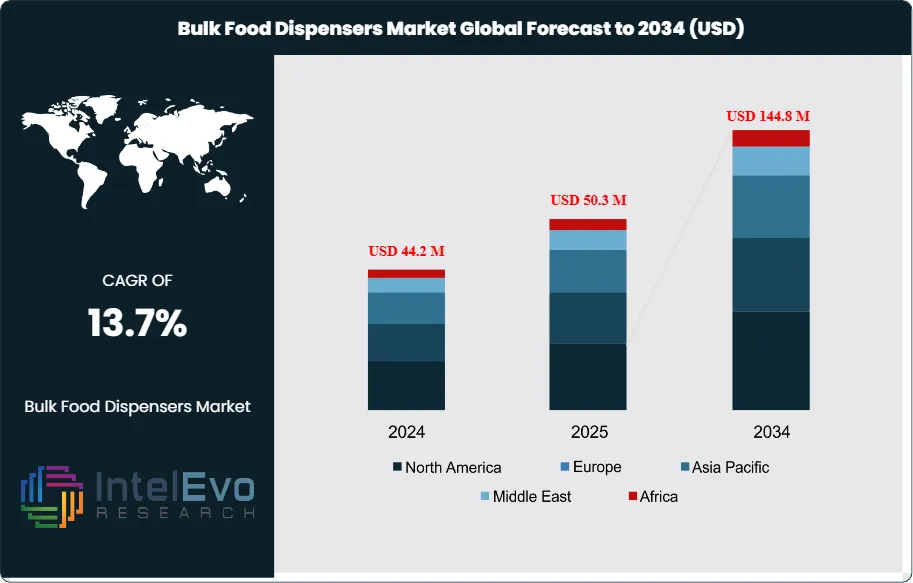

The Bulk Food Dispensers Market is estimated at USD 44.2 million in 2024 and is on track to reach roughly USD 144.8 million by 2034, implying a compound annual growth rate of 13.7% over 2024–2034. From a niche format a decade ago, the category is entering a scale-up phase as retailers, institutions, and foodservice operators adopt gravity and scoop dispensers for cereals, grains, pulses, nuts, and snacks. The market’s value is set to more than triple (3.3x) over the forecast horizon, underpinned by sustainability mandates, packaging-waste reduction goals, and the economics of bulk merchandising. Industry pilots indicate bulk programs can meaningfully cut single-use packaging volumes and reduce product shrink, while improving SKU visibility and replenishment efficiency—benefits that translate into stronger sell-through and margin resilience in high-inflation environments.

Get More Information about this report -

Request Free Sample ReportDemand-side momentum is reinforced by consumers’ rising preference for waste-light shopping and price transparency, while on the supply side, improvements in dispenser design (modular footprints, tamper-evident closures, food-grade materials) and standardized sanitation protocols are addressing historical concerns around hygiene and cross-contamination. Challenges remain: upfront capex for retrofits, staff training, and variability in store traffic can slow rollout cadence; materials costs and quality control in components such as food-grade polycarbonate and stainless steel also require careful vendor selection and long-term service agreements.

Technology is accelerating adoption. Smart dispensers with IoT sensors enable real-time inventory monitoring, automated planogram compliance, and refill alerts; integration with POS and handheld apps supports frictionless tare-and-weigh checkout. Emerging AI use cases—demand forecasting at bin level, loss-detection from flow anomalies, and dynamic space optimization—are lifting labor productivity and reducing out-of-stocks.

Regionally, North America and Europe currently lead, together accounting for roughly 55–60% of 2024 revenues, driven by zero-waste retail formats and retailer ESG targets. Asia–Pacific is the fastest-growing region (mid-teens CAGR), with India a standout. India’s food processing sector contributes 1.69% to national GVA, and policy support is deepening: the Ministry of Food Processing Industries’ ₹3,290-crore allocation for 2024–25 (+30.19% YoY) strengthens cold-chain and processing infrastructure; the PLISFPI reimburses up to 50% of international branding spends (capped at ₹50 crore per year); and PMKSY targets ₹31,400 crore in leveraged investment, benefiting ~20 lakh farmers and creating 5+ lakh jobs. Strong wheat procurement—2.08 million metric tons since March 15, 2025, up 44.4% year over year—underscores supply stability. Investment hotspots include modern trade, campus and corporate dining, and public distribution modernization in high-growth urban corridors across India and Southeast Asia.

Key Takeaways

- Market Growth: The global Bulk Food Dispensers Market will expand from USD 44.2 Mn in 2024 to USD 144.8 Mn by 2034, a 13.7% CAGR (≈3.3x growth), propelled by sustainability mandates, packaging-waste reduction, and modern trade rollouts.

- Technology: Gravity-fed systems lead with 57.3% share, reflecting lower product breakage, faster throughput, and fewer touchpoints versus scoop models—key advantages for high-traffic grocery aisles.

- Material: Plastics account for 58.3% of units due to cost efficiency, light weight, and product visibility, while glass and stainless alternatives remain niche where premium aesthetics or stricter hygiene coding is required.

- Driver: Organized retail adoption is accelerating—hypermarkets & supermarkets hold 48.3% share—while retrofit-friendly formats (countertop at 46.3%) and smaller bins (up to 3 gallons at 46.3%) align with space constraints and frequent-turn dry categories.

- Restraint: Upfront capex and sanitation compliance temper rollout; the continued presence of non-gravity solutions (42.7%) and non-plastic materials (41.7%) signals cost sensitivity and maintenance burdens that slow conversions, especially in independents.

- Opportunity: Penetration white space outside the current leaders is sizable; capturing just 5 percentage points of the global market by 2034 equates to roughly USD 7.1 Mn in incremental revenue (5% of the USD 142.8 Mn TAM), with compact countertop and ≤3-gallon formats best positioned to win.

- Trend: Mix is shifting toward compact, modular deployments—evidenced by countertop (46.3%) and ≤3-gallon (46.3%) shares—supporting micro-aisle “zero-waste” concepts and phased retrofits; suppliers are prioritizing modularity, tamper-evident closures, and food-grade polymers to standardize hygiene.

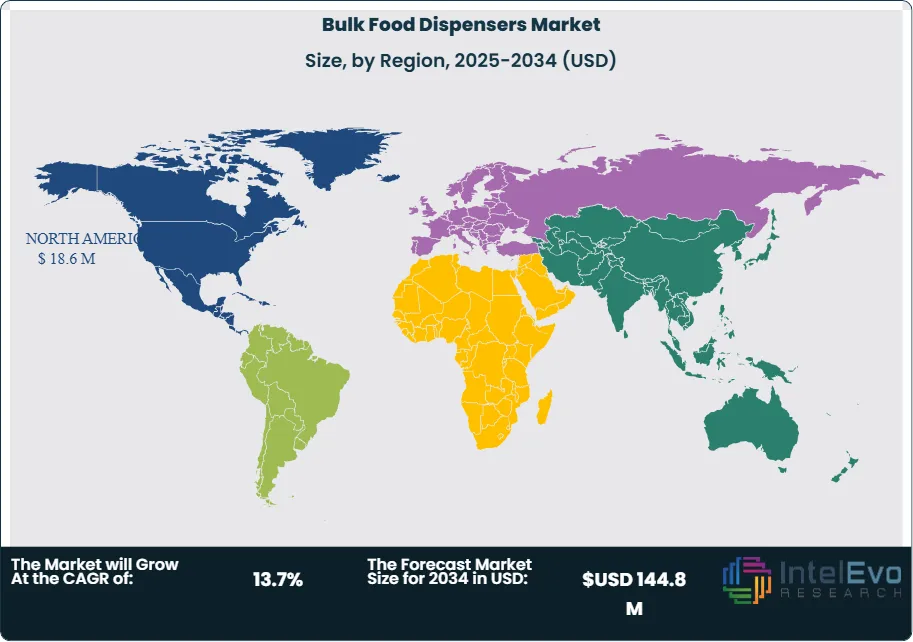

- Regional Analysis: North America leads with 43.2% of 2024 revenue (≈USD 18.6 Mn), while the rest of the world represents 56.8% (≈USD 24.6 Mn); if shares were to hold constant, North America would scale to ~USD 61.8 Mn by 2034, underscoring both a durable core market and substantial international whitespace.

Type Analysis

Gravity-fed dispensers remain the industry’s anchor format entering 2025, accounting for an estimated 57.3% of 2024 shipments and sustaining leadership on the back of simpler mechanics, faster line speeds, and fewer touchpoints in-store. Their controlled flow reduces product breakage and shrink versus scoop-based systems, which continue to serve fragile SKUs (e.g., specialty confectionery) but face slower adoption in high-traffic aisles. Pre-packaged bulk dispensers—pre-portioned, refillable cartridges—are a smaller but rising niche, benefiting formats that prioritize hygiene, traceability, and labor-light replenishment, particularly in pharmacies, travel retail, and campus convenience.

Material and design choices reinforce this mix: plastics (polycarbonate, copolyester, ABS) represented roughly 58.3% of unit materials in 2024 due to impact resistance, optical clarity, and lower total cost of ownership. Vendors are adding tamper-evident closures, food-grade seals, and IoT-ready lids to gravity systems, enabling bin-level stock sensing, planogram compliance, and predictive refills—features increasingly specified by top grocery banners and cash-and-carry chains.

Application Analysis

Staple pantry categories—cereals, grains, pulses, rice, and dry beans—drive the highest throughput in modern trade, where gravity bins minimize handling and speed self-service. Premium and impulse lines (nuts, trail mixes, candy, granola, and specialty snacks) favor compact footprints that support frequent rotation and visual merchandising. Coffee and tea benefit from aroma-preserving valves and UV-resistant canisters, while pet food and baking ingredients (flour, sugar) rely on wider spouts and anti-bridging inserts to maintain consistent flow.

Capacity and placement correlate tightly with mix. ≤3-gallon units accounted for ~46.3% of 2024 deployments, aligning with higher-margin or fast-turn items that need smaller batches and fresher rotations; larger 3–6+ gallon bins continue to anchor staples where velocity and price transparency matter most. Countertop positioning (46.3% share in 2024) supports impulse categories at service counters and endcaps, whereas wall-mounted arrays and floor-standing gondolas optimize staple aisles and back-of-house replenishment.

End-Use Analysis

Hypermarkets and supermarkets are the primary demand engine, holding about 48.3% share in 2024 as chains expand zero-waste aisles and private-label bulk programs to cut packaging and improve price perception. General retail (organic stores, refilleries, drugstores) is broadening category width—often starting with snacks and coffee—while foodservice (corporate cafeterias, universities, QSR salad/ice-cream toppings) deploys closed systems to manage portion control and hygiene. Residential adoption is nascent but growing in premium kitchen and co-living formats, aided by compact, modular dispensers and online D2C kits.

Operationally, retailers prioritize solutions that compress labor minutes per refill and standardize sanitation. This is accelerating the shift to modular cartridges, bin-level sensors, and POS-integrated tare workflows, which collectively reduce out-of-stocks, improve shrink control, and lift conversion in fresh-adjacent aisles.

Regional Analysis

North America entered 2025 as the largest regional market with ~43.2% revenue share in 2024 (≈USD 18.6 million), supported by mature modern trade, ESG targets, and strong uptake of touchless features. Europe follows with dense urban refillery ecosystems and retailer plastics pacts driving sustained rollouts, though regulatory complexity and store-labor constraints favor modular, service-light systems. Asia Pacific is the fastest-growing region (double-digit CAGR through 2034), led by organized retail expansion and government programs that strengthen food processing and distribution infrastructure—India’s policy push and modern trade growth are particularly supportive of bulk formats.

Latin America and the Middle East & Africa are emerging opportunity corridors where cash-and-carry and value banners are piloting bulk to sharpen price points and reduce secondary packaging. Across all regions, 2025–2030 investment themes center on hygiene-by-design, bin telemetry, and adaptable footprints (countertop, wall-mounted, and floor-standing) that let retailers scale from pilot bays to full-aisle conversions while protecting capex and labor budgets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Material Type

- Plastics

- Acrylic

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Copolyester

- Others

- Metal

- Glass

By Type

- Gravity-fed

- Scoop bins

- Pre-Packaged Bulk Food Dispenser

By Installation Type

- Countertop

- Wall-Mounted

- Floor-Standing

By Capacity

- Up to 3 Gallon

- 3 to 6 Gallon

- Above 6 Gallon

By End-user

- Hypermarkets & Supermarkets

- Retail Stores

- Food Service

- Residential

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 44.2 M |

| Forecast Revenue (2034) | USD 144.8 M |

| CAGR (2024-2034) | 13.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Material Type (Plastics, Metal, Glass), By Type (Gravity-fed, Scoop bins, Pre-Packaged Bulk Food Dispenser), By Installation Type (Countertop, Wall-Mounted, Floor-Standing), By Capacity (Up to 3 Gallon, 3 to 6 Gallon, Above 6 Gallon), By End-user (Hypermarkets & Supermarkets, Retail Stores, Food Service, Residential) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Server Products Inc, Rosseto Serving Solutions, Joalpe International UK, Hubert Company, LLC, BestBins, Jiangxi Eco Technology Group Co., Ltd., Cal-Mil, Nestlé S.A., Food Dispense, Lipton, Danone, Akriform Plast AB, IDM LTD, Purcell, Hangzhou Fulinde Display Manufacturer, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date