Caviar Market Size USD 975.7M & 9.8% CAGR Forecast 2034

Global Caviar Market Size, Share & Luxury Food Industry Analysis By Product Type (Beluga, Osetra, Sevruga), By Source (Wild, Farmed), By Distribution Channel, Consumer Trends, Regional Demand Outlook, Key Producers & Forecast 2025–2034

Report Overview

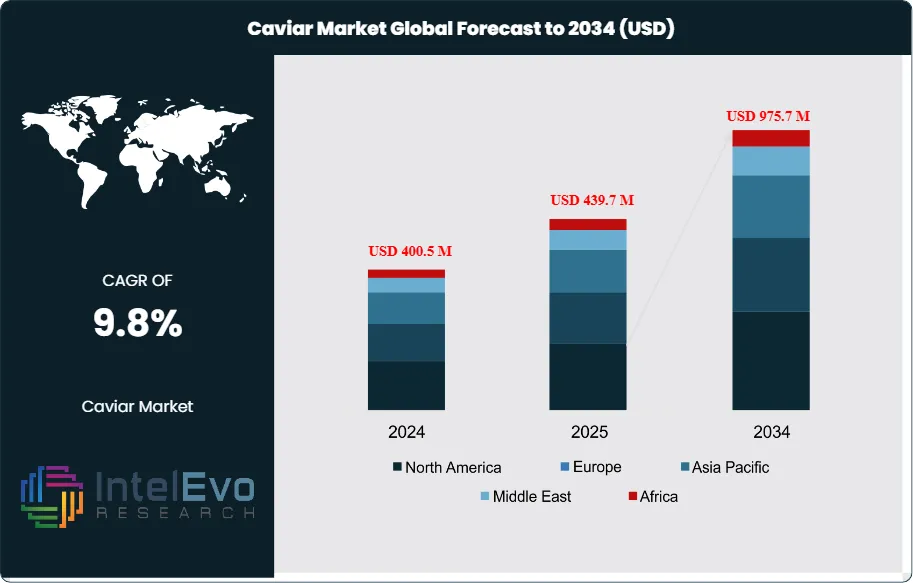

The Caviar Market is estimated at USD 400.5 million in 2024 and is projected to reach approximately USD 975.7 million by 2034, registering a CAGR of about 9.8% during 2025–2034. Market growth is increasingly value-driven rather than volume-led, supported by premium pricing, controlled supply, and rising demand from luxury food and gifting segments. Legal aquaculture now supplies over 95% of global volumes, following strict trade controls enforced under CITES, which have effectively constrained wild sturgeon harvesting.

Get More Information about this report -

Request Free Sample ReportAverage retail prices remain elevated, ranging from USD 1,200–6,000 per kilogram for Osetra and USD 5,000–10,000 per kilogram for Beluga, sustaining revenue expansion even during periods of volume volatility. Between 2019 and 2023, global production volumes increased at an estimated 5–6% CAGR, while market value grew faster at 7–8% CAGR, driven by premium product mix, improved traceability, and brand differentiation. Beluga, Osetra, and Sevruga together account for nearly 70% of premium-grade sales, while American sturgeon species have regained traction in the U.S., now representing around 15% of domestic consumption.

From an end-use perspective, foodservice continues to dominate, accounting for roughly 60% of global demand, supported by fine-dining, chef-driven tasting menus, and luxury hospitality. At the same time, online gourmet retail has expanded rapidly and now represents approximately 18% of sales in key markets, reflecting growth in direct-to-consumer luxury food purchasing. Non-food applications—including cosmetics and nutraceuticals—contribute 5–7% of total revenue, with demand rising on the back of protein, omega-rich lipid, and vitamin B12 positioning.

Supply-side advancements are reinforcing long-term growth potential. Increased aquaculture investment is expanding production capacity through recirculating aquaculture systems, while improved broodstock management has shortened harvest cycles by 6–12 months. Technologies such as machine vision, ultrasound-based sex identification, DNA barcoding, and tamper-proof labeling are improving roe yield, enhancing quality consistency, and reducing fraud risk—critical factors for sustaining premium pricing and consumer trust.

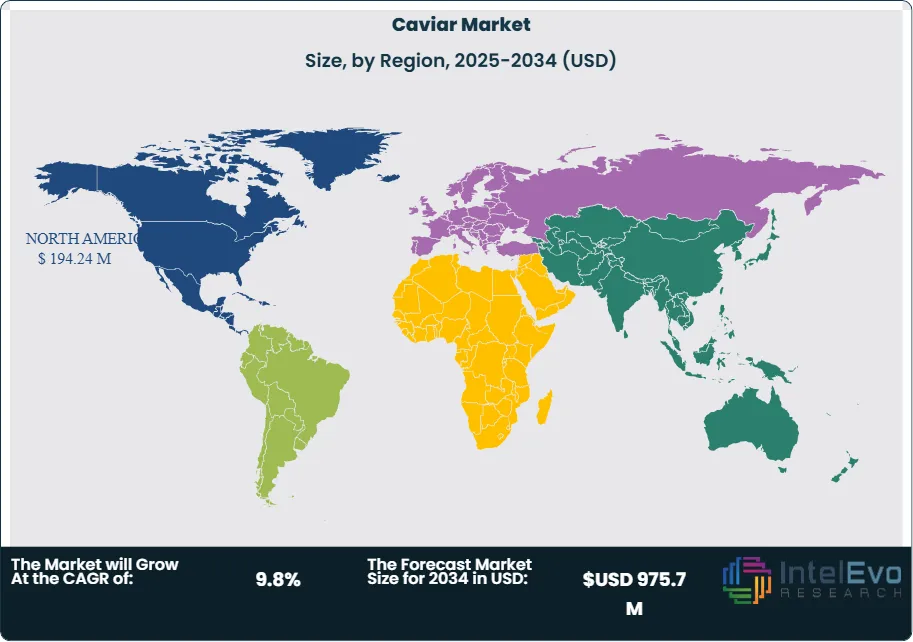

However, structural constraints remain. Long biological maturation cycles of 6–10 years continue to tie up capital, while feed, energy, and cold-chain logistics costs pressure producer margins. Trade restrictions, sanctions, and quota regimes are reshaping global flows, while poaching and counterfeit products pose ongoing brand risks. Regionally, Europe leads consumption with an estimated 47–50% share, followed by North America at 26–28%, characterized by strong holiday seasonality. China is the largest producer and a rapidly growing consumer, with Asia Pacific projected to expand at 10–12% CAGR through 2034. The Gulf region is emerging as an investment hotspot as luxury hospitality accelerates in the UAE and Saudi Arabia, with leading opportunities centered on farm automation, branded D2C channels, and certified sustainability labels that can command 8–15% price premiums.

Key Takeaways

- Market Growth: The global caviar market stood at USD 400.5 million in 2024. It is projected to reach USD 975.7 million by 2034 at 9.8% CAGR, driven by premium pricing, expanding aquaculture capacity, and high-end dining demand.

- Product Type: Sevruga leads with a 39.4% share due to wider farm availability and more accessible pricing than Beluga. Osetra continues to gain in premium retail mixes where price elasticity is lower.

- Sales Channel: On-trade captures 67.2% of sales; restaurants account for 62.3% by application, underscoring foodservice dependence. You should plan for Q4 holiday peaks and chef-driven tasting menus.

- Driver: Legal aquaculture supplies exceed 90% of volumes under CITES oversight, stabilizing availability. Online gourmet retail has reached roughly 15–20% of sales in key markets, with brands such as Kaluga Queen, Petrossian, and Marky’s expanding D2C offerings.

- Restraint: Long sturgeon maturation cycles of 6–10 years limit rapid supply response and tie up working capital. Feed and energy together comprise over 50% of farm operating costs, squeezing margins during input price spikes.

- Opportunity: Certified sustainability and full-traceability labels command 8–15% price premiums; you can convert mix upgrades in luxury retail and hospitality. Asia Pacific offers a 9–11% CAGR through 2034, anchored by China’s producer-consumer role.

- Trend: Farms are scaling recirculating aquaculture systems and using imaging and ultrasound to improve sexing accuracy and roe yields. DNA barcoding and QR-backed traceability are spreading across top exporters, with Caviar House & Prunier and Kaluga Queen showcasing end-to-end provenance.

- Regional Analysis: North America leads with 48.5% of revenue. Europe ranks second at roughly one-third of sales, while Asia Pacific is the fastest-growing region at 9–11% CAGR; the Gulf states are investment hotspots linked to luxury hospitality in the UAE and Saudi Arabia.

Product Analysis

Sevruga remains the anchor of premium demand. It held 39.4% of global revenue in 2024 on the back of consistent farmed supply, refined flavor, and pricing that sits below Beluga but above mass-market roe. You see steady menu placement in fine dining and luxury hospitality, supported by CITES-compliant aquaculture that now supplies more than 90% of volumes. Leading brands such as Kaluga Queen, Caviar House & Prunier, Petrossian, and Marky’s continue to shape assortment and provenance standards.

Osetra is gaining share in premium retail and direct-to-consumer channels due to its broader flavor range and stable availability. Salmon roe and “sushi” formats push volume in mid-tier foodservice and retail, where price sensitivity is higher and portion sizes are smaller. Expect mix upgrades in 2025–2028 as traceability, lot-level quality data, and chef-led pairings raise willingness to pay for labeled origin and sustainable practices.

Form Analysis

Fresh caviar led with 42.2% share in 2024. Fine dining prefers fresh for texture integrity and aroma; it carries a clear price premium versus preserved or frozen alternatives. Adoption benefits from tighter cold-chain control, shorter farm-to-kitchen lead times, and batch-level certificates that reassure buyers on species and feed practices.

Preserved and frozen formats scale exports and expand reach in specialty retail and e-commerce. These formats sustain quality over longer transits and reduce waste for smaller buyers. You should expect mid-single-digit growth in preserved volumes through 2029 as online gourmet marketplaces widen assortment and as QR-linked authenticity checks reduce substitution risk. Dried products remain niche and occasion-led.

Application Analysis

Restaurants accounted for 62.3% of demand in 2024. Tasting menus, omakase counters, and event catering drive consistent throughput, particularly in Q4 holiday periods. Higher check sizes and curated service support premium pricing for Sevruga and Osetra, while salmon roe underpins volume-led dishes.

Household consumption is smaller but rising with D2C fulfillment and insulated packaging. Online gourmet retail has reached roughly 15–20% of sales in key markets, improving access for first-time buyers. Expect growth from 10–50 gram packs, curated gift sets, and subscription models that emphasize provenance, freshness windows, and serving guidance.

Sales Channel Analysis

On-trade dominated with 67.2% share in 2024. Hotels, restaurants, and bars monetize presentation, pairing, and service, which reinforce brand equity and reduce perceived risk at the point of consumption. Seasonal events and luxury hospitality pipelines in North America and the Gulf sustain volume resilience.

Off-trade is building momentum via specialty retailers and brand-owned storefronts. Petrossian, Marky’s, and Kaluga Queen have expanded D2C assortments with smaller formats and temperature-stable logistics. Certified sustainability and full-traceability labels capture 8–15% price premiums, improving margins even as basket sizes remain modest. You should plan for steady off-trade growth through 2028 as authentication tools and consumer education improve trust.

Regional Analysis

North America led with 48.5% of revenue in 2024 and is set to maintain leadership through 2030. The United States anchors demand with luxury dining, corporate gifting, and event-led spikes. Health positioning around omega-3 and high-quality protein supports adoption in high-income households, while specialty retailers and online channels expand reach across tier-1 metros.

Europe ranked second at roughly one-third of global sales, sustained by France, Italy, Germany, and the UK. Asia Pacific is the fastest-growing region with an expected 9–11% CAGR through 2034. China is both the largest producer and a rising consumer; Japan and South Korea add stable sushi-driven demand; Australia is expanding luxury hospitality.

Latin America remains a small but growing destination, led by Mexico and Brazil in premium retail and high-end hotels. The Middle East and Africa are investment hotspots. The UAE and Saudi Arabia continue to open luxury properties that raise on-trade throughput and support year-round availability via air-freight cold chains.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Beluga Caviar

- Osetra Caviar

- Sevruga Caviar

- American Sturgeon Varieties

- Salmon Roe and Alternative Roe Products

- Others (Hybrid and Farm-Specific Grades)

Form

- Fresh Caviar

- Preserved and Frozen Caviar

- Dried and Specialty Formats

Source

- Aquaculture-Based Caviar

- Wild-Sourced (Restricted / Legacy Trade)

- Sustainability and Certification Status

Sales Channel

- On-Trade Channel

- Off-Trade Channel

Application

- Restaurants and Foodservice

- Household Consumption

- Gifting and Subscription-Based Consumption

- Others

Regional

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 400.5 M |

| Forecast Revenue (2034) | USD 975.7 M |

| CAGR (2024-2034) | 9.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Beluga Caviar, Osetra Caviar, Sevruga Caviar, American Sturgeon Varieties, Salmon Roe and Alternative Roe Products, Others (Hybrid and Farm-Specific Grades)), Form (Fresh Caviar, Preserved and Frozen Caviar, Dried and Specialty Formats), Source (Aquaculture-Based Caviar, Wild-Sourced (Restricted / Legacy Trade), Sustainability and Certification Status), Sales Channel (On-Trade Channel, Off-Trade Channel), Application (Restaurants and Foodservice, Household Consumption, Gifting and Subscription-Based Consumption, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Caviar House & Prunier, Agroittica Lombarda, Calvisius Caviar, Sterling Caviar, Sturgeon AquaFarms, Beluga Farm, Caspian Tradition, Karat Caviar, Plaza Caviar, Ossetra Caviar Company |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date