Coagulation Analyzer Market Size | Growth Outlook & 7.3% CAGR

Global Coagulation Analyzer Market Size, Share & Analysis By Product Type (Analyser, consumables), By Technology (Optical, Mechanical, Electrochemical, Others), By Test Type (Fibrinogen Testing, Prothrombin Time Testing, D-dimer Testing, Others), By End-User Industry Regions & Key Players – Hemostasis Testing Trends & Forecast 2025–2034

Report Overview

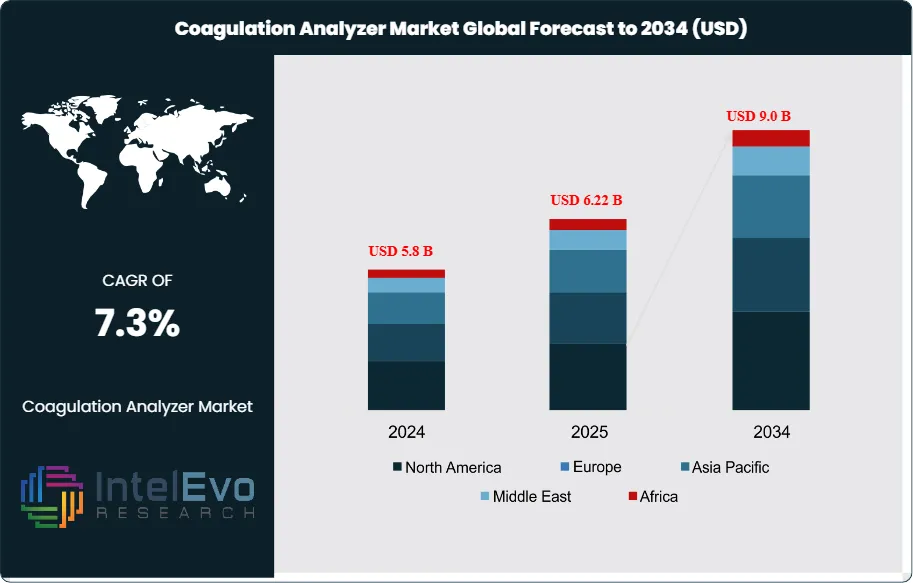

The Coagulation Analyzer Market is estimated at US$ 5.8 billion in 2024 and is on track to reach approximately US$ 9.0 billion by 2034, reflecting a steady CAGR of 7.3% from 2025–2034. Growth is fueled by rising global cases of cardiovascular disorders, diabetes, and blood clotting abnormalities, driving demand for rapid and accurate coagulation testing. Hospitals and diagnostic centers are increasingly adopting fully automated analyzers to improve workflow efficiency and reduce result turnaround time. With the expansion of point-of-care testing, AI-supported diagnostics, and decentralized lab models, the coagulation analyzer market is gaining strong visibility across healthcare innovation channels and trending across clinical, digital health, and med-tech ecosystems.

Get More Information about this report -

Request Free Sample ReportThe market has grown steadily in recent years, supported by rising clinical demand for precise blood coagulation diagnostics. Historically driven by hospital-based testing, the sector is now expanding into decentralized and outpatient settings as healthcare systems prioritize faster diagnostics and early intervention. This shift aligns with a broader push for improved management of clotting disorders such as hemophilia, deep vein thrombosis, and pulmonary embolism, which account for a growing share of morbidity worldwide.

Demand is primarily fueled by the increasing prevalence of cardiovascular and hematologic diseases, an aging global population, and the need for coagulation monitoring during complex surgeries. Public health campaigns and organizations like the National Blood Clot Alliance (NBCA) have also played a role in raising awareness of thrombosis-related complications, encouraging proactive screening. As a result, diagnostic protocols are being revised across hospitals and clinics to include routine coagulation testing, particularly for high-risk patients.

From a technology standpoint, the market is transitioning toward fully automated and point-of-care coagulation analyzers. These systems shorten test turnaround times, reduce manual error, and integrate seamlessly with electronic health record (EHR) platforms. Connectivity features support real-time data access and centralized patient monitoring, allowing providers to improve treatment precision and reduce operating costs. These advances are particularly relevant in high-volume clinical laboratories and intensive care units, where time and accuracy are critical.

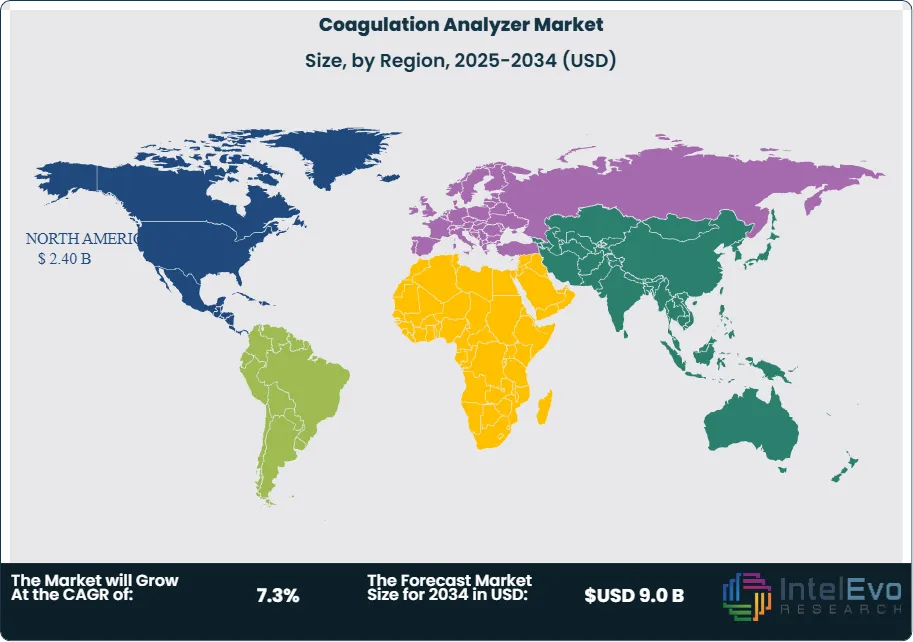

Regionally, North America dominates the market due to advanced healthcare infrastructure, higher diagnostic budgets, and early adoption of automated testing solutions. Europe follows closely, with strong government support for preventive care. However, Asia-Pacific is emerging as a high-growth region, driven by expanding healthcare access, rising disease burden, and increased investment in medical devices. Countries like China and India present untapped potential for manufacturers seeking long-term growth.

As regulatory frameworks evolve and hospitals look to enhance diagnostic efficiency, the coagulation analyzer market is positioned for sustained growth. Companies that offer reliable, integrated, and scalable testing solutions will be best placed to capitalize on this trend through 2034.

Key Takeaways

- Market Growth: The global coagulation analyzer market generated US$ 5.8 billion in revenue in 2024 and is projected to reach US$ 9.0 billion by 2034, registering a CAGR of 7.3%. Growth is driven by rising incidence of clotting disorders and increased demand for automated diagnostic tools.

- Product Type: Analyzers accounted for 57.3% of the market share in 2024, outperforming consumables. Their dominance reflects increasing demand for high-throughput and automated testing systems in hospital laboratories.

- Technology: Optical technology led with a 44.6% share in 2024, supported by its accuracy in detecting coagulation endpoints and widespread adoption in both clinical and research settings.

- Test Type: Prothrombin time testing held the highest revenue share at 39.2% in 2024, due to its routine use in monitoring anticoagulant therapy and detecting clotting abnormalities.

- End Use: Hospitals and clinics led the end-user segment with a 52.9% revenue share in 2024, driven by high patient volumes and greater availability of advanced diagnostic infrastructure.

- Driver: The rising global burden of cardiovascular diseases and surgical procedures requiring coagulation monitoring is fueling demand, particularly in acute care environments.

- Restraint: High capital costs associated with advanced coagulation analyzers limit adoption in low-resource settings, constraining growth in some emerging markets.

- Opportunity: Asia-Pacific presents strong growth potential, with increasing healthcare investments and expanding diagnostic access. The region is projected to see a double-digit CAGR through 2034.

- Trend: Point-of-care testing is gaining traction, driven by the need for rapid diagnostics. Manufacturers are integrating analyzers with EHR systems to enhance clinical workflows and reduce turnaround times.

- Regional Analysis: North America led the market with a 41.3% share in 2024, backed by advanced healthcare systems and early adoption of diagnostic technologies. Asia-Pacific is the fastest-growing region, supported by expanding infrastructure and rising awareness of coagulation-related disorders.

Product Type Analysis

Analyzers held the dominant share of the coagulation analyzer market in 2024, accounting for 57.3% of global revenue. Their continued lead into 2025 and beyond reflects growing demand for efficient, high-precision diagnostic tools across clinical settings. These devices are essential in managing coagulation disorders and monitoring patients on anticoagulant therapy, especially as global incidences of stroke, deep vein thrombosis, and hemophilia continue to rise. Hospitals and diagnostic centers are increasingly adopting automated analyzers that offer rapid turnaround, reduced manual intervention, and enhanced diagnostic accuracy.

The segment is also benefiting from advancements in workflow automation and system integration, particularly within larger healthcare facilities. Modern analyzers now support higher throughput and connectivity with electronic medical records, improving both diagnostic speed and data accessibility. As healthcare systems focus on operational efficiency and early-stage intervention, demand for next-gen coagulation analyzers is expected to grow steadily throughout the forecast period.

Technology Analysis

Optical technology led the market in 2024, capturing 44.6% of total revenue. This trend is expected to continue due to its reliability in delivering real-time, high-precision coagulation measurements. Optical analyzers are favored in high-volume labs for their lower maintenance requirements and superior sensitivity. These systems also align well with the shift toward automated diagnostics, where speed and accuracy are critical to clinical decision-making.

As more providers move toward personalized care plans, optical analyzers are gaining traction for their ability to deliver consistent, repeatable results, particularly for high-risk patients. Their integration into automated lab environments is also supporting workflow efficiency, making them the preferred choice in both developed and rapidly modernizing healthcare markets.

Test Type Analysis

Prothrombin time (PT) testing held the highest market share among test types in 2024, contributing 39.2% to global revenue. Its widespread adoption stems from its essential role in managing anticoagulant therapy and detecting bleeding and clotting abnormalities. PT testing is a routine requirement for patients with atrial fibrillation, mechanical heart valves, and other cardiovascular conditions that necessitate long-term anticoagulation.

The growing shift toward point-of-care diagnostics is further propelling this segment. PT testing devices that offer quick, accurate results are increasingly deployed in outpatient clinics, emergency settings, and even home care, reducing complications and improving treatment adherence. As demand rises for personalized and preventive healthcare, this segment is likely to remain a key driver of market expansion.

End-User Analysis

Hospitals and clinics led the end-user segment in 2024 with a 52.9% revenue share, reflecting their role as primary users of high-throughput coagulation analyzers. The growing number of hospital admissions related to cardiovascular, diabetic, and hematologic conditions is driving the need for rapid coagulation testing to guide treatment decisions. In particular, tertiary care hospitals and specialized cardiac centers rely heavily on these diagnostics for surgical monitoring and therapeutic management.

As healthcare systems globally adopt more advanced diagnostic protocols, hospitals are expected to continue investing in automated coagulation platforms that reduce turnaround time and improve care quality. Meanwhile, clinics and outpatient centers are following suit, particularly in urban areas where demand for preventive diagnostics is accelerating. This trend is expected to maintain hospital and clinic dominance through the forecast period.

Regional Analysis

North America led the global coagulation analyzer market in 2024, accounting for 41.3% of total revenue. Growth in the region is underpinned by a well-established healthcare system, early technology adoption, and a rising geriatric population with higher susceptibility to clotting disorders. The U.S. and Canada have seen increased integration of AI-powered diagnostic systems and fully automated analyzers that support faster, more accurate testing across hospitals and laboratories. Strategic partnerships between device manufacturers and health systems continue to expand access to advanced solutions.

In contrast, Asia Pacific is projected to post the highest CAGR through 2034, driven by rising healthcare expenditure and significant infrastructure development in countries such as China, India, and Indonesia. These markets are witnessing increased adoption of point-of-care testing and automated diagnostics to address rising caseloads of diabetes, cardiovascular diseases, and stroke. Public health initiatives aimed at early detection, along with growing private sector investment in diagnostic services, are expected to fuel robust regional growth.

Latin America and the Middle East & Africa are also emerging as growth regions, albeit from a lower base. Increased awareness, improving reimbursement frameworks, and expanding private healthcare services are supporting market expansion in these geographies, especially in urban centers with growing access to diagnostic technologies.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Analyser

- consumables

By Technology

- Optical

- Mechanical

- Electrochemical

- Others

By Test Type

- Fibrinogen Testing

- Prothrombin Time Testing

- D-dimer Testing

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 5.8 B |

| Forecast Revenue (2034) | USD 9.0 B |

| CAGR (2024-2034) | 7.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Analyser, consumables), By Technology (Optical, Mechanical, Electrochemical, Others), By Test Type (Fibrinogen Testing, Prothrombin Time Testing, D-dimer Testing, Others), By End-user (Hospitals & Clinics, Diagnostic Centers, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sysmex Corporation, Abbott Laboratories, Siemens Healthineers, HORIBA Medical, Thermo Fisher Scientific, Beckman Coulter Inc, International Technidyne Corporation, Instrumentation Laboratory |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date