Cling Films Market Size | Global Outlook & 4.9% CAGR

Global Cling Films Market Size, Share & Analysis By Material (Polyvinyl Chloride (PVC), Polyethylene (PE), Polypropylene (PP), Polyvinylidene Chloride (PVDC)), By End Use (Food & Beverage, Automotive, Healthcare) Industry Regions & Key Players – Sustainability Trends, Packaging Regulations & Forecast 2025–2034

Report Overview

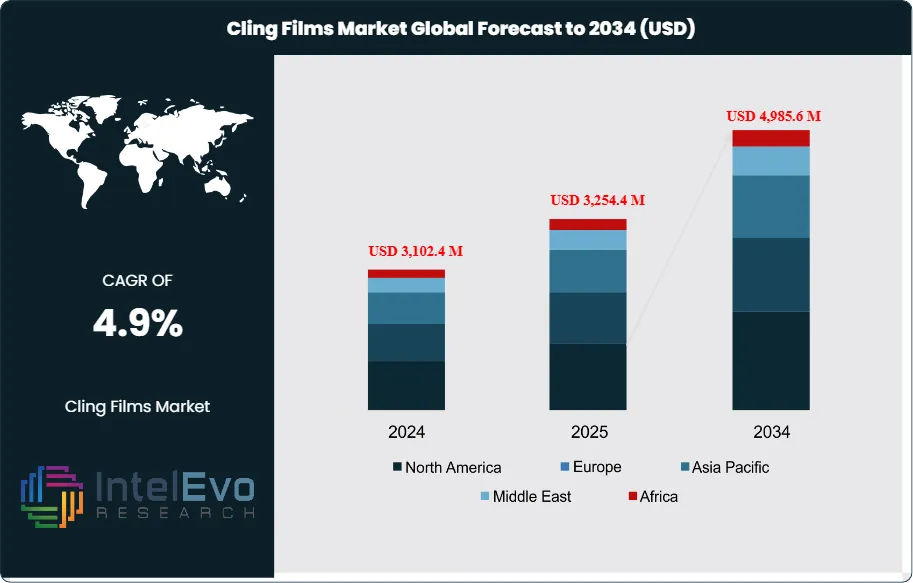

The Cling Films Market is valued at approximately USD 3,102.4 million in 2024 and is projected to reach nearly USD 4,985.6 million by 2034, expanding at a CAGR of about 4.9% from 2025–2034. Growth is being driven by rising global consumption of packaged foods, increasing hygiene awareness, and the expanding retail and e-commerce ecosystem that relies heavily on protective flexible packaging. As sustainability trends intensify, manufacturers are also accelerating the shift toward bio-based and recyclable cling films, further boosting product innovation. With FMCG brands emphasizing freshness, shelf-life extension, and branding appeal, the cling film market continues to trend across food packaging, retail logistics, and circular-economy platforms.

Get More Information about this report -

Request Free Sample ReportThis steady expansion reflects the increasing importance of cling films in ensuring food safety, extending shelf life, and enhancing consumer convenience across diverse end-use sectors. Historically, market growth has been underpinned by the rising adoption of flexible packaging formats, especially in developed economies where consumer awareness regarding food hygiene is high. However, in recent years, the market has seen a shift towards sustainability, prompting manufacturers to innovate with biodegradable and recyclable alternatives.

On the demand side, the surge in consumption of ready-to-eat meals and fresh produce—particularly in urban households and quick-service restaurants—continues to be a primary growth driver. The foodservice industry’s growing emphasis on portion control, freshness retention, and compliance with safety regulations further fuels demand. From a supply-side perspective, advancements in polymer science and extrusion technologies have enabled producers to develop thinner, stronger, and more versatile films, improving both cost efficiency and product performance. Despite this, the market faces notable challenges including environmental concerns related to single-use plastics, tightening regulatory frameworks across Europe and North America, and fluctuating raw material prices, particularly petroleum-based resins.

Technological innovation remains a defining factor in market evolution. Manufacturers are investing in smart packaging solutions, antimicrobial films, and multi-layer barrier films to cater to evolving consumer preferences and compliance standards. Automation and AI integration in production lines have enhanced consistency, minimized waste, and accelerated time-to-market for new formulations.

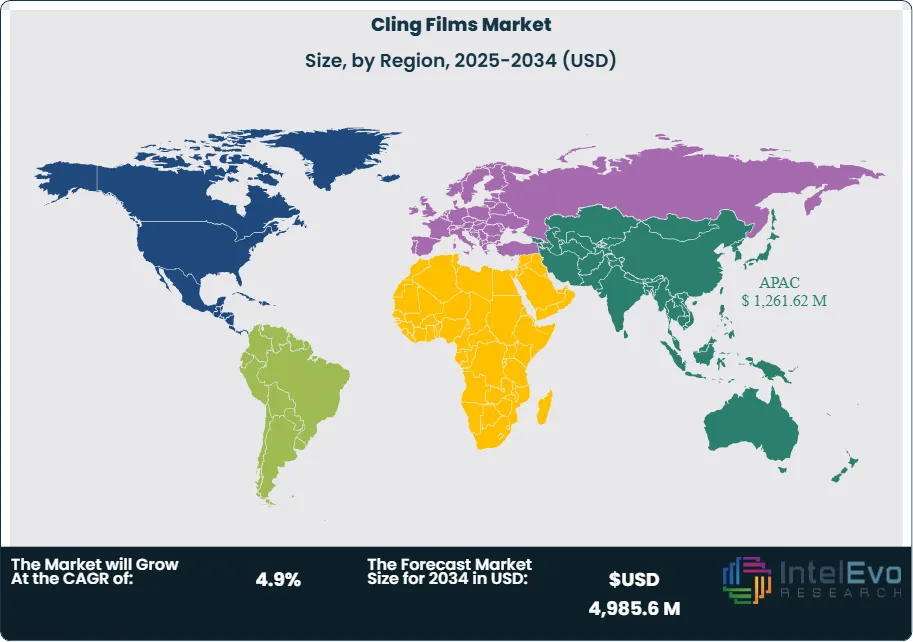

Regionally, Asia-Pacific leads the global cling films market, driven by high-volume consumption in China, India, and Southeast Asian economies, where urbanization and organized retail are rapidly expanding. North America and Europe remain mature markets, increasingly defined by regulatory compliance and sustainability-led innovation. Meanwhile, Latin America and the Middle East & Africa represent emerging investment hotspots due to rising disposable incomes and growing demand for modern food packaging. Collectively, these dynamics indicate a market poised for sustainable growth, shaped by shifting consumer behaviors, technological progress, and regulatory evolution.

Key Takeaways

- Market Growth: The global cling films market was valued at USD 3,102.4 million in 2024 and is projected to reach USD 4,985.6 million by 2034, expanding at a CAGR of 4.9% from 2025 to 2034. Growth is driven by rising demand for hygienic, flexible food packaging and increasing urban consumption of ready-to-eat products.

- Material Type: Polyethylene (PE) emerged as the leading material in 2024, accounting for 37.28% of total market revenue. Its dominance is attributed to its low cost, flexibility, and compatibility with food-grade applications. The segment is also projected to register the fastest CAGR of 4.0% during the forecast period.

- End Use: Food & beverages remained the top end-use segment in 2024, contributing 56.74% of total revenue. This segment continues to benefit from the widespread use of cling films in food preservation, portion control, and safe retail packaging, and is forecasted to grow at a 4.0% CAGR through 2030.

- Driver: Increasing consumer preference for safe, convenient packaging in urban centers and foodservice sectors is significantly fueling demand. The rise in takeaway meals and packaged fresh produce is accelerating adoption, especially in fast-growing economies.

- Restraint: Environmental concerns around single-use plastic waste and evolving regulatory restrictions in Europe and North America are posing compliance and cost challenges for manufacturers, potentially limiting traditional plastic-based cling film sales.

- Opportunity: Asia Pacific presents strong investment potential, driven by its 40.64% market share in 2024 and the fastest projected CAGR of 4.0%. Expanding organized retail, rising disposable incomes, and growing demand for packaged food in China, India, and Southeast Asia underpin this growth.

- Trend: The development of sustainable cling films, including biodegradable and recyclable variants, is gaining traction. Leading players are investing in green materials and smart packaging to address regulatory pressures and shifting consumer expectations.

- Regional Analysis: Asia Pacific led the market in 2024 with a 40.64% revenue share and is expected to maintain leadership with the fastest CAGR of 4.0%. Europe follows closely, with rapid growth anticipated due to stringent food safety regulations and increasing demand for eco-friendly packaging solutions.

Material Analysis

Polyethylene (PE) continues to lead the cling films market, commanding a revenue share of 37.28% in 2024 and projected to maintain the highest CAGR of 4.0% through 2030. Within this segment, low-density polyethylene (LDPE) is particularly favored due to its chemical inertness, non-toxic properties, and moisture resistance. These attributes make PE films highly suitable for food wrapping across residential, retail, and foodservice applications. Additionally, PE films align with growing regulatory support for recyclable plastics and respond well to the rising demand for eco-conscious packaging among consumers. Their increasing use is further supported by government-led sustainability initiatives and the global push toward circular packaging economies.

Polyvinyl Chloride (PVC) films remain a critical component of the global cling film landscape due to their superior clarity, self-cling functionality, and elasticity. Often used for packaging fresh produce, meats, and dairy, PVC films are especially popular in supermarket and food processing settings. Their cost-effectiveness and ability to form tight seals without adhesives contribute to their widespread application. However, the market growth for PVC is being increasingly moderated by rising environmental scrutiny and regulatory restrictions, particularly in the European Union and North America, where chlorinated plastics are under review due to their environmental footprint.

Emerging material categories such as biodegradable films, polyolefin-based blends, and coextruded multilayer films are gaining momentum in response to escalating environmental regulations and consumer demand for sustainable alternatives. These next-generation materials are often targeted at premium markets and regulatory-driven segments that prioritize compostable or recyclable packaging. While currently representing a smaller market share, these alternatives are expected to grow rapidly over the next five years, particularly in Europe and Asia, where sustainability benchmarks are tightening.

End-Use Analysis

The food and beverage sector dominates end-use demand, contributing 56.74% of total market revenue in 2024, with continued growth expected at a 4.0% CAGR through 2030. Cling films are widely employed in this segment for preserving freshness, enhancing shelf life, and preventing contamination of perishable goods such as fruits, meats, and ready-to-eat meals. The proliferation of supermarkets, increasing reliance on food delivery platforms, and rising demand for hygienic and convenient packaging are key drivers. Moreover, the growth of home meal kits, catering services, and quick-service restaurants continues to support the robust demand for cling films in both retail and institutional settings.

In the automotive industry, cling films serve primarily as protective layers during assembly, storage, and transportation. These films are used to shield painted surfaces, electronic panels, and interior trims from scratches, dust, and chemical damage. As global vehicle production rises and manufacturers prioritize high-quality finishes, cling film usage in this sector is expanding. OEMs and aftermarket service providers alike are turning to durable cling films to ensure product integrity throughout the supply chain.

Healthcare applications are also on the rise, with cling films being utilized in medical packaging, laboratory environments, and wound care. Their sterility, protective barrier properties, and disposability make them suitable for a range of uses, including sealing pharmaceutical supplies and safeguarding surgical instruments. The increased focus on infection control and hygiene, particularly in the wake of global health emergencies, is bolstering demand across hospitals, clinics, and research facilities.

Regional Analysis

Asia Pacific continues to lead the global cling films market, capturing 40.64% of total revenue in 2024 and expected to register the fastest CAGR of 4.0% through 2030. This regional dominance is driven by rapid urbanization, a booming food processing industry, and the growing adoption of modern retail formats. Key markets such as China, India, and Japan are experiencing strong growth in packaged food consumption and online grocery platforms, which heavily rely on cling films for food preservation. The rising number of dual-income households and increasing preference for convenience meals further stimulate market expansion across this region.

China holds the largest market share within Asia Pacific, bolstered by its vast food production and e-commerce sectors. The country's expanding middle class increasingly opts for packaged foods, creating high demand for safe, reliable packaging solutions. Major food delivery services, including Meituan and Ele.me, are contributing to the widespread use of cling films in ensuring food hygiene and transport safety. Additionally, national policies aimed at food safety and packaging standardization are reinforcing the market's upward trajectory.

In Europe, the cling films market is witnessing accelerated growth, supported by stringent regulatory frameworks promoting food safety and sustainable packaging. Countries such as Germany, France, and the United Kingdom are at the forefront of this shift, with retail giants like Tesco and Carrefour adopting environmentally compliant packaging formats. The increasing popularity of pre-packaged fresh produce, home delivery meal kits, and ready-to-cook offerings is further driving demand. Meanwhile, North America remains a mature yet steadily growing market, with the U.S. and Canada benefiting from widespread adoption of cling films in both commercial and domestic food applications. Growth in e-commerce grocery and meal prep culture continues to sustain demand, especially for premium-grade cling films.

Latin America and the Middle East & Africa are emerging markets with growing adoption, primarily fueled by expanding foodservice industries, rising urban populations, and improving cold chain infrastructure. While these regions currently represent a smaller share of the global market, ongoing investments in retail development and consumer packaged goods are expected to unlock significant growth opportunities by 2030.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Material

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinylidene Chloride (PVDC)

- Others

By End Use

- Food & Beverage

- Automotive

- Healthcare

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3,102.4 M |

| Forecast Revenue (2034) | USD 4,985.6 M |

| CAGR (2024-2034) | 4.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Material (Polyvinyl Chloride (PVC), Polyethylene (PE), Polypropylene (PP), Polyvinylidene Chloride (PVDC), Others), By End Use (Food & Beverage, Automotive, Healthcare, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Reynolds Consumer Products, POLIFILM, Tilak Polypack, Sealed Air, Greendot Biopak, Amcor plc, IPG, Anchor Packaging LLC, Mitsubishi Chemical Group Corporation, Zhengzhou Eming Aluminium Industry Co., Ltd., Sigma Plastics Group, PRAGYA FLEXIFILM INDUSTRIES, Megaplast India Pvt Ltd, Berry Global Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date