Calcium Carbonate Market to Hit USD 78.4 Bn by 2034 | CAGR 4.9%

Global Calcium Carbonate Market Size, Share & Analysis Report By Type (GCC, PCC, Activated/Surface-Modified Calcium Carbonate), Application (Paper, Plastics, Paints & Coatings, Construction, Adhesives & Sealants, Pharmaceuticals, Food & Beverages, Agriculture), End-Use Industry, Production Process, Regional Insights & Key Players – Industry Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025–2034

Report Overview

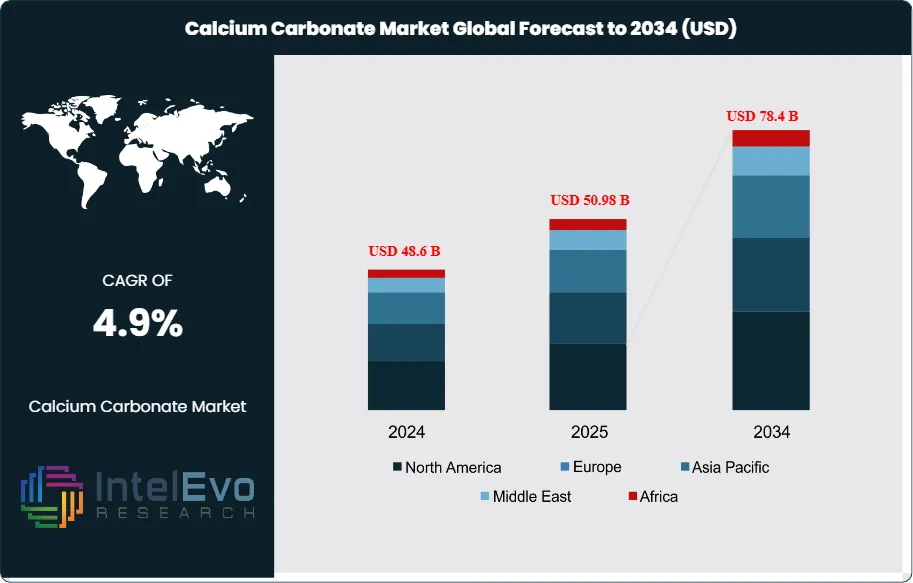

The Calcium Carbonate Market size is expected to be worth around USD 78.4 Billion by 2034, up from USD 48.6 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2024 to 2034. The calcium carbonate market is a foundational segment within the global chemicals and materials industry, encompassing a wide range of natural and synthetic products used as fillers, extenders, and functional additives. Calcium carbonate is critical for industries such as paper, plastics, paints & coatings, adhesives & sealants, construction, pharmaceuticals, agriculture, and food & beverages. The market’s growth is propelled by rising demand for lightweight, cost-effective, and sustainable materials, as well as the ongoing expansion of end-use industries in emerging economies. Technological advancements in surface modification, particle size control, and eco-friendly production processes are further enhancing the performance and value proposition of calcium carbonate in modern manufacturing.

Get More Information about this report -

Request Free Sample ReportSeveral factors are driving the expansion and evolution of the calcium carbonate market. The primary driver is the increasing use of calcium carbonate as a filler and coating pigment in the paper industry, where it improves brightness, opacity, and printability while reducing production costs. The plastics industry is another major consumer, utilizing calcium carbonate to enhance mechanical properties, reduce resin consumption, and improve processability. The construction sector relies on calcium carbonate for cement, concrete, and building materials, benefiting from its abundance, low cost, and environmental compatibility. Advances in nano-calcium carbonate and surface-treated grades are opening new opportunities in high-performance plastics, paints, and biomedical applications. The market is also shaped by regulatory trends favoring sustainable, non-toxic, and recyclable materials, as well as the need for cost optimization in competitive manufacturing environments.

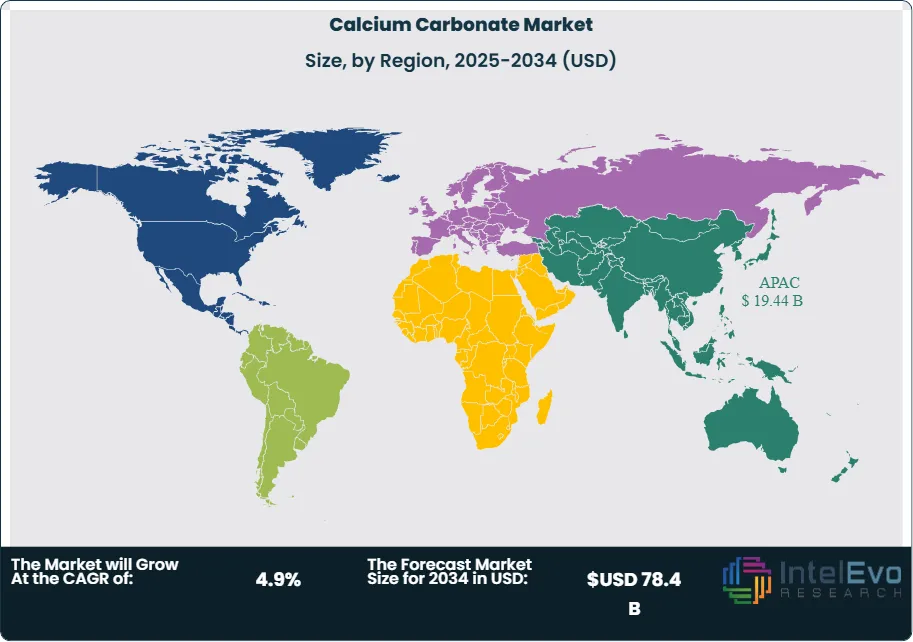

Regionally, the calcium carbonate market exhibits distinct growth patterns reflecting resource availability, industrialization, environmental regulations, and end-use industry maturity. Asia-Pacific leads the market, accounting for over 40% of global share, driven by rapid industrial growth, urbanization, and large-scale investments in paper, plastics, and construction in China, India, and Southeast Asia. North America and Europe follow, with mature manufacturing sectors, advanced technology adoption, and a strong focus on sustainability and regulatory compliance. Latin America and the Middle East & Africa are emerging as high-growth regions, supported by infrastructure development, agricultural expansion, and increasing demand for cost-effective materials. The COVID-19 pandemic initially disrupted supply chains and reduced demand in some sectors, but the market rebounded as manufacturing and construction activities resumed and sustainability initiatives accelerated. Geopolitical factors, such as trade tensions, raw material price volatility, and evolving environmental regulations, continue to influence market dynamics and investment decisions.

Key Takeaways

- Market Growth: The Calcium Carbonate Market is expected to reach USD 78.4 Billion by 2034, driven by demand in paper, plastics, construction, and paints & coatings, as well as advances in material science and sustainable production.

- Type Dominance: Ground calcium carbonate (GCC) leads the market due to its cost-effectiveness and wide applicability, while precipitated calcium carbonate (PCC) is gaining traction for high-performance and specialty applications.

- Application Dominance: The paper industry is the largest application segment, utilizing calcium carbonate for coating and filling, followed by plastics, construction, and paints & coatings.

- Drivers: Key drivers include the need for lightweight, sustainable materials, cost optimization in manufacturing, and regulatory support for non-toxic, recyclable additives.

- Restraints: Market growth is hindered by raw material quality variability, environmental concerns related to mining, and energy-intensive production processes.

- Opportunities: The market is positioned for expansion through the development of nano-calcium carbonate, surface-modified grades, and increased demand in emerging economies.

- Trends: Notable trends include the shift toward eco-friendly production, integration of calcium carbonate in bioplastics and green building materials, and advances in particle engineering.

- Regional Analysis: Asia-Pacific leads with over 40% market share due to rapid industrialization and infrastructure growth. North America and Europe maintain strong positions with a focus on sustainability and advanced manufacturing.

Type Analysis:

Ground Calcium Carbonate (GCC) holds the largest share in the global calcium carbonate market, accounting for well over 60% of total consumption. GCC is produced by grinding natural limestone or marble and is favored for its abundance, low cost, and ease of processing. Its primary advantage lies in its suitability for high-volume, cost-sensitive applications, making it the dominant choice for industries such as paper, plastics, paints, and construction materials. In contrast, Precipitated Calcium Carbonate (PCC) is synthetically produced through chemical precipitation, offering superior control over particle size, shape, and purity. PCC is preferred in high-performance and specialty applications—such as premium papers, pharmaceuticals, food additives, and advanced plastics—where enhanced brightness, opacity, and functionality are required. Activated or surface-modified calcium carbonate, though a smaller segment, is gaining traction in plastics, rubber, and paints due to its improved compatibility and dispersion, achieved by treating the particles with surfactants or coupling agents.

Application Analysis:

The paper industry is the largest application segment for calcium carbonate, commanding more than 35% of the global market share. In paper manufacturing, calcium carbonate is used both as a coating and filling pigment, significantly improving brightness, opacity, and print quality while reducing production costs. The plastics sector follows, where calcium carbonate serves as a filler to enhance mechanical properties, reduce polymer consumption, and improve processability in products such as films, pipes, and packaging. Paints and coatings represent another major application, with calcium carbonate providing whiteness, opacity, and improved rheology, making it a key extender and functional additive in both decorative and industrial paints. In construction, calcium carbonate is integral to cement, concrete, and building materials, valued for its strength, durability, and environmental compatibility. Other important applications include adhesives and sealants, pharmaceuticals, food and beverages, and agriculture, where it is used as a dietary supplement, antacid, soil conditioner, and food additive.

End-Use Industry Analysis:

The paper & pulp industry is the leading end-use sector for calcium carbonate, reflecting its dominant role in paper production worldwide. Calcium carbonate is essential for producing high-quality, cost-effective paper products, and its use has expanded with the shift toward alkaline papermaking processes. The plastics & polymers industry is another significant consumer, utilizing calcium carbonate to improve product performance and reduce costs. Construction & building materials, as well as paints, coatings & inks, also represent substantial end-use markets, driven by ongoing infrastructure development and demand for durable, sustainable materials. Pharmaceuticals & healthcare, food & beverages, and agriculture are important niche sectors, leveraging calcium carbonate’s safety, purity, and functional benefits.

Regional Analysis:

Asia-Pacific is the largest and fastest-growing regional market for calcium carbonate, accounting for over 40% of global demand. This dominance is driven by rapid industrialization, urbanization, and large-scale investments in paper, plastics, and construction across China, India, and Southeast Asia. The region’s robust manufacturing base and infrastructure development continue to fuel demand for calcium carbonate in various applications. North America is a mature market, characterized by advanced technology adoption, a strong focus on sustainability, and stringent regulatory compliance. Europe follows closely, emphasizing eco-friendly production, innovation, and strict environmental regulations, which drive the adoption of high-purity and specialty grades. Latin America and the Middle East & Africa are emerging as high-growth regions, supported by infrastructure development, agricultural expansion, and increasing demand for cost-effective materials in both industrial and consumer applications.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Type:

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Activated/Surface-Modified Calcium Carbonate

- Others

Application:

- Paper, Plastics

- Paints & Coatings

- Construction

- Adhesives & Sealants

- Pharmaceuticals

- Food & Beverages

- Agriculture

- Others

End-Use Industry:

- Paper & Pulp

- Plastics & Polymers

- Construction & Building Materials

- Paints

- Coatings & Inks

- Pharmaceuticals & Healthcare

- Food & Beverages

- Agriculture

- Others

Production Process:

- Dry Process

- Wet Process

- Surface Modification

Region:

- North America

- Europe,

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 50.98 B |

| Forecast Revenue (2034) | USD 78.4 B |

| CAGR (2025-2034) | 4.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Activated/Surface-Modified Calcium Carbonate, Others) Application (Paper, Plastics, Paints & Coatings, Construction, Adhesives & Sealants, Pharmaceuticals, Food & Beverages, Agriculture, Others) End-Use Industry (Paper & Pulp, Plastics & Polymers, Construction & Building Materials, Paints, Coatings & Inks, Pharmaceuticals & Healthcare, Food & Beverages, Agriculture, Others) Production Process (Dry Process, Wet Process, Surface Modification) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Imerys, Omya AG, Minerals Technologies Inc., Lhoist Group, Nordkalk Corporation, Huber Engineered Materials, Mississippi Lime Company, Schaefer Kalk GmbH & Co. KG, Carmeuse, Sibelco, Graymont Limited, CIMBAR Resources Inc., GCCP Resources Limited, Maruo Calcium Co., Ltd., 20 Microns Ltd., Arihant Micron, Okutama Kogyo Co., Ltd., Calchem Industries Ltd., GLC Minerals LLC, Eurocarbon |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date