CPaaS Market to Hit USD 62.3 Bn by 2034 | 14.7% CAGR Growth

Global Communication Platform as a Service (CPaaS) Market Size, Share & Forecast Report By Solution (Messaging APIs, Voice APIs, Video APIs, Authentication & Verification, AI-Powered Chatbots, Analytics & Reporting), By Enterprise Size (SMEs, Large Enterprises), By Deployment Model (Cloud-Based, On-Premises, Hybrid), By Industry Vertical (Retail & E-Commerce, BFSI, Healthcare, Travel & Hospitality, Logistics, Education, Government), Region & Key Players, 2025–2034.

Report Overview

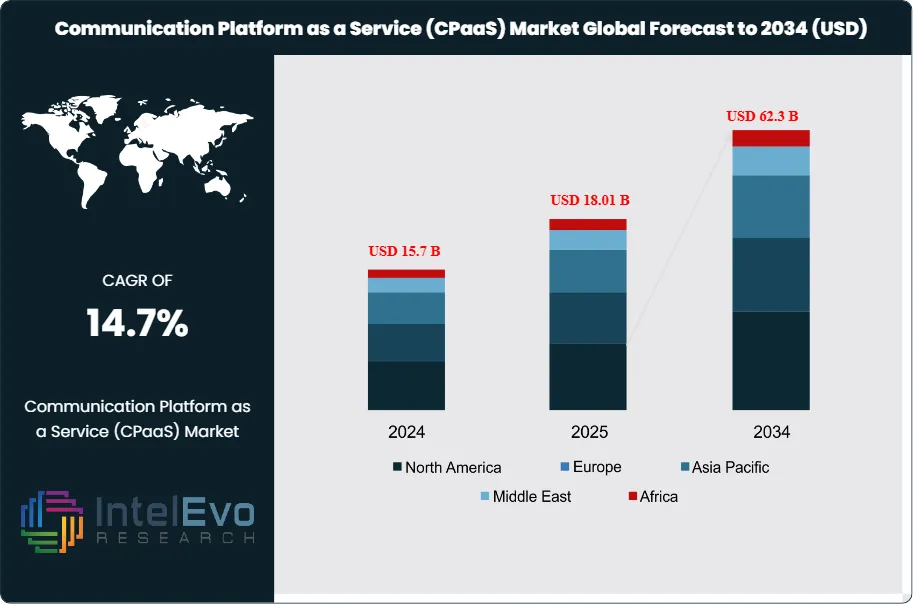

The Communication Platform as a Service (CPaaS) Market size is expected to be worth around USD 62.3 Billion by 2034, up from USD 15.7 Billion in 2024, growing at a CAGR of 14.7% during the forecast period from 2024 to 2034. The CPaaS market encompasses cloud-based platforms that enable businesses to integrate real-time communication features—such as voice, video, messaging, and authentication—into their applications without the need for complex backend infrastructure.

Get More Information about this report -

Request Free Sample ReportThis market represents a transformative shift in enterprise communications, as organizations increasingly leverage CPaaS to deliver seamless, omnichannel customer experiences, support remote workforces, and accelerate digital transformation. The ecosystem includes API-driven platforms, developer tools, integration services, and value-added features such as AI-powered chatbots, analytics, and security.

The CPaaS market is experiencing robust growth driven by the proliferation of digital channels, the rise of customer engagement platforms, and the growing demand for scalable, flexible, and cost-effective communication solutions. Key growth catalysts include the integration of AI and automation, the expansion of use cases in customer service, marketing, and operations, and the increasing adoption of CPaaS by small and medium enterprises (SMEs) and large enterprises alike. The market benefits from ongoing innovation in API design, security, and compliance, as well as the convergence of CPaaS with unified communications and contact center solutions.

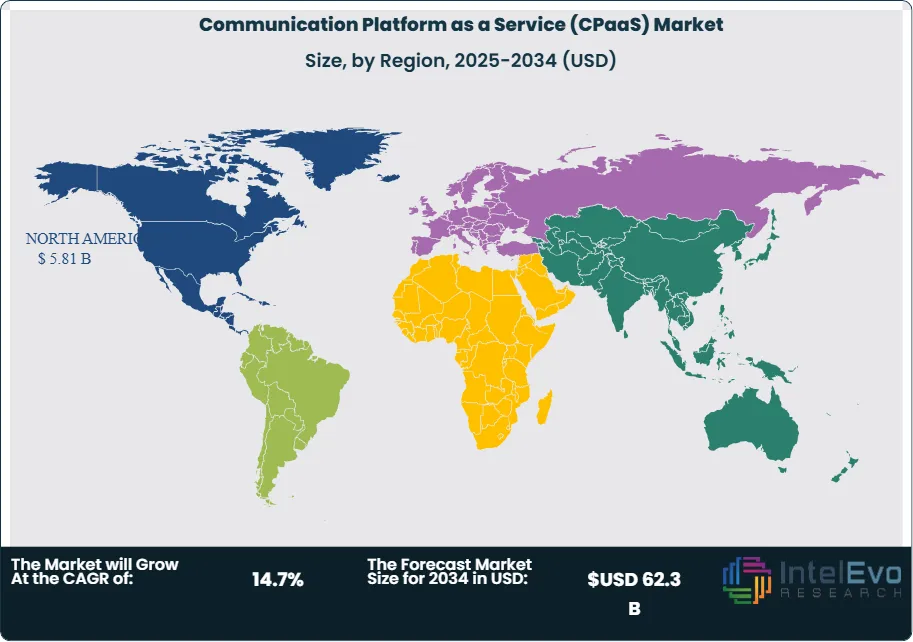

North America and Europe dominate the global CPaaS market, with leadership stemming from advanced digital infrastructure, high cloud adoption, and a strong presence of leading CPaaS vendors and technology partners. Asia-Pacific represents the fastest-growing regional market, driven by rapid digitalization, mobile-first economies, and expanding investments in cloud communications.

The COVID-19 pandemic fundamentally accelerated the adoption of CPaaS as organizations shifted to remote work, digital customer engagement, and contactless service delivery. The crisis created urgent demand for scalable, cloud-based communication solutions, prompting businesses to invest in CPaaS platforms that support agility, resilience, and innovation.

Rising concerns about data privacy, security, and regulatory compliance have significantly influenced the market, creating opportunities for vendors to differentiate through secure, compliant, and user-friendly solutions. The market is also witnessing increased demand for industry-specific CPaaS solutions, low-code/no-code integration tools, and advanced analytics for customer engagement optimization.

Key Takeaways

- Market Growth: The CPaaS Market is expected to reach USD 62.3 Billion by 2034, fueled by digital transformation, the need for omnichannel engagement, and ongoing innovation in cloud communications.

- Solution Type Dominance: Messaging and voice APIs lead market share due to their widespread adoption in customer engagement and operational communications.

- Enterprise Size Dominance: Large enterprises dominate, driven by complex communication needs, global operations, and substantial technology investment capabilities.

- Deployment Model Dominance: Cloud-based solutions lead the deployment segment, primarily due to scalability, cost efficiency, and ease of integration with existing systems.

- Industry Vertical Dominance: Retail & e-commerce, BFSI, and healthcare hold the largest shares, owing to high customer interaction volumes and the need for secure, real-time communications.

- Driver: Key drivers accelerating growth include the demand for omnichannel customer engagement, the proliferation of digital channels, and the need for scalable, flexible communication solutions.

- Restraint: Growth is hindered by data privacy concerns, integration challenges, and the shortage of skilled developers and communication architects.

- Opportunity: The market is poised for expansion due to opportunities like industry-specific CPaaS solutions, low-code integration platforms, and the integration of AI and analytics.

- Trend: Emerging trends including AI-powered communications, video APIs, and the convergence of CPaaS with contact center and unified communications are reshaping the market.

- Regional Analysis: North America leads owing to advanced infrastructure and enterprise adoption. Asia-Pacific shows high promise due to rapid digitalization and mobile-first economies.

Solution Type Analysis

Messaging and Voice APIs Lead: Messaging and voice APIs maintain a commanding position in the CPaaS market, establishing themselves as the most rapidly expanding segment due to exceptional demand for real-time, omnichannel customer engagement. These APIs enable businesses to integrate SMS, MMS, voice calls, and interactive messaging into their applications, supporting use cases such as customer support, notifications, marketing, and authentication.

Other key solution types include video APIs, authentication and verification services, and AI-powered chatbots. Organizations increasingly rely on these tools to deliver seamless, personalized, and secure communications across digital channels. The integration of CPaaS with CRM, marketing automation, and contact center platforms further enhances the value proposition, enabling end-to-end customer journey management.

Enterprise Size Analysis

Large Enterprises Dominate, But SME Adoption Is Rising: Large enterprises maintain a commanding position in the CPaaS market, establishing themselves as the primary consumers of advanced communication solutions due to their complex operational demands, global reach, and substantial technology investment capabilities. These organizations encounter multifaceted communication challenges encompassing customer engagement, internal collaboration, and regulatory compliance.

Their market dominance is reinforced by their capacity to finance large-scale digital transformation projects, execute organization-wide CPaaS adoption, and integrate advanced communications across multiple business units and geographies. However, SMEs are increasingly adopting CPaaS, driven by the availability of affordable, cloud-based solutions and the need to compete on customer experience and agility.

Deployment Model Analysis

Cloud-Based Solutions Lead, On-Premises and Hybrid Models Persist: Cloud-based deployment models demonstrate exceptional growth rates, signaling a fundamental transformation toward scalable, cost-efficient, and globally accessible communication solutions. Cloud-based CPaaS platforms offer rapid implementation, seamless integration with other enterprise systems, and the ability to leverage advanced features without significant upfront investment in IT infrastructure.

On-premises and hybrid deployment models persist, particularly in highly regulated industries and regions with strict data residency requirements. These models offer greater control over data security and customization but may involve higher costs and longer implementation timelines. The accelerated adoption of cloud-based solutions reflects changing client preferences for flexibility, scalability, and continuous innovation.

Industry Vertical Analysis

Retail & E-Commerce, BFSI, and Healthcare Lead: Retail & e-commerce, BFSI, and healthcare sectors hold the leading positions among industry verticals, driven by high customer interaction volumes, the need for secure, real-time communications, and the demand for personalized engagement. Retailers and e-commerce platforms leverage CPaaS for order notifications, customer support, and marketing campaigns. BFSI organizations use CPaaS for transaction alerts, authentication, and customer service, while healthcare providers adopt CPaaS for appointment reminders, telehealth, and patient engagement.

Other key verticals include travel & hospitality, logistics, education, and government, each adopting CPaaS to address industry-specific communication challenges and enhance operational efficiency.

Region Analysis

North America Leads, Asia-Pacific Is Fastest-Growing: North America holds a commanding position in the global CPaaS market, establishing unparalleled market leadership through substantial revenue generation and technology adoption. This regional supremacy is fundamentally anchored by the United States’ overwhelming market presence, which demonstrates exceptional growth potential and market maturity. The region benefits from a concentration of leading CPaaS vendors, advanced digital infrastructure, and a strong culture of innovation.

Asia-Pacific emerges as the most rapidly expanding regional market, demonstrating exceptional growth momentum driven by accelerated digitalization, mobile-first economies, and expanding investments in cloud communications. Major economies including China, India, Japan, and Southeast Asian nations are experiencing unprecedented demand for CPaaS solutions as organizations modernize their communication strategies and pursue global expansion.

Europe maintains a substantial and influential presence in the global CPaaS landscape through well-established digital markets, regulatory complexity, and mature economies requiring advanced communication and compliance solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Solution Type

- Messaging APIs (SMS, MMS, OTT)

- Voice APIs

- Video APIs

- Authentication & Verification

- AI-Powered Chatbots

- Analytics & Reporting

Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Deployment Model

- Cloud-Based

- On-Premises

- Hybrid

Industry Vertical

- Retail & E-Commerce

- BFSI

- Healthcare

- Travel & Hospitality

- Logistics & Transportation

- Education

- Government

- Others

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 18.01 B |

| Forecast Revenue (2034) | USD 62.3 B |

| CAGR (2025-2034) | 14.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Solution Type (Messaging APIs (SMS, MMS, OTT), Voice APIs, Video APIs, Authentication & Verification, AI-Powered Chatbots, Analytics & Reporting), Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), Deployment Model (Cloud-Based, On-Premises, Hybrid), Industry Vertica (Retail & E-Commerce, BFSI, Healthcare, Travel & Hospitality, Logistics & Transportation, Education, Government, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Twilio Inc., Infobip Ltd., Sinch AB, Vonage Holdings Corp. (Nexmo), MessageBird B.V., Bandwidth Inc., Plivo Inc., 8x8 Inc., RingCentral Inc., Cisco Systems (Webex CPaaS), IntelePeer Cloud Communications, LINK Mobility Group, BICS / Proximus Global, Tata Communications (DIGO / Kaleyra), Avaya Inc., Kaleyra Inc., Telnyx LLC, Voximplant (Zingaya Inc.), CM.com N.V., Mitel Networks, Avaya CPaaS, Soprano Design |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Communication Platform as a Service (CPaaS) Market?

The Global CPaaS Market is projected to grow from USD 15.7 Billion in 2024 to USD 62.3 Billion by 2034, expanding at a CAGR of 14.7%. Discover key trends, growth drivers, and market forecasts.

Who are the major players in the Communication Platform as a Service (CPaaS) Market?

Twilio Inc., Infobip Ltd., Sinch AB, Vonage Holdings Corp. (Nexmo), MessageBird B.V., Bandwidth Inc., Plivo Inc., 8x8 Inc., RingCentral Inc., Cisco Systems (Webex CPaaS), IntelePeer Cloud Communications, LINK Mobility Group, BICS / Proximus Global, Tata Communications (DIGO / Kaleyra), Avaya Inc., Kaleyra Inc., Telnyx LLC, Voximplant (Zingaya Inc.), CM.com N.V., Mitel Networks, Avaya CPaaS, Soprano Design

Which segments covered the Communication Platform as a Service (CPaaS) Market?

Solution Type (Messaging APIs (SMS, MMS, OTT), Voice APIs, Video APIs, Authentication & Verification, AI-Powered Chatbots, Analytics & Reporting), Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), Deployment Model (Cloud-Based, On-Premises, Hybrid), Industry Vertica (Retail & E-Commerce, BFSI, Healthcare, Travel & Hospitality, Logistics & Transportation, Education, Government, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Communication Platform as a Service (CPaaS) Market Size to Reach USD 62.3 Billion by 2034

Published Date : 05 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date