Coin-Operated Laundries Market Size | 11% CAGR Growth

Global Coin-Operated Laundries Market Size, Share & Analysis By Service Type (Self-Service, Full-Service, Hybrid), By Location (Urban, Suburban), By Payment Mode (Coin, Digital), Industry Dynamics, Consumer Behavior Trends & Forecast 2025–2034

Report Overview

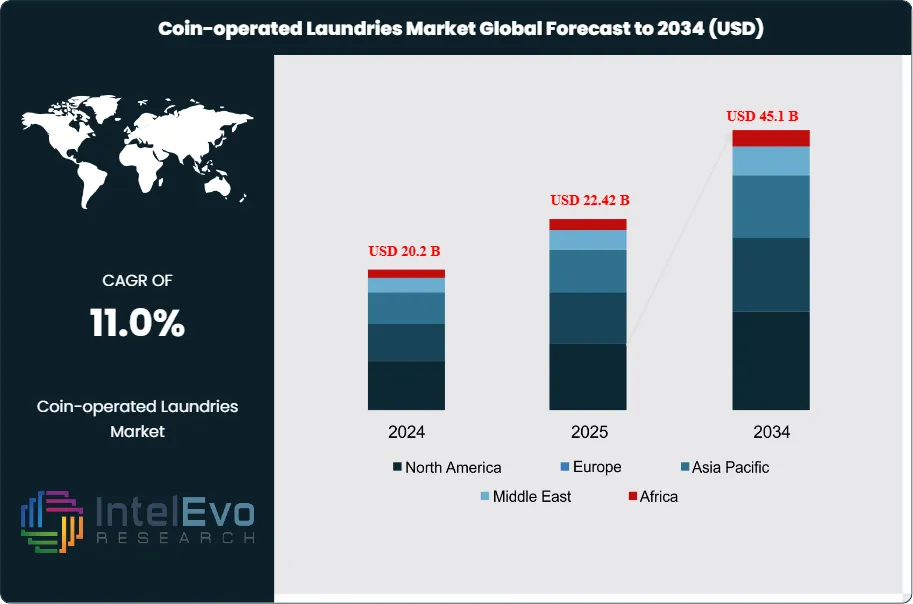

The Coin-operated Laundries Market is estimated at USD 20.2 billion in 2024 and is on track to reach nearly USD 45.1 billion by 2034, reflecting a robust CAGR of 11.0% during 2025–2034. Growth is being driven by rising urbanization, increasing rental housing populations, and the shift toward convenient, affordable, and time-efficient laundry solutions. Self-service laundromats are also gaining popularity due to their low human dependence and rapid digitization through smart payment systems, mobile app tracking, and energy-efficient machines. As hygiene awareness and on-demand service trends continue to surge, coin-operated laundry businesses are becoming a high-visibility segment across real estate, hospitality, and student-living ecosystems.

Get More Information about this report -

Request Free Sample ReportCoin-operated laundries remain a critical service in densely populated urban centers and rental-heavy regions where in-home laundry facilities are limited. Historically concentrated in metropolitan areas, these self-service laundromats continue to grow in relevance due to rising urbanization, smaller living spaces, and a growing base of mobile renters, students, and travelers. The U.S. market alone hosts over 17,000 active laundromats, serving approximately 660 million laundry loads weekly. Globally, demand remains stable across high-density residential zones, particularly in cities with constrained housing footprints.

Affordability, accessibility, and convenience are key demand-side factors. Coin-operated laundries provide a consistent, cash-flow-generating business model with average annual revenues ranging from USD 50,000 to over USD 500,000, depending on location and services offered. In developed regions such as North America and Western Europe, per-store revenue potential is higher due to higher pricing, repeat customer volumes, and greater service expectations. However, new entrants in saturated markets face barriers related to location availability and established local competition. Operators are responding with value-added services, such as digital payment systems, loyalty programs, and amenities like free Wi-Fi or café options, to differentiate their offering and capture foot traffic.

Technology continues to reshape operations. Modern laundromats are adopting stackable, high-capacity washers and dryers capable of processing up to 100 pounds per cycle. These machines allow for more efficient throughput and reduced downtime. Cashless payments, IoT-based monitoring, and smart scheduling systems are becoming standard across urban locations. At the same time, energy efficiency is a rising priority. The U.S. Department of Energy projects that updated energy standards could save laundromat operators up to USD 2.2 billion annually, while reducing carbon emissions by 71 million metric tons over the next three decades. Businesses that upgrade to energy-efficient equipment can lower utility costs while aligning with customer preferences for environmentally responsible services.

As cities grow and rental populations expand, coin-operated laundries are well-positioned to maintain steady growth. Operators that invest in smart technology, efficient infrastructure, and experience-driven services are likely to lead in both profitability and customer retention.

Key Takeaways

- Market Growth: The global Coin-operated Laundries market was valued at USD 20.2 billion in 2024 and is projected to reach USD 45.1 billion by 2034, expanding at a CAGR of 11.0%. Growth is driven by rising urban populations, shrinking household spaces, and increased demand for affordable, accessible laundry services.

- Service Type: Self-service laundry led the market with a 52.3% share in 2024, supported by cost-effectiveness and convenience for consumers without in-home laundry access.

- Equipment Type: Washing machines accounted for 57.6% of equipment usage in 2024, reflecting their central role in high-volume, quick-turnover laundry operations in commercial settings.

- End User: The residential segment held a 64.4% share in 2024, as renters, students, and low-income households increasingly depend on laundromats for routine laundry needs.

- Distribution Channel: Offline retail dominated with 61.2% market share in 2024, driven by the continued preference for walk-in services and location-based accessibility in high-density neighborhoods.

- Driver: Urbanization and limited living space in major cities are key demand drivers. In the U.S., more than 17,000 laundromats process roughly 660 million loads weekly, underscoring steady usage and recurring demand.

- Restraint: Market saturation in urban areas limits expansion for new entrants. Prime locations are largely occupied by established operators, increasing competition and driving up operational costs.

- Opportunity: Emerging economies in Asia-Pacific and Latin America offer untapped growth potential. Rising rental populations and limited access to in-home appliances are expected to drive significant adoption over the forecast period.

- Trend: Laundromats are investing in high-capacity, energy-efficient machines and digital payment systems. Smart scheduling, IoT monitoring, and mobile-enabled user interfaces are reshaping customer experience and operational efficiency.

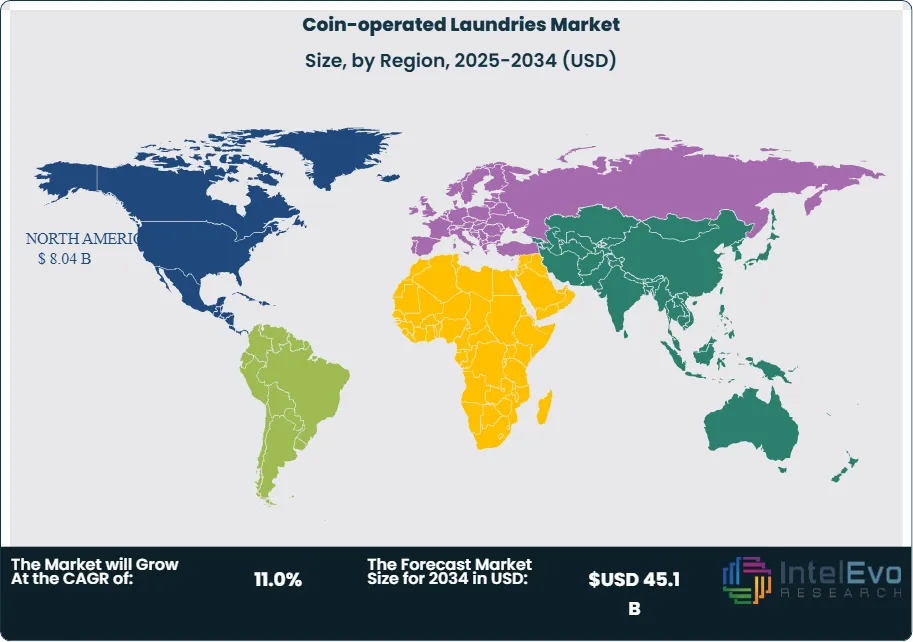

- Regional Analysis: North America led the global market in 2024, contributing 44.2% of total revenue, or USD 8.04 billion. Growth is supported by high urban density, a large renter base, and consistent per-store profitability across the U.S. and Canada.

Service Type Analysis

The global coin-operated laundries market continues to be dominated by self-service laundry, which held a 52.3% share in 2024. This segment remains the preferred model due to its affordability and independence, particularly among renters, students, and short-term residents. These facilities typically operate on a low-overhead model, allowing users to handle washing and drying on their own, supported by coin or cashless payment systems. Urban living constraints—such as smaller apartments without in-unit machines—further reinforce demand for this service type in densely populated cities.

Although smaller in share, full-service laundry and pickup & delivery models are gaining traction among consumers with limited time or specific convenience preferences. These formats provide value-added services like washing, drying, folding, and even garment care, often bundled into subscription packages. Dry cleaning remains a niche but essential category for customers requiring professional garment care, particularly for high-maintenance or formal wear. As consumer expectations shift toward convenience and time efficiency, operators are increasingly diversifying their service offerings to include home pickup, scheduled delivery, and real-time service tracking.

Equipment Type Analysis

Washing machines accounted for 57.6% of equipment usage in coin-operated laundries, reaffirming their central role in the operational infrastructure. Commercial-grade machines are built for durability, large load capacities, and frequent use. Their ability to accommodate up to 100 pounds per cycle makes them critical for handling high customer volume efficiently.

Dryers are essential complements, enabling customers to complete the laundry cycle within one visit. Increasingly, operators are investing in energy-efficient models to reduce utility costs and comply with evolving energy standards. Additionally, coin vending machines and card payment systems are modernizing transactions. Cashless systems—now standard in many urban markets—support customer convenience while improving revenue tracking. Laundry folding machines, though less widely adopted, are emerging in premium laundromat models targeting higher-end users and commercial clients seeking full-cycle services.

End Use Analysis

The residential segment leads the market with a 64.4% share as of 2024, driven by limited in-home laundry options in apartment complexes and rental housing. In urban areas, this segment is particularly robust due to space constraints and cost-sensitive demographics. Coin-operated laundries provide essential services for tenants, students, and mobile professionals, making them a fixture near residential zones, transit hubs, and university campuses.

The commercial end-user segment includes clients such as hospitality chains, gyms, and healthcare providers that require high-capacity laundry services. While this segment is smaller by volume, it offers higher frequency and larger loads per service cycle. Growth in this category is closely tied to economic activity in travel, healthcare, and food service sectors.

Regional Analysis

North America remains the largest regional market, accounting for 44.2% of global revenue in 2024, valued at approximately USD 8.04 billion. This dominance is driven by high urban population density, widespread adoption of self-service laundry models, and steady consumer spending on convenience-based services. The U.S. leads the region with more than 17,000 laundromats, reflecting stable, recurring demand across major cities.

Looking ahead, North America's market share is expected to remain strong, bolstered by continued urbanization and the expansion of mixed-use developments. Operators are also investing in smart technologies such as mobile payment apps, loyalty programs, and remote machine monitoring. These enhancements not only improve customer experience but also streamline operations. In contrast, emerging markets in Asia Pacific and Latin America are beginning to show potential, driven by rapid urban growth, rising rental populations, and increasing acceptance of self-service models in major metro areas.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Service Type

- Self-service Laundry

- Full-service Laundry

- Dry Cleaning

- Laundry Pickup & Delivery

By Equipment Type

- Washing Machines

- Dryers

- Coin Vending Machines

- Card Payment Systems

- Laundry Folding Machines

By End User

- Residential

- Commercial

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 20.2 B |

| Forecast Revenue (2034) | USD 45.1 B |

| CAGR (2024-2034) | 11.0% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Service Type (Self-service Laundry, Full-service Laundry, Dry Cleaning, Laundry Pickup & Delivery), By Equipment Type (Washing Machines, Dryers, Coin Vending Machines, Card Payment Systems, Laundry Folding Machines), By End User (Residential, Commercial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Electrolux Professional, Dexter Laundry, Inc., Huebsch (Alliance Laundry Systems), Pellerin Milnor Corporation, Speed Queen (Alliance Laundry Systems), LG Electronics Inc., Girbau Group, Maytag (Whirlpool Corporation), Primus Laundry (Alliance Laundry Systems), Wascomat (Laundrylux) |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Coin-operated Laundries Market

Published Date : 05 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date