Chlorine Gas Market Size USD 58.5B & 5.2% CAGR (2034)

Global Chlorine Gas Market Size, Share & Industrial Chemicals Analysis By Application (Water Treatment, PVC, Pharmaceuticals, Pulp & Paper), By Production Method, Regulatory Impact, Regional Supply-Demand Balance, Price Trends, Key Producers & Forecast 2025–2034

Report Overview

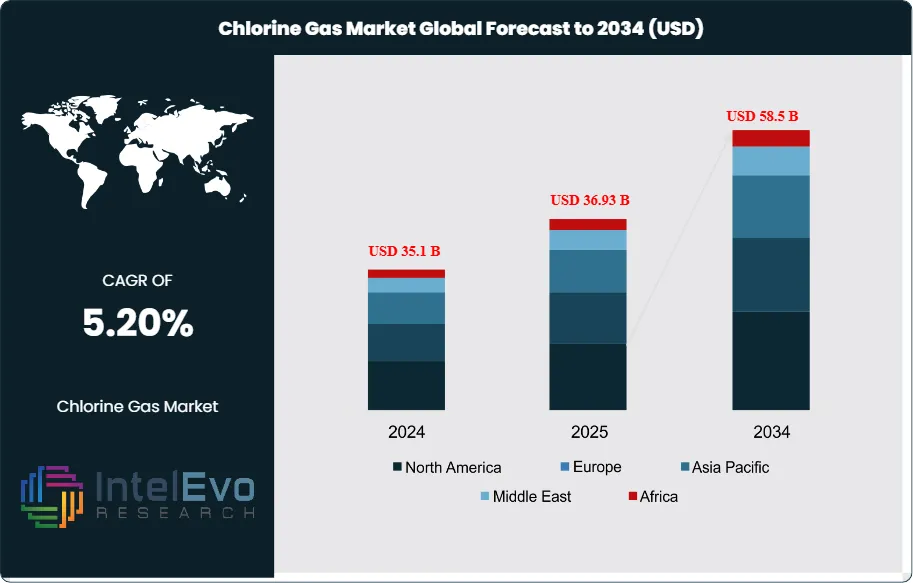

The Chlorine Gas Market is estimated at USD 35.1 billion in 2024 and is projected to reach approximately USD 58.5 billion by 2034, registering a CAGR of about 5.2% during 2025–2034. Growth is being driven by sustained demand from water treatment, food processing sanitation, pharmaceuticals, and PVC manufacturing, where chlorine remains a critical and cost-effective input. Expanding municipal water disinfection programs in emerging economies, rising packaged food output, and continued infrastructure investments are reinforcing baseline consumption. In parallel, the shift toward energy-efficient membrane-cell chlor-alkali technology and long-term supply contracts is improving operational stability, positioning chlorine gas as a structurally resilient commodity chemical over the next decade.

Get More Information about this report -

Request Free Sample ReportChlorine remains a core building block of the chemical value chain. Annual output exceeds 70 million metric tons, driven by the chlor-alkali process that co-produces sodium hydroxide and hydrogen. Demand tracks PVC, water treatment, and a broad set of intermediates. Roughly 35 to 40 percent of chlorine feeds the EDC-VCM-PVC chain. Asia-Pacific accounts for about 40 percent of global demand and continues to add capacity alongside downstream PVC. You should expect a steady shift in volumes toward construction, infrastructure, and urban services across India, Southeast Asia, and China.

Growth rests on three pillars. First, construction and infrastructure keep PVC demand resilient, with residential and utilities spend supporting pipes, profiles, and wiring. Second, municipal and industrial water markets expand, supported by stricter disinfection rules and water reuse. Many cities target chemical spend growth of 6 to 8 percent annually. Third, food safety standards lift usage in sanitation; typical chlorine concentrations range from 50 to 200 ppm for food-contact surfaces. On the supply side, electricity is the largest cost line; membrane cells typically consume 2,200 to 2,500 kWh per metric ton of chlorine. This makes regional power prices a key margin driver.

Risk factors are clear. Chlorine transport is limited, so producers rely on co-located demand or conversion to derivatives such as EDC and PVC. Co-product balancing with caustic soda can tighten availability or cap run rates. Formation of disinfection by-products, including trihalomethanes, prompts tighter limits in some markets and supports a gradual shift to on-site hypochlorite generation or alternative oxidants in sensitive applications.

Technology upgrades shape cost curves. Continued conversion from legacy cells to membrane plants cuts energy intensity by double digits and removes mercury-related liabilities. In India, the PAT scheme encourages higher-efficiency operations and membrane adoption. In Europe, prior mercury phase-out and recent energy volatility prompted capacity rationalization, improving utilization of remaining assets. In North America, debottlenecking aligns with stable power and integrated PVC chains. The Middle East presents an emerging investment case tied to integrated petrochemicals and salt resources. For investors, Asia-Pacific PVC, regulated water markets, and energy-advantaged chlor-alkali sites are the primary hotspots over the next decade.

Key Takeaways

- Market Growth: The market stands at USD 35.1 billion in 2024 and is set to reach USD 58.5 billion by 2034 at a 5.2% CAGR. Growth tracks PVC demand, municipal water disinfection, and industrial sanitation; global chlorine output exceeds 70 million metric tons annually.

- Application: Water treatment leads with 36.3% share in 2024. Tightening potable water and wastewater standards keep volumes resilient across municipalities and industry; typical sanitation uses 50 to 200 ppm chlorine.

- End Use: The chemical industry holds 41.2% share. The EDC–VCM–PVC chain consumes about 35 to 40% of chlorine globally, supported by construction and utilities spending in Asia.

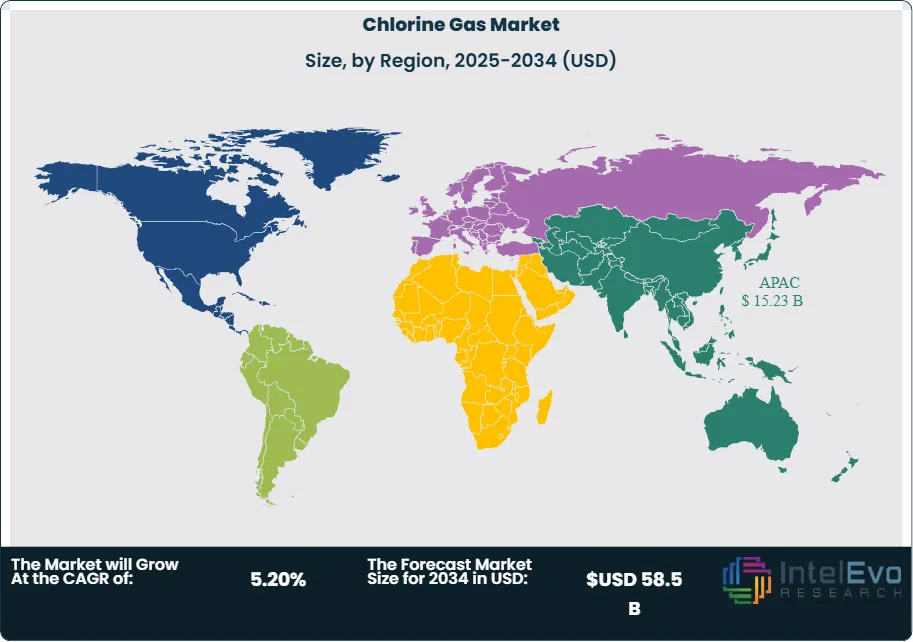

- Driver: PVC-linked construction demand and urban infrastructure outlays lift baseline growth. Asia-Pacific accounts for roughly 40% of chlorine demand and 43.4% of revenues in 2024, underpinned by integrated chlor-alkali and PVC capacity.

- Restraint: Energy intensity remains high at 2,200 to 2,500 kWh per metric ton. Electricity can represent 45 to 55% of cash costs; power price spikes have triggered curtailments in Europe and can compress margins by double digits.

- Opportunity: Regulated water markets in APAC and the Middle East show the fastest growth. You can target projects in municipal disinfection and reuse where segment CAGRs of 6 to 8% are common; APAC revenues reached USD 14.3 billion with room for greenfield capacity.

- Trend: Conversion to membrane cell technology accelerates. Membrane share is approaching 75 to 80% of global capacity, lowering energy intensity and eliminating mercury-related liabilities; producers such as Olin, Westlake, Shin-Etsu, and Grasim continue debottlenecking and efficiency upgrades.

- Regional Analysis: Asia-Pacific leads with 43.4% revenue share in 2024. North America benefits from integrated PVC chains and steadier power, supporting 4 to 5% growth; Europe remains capacity-constrained after energy volatility; the Middle East and India emerge as investment hotspots with 6%+ projected CAGRs.

Form Analysis

Power form maintained a dominant position in 2024 with 69.1% share. Users value precise dosing, continuous supply, and stable purity for chlorination, EDC-VCM-PVC, and bleach conversion lines. Expect this lead to persist in 2025 and beyond as utilities and integrated chemical parks standardize on high-reliability feed. Typical membrane-cell energy intensity ranges from 2,200 to 2,500 kWh per ton of chlorine, which keeps form selection closely tied to onsite power economics.

Liquid form serves bulk movements to PVC complexes and large water treatment hubs. Adoption rises where pipeline connections and captive brine-to-chlorine units are in place. Others include onsite hypochlorite generation for facilities that avoid chlorine handling. Global chlorine output remains above 70 million metric tons per year. Power and liquid forms will track the market CAGR of about 5.5% through 2034, with liquid slightly faster in PVC-centric corridors.

Packaging Analysis

Bags held 54.2% share in 2024 and remain the preferred option for small and mid-volume users that prioritize handling simplicity and storage efficiency. Utilities and light manufacturing favor standardized bagged units for predictable dosing and inventory control. The format aligns with safety procedures and short-haul distribution. Expect steady demand in 2025 as municipal budgets and O&M contracts expand.

Drums and other industrial containers support higher-volume users across chemicals and large treatment assets. These formats enable tighter logistics control and fewer changeovers. Freight, containment, and regulatory compliance costs drive packaging choice. You should plan packaging strategy by site throughput and operator safety KPIs. Packaging mix will remain stable near current shares while compliance spending rises in double digits in stricter jurisdictions.

Application Analysis

Water treatment led with 36.3% share in 2024 and will retain the top spot. Cities continue to expand disinfection and reuse capacity to meet stricter potable and wastewater standards. Typical application rates range from 1 to 3 mg/L for potable systems, with 50 to 200 ppm used for food-contact surface sanitation. Budgeted growth in municipal chemicals often sits at 6 to 8% per year in large metros.

EDC/PVC remains the second anchor application with about one third of total consumption in many markets. Construction activity, pipe replacement cycles, and cable demand keep the PVC chain resilient. Organic and inorganic chemicals, isocyanates, chlorinated intermediates, propylene oxide, C1/C2, and aromatics form a diversified tail that stabilizes plant utilization. Co-product balancing with caustic soda can influence run rates and availability during demand swings.

End-Use Analysis

The chemical sector accounted for 41.2% share in 2024 and will stay the core sink for chlorine through 2030. Integrated chlor-alkali complexes that feed PVC, epichlorohydrin, and chlorinated solvents anchor long-term contracts and capacity planning. Producers such as Olin, Westlake, OxyChem, INEOS Inovyn, Shin-Etsu, Tosoh, and Grasim continue to focus on energy efficiency and membrane debottlenecking.

Pharmaceuticals, paper and pulp, and agriculture provide steady multi-year demand. Pharma relies on chlorinated intermediates for APIs and sanitization. Pulp and paper use chlorine-based chemistries under tighter environmental controls. Automotive and construction aggregate demand via PVC profiles, wiring, films, and coatings. Expect mid single-digit growth across these verticals, with higher rates where sanitation and packaging investments accelerate.

Regional Analysis

Asia Pacific led with 43.4% share in 2024, or about USD 14.3 billion, supported by China, India, and Southeast Asia. The region benefits from integrated PVC chains, large-scale water programs, and new chlor-alkali capacity. APAC is projected to grow at 6% or more as infrastructure and urban services expand. India’s PAT scheme continues to push membrane adoption and lower unit energy costs.

North America shows stable growth at 4 to 5% on the back of competitive power, salt resources, and integrated PVC assets along the Gulf Coast. Europe remains constrained after energy price volatility and past mercury cell retirements. The region emphasizes utilization and selective upgrades rather than greenfield builds. Latin America and the Middle East & Africa present emerging opportunities with 5 to 7% projected CAGRs tied to desalination, municipal water investment, and petrochemical integration. You should watch the Middle East for integrated chlor-alkali units linked to low-cost power and brine.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Form

- Power

- Liquid

- Others

By Packaging

- Bags

- Drums

- Others

By Application

- Water Treatment

- EDC/PVC

- Organic Chemicals

- Inorganic Chemicals

- Isocyanates

- Chlorinated Intermediates

- Propylene Oxide

- C1/C2, Aromatics

- Others

By End-Use

- Chemical

- Pharmaceutical

- Paper and Pulp

- Agriculture

- Automotive & Construction

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 35.1 B |

| Forecast Revenue (2034) | USD 58.5 B |

| CAGR (2024-2034) | 5.20% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Form (Power, Liquid, Others), By Packaging (Bags, Drums, Others), By Application (Water Treatment, EDC/PVC, Organic Chemicals, Inorganic Chemicals, Isocyanates, Chlorinated Intermediates, Propylene Oxide, C1/C2, Aromatics, Others), By End-Use (Chemical, Pharmaceutical, Paper and Pulp, Agriculture, Automotive & Construction, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | BASF SE, Tata Chemicals Limited, Covestro AG, Occidental Petroleum Corporation, Hanwha Group, Ercros, Aditya Birla Chemicals Pvt. Ltd., Olin Corporation, Tosoh Corporation, Grasim Industries Limited, Gujarat Fluorochemicals (GFL), INEOS, Xinjiang Zhongtai Chemicals Co. Ltd., Westlake Corporation, PPG Industries, |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date