Contact Center as a Service (CCaaS) Market Size, Growth | CAGR 20.1%

Global Contact Center as a Service (CCaaS) Market Size, Share & Analysis By Function (Automatic Call Distribution, Call Recording, Customer Collaboration, Interactive Voice Response, Dialer, Other Functions), By End-Use Industry (BFSI, Healthcare, IT & Telecom, Government, Consumer Goods & Retail) Industry Regions & Key Players – CX Transformation, AI Integration & Forecast 2025–2034

Report Overview

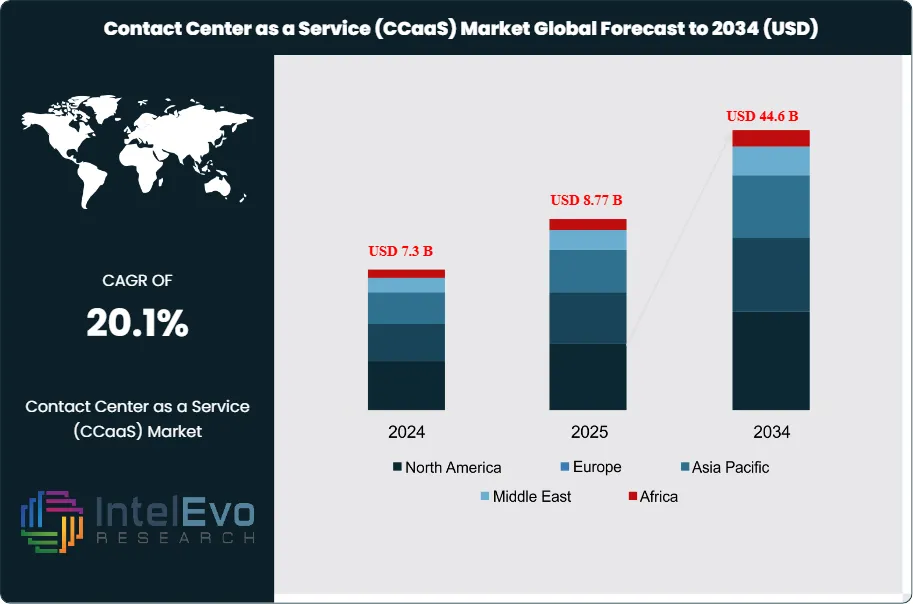

The Contact Center as a Service (CCaaS) Market size is expected to be worth around USD 44.6 Billion by 2034, from USD 7.3 Billion in 2024, growing at a CAGR of 20.1% during the forecast period from 2025 to 2034. This rapid expansion reflects the increasing global shift toward cloud-based communication platforms that enable enterprises to enhance customer engagement while reducing reliance on traditional, hardware-intensive call center models.

Get More Information about this report -

Request Free Sample ReportThe market has evolved from being a niche offering to becoming a mainstream solution for organizations seeking agility, scalability, and cost efficiency in managing customer interactions. CCaaS platforms integrate a wide range of features, including interactive voice response (IVR), omnichannel routing, call recording, analytics, and seamless app integrations, which collectively enhance customer satisfaction and operational performance. Enterprises across sectors are leveraging these capabilities to deliver personalized, responsive, and consistent support experiences across voice, chat, email, and social media channels.

Key growth drivers include the rising demand for remote and hybrid customer support solutions, heightened focus on improving customer experience, and growing need for business continuity strategies. In particular, the surge in digital-first customer behavior is compelling organizations to adopt cloud-based contact centers that ensure scalability and flexibility while minimizing capital expenditure. However, challenges such as data security concerns, integration complexities with legacy systems, and compliance with regional data protection laws remain critical hurdles to broader adoption.

Technological innovation is playing a pivotal role in shaping the CCaaS landscape. Artificial intelligence (AI) and machine learning (ML) are being increasingly embedded into contact center platforms, enabling predictive routing, intelligent chatbots, real-time sentiment analysis, and workforce optimization. These advancements are expected to drive higher levels of automation and efficiency, reducing average handling times while enhancing customer engagement outcomes.

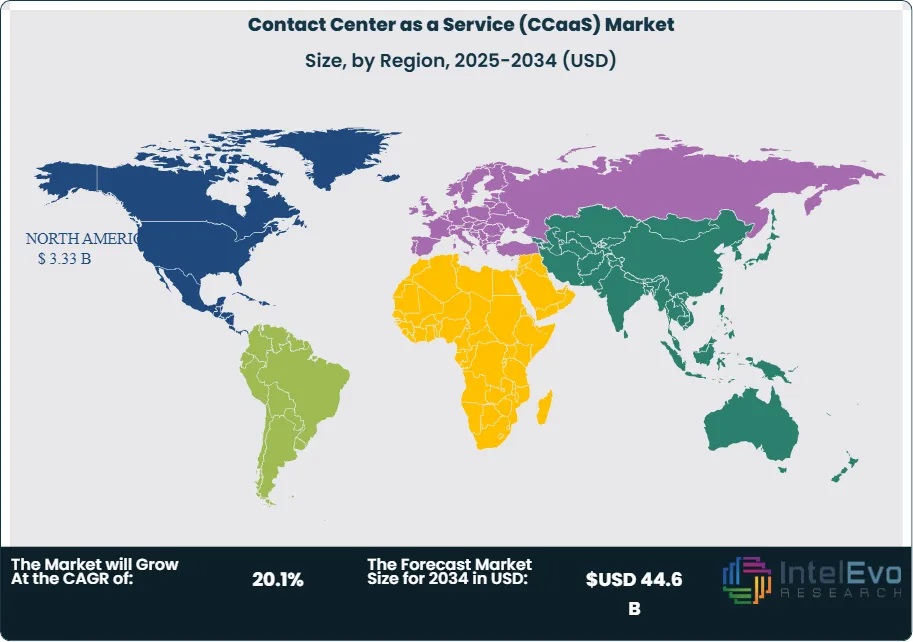

Regionally, North America dominates the market, underpinned by strong cloud adoption, technological maturity, and a concentration of leading vendors. Europe is witnessing steady growth fueled by regulatory compliance needs and digital transformation initiatives, while Asia-Pacific is emerging as a high-potential investment hotspot, driven by rapid enterprise digitization, expanding customer bases, and rising demand for cost-effective, scalable solutions. Collectively, these dynamics position the CCaaS market as a critical enabler of next-generation customer engagement strategies worldwide.

Key Takeaways

- Market Growth: The Global Contact Center as a Service (CCaaS) industry is on a steep growth trajectory, forecast to rise from USD 7.3 Billion in 2024 to approximately USD 44.6 Billion by 2034. This reflects a strong CAGR of 20.1% over the 2024–2034 period, supported by widespread cloud adoption, the shift toward digital-first engagement, and the need for agile, cost-efficient communication models.

- Functionality: Among solution categories, Automatic Call Distribution (ACD) continues to hold the largest share, as enterprises prioritize efficient routing of high call volumes to reduce waiting times and improve agent productivity. Meanwhile, customer collaboration tools are gaining momentum, helping organizations facilitate real-time, multi-channel interaction and boost customer satisfaction.

- End-Use Industry: The banking, financial services, and insurance (BFSI) sector is the largest adopter of CCaaS solutions, driven by heavy customer interaction needs, digital banking initiatives, and strict compliance requirements. Looking forward, retail and e-commerce are expected to record the fastest uptake, fueled by the surge in online shopping and the need to manage omnichannel customer engagement at scale.

- Growth Driver: Heightened focus on delivering seamless customer experiences and ensuring uninterrupted service in remote or hybrid work environments is propelling CCaaS adoption. Flexible cloud platforms allow enterprises to integrate voice, chat, and digital channels under one system, enabling consistent service delivery.

- Restraint: Data protection concerns and regulatory complexities—especially around cross-border information handling—pose significant hurdles to wider adoption, particularly in heavily regulated verticals such as finance and healthcare.

- Opportunity: Advanced use of artificial intelligence (AI) and machine learning (ML) is opening new growth avenues. Capabilities such as intelligent chatbots, predictive analytics, and real-time sentiment monitoring are helping companies lower costs, improve service quality, and scale automation across contact centers.

- Trend: A major trend shaping the market is the move toward integrated omnichannel platforms, where enterprises unify voice, email, social media, and messaging into seamless workflows to provide consistent, personalized customer journeys.

- Regional Outlook: North America currently leads the global market, supported by strong IT infrastructure, early adoption of cloud solutions, and the presence of leading providers including Cisco, Microsoft, and Genesys. The Asia-Pacific region is registering the fastest growth, driven by rapid digitalization, a surge in SMEs adopting cloud-based tools, and the booming e-commerce sector in economies such as India and China.

Function Analysis

In 2025, automatic call distribution (ACD) continues to represent the leading function within the global Contact Center as a Service (CCaaS) market, accounting for a significant share of total revenues. ACD solutions are valued for their ability to intelligently route high volumes of inbound calls to the most appropriate agents, thereby reducing wait times and improving overall service efficiency. For organizations managing thousands of customer interactions daily, this functionality has become indispensable to ensuring seamless operations and consistent service quality.

Beyond ACD, customer collaboration tools are gaining momentum as enterprises increasingly focus on two-way engagement and issue resolution through real-time feedback. Similarly, call recording and analytics functions are experiencing strong adoption, particularly within regulated industries where compliance, quality monitoring, and performance optimization are critical. Together, these capabilities reflect a market shift toward integrated, data-driven platforms that improve operational efficiency while enhancing the customer journey.

End-Use Industry Analysis

The Banking, Financial Services, and Insurance (BFSI) sector remains the dominant end-use industry in 2025, holding the largest revenue share of the CCaaS market. Digital transformation initiatives, the rise of mobile and online banking, and stricter compliance requirements have significantly increased customer touchpoints. As a result, financial institutions are relying heavily on CCaaS solutions to manage omnichannel interactions, strengthen client relationships, and ensure secure, compliant communications.

The IT and telecom sector is another critical adopter, leveraging CCaaS to handle vast volumes of technical queries and customer support requests. With the expansion of broadband, 5G networks, and cloud services, telecom providers are integrating AI-powered virtual assistants and interactive voice response (IVR) systems to streamline support delivery. Other industries such as healthcare, government, travel, and hospitality are also expanding their adoption, driven by rising expectations for accessible, responsive, and cost-effective customer engagement solutions.

Regional Analysis

North America continues to lead the global CCaaS market in 2025, holding over one-third of global revenue share. The region’s dominance is underpinned by rapid cloud adoption, advanced IT infrastructure, and the presence of leading technology providers such as Cisco Systems, Genesys, and Microsoft. Enterprises across sectors are deploying AI-enabled CCaaS solutions to deliver more personalized and predictive customer experiences, further reinforcing market growth in the region.

Meanwhile, the Asia-Pacific market is witnessing the fastest expansion, projected to record the highest CAGR over the forecast period. Factors such as the booming e-commerce sector, large-scale digitization initiatives, and growing adoption of cloud-based tools by small and medium enterprises are driving regional momentum. Countries including India, China, and Southeast Asian economies are emerging as high-potential investment hubs, as businesses increasingly prioritize scalable, multilingual, and cost-effective customer engagement platforms to serve rapidly expanding consumer bases.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Function

- Automatic Call Distribution

- Call Recording

- Customer Collaboration

- Interactive Voice Response

- Dialer

- Other Functions

By End-Use Industry

- BFSI

- Healthcare

- IT & Telecom

- Government

- Consumer Goods & Retail

- Other End-Use Industries

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 8.77 B |

| Forecast Revenue (2034) | USD 44.6 B |

| CAGR (2025-2034) | 20.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Function (Automatic Call Distribution, Call Recording, Customer Collaboration, Interactive Voice Response, Dialer, Other Functions), By End-Use Industry (BFSI, Healthcare, IT & Telecom, Government, Consumer Goods & Retail, Other End-Use Industries) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Cisco Systems Inc., Microsoft Corporation, Genesys, SAP SE, NICE CXone, Enghouse Interactive Inc., Avaya Inc., Unify Inc., Alcatel Lucent Enterprise, Computer Talk Technology Inc., Oracle Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Contact Center as a Service (CCaaS) Market?

The CCaaS Market is projected to reach USD 44.6 Billion by 2034, growing at a CAGR of 20.1% from 2025–2034. Rising adoption of cloud-based platforms is transforming customer engagement and reducing reliance on traditional call center infrastructure.

Who are the major players in the Contact Center as a Service (CCaaS) Market?

Cisco Systems Inc., Microsoft Corporation, Genesys, SAP SE, NICE CXone, Enghouse Interactive Inc., Avaya Inc., Unify Inc., Alcatel Lucent Enterprise, Computer Talk Technology Inc., Oracle Corporation

Which segments covered the Contact Center as a Service (CCaaS) Market?

By Function (Automatic Call Distribution, Call Recording, Customer Collaboration, Interactive Voice Response, Dialer, Other Functions), By End-Use Industry (BFSI, Healthcare, IT & Telecom, Government, Consumer Goods & Retail, Other End-Use Industries)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Contact Center as a Service (CCaaS) Market

Published Date : 06 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date