Cerebral and Tissue Oximetry Devices Market 2024–2034 | 7.9% CAGR

Global Cerebral and Tissue Oximetry Devices Market Size, Share & Analysis By Type (Handheld, Tabletop), By End-Use (Hospitals, Clinics, Others) Industry Outlook, Clinical Accuracy Trends & Forecast 2025–2034

Report Overview

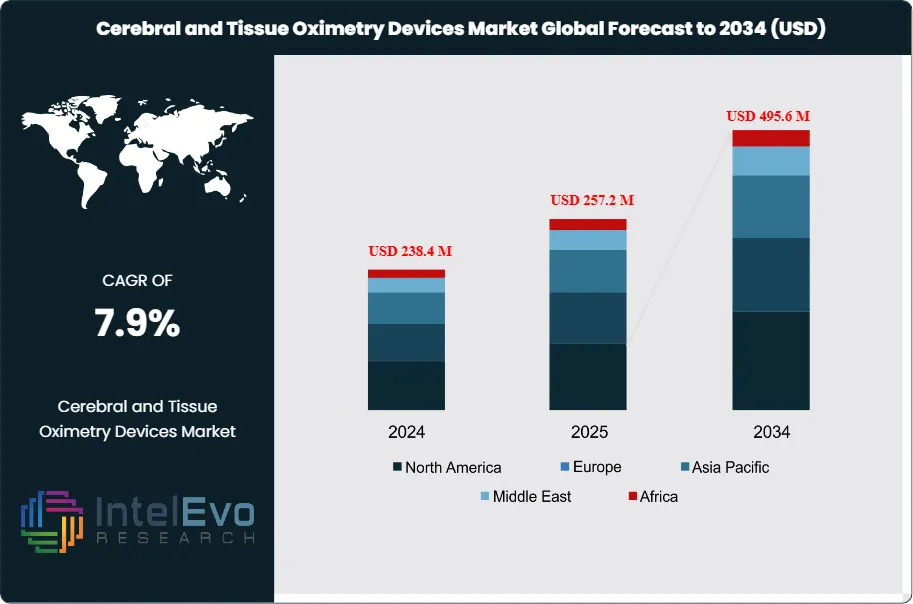

The Cerebral and Tissue Oximetry Devices Market is estimated at USD 238.4 million in 2024 and is projected to reach approximately USD 495.6 million by 2034, reflecting a strong CAGR of about 7.9% during 2025–2034. This growth outlook is supported by rising adoption of non-invasive monitoring technologies, expanding usage in cardiac and neurocritical care, and increasing preference for real-time cerebral oxygenation assessment. As hospitals modernize surgical infrastructure, demand for advanced oximetry solutions continues to accelerate, positioning the segment among the fastest-growing perioperative monitoring markets this decade.

Get More Information about this report -

Request Free Sample ReportThis market is expanding as healthcare systems increasingly prioritize real-time, non-invasive monitoring tools to manage critical care. The use of cerebral and tissue oximetry devices—particularly those using near-infrared spectroscopy (NIRS)—has grown in surgical environments, intensive care units, and neonatal settings. These devices allow clinicians to track oxygen saturation in the brain and other organs with high accuracy, directly impacting outcomes in high-risk procedures and early-stage infant care.

Between 2018 and 2023, the market showed steady uptake, driven by rising global healthcare expenditure, technological improvements in sensor accuracy, and the growing prevalence of chronic diseases among aging populations. Demand has notably increased in neonatal intensive care, where accurate oxygenation monitoring can significantly reduce complications in premature infants. The broadening scope of application across other organs—such as liver and muscle tissue—has also helped diversify use cases beyond traditional neuromonitoring.

On the supply side, competition is intensifying. A mix of established manufacturers and new entrants are investing in multi-parameter oximetry systems, real-time analytics integration, and form-factor improvements. Regulatory frameworks in North America and Europe support the clinical adoption of these devices, while reimbursement policies remain a key factor in influencing purchasing decisions in hospital networks. However, pricing pressures and approval hurdles in emerging markets may slow penetration rates in some regions.

Technological progress continues to shape the market. Enhanced miniaturization, AI-powered data interpretation, and wireless monitoring capabilities are streamlining workflows and improving diagnostic speed. These advances are especially relevant in surgical and post-operative care, where time-sensitive data is critical.

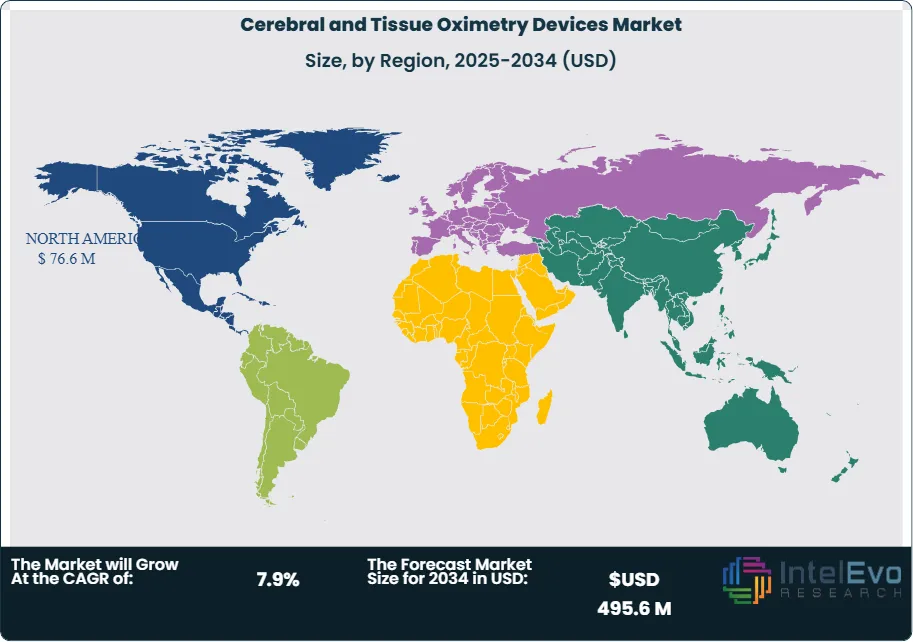

North America remains the largest regional market, supported by high per capita healthcare spending and strong institutional adoption. Europe follows closely, while Asia Pacific shows the fastest projected growth. Countries such as China, India, and South Korea are increasing investments in hospital infrastructure and neonatal care equipment, making them strategic targets for global suppliers. Investors should closely monitor regional procurement trends and shifts in clinical practice guidelines to identify growth opportunities.

Key Takeaways

- Market Growth: The global cerebral and tissue oximetry devices market reached USD 238.4 million in 2024 and is projected to hit USD 495.6 million by 2034, registering a CAGR of 7.9%. Growth is driven by increased surgical procedures, rising neonatal care demand, and improved monitoring capabilities in critical care.

- Product Type: Tabletop devices accounted for 56.5% of global revenue in 2023 due to their robust clinical performance, integration with hospital systems, and suitability for continuous patient monitoring in high-acuity settings.

- End Use: Hospitals held a leading 52.1% market share in 2023. This dominance reflects their role as primary centers for surgeries, intensive care, and neonatal units where oximetry devices are routinely used.

- Driver: The rising number of surgeries worldwide is accelerating device demand. Inpatient and outpatient surgical volumes are pushing hospitals to invest in real-time cerebral and tissue oxygenation monitoring to reduce complications.

- Restraint: High acquisition costs and reimbursement gaps remain major barriers, particularly for small- and mid-sized facilities. Additionally, performance variability in certain clinical conditions affects physician confidence.

- Opportunity: The neonatal care segment presents strong upside potential, especially in emerging economies. Expanding NICU infrastructure and greater focus on preterm infant survival are expected to drive adoption.

- Trend: Wireless connectivity, miniaturized sensors, and AI-enabled data analytics are reshaping device design and usability. Manufacturers are increasingly integrating advanced features to support remote and continuous monitoring.

- Regional Analysis: North America led the market in 2023, generating USD 76.6 million and capturing 36.5% of total revenue. Asia Pacific is projected to post the fastest CAGR through 2033, driven by expanding healthcare infrastructure and rising investment in critical care and neonatal services.

Type Analysis

As of 2025, tabletop cerebral and tissue oximetry devices continue to lead the market, accounting for over 56% of global revenue. These systems are widely adopted in hospital environments due to their stable performance, intuitive interfaces, and compatibility with other clinical monitoring tools. Their fixed setup allows for continuous, real-time tracking of cerebral and tissue oxygen saturation during surgeries and in intensive care units. The growing emphasis on intraoperative monitoring and early detection of hypoxia has further strengthened demand for tabletop units.

Despite their smaller footprint in the market, handheld oximetry devices remain essential in settings where mobility and speed are critical. These portable units are particularly useful in emergency care, outpatient procedures, and in-home health assessments. While they lack some advanced functionalities of tabletop systems, their flexibility makes them an attractive option for clinicians operating in space-constrained or fast-paced environments. However, growth in this segment is slower, as hospitals increasingly favor stationary solutions for long-term monitoring and integration into digital health infrastructure.

End-Use Analysis

Hospitals represent the largest end-use segment for cerebral and tissue oximetry devices, holding over 52% of the global market in 2025. These institutions rely on real-time monitoring systems to support surgical decision-making, manage critically ill patients, and monitor neonatal oxygenation levels. The demand is particularly strong in neurosurgery, cardiovascular operations, and intensive care, where oxygen desaturation poses significant clinical risk. Hospitals also benefit from purchasing power and streamlined procurement channels, enabling large-scale adoption.

Clinics and other healthcare settings, including ambulatory surgical centers and specialized diagnostic facilities, are showing increasing interest in these devices. Although they currently hold a smaller share, their growth trajectory is positive. Rising demand for minimally invasive procedures and enhanced patient monitoring outside of tertiary care settings supports this expansion. As device prices become more competitive and user training improves, smaller healthcare providers are expected to adopt cerebral and tissue oximetry technologies more broadly.

Regional Analysis

North America continues to dominate the global market in 2025, with an estimated 36.5% share and revenues exceeding USD 80 million. This leadership is supported by strong healthcare infrastructure, high surgical volumes, and favorable reimbursement frameworks for advanced monitoring equipment. The region’s early adoption of cerebral oximetry, particularly in cardiac and neonatal care, has established a mature market landscape with consistent demand across public and private sectors.

Europe follows closely, driven by national health systems investing in patient safety and perioperative care. Countries like Germany, France, and the UK are integrating cerebral oximetry into clinical guidelines, particularly for pediatric and elderly care. Meanwhile, Asia Pacific is emerging as the fastest-growing region, with annual growth exceeding 8%. Expanding hospital infrastructure in India, China, and Southeast Asia, coupled with government-led healthcare initiatives, is increasing access to advanced monitoring tools. Latin America and the Middle East & Africa are in earlier stages of adoption but are expected to see steady growth as healthcare modernization efforts continue and surgical volumes rise.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Handheld

- Tabletop

By End-Use

- Hospitals

- Clinics

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 238.4 M |

| Forecast Revenue (2034) | USD 495.6 M |

| CAGR (2024-2034) | 7.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Handheld, Tabletop), By End-Use (Hospitals, Clinics, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Masimo Corp., Moor Instruments Ltd., Spectros Medical Devices Inc., Nonin Medical Inc., ISS Inc., HyperMed Imaging Inc., Medtronic Plc, Artinis Medical Systems, Hamamatsu Photonics KK, Edwards Lifesciences Corp., Sotera Health Co. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Cerebral and Tissue Oximetry Devices Market

Published Date : 12 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date